Legislation

Valuation of inherited property is a mandatory activity. It must be carried out by the recipients of the property, even if they are exempt from paying the duty. In accordance with the law, a citizen can inherit property objects that are endowed with material value. In the absence of an assessment, it is impossible to reliably determine the value of an object.

The valuation of property for inheritance is regulated by the following regulations:

- Constitution of the Russian Federation;

- Tax Code of the Russian Federation;

- Law on Valuation Activities.

Art. 35 of the Constitution of the Russian Federation guarantees the inheritance rights of citizens.

Art. 333.25 establishes the entities that are authorized to conduct appraisals and the documentation that recipients must provide to the notary.

The Law on Valuation Activities regulates in detail the procedure for conducting market and cadastral valuations.

Stages of real estate valuation

First of all, the client provides the contractor with all the documentation relating to the property. The list of papers can be found by contacting us by contact numbers. Next, our expert studies them, carries out a number of necessary procedures, observing the procedure for assessing real estate in accordance with legal norms. The final stage will be a written reflection of the results of the examination in a report, which the client can present to any authorities in order to protect their legitimate interests. Our assessment is independent, competent and unbiased. Therefore, to ensure that the contractual value of the property does not turn out to be higher than its real market price, we are always happy to conduct a professional examination for you.

What is a property valuation and why is it needed?

Property valuation means determining its book value, cadastral or market value as of the date of a legally significant action. The assessment procedure is regulated by Federal Law No. 135-FZ dated July 29, 1998.

The result of the assessment is the provision to the customer of a document containing the cost of the object at a certain moment.

In the case of registration of inheritance, the assessment is ordered as of the date of death of the owner. Moreover, it does not matter whether the heir turned to the notary within the prescribed period or after the expiration of the period. The date cannot be changed.

The assessment document can be:

- report of the appraisal organization;

- cadastral extract;

- certificate from the BTI.

The document is used to calculate the amount of the fee that the heir must pay. The applicant independently decides which type of assessment to use when calculating the state duty. The document on the assessment of the inheritance is issued to the legal successors only after payment for the work.

Since the law fixes the day of the commission of a legally significant action, the date of contacting the appraiser does not matter. A citizen can draw up a document at a time convenient for himself. However, the certificate of inheritance rights will not be issued until the fee is paid.

Valuation of property for authorized capital

In accordance with the requirements of the law, when increasing the authorized capital of an organization by introducing non-monetary property, an independent assessment is required. This document is called an assessment report. Subsequently, it will be provided to the tax service to justify the figures in the constituent documents.

Property valuation is carried out according to all standards of valuation activities. Moreover, the appraiser performing this work must not only be a member of the SRO and have valid insurance, but also have a qualification certificate in the relevant accounting specialty. That is, someone who can evaluate special equipment or a car cannot evaluate hangars and offices and vice versa.

For small organizations, which, as a rule, are small businesses, an independent assessment of movable property (furniture, refrigeration equipment, production line, etc.) is mainly relevant. The end result of this procedure is obtaining a license to sell alcohol. For large enterprises, the assessment of technological lines, machine tools, warehouse complexes, hangars, special equipment and other vehicles is often in demand.

Before calling an appraiser to determine the value of the organization’s property, working conditions are agreed upon. First of all, you need to provide an accurate list of research objects from the customer. The specifics of the work and how much the property valuation costs depend on this. Payment is made by bank transfer. But if the amount of work is relatively small, a different order is possible. But this is more likely the case if the client of the appraisal company is an individual entrepreneur or LLC with small turnover, when several things are being assessed (a computer and a couple of cabinets).

First of all, long procedures for agreeing on working conditions are associated with the counterparty’s decision-making chain. After all, in large organizations this takes time.

If it is possible to travel to the location of the property, the appraiser does so. Conducts an inspection, photographs property or real estate, draws up a research report, which is the primary document for subsequent evaluation. But if access to the object is not possible (sensitive object, distant region), then the assessment is made without visiting the site using documents, photographs and other materials provided.

Why do you need to evaluate an inheritance, and what property is subject to it?

A document officially confirming the value of the property included in the inheritance is required to be presented to a notary and is called an appraisal report. It must record the value of the property on the date the citizen was declared dead.

The price indicated in the document serves as the basis for calculating the state duty that the heir must pay in accordance with the law. It is charged for opening and conducting an inheritance case by a notary, as well as issuing a certificate giving him the right to own this inheritance. This title document provides the basis for registering ownership of property with government agencies.

The amount of the duty is calculated as a percentage of the established value of the inherited property and depends on the degree of relationship between the heir and the deceased person. Relatives of the first and second priority are charged 0.3% of the price of the property, and the amount should not exceed 100 thousand rubles. The remaining relatives, as well as citizens who received an inheritance on the basis of a will, must pay 0.6% of the established value of the inheritance. The maximum amount of such duty should not exceed 1 million. rubles

Persons under 18 years of age, citizens who permanently resided with the owner of the property, and persons inheriting bank deposits are exempt from paying the fee.

It is required to evaluate inherited property in addition to determining the amount of duty and for another purpose. A monetary expression of the amount of the inheritance is required so that the inheritance can be divided equally among all the heirs to whom it is due by law.

Particularly relevant is the assessment of real estate, including residential buildings, offices, apartments, summer cottages and other objects. Property that is classified as movable inheritance must also be assessed. This includes, for example: vehicles, business equipment and the business itself, intellectual property and other valuables.

Important! All inherited property included in the inventory report must be assessed!

Why do you need a property valuation to enter into an inheritance?

Determine the amount of state duty

In order to inherit any property, you must obtain a certificate and pay a state fee. And to determine its size, you need to evaluate the equipment.

Who should order an assessment of inherited property?

A high-quality assessment of property is necessary not only to determine the state duty, but also for a fair division between heirs, as well as proof of correctness in court.

If the distribution of property occurs in order of priority, then the persons called to inherit must provide information about its price.

When inheriting in accordance with a will, the persons specified in the document will have to issue a certificate of valuation.

If one of the relatives considers the division unfair, he has the right to go to court, but he will also have to evaluate the property and provide the relevant documents to the judge.

The assessment must be carried out within 6 months from the date of opening of the inheritance. This period is provided to the heirs to prepare documents.

Types of assessment

The law provides for different methods of assessing property. The heir has the right to use one of them at his own discretion.

Types of assessment

| No. | Name of assessment | Comments |

| 1 | Inventory | It can be ordered from BTI. Its feature is the low cost of work and lower cost of the object. When carrying out work, the specialist takes into account exclusively the technical characteristics of the object. In this way, you can evaluate residential and non-residential premises, as well as land. |

| 2 | Cadastral | This type of assessment was introduced in Russia not so long ago. Price adjustments are made every five years. A cadastral extract is issued in relation to land plots. |

| 3 | Market | The obtained figures are as close as possible to the real price of the object. Conducted by private organizations. When assessing real estate, the technical characteristics of the property, infrastructure, transport accessibility and other indicators are taken into account. A commercial organization can evaluate almost any type of property. |

The heir can order one or two types of assessment in order to compare the results obtained and choose the best option for calculating the state duty.

Important! A notary cannot impose any specific type of assessment on the heir (Article 333.25 of the Tax Code of the Russian Federation).

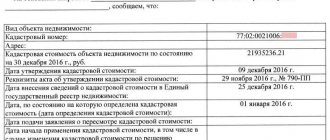

Cadastral value assessment

The cadastral value is applied to the valuation of real estate and land plots and is defined as the value entered in the state cadastral register of real estate.

An independent assessment of property at cadastral value is carried out in a manner regulated by Law No. 135-FZ dated July 29, 1998. According to the law, the municipality decides to conduct an assessment and, after a tender, enters into an agreement with an independent one. Upon completion of the assessment and drawing up a conclusion, data on the cost of the object (objects) are entered into the State Cadastre (SC).

Be sure to read it! Articles of the Code of Administrative Offenses and the Criminal Code of the Russian Federation for prostitution in 2020: punishment and responsibility

The heir can obtain information about the cadastral value of the bequeathed property using the electronic resource Rosreesra , which allows:

- order an extract on the value of the property by filling out the appropriate application on the website;

- find the required object by cadastral number on the map, and then obtain information about its cadastral value and other characteristics;

- obtain information on the object online;

- download an electronic report on the results of the cadastral assessment.

In addition, documentary confirmation of the cadastral value of the property can be obtained directly from the Federal Cadastral Chamber of Rosreestr by submitting a corresponding application there. If the request is completed correctly, a cost certificate will be provided to the customer within five working days. The notary is obliged to accept the received certificate as a document for calculating the state duty.

In 2020, a frequent occurrence was the challenge of a property valuation made by an independent appraiser and included in the Cadastral Register. If, in the opinion of the heir, the cadastral value is not equivalent, then he can contact a commercial company to obtain a report on the real value of the inheritance.

Inventory value assessment

The inventory value of the object of inheritance is determined according to the conclusion of the BTI expert appraiser .

To obtain a certificate, the heir must contact the BTI with an application and passport. It should be noted that in 2020, there is virtually no practice of using inventory value to calculate state duty for inheritance. This is due to the fact that the cost of the object, according to the BTI, includes a small number of evaluation criteria and does not take into account the location of the building, its infrastructure, etc. As a result, the price of real estate determined by the BTI is significantly lower than its real value. The amount of state duty paid in this case is considered too low.

This position is confirmed by letter of the Ministry of Finance No. 03-05-06-03/57471 dated December 26, 2013. At the same time, such letters are not legislative acts. That is, if the heir registers the right of ownership in 2020, the notary is obliged to accept a report on the inventory value to calculate the state duty.

Market value assessment

Market value is calculated as the price at which the valuation object can be bought (or sold) on the market under competitive conditions.

This indicator is considered the most relevant, since the assessment takes into account not only the operational characteristics of the object, its purpose and usefulness, but also the influence of the market environment. That is why the calculation of the market price when paying state fees for inheritance has received the most widespread use in valuation activities in 2020.

It should also be noted that the object of inheritance can be not only real estate or land. If the heir claims ownership of movable property or small material assets, then it is possible to evaluate them only at the market price.

To obtain a conclusion on market valuation, the heir must contact an independent company that has a license to carry out this type of activity. The customer and the appraiser company enter into a service agreement, which specifies what needs to be appraised and how much the property appraisal costs. After concluding the contract, the company’s independent expert carries out an assessment procedure, which includes:

- inspection of property;

- determination of quantitative and qualitative characteristics of the object (objects);

- market analysis;

- choice of assessment method;

- generalization of results;

- drawing up and issuing a written assessment report to the customer.

After receiving documentary confirmation of the market price of the property from the expert, the heir provides a report to the notary to calculate the state duty.

Conduct a property assessment

Advice from lawyers:

1. Do bank employees have the ability to conduct a preliminary assessment of the debtor’s property?

1.1. No, they do not have the right, unless you yourself signed it in the contract.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. How to properly evaluate property and what should be evaluated, thank you.

2.1. Invite an appraiser. GOOD LUCK TO YOU.

Did the answer help you?YesNo

3. How can you conduct a real estate valuation without an expert assessment of the property?

3.1. Could you please clarify your question in detail - what kind of property (land or apartment or other object) are we talking about, who wants to carry out what - an appraiser or an expert - and for what purpose?

Did the answer help you?YesNo

4. My husband has a house where his ex-wife lives. He is going to file for division of property. If you evaluate the house, it will not let anyone into the house, that is, it is impossible to carry out an inventory value of the house. Is it possible for him to sue himself without appraising the house, to indicate the value of the house himself?

4.1. Good afternoon, Ksenia. You can file a claim for division of property in equal shares, you can indicate the value of the share yourself.

Did the answer help you?YesNo

4.2. Good afternoon Yes, of course, you can file a claim in court without appraising the house, indicating the value as you are appraising this house. If the ex-wife does not agree with such an assessment, then the court can order an assessment and then she will have to let the appraisers in.

Did the answer help you?YesNo

5. The car was seized. The car was purchased during marriage. The car is parked in the bailiff's parking lot and has been assessed. Should the bailiffs allocate a share to the spouse (50%), because... Is this joint property?

5.1. Yes, in this case, the issue of determining the share must be resolved by the court upon the application of the bailiff.

Did the answer help you?YesNo

6. Is it possible to conduct an assessment of movable property that is in someone else’s illegal possession, without the appraiser having access to these objects, without having serial numbers, operability of the objects, or technical characteristics. There is a contract for the purchase and sale of property from an individual, in which the property is vaguely named, without indicating the exact brands or serial numbers. Is it possible to conduct an assessment only on this contract? And how is the cost determined if the year of manufacture is 70-80?

6.1. Is there any property available? In order to evaluate it, you will need the property itself. The court can provide access. Federal Law “On Valuation Activities in the Russian Federation” dated July 29, 1998 N 135-FZ (latest edition) Art. 5

Did the answer help you?YesNo

6.2. This is decided by the expert; if he has enough data, then the assessment is possible. If not, they write about it.

Did the answer help you?YesNo

6.3. Hello. To carry out an assessment, it is necessary to establish, among other things, the degree of wear. But without the property itself, only according to documents, especially, only according to one agreement, this is impossible.

Did the answer help you?YesNo

7. Who should conduct an assessment of stolen property under Article 15 of the Criminal Code of the Russian Federation? The police returned it, like do it yourself, idiots, if it was stolen, how will I evaluate it? What to do?

7.1. Hello, unfortunately you did not formulate the question precisely. If a criminal case has been initiated for theft of property, the police themselves will appoint a forensic assessment examination.

Did the answer help you?YesNo

7.2. In respect of what was the theft committed?

Did the answer help you?YesNo

8. Why is it necessary to evaluate the apartment in advance when dividing property after a divorce in court and spend money on it? After all, if the defendant agrees with the cadastral value or the value declared by me, then there is no need for it. You can file a petition and conduct an assessment during the court hearing and share the burden of paying for it with the defendant. Right?

8.1. Hello, everything is correct, it is not necessary to carry out an assessment, you can provide a certificate of cadastral value. If a dispute arises regarding the cost, then a forensic examination will be appointed. Good luck and all the best.

Did the answer help you?YesNo

8.2. The court must accept even the inventory value of the duty paid. Art. 91 of the Code of Civil Procedure of the Russian Federation: 1. The price of the claim is determined: 9) for claims for ownership of a real estate object owned by a citizen by right of ownership, based on the value of the object, but not lower than its inventory estimate or, in the absence of one, not lower than the value of the object according to an insurance contract for an object of real estate owned by an organization - not lower than the balance sheet value of the object; Sincerely, lawyer in Moscow - Stepanov Vadim Igorevich.

Did the answer help you?YesNo

9. The debt was collected, the debtor’s property was seized, does the collector have the right, due to the fact that the bailiffs make an assessment for half a year, to make an assessment himself. And hold an auction on it.

9.1. The claimant does not have such a right. The only thing left to do is complain.

Did the answer help you?YesNo

10. An open auction with an open form for submitting price proposals was declared invalid. Open bidding was announced through a public offer (bankruptcy of an individual), while the assessment of the property being sold was carried out 9 months before the end of the bidding. Is it possible to invalidate the auction based on the fact that the property assessment is valid for only 6 months?

10.1. Is it possible to invalidate the auction based on the fact that the property assessment is valid for only 6 months? No you can not.

Did the answer help you?YesNo

11. Please tell me who the independent assessment agencies report to? And how can you prove the unreliability of a property valuation? Thank you.

11.1. Good afternoon. You can challenge the examination by contacting another organization, including a state expert organization. There is criminal liability for giving a knowingly false conclusion in a forensic examination.

Did the answer help you?YesNo

12. I have a question: my ex-husband and I are sharing property, which is currently located in our common house, where the ex-husband lives. he took photos of furniture and other things and on the basis of these photos an assessment of the property was carried out, the act says that the expert was not present when photographing this property, but in court I saw photos of things that were not ours at all, how can I challenge this assessment if the property is fake on the picture.

12.1. Make your assessment and invite witnesses who will confirm that these are your things. In accordance with Article 56 of the Code of Civil Procedure of the Russian Federation, each party must prove the circumstances to which it refers.

Did the answer help you?YesNo

13. Tell me please. Is it possible to file a claim for a share in an apartment if, according to an assessment of improvements in the apartment during the marriage, the cost has increased by 18% of the initial value. Divorced 8 months ago. My ex-husband has not lived in the apartment for 2 years. The apartment was purchased a month before the marriage. Husband's property. We have been married for 20 years. There are threats about changing the lock and eviction. The division of property has not yet been carried out.

13.1. File a claim for division of jointly acquired property. Try to include this apartment in your jointly acquired property, since you have invested a lot in it. The chances are good to get something from her. Not necessarily a share. The court may allocate more property to you, taking into account the investment in the apartment.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. I have a question. Is it possible by law to claim a share in an apartment in a statement of claim (when dividing property after a divorce). During the period of marriage (20 years), improvements were made to the apartment. They may not be that significant, but they are there. Improvements have been assessed. My lawyer tells me that I can report it.

14.1. To answer the question, you need to describe in more detail whose apartment this is currently and how it was acquired by the owner (purchase and sale, exchange, donation...).

Did the answer help you?YesNo

15. I am preparing a claim for division of property in the district court. Question: 1. Is a divorce decree required for a claim or is it necessary to obtain a divorce certificate? 2. I have assessed the property. Do I need to make a copy (2 folders of 50 sheets each) for the defendant or is it enough to submit the original for consideration by the judge?

15.1. When filing a claim with the court for the division of property, you must attach a certificate of divorce (photocopy) and make two photocopies of the assessment, one for the court and the other for the defendant. Keep the original assessment with you, you will present it for review in court.

Did the answer help you?YesNo

15.2. Good afternoon, Sergey Vladislavovich! Ideally, a divorce certificate is attached, but I think a court decision will do. Of course, copies of documents for the defendant will have to be attached to his copy of the statement of claim.

Did the answer help you?YesNo

16. We own municipal non-residential premises under the right of economic management and would like to rent them out. We assessed the market value using the company's own resources. The charter of the enterprise only states that the rights of the owner of our property are exercised by the municipality. Do we need to coordinate the rental price obtained as a result of the assessment with the municipality and is this agreement enshrined somewhere in the legislation?

16.1. Good afternoon Real estate of a state or municipal institution is leased based on the results of auctions, with the exception of cases provided for in Art. 17.1 of the Law on Protection of Competition. If the auction is not held, the contract may be declared invalid, and the official who made the decision to lease the property will bear administrative liability.

An enterprise does not have the right to sell real estate owned by it under the right of economic management, rent it out, pledge it, make a contribution to the authorized (share) capital of business companies and partnerships, or otherwise dispose of this property

without the consent of the owner

. Art. 295, “Civil Code of the Russian Federation (Part One) Thus, the conclusion of lease agreements in relation to property owned by the right of economic management should be carried out based on the results of competitions or auctions for the right to conclude these agreements, except for the cases specified in Art. 17.1 of Law No. 135-FZ.

Did the answer help you?YesNo

17. Should the arbitration manager in his report reflect information about sending a report on the assessment of the property of the debtor enterprise (MUP) to the state financial control body (for a conclusion on the assessment)?

17.1. Who are you in this case? These issues are dealt with by a full-time lawyer; if there is not one, then contact a lawyer. Have your passport and money with you. Sincerely, Lawyer in Volgograd - Stepanov Vadim Igorevich

.

Did the answer help you?YesNo

18. My car was seized on November 23, 2017. It was handed over to the claimant for storage. The property has not even been assessed yet. And also the keeper violates the storage conditions, since he drags it from place to place, since it interferes with him. I contacted the bailiff on January 11, 2018, but no action has been taken so far. Can I return the property and file a complaint?

18.1. According to Art. 85 of the Federal Law “On Enforcement Proceedings”, after identifying the property, it is required to attract an appraiser for evaluation. In case of violation of the order and deadlines, contact directly the senior bailiff of the department or the chief bailiff of your region. As for the actions of the claimant with your property, contact the bailiff, provide him with a substantiated statement that such actions with the property lose its value, worsen its condition, provide photos and other evidence. Apply for the cancellation of the decision and the transfer of the property for storage to you or another organization.

Did the answer help you?YesNo

19. As a creditor filed a claim against the debtor’s estate, an heir was identified in court, and he accepted 1/12 of the house’s share as an inheritance. The court is asking for an appraisal of this house, can I come with an appraiser and appraise it? Will the residents of the house let me in?

19.1. Christina, good afternoon! The homeowner has the right not to let you in, only appraisers executing the court decision. Best wishes to you!

Did the answer help you?YesNo

19.2. Good afternoon Christina. Residents of the house may not let you in and have a legal right to do so. An appraiser can also be allowed in only on the basis of a court decision and an execution sheet.

Did the answer help you?YesNo

20. In the Court of Appeal, the judge ordered an appraisal of the property. At the second meeting, he made a decision to put the property up for auction based on the assessment. The bank is now challenging this decision and is filing a lawsuit again. A notification has arrived from the aircraft. what to do? If the bank begins to insist on its expertise.

20.1. Hello, file objections to the bank’s demands; your position must be expressed. Good luck and all the best.

Did the answer help you?YesNo

20.2. Good day to you. In this case, write a review of the bank’s complaint. The bank apparently appealed to the cassation authority. Good luck and all the best.

Did the answer help you?YesNo

20.3. In this case, everything is at the discretion of the court; you only have to object to the Bank’s arguments, provide your arguments and references to legislation and similar practice, so that the previously issued judicial act is not changed.

Did the answer help you?YesNo

20.4. File an objection to the bank's complaint. The bank will need to prove that the assessment of the expert organization is incorrect, which is very difficult.

Did the answer help you?YesNo

Tell me how to assess damaged property in an apartment (furniture, items, etc.)

Dear lawyers, please tell me if I can take advantage of the debtor’s right to priority redemption of my seized property (car).

A mentally ill man threw property from his balcony and damaged the roof and hood of a vehicle.

Is it possible to hold an auction for the rental of special valuable movable property (bus)

The couple lived in a civil marriage for more than 20 years. The husband died, there were no heirs, but there was a garage and a car registered in his name.

The appellate court ordered an assessment of the property, they did not familiarize me with the results, I do not agree with the assessment, what should I do next?

After the death of my husband, there were heirs: me and his parents. We have a conflict, they seized their property: a house, a plot and a car.

Another question about the division of property. It is impossible to assess the property before the trial.

My name is Alexander, I am the only participant in the LLC, I want to add one more person to the founders, the authorized capital is now 10,000 rubles.

A claim will be filed with the court for the division of property, it is necessary to evaluate the house and determine the percentage of readiness of the house during construction.

Question: Are unfinished construction projects subject to property tax?

Who is doing?

Only qualified appraisers have the right to evaluate the inheritance. These include independent specialists with the appropriate license. Appraisers must be members of the SRO.

Reports compiled by other specialists will not be recognized by either the court or the notary. State specialists are also authorized to carry out the assessment procedure.

To attract such experts, you should contact the local BTI (regulated by Article 333.25 of the Tax Code of the Russian Federation). In some localities, an inventory was not carried out, so the municipality is responsible for assessing the inheritance. If the inherited property is located abroad, then the assessment procedure is carried out by the authorized body of the state in which the property is located.

When indicating the value of the successive property in another currency, the price will be recalculated at the ruble exchange rate, according to information from the Central Bank at the time of opening of the inheritance. In the absence of an agreement between the successors on the assessment of the inheritance, the procedure is carried out at the expense of its customers. The cost of the assessment is divided equally between all heirs (Article 1172 of the Civil Code of the Russian Federation).

What could be the purpose of the assessment?

Various parties may be interested in carrying out real estate valuation work:

— sellers and buyers;

— owners of real estate for various purposes;

— investors;

— credit organizations (banks);

— government structures (control and audit and tax);

— management structures of municipalities;

- insurance companies, etc.

All of them, realizing their economic interests, can order an assessment and thereby become customers.

It should be noted that the owner's appraisal needs may result from third party requirements.

In fact, the third party may itself act as a customer, for example:

— insurance companies want to know the amount of risk they are taking on, or to confirm compliance with the risk sharing agreement between the insurer and the policyholder;

— credit institutions want to know what amounts they can safely lend for a property and get it back in the event of the borrower’s bankruptcy;

— government agencies want to know the reasonable market value for the purchase of government-owned real estate.

Third parties may include manufacturers and intermediaries (dealers and brokers), buyers and sellers, cadastral appraisers and insurers, lenders (banks) and courts, tenants and lessors, accountants and managers, lawyers and consultants, financial and leasing companies, partners and spouses.

In FSO-2, the purpose and function of the assessment are specified as follows:

— The purpose of the appraisal is to determine the value of the appraisal object, the type of which is determined in the appraisal assignment.

— The result of the assessment is the final value of the value of the object being assessed. The result of the assessment can be used when the parties determine the price for completing a transaction or other actions with the object of assessment.

In accordance with Art. 6 of the Law on Valuation Activities, subjects of various forms of ownership of the Russian Federation, individuals and legal entities have the right to conduct an assessment of real estate properties owned by them. This right is unconditional and does not depend on the established procedure for state statistical and accounting and reporting. Situations in which an assessment is mandatory are defined in Art. 8 of this Law.

Conducting an assessment is mandatory in the case of involving real estate objects in a transaction that belong in whole or in part to the Russian Federation, constituent entities of the Russian Federation or municipalities.

The complete list of all the reasons why a real estate valuation is necessary is quite large. You can indicate the most common ones.

The need to evaluate privately owned real estate arises when:

— purchase and sale of real estate;

— corporatization of enterprises and redistribution of property shares;

— reorganization of enterprises;

— introducing real estate as a contribution to the authorized capital of enterprises and organizations;

— in case of an additional issue of shares or attraction of new shareholders;

— liquidation of real estate;

— real estate rental;

— clarification of the tax base of real estate objects: buildings and land plots;

— insurance of real estate;

— lending secured by real estate;

— development of investment projects and attraction of investors;

— making management decisions;

— preparation of financial (accounting) statements;

— execution of inheritance rights, court verdict, resolution of property disputes, etc.

Since the type of value depends on the purpose (purpose) of the valuation, the appraiser should explain in detail to the customer the features of the selected type of value being assessed and the need to use this particular type of value in a particular case. That is, when performing an assessment, the appraiser must agree on the purpose of the assessment with the customer, and if it is non-standard and not defined by law or current regulations, then its special wording must be reflected in the assessment agreement.

Documents for assessment

The number of documents will depend on what is being assessed. This includes:

- heir's passport;

- documents for inherited property confirming ownership (purchase and sale agreement, registration certificate);

- technical documentation;

- information about encumbrances;

- a certificate confirming the absence of debt;

- documents on shared participation in construction (if available).

If securities are subject to evaluation, a report is drawn up that includes a description of the state of the securities market, an analysis of the financial condition of the issuer, and calculation of the market value of the securities. As attachments, the report contains a photocopy of the organization's charter, documents on the number of share issues; financial statements for 3-5 years; the results of the audit report; information about assets, accounts payable and receivable; strategic plan for the development of the enterprise.

The testator has the right to obtain information about the price of the inheritance from several sources: government agencies, private organizations or from an independent appraiser.

If the property is located on the territory of another state, then the assessment is made at the location of the object by authorized persons of the same country.

Procedure

When ordering an assessment, the testator enters into an agreement with a specialist or expert organization. Based on it, appraisers collect the necessary information and form an objective conclusion.

Procedure for assessing inherited property:

- inspection of the property being valued;

- determination of its characteristics;

- choice of assessment method;

- market analysis;

- generalization of the obtained data;

- preparation of an assessment report;

- receipt of the report by the heirs.

The specific method of assessing property and who will undertake this procedure depends on the objects of inherited property and their characteristics.

The expert involved in the assessment will need to provide a certain package of documents. However, their list may vary depending on the type of property being valued.

General list of required documents:

- identification documents of heirs;

- death certificate;

- papers confirming the relationship of the successors and the deceased;

- confirmation of the deceased’s rights to own inherited property;

- technical documentation;

- extract from the state register of real estate rights.

Property valuation procedure

- Concluding an agreement with the customer. Study of submitted documents.

- Visit to the site. Carrying out inspection and photography with drawing up a report.

- Processing of received data. Processing of received data.

- Preparation and delivery of a real estate assessment report to the customer. This document has legal force in courts and other authorities.

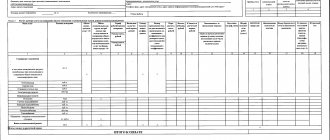

Property valuation cost

| Name of the type of examination | The cost of conducting a pre-trial examination per unit | Cost of examination within the framework of legal proceedings per unit | |

| Determining the market value of an apartment | 6000 rubles | 15,000 rubles | |

| Determining the market value of residential buildings | |||

| up to 150 m2 | 8000 rubles | 15,000 rubles | |

| up to 350 m2 | 15,000 rubles | 20,000 rubles | |

| over 350 m2 | From 25,000 rubles | From 30,000 rubles | |

| Determining the market value of a land plot | |||

| up to 10 acres | 7000 rubles | 15,000 rubles | |

| up to 50 acres | 12000 rubles | 20,000 rubles | |

| from 90 acres | 25,000 rubles | 30,000 rubles | |

| from 1 ha | by agreement | by agreement | |

| Determination of the market value of non-residential buildings and premises | |||

| up to 150 m2 | 15,000 rubles | 25,000 rubles | |

| up to 300 m2 | 25,000 rubles | 35,000 rubles | |

| up to 500 m2 | 30,000 rubles | 45,000 rubles | |

| up to 1000 m2 | 40,000 rubles | 55,000 rubles | |

| over 1000 m2 | by agreement | by agreement | |

| Determining the market value of an enterprise | |||

| small | From 50,000 rubles | From 50,000 rubles | |

| average large | 150000 from 200000 rubles | 150000 from 200000 rubles | |

| Other types of assessment | By agreement | ||

* The price is indicative and is not a public offer for concluding a contract; the final cost should be confirmed with specialists.

What property is subject to valuation?

The inheritance may include movable and immovable property. The following types of property are subject to assessment:

- private houses.

- apartments in an apartment building.

- land.

- shares in the authorized capital of an economic entity.

- enterprise securities.

- property complexes.

- industrial equipment.

- weapon.

When is an assessment required?

When entering into an inheritance, an assessment is required in the following cases:

- when submitting documents to a notary;

- when submitting documents to the court to establish the fact of acceptance of the inheritance in court;

- in case of litigation with other heirs.

Let's consider whether it is possible to do without an assessment. Citizens exempt from paying fees may not order assessment documents. However, this option is possible if the person entitled to the benefit is the only heir.

In addition, citizens who inherit:

- residential premises in which they lived together with the testator;

- funds on deposits.

It is worth considering separately whether a report is needed when actually accepting an inheritance. The possibility of exemption from paying the duty is provided depending on the identity of the heir or the type of property. The method of accepting the inheritance does not matter. When registering property, the actual heirs undergo a full list of procedures, including assessment (Article 1153 of the Civil Code of the Russian Federation).

Be sure to read it! Judicial practice on gift agreements 2020

The only difference is that the heir contacts the notary at any time. The assessment must be made in advance.

In what cases is an independent assessment carried out when dividing marital property?

An independent assessment during the division of property of divorcing spouses is required not only in the event of disagreements, pre-trial or judicial proceedings. We also provide the service upon the voluntary request of parties who want to obtain accurate data and enter it into the appropriate agreement on the division of property. We carry out all the necessary activities and provide expert opinions also:

- when one of the parties to the divorce proceedings applies, disagrees with the value of the jointly acquired property voiced by the other party or doubts the literacy or veracity of the assessment;

- forcibly by a court ruling, when no other ways to identify the value of the objects in dispute have been found;

- at the request of a third interested party, including participants in the trial, if any.

All requests to the appraisal company are made for the purpose of calculating the market value of the divided property. The law clearly defines not only those objects that are subject to division, but also those that are not subject to it. These include:

- movable and immovable objects donated by one of the parties;

- property passed by inheritance or will;

- personal belongings;

- patents and other registered intellectual property rights;

- property acquired by one of the parties during the period of separation.

We recommend ordering an independent assessment of property during a divorce, even if there are no disagreements between the spouses during the division. This will allow you not to be disappointed in the decisions made in the future, and not to challenge an already signed agreement in court, proving deception or fraudulent actions. Contact us and we will:

- we will discuss the situation, the objects of dispute and their value;

- we will draw possible preliminary conclusions about the results of the independent assessment;

- We will provide free expert advice;

- We will give recommendations on how to interact with a company expert and accept your application.

A specialist involved in an application under a contract conducts market research, collects data about the object, analyzes it, summarizes the results, and generates reporting documents. The conclusion, depending on the client’s requirements, will contain conclusions about:

- the possibility of dividing movable and immovable property in equal shares;

- the amount of monetary compensation for one of the parties if it receives a smaller share if an equal division is not possible;

- the amount of compensation to the spouse who does not receive a certain object, part of the object;

- the market value of the objects in dispute, if division is impossible and their sale with subsequent division of funds is planned.

Our clients also receive a list of more detailed and specific recommendations for subsequent actions when drawing up an agreement on the division of property.

How to evaluate property when entering into inheritance

You can order a property assessment at one of the specialized institutions. The law provides for the possibility of carrying out work by the following organizations:

- state (Rosreestr, BTI);

- commercial (private companies).

Important! If we are talking about the valuation of shares of an enterprise, then the holder of the register of shareholders has such powers.

To order the service, the heir needs to prepare a package of documents. If necessary, a contract is concluded and the contractor’s services or state fees are paid. After the specified period, the heir is given a report or extract on the value of the property.

How to evaluate an inheritance taking into account the market?

You can order an assessment of the value of property at market price from an independent organization that has permission for such activities. The result obtained will correspond to the price of the object at which it can actually be sold. Therefore, the method of determining the price based on market demand is most often used when valuing inherited property. When conducting it, both the operational indicators of the object being assessed and other significant characteristics are taken into account. These include:

- size of the property;

- its location;

- characteristics of communications (plumbing installation, method of installing water supply and electrical wiring, availability of gas, etc.);

- proximity of the property to infrastructure (school, kindergarten, clinic, shopping center);

- transport accessibility, etc.

If property other than real estate is valued, for example, a car, paintings, jewelry and other valuable items, then they can only be valued at market price by knowledgeable specialists. For example, when evaluating a car, its make, date of manufacture, mileage, and lack of repairs after an accident are taken into account. When assessing a business, the financial condition of the company, its market viability and development prospects are taken into account.

To obtain an appraisal document, you must contact a commercial appraisal company and draw up an agreement with it for appraisal services. It must be accompanied by documents characterizing the object of assessment. For example, to evaluate a country house with a plot of land, the appraiser will need the following documents:

- certificate of ownership of the house and land plot adjacent to the house, issued to the old owner;

- real estate passport from the Bureau of Technical Inventory;

- certificate of payments for the last year of operation of the house;

- extract on payment of land tax;

- cadastral passport with the characteristics of utilities, a plan of the entire site and the house;

- data on the repairs carried out and the costs of them, if any;

- information about the presence or absence of an encumbrance, for example, about putting a house as collateral;

- information about the customer of the document on the assessment of country real estate (passport details, degree of relationship, etc.).

After inspecting all the property and analyzing market conditions, experts draw up a report in the form of an assessment report on its value. It will serve as the basis for calculating the amount of duty.

How much does the service cost?

Various experts may be involved in the appraisal depending on the type of property and the procedures required. These could be specialists in the field of construction, automotive equipment, employees of the Ministry of Internal Affairs, weapons experts, etc.

Real estate

Determining the value of housing or other real estate occupies the most significant place among the number of assessments of inherited property.

In the capital and Moscow region, you will have to pay 5-6 thousand rubles for the provision of the service.

Prices for valuation of various real estate objects are in the following range:

| A private house | from 15 thousand rubles |

| Land plot | from 10 thousand rubles |

| Garage | around 3500 rubles |

| Commercial real estate | from 25 thousand rubles |

Automobile

The vehicle is assessed depending on its type, mileage, wear and tear and demand for the vehicle.

The assessment is carried out within three days and on average will cost the following amount:

| Cars | 2.5-3 thousand rubles |

| Trailers | 2 thousand rubles |

| Motorcycles | from 4 thousand rubles |

Stock

To evaluate shares, specialists study the stock market and quotes of various securities.

The procedure takes from two to three hours to several days and will cost the heir inexpensively - on average, the amount ranges from 2 to 10 thousand rubles.

Share in LLC

When inheriting a share in a company, a notary needs a protocol confirming the value, drawn up on the date of the testator’s death. To evaluate the share, the expert must submit:

- constituent documentation of the company;

- information about the organization's registration with the tax authority;

- information about the license;

- if desired, the company’s business plan for the coming period.

The cost of assessing a share in an LLC is in the region of 10-15 thousand rubles, but may vary from region to region.

Land plot

Determining the price of a land plot is carried out in one day and will cost the successor in the amount of 2.5 thousand rubles.

You will have to pay the same amount for the appraisal of a country house, but for a house with a plot you need to pay a little more - from 4 thousand rubles.

An example of calculating state duty when inheriting an apartment

After the death of the mother, the apartment remained. Before her death, the woman made a will, according to which 1/4 of the apartment was transferred to the deceased’s partner, and 3/4 to her own daughter. The market value of the apartment is 1,750 thousand rubles. The amount of state duty for my daughter was 3937.5 rubles. (1,750,000 x 0.75 x 0.3%), and for a cohabitant - 2,625 rubles. (1750000x0.25x0.6%).

After paying the state fee established on the basis of any of the values, the heir provides a receipt to the notary and receives a certificate of the right to inheritance.