A payment order is a document with which the owner of a current account instructs the bank to transfer funds to another specified account. In this way, you can pay for goods or services, pay an advance, repay a loan, make government payments and contributions, that is, in fact, ensure any movement of finances permitted by law.

Payment orders must be drawn up in accordance with the procedure established by the Ministry of Finance, since they are processed automatically. It does not matter whether the payment is submitted to the bank in paper form or sent via the Internet.

A complex form developed by the Central Bank of the Russian Federation and approved by federal legislation must be filled out correctly, since the cost of an error may be too high, especially if it is an order for tax payments.

To avoid problems associated with incorrectly filling out the fields of a payment order, we will understand the features of each cell.

Step-by-step instructions for filling out a payment order

On the sample form, each cell is assigned a number to make it easier to explain its meaning and clarify exactly how it needs to be filled out.

Check whether you are using the current payment order form, updated in 2012. The new form is approved by Appendix 2 to the Regulation of the Bank of Russia dated June 19, 2912 No. 383-P.

Check the number listed at the top right. No matter who the money sent via payment order is intended for, the same numbers will be indicated - 0401060 . This is the form number of the unified form valid today.

We begin to fill out the fields of the document one by one. Field 3 – number. The payer indicates the payment number in accordance with its internal numbering order. The bank can provide the number to individuals. This field cannot contain more than 6 characters.

Field 4 – date. Date format: two digits day, two digits month, 4 digits year. In electronic form, the date is formatted automatically.

Field 5 – type of payment. You need to choose how the payment will be made: “urgent”, “telegraph”, “mail”. When sending a payment through a client bank, you must indicate the encoded value accepted by the bank.

Field 6 – amount in words. The number of rubles is written with a capital letter in words (this word is not abbreviated), kopecks are written in numbers (the word “kopek” is also without abbreviations). It is acceptable not to indicate kopecks if the amount is a whole amount.

Field 7 – amount. Transferred money in numbers. Rubles must be separated from kopecks with the sign – . If there are no kopecks, put = after the rubles. There should be no other characters in this field. The number must match the words in field 6, otherwise the payment will not be accepted.

Field 8 – payer. Legal entities must indicate the abbreviated name and address, individuals - full name and registration address, those engaged in private practice, in addition to this data, the type of activity, individual entrepreneur - full name, legal status and address must be noted in brackets. The name (title) is separated from the address by the // symbol.

Field 9 – account number. This refers to the payer's account number (20-digit combination).

Field 10 – payer bank. Full or abbreviated name of the bank and the city of its location.

Field 11 – BIC. Identification code belonging to the payer’s bank (according to the Directory of participants in settlements through the Central Bank of Russia).

Field 12 – correspondent account number. If the payer is served by the Bank of Russia or its division, this field is not filled in. In other cases, you need to indicate the subaccount number.

Field 13 – beneficiary bank. The name and city of the bank where the funds are sent.

Field 14 – BIC of the recipient's bank. Fill in the same way as clause 11.

Field 15 – recipient's subaccount number. If money is sent to a client of the Bank of Russia, there is no need to fill out the box.

Field 16 – recipient. A legal entity is designated by its full or abbreviated name (both can be done at once), an individual entrepreneur - by status and full name, privately practicing individual entrepreneurs must additionally indicate the type of activity, and it is enough to name an individual in full (without inclination). If funds are transferred to the bank, then the information from field 13 is duplicated.

Field 17 – recipient's account number. 20-digit account number of the recipient of the funds.

Field 18 – type of operation. The code established by the Central Bank of the Russian Federation: for a payment order it will always be 01.

Field 19 – payment term. The field remains empty.

Field 20 – purpose of payment. See paragraph 19, until the Central Bank of the Russian Federation indicates otherwise.

Field 21 – payment queue. A number from 1 to 6 is indicated: queue in accordance with Article 855 of the Civil Code of the Russian Federation. The most commonly used numbers are 3 (taxes, contributions, salaries) and 6 (payment for purchases and supplies).

Read more: Where to file a complaint against the tax office

Field 22 – UIN code. A unique accrual identifier was introduced in 2014: 20 digits for a legal entity and 25 for an individual. If there is no UIN, 0 is entered.

Field 23 – reserve. Leave it blank.

Field 24 – purpose of payment. Write down what the funds are being transferred for: name of the product, type of service, number and date of the contract, etc. It is not necessary to indicate VAT, but it is better to be on the safe side.

Field 43 – payer’s stamp. Placed only on a paper version of the document.

Field 44 – signatures. On paper, the payer puts a signature that matches the sample on the card submitted when registering the account.

Field 45 – bank marks. On the paper form, the banks of the sender and recipient of the funds put stamps and signatures of authorized persons, and in the electronic version - the date of execution of the order. Field 60 – payer’s tax identification number. 12 characters for an individual, 10 for a legal entity. If there is no TIN (this is possible for individuals), write 0.

Field 61 – recipient’s TIN. Similar to paragraph 28.

Field 62 – date of receipt at the bank. Fills the bank itself.

Field 71 – write-off date. Issued by the bank.

IMPORTANT! Cells 101-110 must be filled out only if the payment is intended for tax or customs.

Field 101 – payer status. Code from 01 to 20, specifying the person or organization transferring the funds. If the code is in the range from 09 to 14, then field 22 or field 60 must be filled in without fail. Field 102 – payer checkpoint. Registration reason code (if available) – 9 digits.

Field 103 – recipient checkpoint. 9-digit code, if assigned. The first two digits cannot be zeros.

Field 104 – KBK. New for 2020. The budget classification code reflects the type of income of the Russian budget: duty, tax, insurance premium, trade fee, etc. 20 or 25 characters, all digits cannot be zeros.

Field 105 – OKTMO code. Indicated since 2014 instead of OKATO. According to the All-Russian Classifier of Municipal Territories, you need to write in this field 8 or 11 digits assigned to your locality.

Field 106 – basis of payment. The code consists of 2 letters and indicates various reasons for payment, for example, OT - repayment of deferred debt, DE - customs declaration. In 2016, several new letter codes were introduced for the basis of payment. If the list of codes does not indicate the payment that is made to the budget, 0 is entered in the cell.

Field 107 is an indicator of the tax period. It is noted how often the tax is paid: MS - monthly, CV - once a quarter, PL - every six months, GD - annually. The date is written after the letter designation. If the payment is not tax, but customs, the code of the relevant authority is written in this cell.

Field 108 – payment basis number. From March 28, 2016, in this field you need to write the number of the document on the basis of which the payment is made. The document is selected depending on the code specified in field 107. If cell 107 contains TP or ZD, then 0 must be entered in field 108.

Field 109 – date of the payment basis document. Depends on field 108. If there is 0 in field 108, 0 is also written in this cell.

Field 110 – payment type. The rules for filling out this field have changed in 2020. This cell does not need to be filled out, since field 104 indicates the KBK (its 14-17 digits precisely reflect the subtypes of budget revenues).

Examples of personal accounts

We have looked at what a personal account is and why it is needed. Let's move directly to the areas in which it is used. L/S is used in many areas related to the budget: tax authorities, government agencies, insurance companies, banks, pension funds, etc.

The most common examples of accounts:

- Bank personal account.

- Employee's personal account.

- Taxpayer account.

- Financial and personal account.

Let's look at the nuances of each of them.

Bank

A bank personal account records all financial relationships between the bank and the client. The client can be an individual or, less commonly, a legal entity. The fact is that payments related to business activities should not be carried out using L/S. For these purposes, current accounts are opened for legal entities.

For individuals, an account is opened automatically upon concluding an agreement with a bank for the provision of any type of service - obtaining a loan, opening a deposit. Account required:

- to store your own savings and receive interest;

- carrying out transfers with the participation of legal entities;

- payment of debt under a loan agreement.

You can see the account number in the contract.

Taxpayer

The taxpayer’s personal identification number is opened at the tax office at the time of registration, simultaneously with the assignment of the TIN. The account contains information on accrued and paid tax payments.

The Federal Tax Service, along with the term “Personal account”, uses the concept of CRSB - a card for settlements with the budget. It is created for each taxpayer and for each type of tax.

Important: when an application for a tax refund is asked to indicate the taxpayer’s personal account number, you must indicate a bank personal account - the money will be transferred to it

Employee

This type of personal account is a T-54 form, which is called standard or salary. Opened by the accounting department at the time a person is hired. The employee’s personal account contains data on the accrued salary, information on additional payments: social assistance, allowances, bonuses. Based on this information, the amount of tax contributions and the amount of pension contributions are formed.

Financial and personal account

The financial and personal account is directly related to the payment of housing and communal services. In addition to information about payment transactions and persons living in the apartment, it contains information about the living space itself: square footage, number of rooms, address, etc. In other words, this is a document with a complete list of data about the premises. The payer's L/C number can be found on the receipt.

You might be interested

- How to find out which bank an individual has an account with?

- Rules for blocking and unblocking accounts

- Where is the best place to open a brokerage account: advantages

- How much does it cost to open a bank account?

Additional nuances

Typically, the payment form must be drawn up in 4 copies:

- The 1st is used when writing off at the payer’s bank and ends up in bank daily documents;

- The 2nd is used to credit funds to the recipient’s account in his bank, stored in the documents of the day of the recipient’s bank;

- 3rd confirms the bank transaction, attached to the recipient's account statement (at his bank);

- The 4th with the bank’s stamp is returned to the payer as confirmation of acceptance of the payment for execution.

NOTE! The bank will accept the payment, even if there is not enough money on the payer’s account. But the order will be executed only if there are enough funds for this.

If the payer contacts the bank for information about how his payment order is being executed, he should receive an answer on the next business day.

How many numbers should be in a personal gas bill?

A personal account is a special document that is issued for housing and contains data on payments for the operation of this housing, providing it with the utilities necessary for people’s lives, management and maintenance.

It contains information about the condition of the housing, how many floors it consists of, to what extent it is comfortable, and the number of rooms in it.

The number of owners of an apartment, the number of people living in it, the presence of tenants - all this can be analyzed by knowing only one personal account number.

How many numbers should be in a personal account for a gazelle?

Attention This is the document confirming that a given citizen is registered in the apartment, as well as any existing or absent debt on utility bills.

This number is also associated with information about what utilities are provided at a particular address and how regularly they are paid for. It is according to it that all housing and communal services are paid in accordance with the rules prescribed in Article 155 of the Housing Code of the Russian Federation.

As of 2020, there is such a thing as a single personal payer account, compiled automatically by the housing and communal services system and containing information regarding a specific residential premises, as well as a person acting as a payer for the provided utilities and the actual use of this housing.

This document may belong exclusively to the owner of the apartment mentioned in it.

How many numbers should there be in a gazelle personal account?

At the same time, there is also a current account.

Refers to bank details.

How to find out the rent debt by personal identification In addition, it is worth noting that many large players in the housing and communal services market, in addition to personal portals with accessible information, also offer the opportunity to pay all debts online. And, if you have at least one receipt at home for payment of housing and utility services, then you can easily find out your account number.

Payer code housing and communal services financial account account

To open such an account when paying, you must contact your local passport office.

As a rule, the owner of the home or the responsible tenant applies.

In most cases, such an account can be registered for a separate residential premises as a whole.

To do this, you need to find out the current amount of debt, which is possible if you know your personal account number.

You can do this in several ways:

- Via the Internet - in your personal account on the Sberbank website, if the citizen is its client, or on the official websites of companies providing utility services;

- Through a banking institution - by contacting the operator directly at the cash register window, which is not always convenient due to the need to waste time going there and standing in line;

- By phone - by calling the hotline and telling the operator your personal account number, as well as the amount of debt or advance payment.

How to find out your number

Today, most of the population actively uses the Internet, and therefore government Internet services are developing.

Thanks to government portals, any interested person can submit requests and find out the necessary information without leaving home. The opportunity to find out your personal account number by indicating the exact postal address of the real estate is no exception.

As a client of Sberbank, you can use its online services to pay for utilities.

To obtain information about a personal account, you also need to know the address. This can also be done by calling the company providing the services.

All of the above options are relevant if payment receipts have not been preserved, since they must indicate the personal number, and also if for some reason it has been changed or divided into several separate ones.

Possibility of partition

To split your personal utility bill, you must have this right.

In order to become a responsible tenant, you must meet the following criteria:

- The citizen must be an adult.

- Capacity, that is, a person must be aware and account for his actions.

- The person must be registered in this residential premises.

To open a personal account for an apartment, you must present the following documents:

- certificate of state registration or, in the case where the apartment is municipal, a social tenancy agreement;

- the basis document, namely a purchase and sale agreement, a gift agreement, etc.;

- act of acceptance and transfer of the apartment;

- passport;

- if the interests of the tenant are represented by a trusted person, then a power of attorney.

It must be borne in mind that documents must be submitted in copies and originals.

- legal owner;

- tenant (provided that the housing is owned by the state or municipality);

- member of a housing cooperative.

Important Payment for housing and communal services on a personal account is made by the citizen in whose name it is opened. In the case where utility bills are paid by the tenant, bill splitting is provided.

Samples of filling out payment orders 2019

This is 01 for organizations and 09 for individual entrepreneurs. From February 6, 2020, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

INN and KBK details are the most important values in payments. If they are correct, then the payment will most likely go through.

The account (number) of payment orders (above) can be anything and they can be made with the same numbers. But it's better to take turns. VAT in payment orders is always indicated in the purpose of payment. If it does not exist or cannot exist, it is credited as “Without VAT”.

What is a personal account

This term is actively used not only by financial institutions, but also by a number of other organizations: the Pension Fund, housing and communal services organizations, tax services, etc. In the banking industry, a personal account is understood as the client account number or account number, consisting of 20 characters and used only in relation to individuals. Often in banks it is also called current.

So that the account can be used at a convenient time and anywhere in the world, almost all banks offer to issue a debit card simultaneously with opening the account. The card account is also called a card account, and most often the bank card account coincides with the personal account number. Thus, when transferring money to individuals. a person with a current account only needs to indicate any of these accounts and the details of the recipient bank.

In order to open such an account, an individual The person must have an identification document: a passport of a citizen of the Russian Federation, a temporary identity card, a military ID, etc. For citizens of foreign countries, it is also necessary to provide documents confirming the right to stay on the territory of the Russian Federation, for example, a migration card.

Explanation of payment order fields

If the payment amount is expressed in words in whole rubles, then kopecks can be omitted, and in the “Amount” field the payment amount and the equal sign “=” are indicated. For example: “Twenty-eight rubles 10 kopecks” or “One hundred and forty rubles.” In the “Amount” field (7) the payment amount is indicated in numbers, rubles are separated from kopecks by a dash sign “-“.

Read more: Actions of bailiffs to collect alimony

If the payment amount is expressed in numbers in whole rubles, then kopecks can be omitted; in this case, the payment amount in rubles and the equal sign “=” are indicated, while in the “Amount in words” field the payment amount in whole rubles is indicated. For example: "28-10" or "140 =" . In the “Payer” field (8) the name of the payer of the funds is indicated.

Additionally, the client's personal account number, name and location (abbreviated) of the servicing credit organization, branch of the credit organization are indicated if the client's payment is made through an open

Personal account for an apartment more than 10 digits

Example A citizen went to court with a demand to divide her personal account into a municipal apartment.

This apartment was previously provided under a social rental agreement as official housing to her husband. She and her husband divorced, and the husband has not paid utility bills for a year. The court refused to satisfy the claims, since it is impossible to divide the personal account into official housing. Is it possible to split bills in a privatized apartment? It is possible to divide a personal account if the apartment is registered in shares.

If the privatization of the apartment was carried out for one owner, then splitting the account does not make sense.

If the apartment is in shared ownership without indicating the square meters belonging to each of the owners, then the allocation of the share in kind and the subsequent division of the personal account are possible only in court.

Personal account for housing and communal services is 12 digits in the EIR receipt, it is 9 digits

Important

- data of the payer-owner of the apartment or the one for whom the personal account is registered (we also hid this data);

- account number;

- indication of the accrual period;

- the amount accrued for the month as a whole;

- the amount of debt for previous periods, if any;

- apartment area;

- number of people registered in housing.

Sometimes people need to know their payer code. It is not always indicated on receipts. In our example, you can see that there is no code - there is payer data (full name and address) and personal account number. In such cases, you need to find out this very code from the management company or EIRC (by applying with your passport).

Sometimes this code is there, in which case it is usually indicated in the upper right corner, it is 10 digits. In fact, this data is quite enough for payment.

We pay for housing and communal services through Sberbank online

Opening a personal account is possible only in the name of a person who has reached the age of majority and is endowed with legal capacity and has Russian citizenship. Article 153 of the Housing Code defines the circle of persons who have the right to receive this number:

- a person endowed with the rights of an owner in accordance with a social tenancy agreement or rental of residential premises;

- legal owner;

- tenant (provided that the housing is owned by the state or municipality);

- member of a housing cooperative.

Payments for housing and communal services on a personal account are made by the citizen in whose name it is opened. In the case where utility bills are paid by the tenant, bill splitting is provided.

What is a housing and communal services account under a single personal account: where to look and how to find it out?

And if you consider that advertising on housing and communal services receipts is now very common, justified concerns may arise: is it possible that you have to pay extra? In order to make sure that everything is fine and there are no extra items in the payment order, let's look at it carefully. Note! Since June 2020, the form of the housing and communal services receipt has changed.

What does a document for paying for housing and communal services look like? A typical example of a payment document for an apartment and related services for an average Russian looks like this: We see that the document must have the name of the organization that provides the services.

Usually this is the management organization of the house, as well as its bank details for payment (in the example, in order to maintain confidentiality, this data is hidden).

Personal account for the apartment

Attention It provides current data, and at the same cash desk you can pay the required amount. When choosing this method, keep in mind that banks usually tend to charge a commission for their services, and paying for utility bills is no exception.

What it is? A receipt is a payment form used to pay for:

- utilities;

- general house expenses;

- housing maintenance.

The recipient of receipts can be both individuals and legal entities. The payment document usually contains a table. It contains several lines, each of which contains the name of a specific service, its tariff/standard, and the amount to be paid.

The total amount to be paid is written at the bottom of the table. Legislative regulation A receipt for payment of utilities is a regulatory document.

How to find out arrears in rent (housing and communal services) and not pay fines

In order to become a responsible tenant, you must meet the following criteria:

- The citizen must be an adult.

- Capacity, that is, a person must be aware and account for his actions.

- The person must be registered in this residential premises.

To open a personal account for an apartment, you must present the following documents:

- certificate of state registration or, in the case where the apartment is municipal, a social tenancy agreement;

- the basis document, namely a purchase and sale agreement, a gift agreement, etc.;

- act of acceptance and transfer of the apartment;

- passport;

- if the interests of the tenant are represented by a trusted person, then a power of attorney.

It must be borne in mind that documents must be submitted in copies and originals. Originals are required for verification with copies.

The procedure for re-registering a personal account to pay for housing and communal services after purchasing an apartment

Returning to the storage period for personal receipts, experts recommend keeping such documents for at least five years, in order to avoid possible conflicts with management companies and utility providers.

We are studying the invoice for payment of housing and communal services. Payment for various additional services and other expenses must be approved by a decision of the general meeting of owners of the premises of an apartment building, otherwise it is collected illegally.

In some invoices, separate lines may indicate services for the maintenance of elevators and garbage removal, which are part of the service for the maintenance and current repairs of housing and are charged on the total area of the premises. How to find out the personal account of the apartment at address 1.

Through the State Services website (for Muscovites) For example, Moscow residents have access to the State Information System website created by the city’s fuel and energy department.

Is it possible to find out the housing and communal services account number by address?

Each residential property is assigned a unique housing and communal services account number, from which you can find out a lot of useful information about a specific apartment.

In particular, it allows you to obtain information regarding the technical indicators of housing, the number of people living in it, and access to utilities.

What it is? A personal account is a special document that is issued for housing and contains data on payments for the operation of this housing, providing it with the utilities necessary for people’s lives, management and maintenance.

It contains information about the condition of the housing, how many floors it consists of, to what extent it is comfortable, and the number of rooms in it. The number of owners of an apartment, the number of people living in it, the presence of tenants - all this can be analyzed by knowing only one personal account number.

Deciphering the housing and communal services receipt

How to find out your debt? Every year, an increasing number of companies that supply utility services to consumers acquire their own Internet resources, the presence of which significantly simplifies interaction between the parties.

With the help of such sites, every citizen can easily check whether he has any utility debts, and also pay them in just a few minutes.

For the convenience of users, a wide range of options for paying utility bills online is available:

- Internet banking. The most popular and widespread product in this category is Sberbank Online, which allows you to easily and conveniently pay utility bills anywhere and with an extremely low commission.

- Electronic payment systems.

How many numbers should be in a personal housing and communal services account?

This may be the owner of the apartment or its tenant. We must keep in mind that this can only be an adult, capable citizen registered in this apartment. To carry out various types of transactions with an apartment, you must provide an extract from your personal account.

It is the document confirming that a given citizen is registered in the apartment, as well as any existing or absent debt on utility bills.

This number is also associated with information about what utilities are provided at a particular address and how regularly they are paid for. It is according to it that all housing and communal services are paid in accordance with the rules prescribed in Article 155 of the Housing Code of the Russian Federation.

As of 2020, there is such a thing as a single personal payer account, compiled automatically by the housing and communal services system and containing information regarding a specific residential premises, as well as a person acting as a payer for the provided utilities and the actual use of this housing.

This document may belong exclusively to the owner of the apartment mentioned in it. Moreover, according to current standards, both the real owner of the property and the one who rents it under a contract can be called the owner.

Method No. 1: by receipt The surest way to tell you how to find out the payer code is to look at the receipt for payment for housing and communal services. They are dropped into mailboxes and handed over personally to the concierge, the entrance manager, etc. Typically, in receipts this information is contained in the upper right corner of the “header” of the sheet in the corresponding line - “Payer code”.

Next door will be information about you, a barcode, and the total cost. If the receipt does not contain a code, then this is a reason to doubt its authenticity. Decoding the housing and communal services receipt Entering readings in your Personal Account is available from the 10th to the 28th inclusive.

The period may vary for some areas. Exact information is available in the “Entering readings” section.

Source: https://departamentsud.ru/litsevoj-schet-za-kvartiru-bollee-10-tsifr/

Where and how to get an extract from the tenant’s personal account

The difference between a personal account and a settlement account A personal account for a bank is a register for organizing analytical accounting, with the help of which the client is identified. A personal account for a client is a set of numbers indicated as bank details. At the same time, there is also a current account.

Refers to bank details. Important How to find out your personal housing and communal services account by address If you do not know how to find out your personal housing and communal services account by address, then you should use one of the above methods.

This way you will have access to the necessary information in the shortest possible time and will be able to solve your problems much more effectively and easily.

How to find out the rent debt by personal identification In addition, it is worth noting that many large players in the housing and communal services market, in addition to personal portals with accessible information, also offer the opportunity to pay all debts online.

Payment order to bailiffs - sample 2020

Payer's name (field 8).

The short name of the organization that transfers the withheld amounts to the budget is given, i.e.

e. yours. Payer status (field 101). For these payments, Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n provides the status “19”.

Read about other possible payer statuses.

- Code (field 22). If there is a unique accrual identifier, it is provided (20 or 25 characters). If there is no UIN, 0 is entered.

- KBK (field 104). Here they put 0, since BCCs are not provided for such transfers.

- OKTMO is brought to the location of the bailiff service.

- Document number (field 108). For payer status with code 19, field 108 requires the identification of information about the individual. Such an identifier can be SNILS, series and number of a passport or driver’s license, series and number of a car registration certificate, etc.

The financial personal account number of the apartment is the payer code

- n purpose of payment (for example, “invoice for collecting payments for housing and communal services (HCS)");

- who is the payer: his full name, his financial and personal account number (FLA), address, for what period he is offered to pay, payment code, amount to be paid;

- who is the recipient of the payment: DEZ (REU, MUP, etc.), address, his individual tax number (TIN), payee code (KPP);

- the payee's bank, his TIN and bank identification code (BIC);

- What exactly do you pay for: cold/hot water, water disposal (sewage), gas, heating, maintenance and repair of common property, insurance, for example.

We recommend reading: Where and How to Change Your Passport at 45 in Moscow

List of counterparty banks:* Sberbank PJSC* VTB 24 (PJSC)* Federal Post Office in Moscow - branch of FSUE Russian Post* Department of Federal State Unitary Enterprise of the Moscow Region - branch of FSUE Russian Post* Bank Vozrozhdenie (PJSC)* PJSC "Mosoblbank"* PJSC "Bank Uralsib"* JSCB "Military-Industrial Bank" (CJSC)* QIWI Bank (JSC)* LLC NKO "Rapida"* JSC NCO "Moskliring (ZAO)* NCO JSC Leader* CB "Russian Trade Bank" » (LLC)* NPO Krasnoyarsk Regional Settlement * LLC CB "Platina" * JSC "Bank Voronezh" * NPO "Moneta.ru" * JSCB "Interkoopbank" (PJSC) * "SDM Bank" (PJSC) All Banks and acceptance agents payments for housing and communal services were notified of the reorganization of the Bank of Moscow and the transfer of the functions of the financial operator for organizing household payments for housing and communal services to VTB Bank.

Payment order 2020, new filling rules

p. for goods, works, services... From July 3, 2020, the law requires the use of cash register systems for any method of non-cash payment. For example, when paying by receipt or payment order through a bank. But additional checks will need to be punched only from July 1, 2020.

Non-cash payments, except for electronic means, were exempted from cash register until July 1, 2020 (Clause 4, Article 4 of Law No. 192-FZ dated July 3, 2019). Answers to frequently asked questions Yes, it is necessary.

From July 1, 2020, it is necessary to use cash register systems, but only when making payments using electronic means of payment.

About banks and finance

The manager of the country's budget funds is a government body of the Russian Federation that acquires contributions from the superior manager of the country's budget funds for their distribution between the recipients of the funds and the lower managers of the country's budget under its jurisdiction.

1. personal account of the manager of funds, intended to account for the operations of the manager of the manager of funds and the main funds to bring and distribute the amounts of budget financing limits and obligations to recipients and managers of funds under their jurisdiction;

06 Aug 2020 consurist 957

Share this post

- Related Posts

- Parties to the energy supply agreement

- Civil Code of the Russian Federation 153

- Unjust enrichment state duty

- State duty on alimony in a fixed amount

Payment order

Payment orders can be urgent payment orders or early payment orders.

- making partial payments for transactions involving large amounts.

- making payment after shipment of goods, performance of work, provision of services;

- making an advance payment, that is, payment is made before the goods are shipped, work is performed, or services are provided;

You can pay in part or in full if the necessary funds are not available in the payer’s account.

What is a personal account and why is it needed?

The scope of application of personal accounts is very wide. They are opened by individuals and some organizations for non-commercial purposes. Most often - to satisfy some personal needs: making and receiving non-cash payments for transactions involving large amounts. This is how they sell real estate, cars, etc.

A personal account is also opened in a bank and has a number similar to a current account. But opening a personal account is accompanied by a much smaller set of documents and requirements.

The widespread use of the term “personal account” complicates understanding.

- So, at enterprises, personal accounts of employees are opened for calculating and issuing salaries.

- A personal bank account can be a demand account, opened to receive non-cash funds, regularly or one-time.

- Personal accounts for individuals are opened with the tax authorities.

- Mobile operators and many other structures open personal accounts for individuals and legal entities for storing and moving money.

Legal entities and entrepreneurs also open personal accounts. This is cheaper than registering a current account. But using such accounts for commercial transactions is dangerous. Even receiving a transfer to a personal account from an enterprise or entrepreneur can become a reason for attention and verification by the state. It is not advisable to indicate to counterparties a personal account for receiving transfers; this may cause them to worry about the legality of the transaction.

A justified purpose for opening a personal account for a commercial structure may be to receive and repay a bank loan, or some kind of social activities.

How does a current account differ from a personal account?

The main features of each account have already been listed above.

But for greater clarity, let’s put them in a table. Differences between a current account and a personal account

| Checking account | Personal account |

| Designed for commercial and business operations. | Designed for personal financial transactions. |

| Registered almost always by organizations and entrepreneurs | More often open to individuals. Not always independently by these persons. |

| Opening an account requires providing a list of required documents and verifying client data. | Sometimes it opens automatically. Document requirements are often minimal. Usually a passport is enough. |

| Control of transactions by banks, tax and other government authorities is constant and strict. | Control is less thorough. What is justified, incl. significantly smaller range of possible translations. |

Sometimes you can notice how personal, bank and current accounts are confused. The difference is that the use of the term “bank” will be legal for all current accounts, and personal accounts can be bank accounts, but they also refer to accounts of individuals and legal entities in other organizations.

Found an error? Select it and press Ctrl + Enter.

Fill out the payment order

Example 1 Collapse Show In field No. 7 “Amount” the payment amount is entered in numbers, rubles are separated from kopecks with a dash “–”.

If the amount is expressed in numbers in whole rubles, then kopecks may not be indicated. In this case, the payment amount and the equal sign “=” are shown, while in the “Amount in words” field the payment amount is entered in whole rubles, without mentioning kopecks. See an example of completed payments below.

Example 2 Collapse Show or The author recommends that you choose one of the methods and use it. Otherwise, you can get confused about what to write and when.

Let us remind you that an individual entrepreneur and ordinary individuals do not have a cash register.

Is there one number

A tenant can have one number or several. If payments for all resources go through a management company, then it is enough to create one. The company receives payment from the client and independently transfers the money to suppliers.

It is possible that residents at a meeting decide to pay resource companies directly. In most regions, utility services are provided by different companies. Therefore, a citizen pays for electricity, gas supply, heating, water supply, garbage collection and other services using separate receipts. In this case, one number is not enough, and each company has one.

It happens that an apartment is shared ownership by several owners. Then the bill is divided between them in proportion to the areas they own. Each citizen independently pays for his share to the organization providing the services. To obtain a personal account for all residents, you need to contact the resource supply company.

Co-owners may not share the account and use one. You will need to conclude an agreement on the distribution of payments by shares and transfer it to the company. Then the residents give the money to one owner, and he pays for everyone with one receipt. If a voluntary agreement of interests is not achieved, the issue should be resolved through the courts.

Where is the personal account indicated in the payment order?

This is a provision on the transfer of funds, or more precisely on the rules for carrying out this process.

In April 2014, instruction No. 3248-U was issued with changes to the regulations. They came into force in December 2014. The form defined for the document is OKUD 0401060.

This is stipulated in OKUD OK 011-93, regarding the unification of the bank’s document system. Regarding the use of PP for the purpose of paying taxes and insurance premiums, there is Order of the Ministry of Finance dated November 2013 No. 107n. Amendments to this order were issued in 2020.

There is also a letter from the Federal Tax Service dated 02/03/17 No. ZN-4-1/1931. At first glance, the payment order itself looks simple - it is a piece of paper with a set of numbers. An error in one of the numbers can send the payment being made to a completely different place.

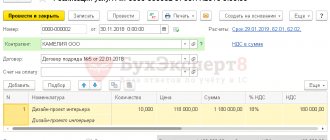

“Accounting for budgetary institutions” Filling out field 104 (BC code) in a payment order addressed to the counterparty whose personal account is opened with the treasury authority

In this case, when filling out a payment order, you should be guided by the Regulations on the peculiarities of settlement and cash services of territorial bodies of the Federal Treasury (approved.

Central Bank of the Russian Federation No. 298-P, Ministry of Finance of the Russian Federation No. 173n dated December 13, 2006). In the first case, in addition to field 104 (BC code), it is necessary to fill in fields 101, 105-110. Moreover, if it is impossible to indicate a specific value of the indicator, a zero (“0”) is entered in fields 106-110 of the settlement document, in accordance with paragraph 2 of Appendix 2 to Order of the Ministry of Finance of Russia dated November 24, 2004 No. 106n.

Read more: Individual housing construction definition

In the second case, only the budget classification code (field 104) is additionally indicated; fields 101, 105-110 should not be filled in.

In the “1C: Accounting for Budgetary Institutions” program, when filling out a payment order for the transfer of taxes, fees and other payments to the budget, you should enable the 2 Transfer of taxes and fees checkbox”, and the details for filling out fields 104-110 will become available.

Ways to find out the housing and communal services account number at the address

Owners, knowing the address of the property, have the right to find out information about the individual registration number in different ways.

If the house is maintained by a management company, then the necessary information is stored there. It is enough to call by phone to find out an individual personal account at the address of your apartment. The owner can also visit the company’s office and consult with a specialist. He will issue an extract and conduct a reconciliation of money transfers.

Sberbank clients use the online service. You must log in using your account. In the “Personal Accounts” tab you need to enter the apartment address. The search engine will provide the necessary information. The client will see the status of current payments. You can also make a payment here. If there is no access to a computer, the bank terminal will display the same data.

You can find out your personal housing and communal services account number through State Services in the “Payment for housing and communal services” section. You need to fill out the proposed form for transfers for utility resources. It is enough to know the company, its bank account and your address. The number will be displayed automatically.

In many large cities, there are special Internet resources through which citizens, knowing only their address, can verify the individual apartment registration number. Among them there are paid portals that charge a commission for the service provided.

Filling out a payment order by budgetary institutions

At the same time, they are filled out in accordance with the requirements established by the Regulations, taking into account a number of features that will be discussed below. As is known, a payment order is one of the forms of non-cash payments. However, for them to be carried out, the following conditions must be met: the settlement document (payment order) must be drawn up in accordance with the Regulations, and there must be funds in the account from which the debit is made.

Subject to all conditions as specified in Art.

865 of the Civil Code of the Russian Federation, the bank that accepted the payer’s payment order is obliged to transfer the corresponding amount of money to the recipient’s bank for crediting it to the account of the person specified in the order.

At the same time, the bank is held liable for non-execution or improper execution of a payment order (Art.

Sample payment order with field numbers

In the current domestic system of non-cash payments, it is difficult to overestimate the role of the payment order. However, difficulties often arise with filling out certain fields of this form, which in turn can lead to problems with processing and crediting the payment. To simplify the procedure for generating a document, you can use the link to view a sample of the fields for a payment order in 2017.

How to open a beneficiary account

A current or personal account is opened solely at the request of a person or organization. There is no obligation to have accounts in Russian legislation. But it can be quite difficult for individual entrepreneurs and organizations to do without it. Many large companies refuse to make payments or accept payments in cash. The size of the transaction within the framework of one agreement when paying in cash is also limited to 100 thousand rubles.

Ordinary citizens will also rarely be able to do without personal accounts. Most employers prefer to transfer salaries by bank transfer and it can be difficult or even impossible to convince them to pay them in cash. But the law allows a person to choose the method of receiving the money he earns.

To open an account, an individual must take the following steps:

- Choose a suitable bank and product. Almost all Russian banks provide similar services.

- Contact a credit institution with your passport. Sometimes you may also need SNILS.

- Sign a banking service agreement. A bank office employee can immediately issue a bank card if necessary.

Usually the whole procedure takes a little time, but you need to carefully read the contract and tariffs. Banks may charge a service fee. But you can also find offers that do not require payment, for example, the recipient's Sberbank account will be free for private clients.

To open an account, legal entities and individual entrepreneurs need:

- Choose a suitable offer from the bank. The cost of settlement and cash services for a company can range from 0 to 10-12 thousand rubles or more per month. But each package includes a different set of services.

- Submit an application through the website or bank branch. It will need to be accompanied by a package of documents in accordance with the requirements of a specific credit institution.

- Wait for the documents to be prepared and sign them. Without a paper agreement, the bank will not be able to provide its services.

An account number is required for non-cash payment.

Sometimes a bank may refuse to conclude an agreement, even if it is not related to loans. This may happen, for example, due to the fact that the client was caught cashing out illegal proceeds or engaging in other activities prohibited by law.

Taxpayer account number

- Fully ensure the safety of all tax documents within the period established by the Tax Code - four years from the date of preparation;

- Submit tax and accounting reports to the Federal Tax Service;

- Keep records of income and expenses, on the basis of which to calculate the tax base;

- At the request of the tax authorities, provide the documents requested for verification;

- Accrue and pay necessary taxes.

The Tax Code has such a concept as a taxpayer. For most, this is a person who simply pays taxes. But few people know that according to the Tax Code of the Russian Federation, the taxpayer has his own responsibilities, he performs a number of functions, but at the same time he also has his own rights. And one of the functions is to obtain a taxpayer number, without which it is impossible to pay taxes and, therefore, legally conduct business in the Russian Federation. And further about who a taxpayer is and what a taxpayer account number is.

01 Feb 2020 etolaw 1677

Share this post

- Related Posts

- Claim Act Sample

- I'm on the young family program, can I sell my apartment?

- Amount for Travel for Pensioners on Public Transport Compensation in Nizhny Novgorod

- The size of the pension for a disabled Chernobyl survivor of group 2