Pravozhil.com > Real estate registration > How to draw up an agreement on the division of inherited property between a group of heirs?

Sometimes, when entering into an inheritance, the property of the deceased will have to be divided among several people. This occurs by concluding an agreement on the division of inherited property between the heirs.

Often, with this method of distributing inheritance, questions arise about the procedure for applying legislative provisions in specific situations. Let's talk about this further.

Compilation requirements

For a simple written agreement to have legal effect, the requirements include:

- availability of legally significant information, its relevance;

- legibility of text writing, absence of erasures and corrections - in general, it is better to type the document on a computer;

- brevity and specificity of presentation;

- competent legal formulations and absence of colloquial expressions.

When concluding an agreement on the division of property between heirs through a notary, a standard template is used. In this case, compliance with legal requirements is guaranteed.

Algorithm of actions involving the agreement

According to the information contained in Article 1165 , claimants to inheritance whose rights are finally confirmed are able to divide the property by concluding an agreement among themselves. The process of becoming a full-fledged legal successor of the testator consists of several basic steps.

- The act of agreement can take place only after receiving a certificate of the right to inheritance, for which you must contact a notary.

- After formalizing the agreement and reaching a compromise on the division of property, the heirs apply to a government agency to register their rights.

The text of the agreement on the division of property requires the indication of certain data. This document is drawn up collectively and signed by all heirs.

How is it filled out?

- the top line of the title page indicates the city, state where the document was drawn up and the date;

- The following is a list of the full names of the heirs, their dates of birth, and residential address. In addition, the details of the identity document are attached (series, passport number, who issued it, etc.);

- the fact of the existence of a certificate of inheritance must be indicated (the full name of the notary who issued the document, its registration number, and the date of registration are attached);

- called the full name of the testator;

- movable and immovable property is listed, the division of which is provided for by the agreement: in the case of an apartment or house, the exact address is indicated;

- if we are talking about a vehicle, then the make, year of manufacture, and license plate are given;

- savings in a bank will require the indication of a credit institution, account number, and city name.

The sample can be downloaded here.

What is the price?

Of course, you will need to pay for the services of a notary who certifies the agreement. The average price for such work is 500 rubles. Consultation regarding the legal and technical aspects of the case will cost more - 4,000 rubles .

Legal nature

Determining the nature of an agreement on the division of inheritance lies in the foundations of legal theory. In the traditions of the pre-revolutionary legal school, an “agreement” was understood as a contract that imposes obligations.

Today, the problem of this definition has been devoted to a whole series of legal libraries, with many books and monographs devoted to it. The “consensus idea” of understanding “agreement” prevails, which implies the establishment, change, or termination of civil rights between a number of persons.

Conditions for division of property

The procedure for dividing property between heirs

The distribution of the inheritance takes place taking into account the following legal requirements:

- if among the heirs there are minors, incompetent or partially capable persons, the agreement is drawn up only after receiving the approval of the guardianship and trusteeship authorities;

- According to the law, the conceived but not yet born descendants of the deceased receive the right of inheritance. In this case, to divide the property, the applicants will have to wait for the birth of a “competitor” and provide part of the inheritance for his share;

- among things and inheritance rights there may be “indivisible” objects and providing for the “preemptive right” of one of the heirs: those objects that cannot be distributed among people without loss of consumer qualities and technical characteristics (for example, a vehicle) are indivisible;

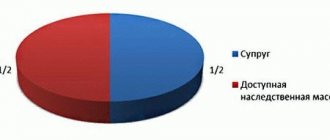

- First of all, those heirs who owned the property by right of personal ownership during the life of the testator on an equal basis with him (regardless of the actual use of the object) lay claim to the thing. Such ownership can be an apartment in shared ownership with the testator for 1/2 of its part;

- the interests of disabled heirs from among those who were permanently dependent are also taken into account in the first place;

Important. “Usual” property is due to be shared equally with the other estate, and not in excess of it. So you shouldn’t count on a general increase in your share due to household utensils.

The following property and rights do not fall into the inheritance estate for shared division:

- escheated - objects alienated to the state due to refusal of the heirs;

- transferred to the applicant partly by law, partly by will;

- when the object is legally claimed by one heir;

- things precisely distributed by will.

Registration of inheritance rights and division of property

Property division

Applicants who claim the right to inheritance are faced with the need to divide it. This process is possible in two forms: through agreement and court. The point is that all heirs have basic equality in shares of the property; an exception is possible only if the deceased gave specific instructions in the will regarding the disposition of his property.

An important fact is that the heirs themselves have the opportunity to change equal shares individually at the time of signing the agreement.

In fact, receiving an inheritance and dividing it are two different legal actions and they are drawn up as different documents. In other words, a change in the ratio of shares of the inheritance must be recorded in a separate legal act. In a situation where the price for property and the share of one of the applicants for it are different, material compensation (in monetary terms) is quite appropriate.

Advantage when dividing indivisible things

Indivisible things, according to Article 1168, are those property that cannot be divided without its complete or partial destruction. The heirs of the first wave have an advantage in the division, i.e. close relatives who own have the right of common property. The following are those who directly used this type of indivisible property but do not have ownership rights to it.

There is also one nuance here . If heirs who do not have property rights cannot acquire other housing, then their priorities change in inverse proportion and they receive the full right to receive the inheritance in the first place.

All other categories of heirs, regardless of whether they want it or not, receive monetary compensation, regardless of the share of ownership.

Registration of rights

For those heirs who received what was due to them at the right time and in a legal way, the way is open to obtaining a certificate of inheritance from a notary. You need to contact the specialist who opened the will; he will need to submit a written statement about the desire to receive a certificate.

To issue a certificate to the heirs, the notary checks the presence of all legal precedents important for receiving the inheritance. These include:

- confirmation of the death of an individual whose property is subject to division;

- the presence of family ties between the deceased and the heirs (see how to establish them here);

- the fact of marriage or long-term cohabitation in accordance with the norms established by law;

- in the case of inheritance through a will, it is necessary to confirm the existence of the latter;

- the exact date, time and place where the will was opened;

- a list of property referred to in the document and for which a certificate is issued.

In a situation where the required six months for issuing the certificate have passed, and the heir missed this moment, further action will have to be taken through the court.

Registration of property rights

The procedure for registering rights to property received as an inheritance

Inheritance is divided into registered property (real estate, vehicles, shares, deposits) and those that do not impose such obligations on the owner (household appliances, clothing, etc.).

The second category is clear - you received a certificate, signed an agreement and use it.

For the registered part, the basis for inclusion in the registers will be the inheritance certificate and the agreement of the applicants on the division of property.

The heir-"shareholder" draws up his share according to the general rules of state registration of objects:

- vehicles, depending on their type, are registered with the State Traffic Safety Inspectorate or Gostekhnadzor authorities (for example, tracked off-road vehicles);

- the property is re-registered in Rosreestr. On the website of the Federal Registration Service, you can clarify the department for registering a specific object, a list of documents, and join the electronic queue when providing such a service.

Existing rules

The procedure for dividing property involves a series of steps that the heirs must take to receive it and further dispose of it. In order for the inheritance to be in the hands of its rightful owners, the latter need to declare their rights to it.

Such a document must be handed over to a notary who deals with the affairs of the deceased (mainly at the place of residence) for six months after death. After receiving the document declaring the rights to the inheritance, it is divided between the claimants in the form of a compromise agreement, or through the court.

The rules for dividing property into shares depend on the determining factors:

- forms of inheritance (through a will, or in court);

- the ability to share things, or lack thereof;

- legal aspect of the case (type of property, transfer of ownership rights);

- the presence among the heirs of applicants with a special situation (disabilities, minors, etc.).

The rules on receiving the property of the deceased are valid for 3 years from the date of publication of documents on the inheritance. It is very important to remember that the countdown is carried out exclusively after the official opening of documents. Therefore, the heirs who are further in line (in 4th place) and suddenly, due to circumstances (previous applicants in the 3rd line renounced their rights) find themselves ahead, for them the time period is reduced by a year.

Documents for registering inheritance by agreement

Depending on the situation, the package includes various papers. This will always require:

- passport;

- certificate of inheritance;

- agreement on shares of inheritance;

- documents for the registered object according to the list of the accounting authority.

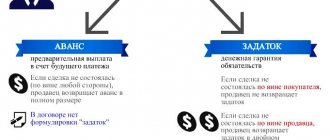

Note that the law does not prohibit oral agreements between citizens. But when several heirs appear before the notary’s gaze, the specialist, of course, will offer to draw up an agreement on the division of the inherited property. This can be done in simple written form, or you can get a notarized document. Why?

There are often situations when disputes arise after the “point” in the inheritance case. Only a written document will serve as evidence of the agreement of the parties in court. He will also help judge the disputants according to the law and conscience.

In addition, under an oral agreement, difficulties may arise with the registration of property that is required to be recorded. So do not neglect the rules of legal security: seek help from lawyers for competent inheritance.

List of documents

When contacting a notary to declare his rights, the heir must have:

- Passport;

- A document confirming the relationship with the deceased;

- A document confirming the fact of living in the same living space with the deceased;

Since the division agreement is needed to formalize the re-registration of the deceased’s property to the heir, the following documents will be needed in the process of its registration:

- Certificate of right to inheritance obtained from a notary;

This document contains the property that needs to be transferred to the new owner.

- Agreement on division of inherited property;

- A document confirming the ownership of the property of the testator himself;

If the property is a separate plot of land, then the list of documents required to submit will be supplemented by the cadastral passport.

If the inherited property is an apartment, then you will also need a technical passport from the Bureau of Technical Inventory.

Additional documents

When registering an inheritance for securities and shares and opening an inheritance case, the notary must submit the following documentation:

- death certificate of the testator;

- confirmation of family relations with the testator - birth certificate for parents and children, marriage or divorce certificate for spouses;

- a will, if any;

- general passport;

- official name of the joint stock company;

- savings book, depositor agreement;

- extract from the register of shareholders;

- certificates and other securities (bills, bonds).

If the certificate does not indicate how many securities and shares belong to the legal successors by name, the inheritance passes into common shared ownership, that is, a common joint ownership account is opened for all heirs. The heirs have the right to make a decision on the redistribution of securities when concluding among themselves a settlement agreement on the division of the property of the deceased (find out how to receive shares by inheritance here).

The procedure and conditions for drawing up an agreement on the division of inheritance, a sample document can be obtained from a notary or registrar.

The division of inheritance by agreement is applied out of court.

How to draw up an agreement correctly

- date and place of compilation;

- information about the parties involved in the agreement - surname and initials, date of registration of heirs;

- the name of the document is “Agreement...”;

- a list of inherited material and other property subject to division between heirs (information specified in the cadastral, registration or technical documentation);

- procedure for dividing inherited property;

- the value of the property for each item;

- additional provisions;

- details of the parties, certified by personal signatures.

This is important to know: Contract agreement with an individual: how to draw it up correctly, payment terms, sample 2020

When drawing up an agreement, the heirs have the right to indicate in it the issues that, in their opinion, are the most important. An example of such an interest of the parties is the clause on compensation payments or refusal of them. The above question is not mandatory when drawing up an agreement, but if the parties wish, it is included in the document.

How to apply?

The procedure for concluding an agreement on the division of inherited property between the heirs is not accompanied by any difficulties if the parties have reached full agreement.

Acceptance of inheritance law

Before executing the contract, the heirs must accept the inheritance. Without a certificate confirming the existence of the right to the property of the deceased, it is impossible to complete a transaction.

To receive it, successors must contact a notary's office and submit an application that contains a desire to accept the inheritance share. Inheritance is of a declarative nature. This means that if the heir does not indicate his intention to enter into the inheritance, the notary will consider him to have renounced his rights to it. For this reason, an application must be submitted.

You will also need to bring the following documents:

- Passport.

- A certificate that certifies the death of the testator.

- A certificate indicating where the deceased lived at the time of death.

- Documentation of property included in the inheritance.

- A paper certifying relationship with the testator.

- Receipt confirming payment of the state duty.

The application must be submitted along with documents within six months from the day the relative passed away. It is on this day that the notary opens the inheritance case. If for a good reason this period was missed, you can agree with the remaining heirs about its restoration or make this request to the court.

After 6 months, the notary will issue a certificate confirming the heirs’ right to the property. After receiving it, the successors can agree on the distribution of property themselves.

Registration of the contract

The legislation does not impose strict requirements on the form of the agreement. It can be concluded either in writing or orally. A written and notarized document is required when real estate is divided. In other cases, an oral agreement is possible.

The agreement contains the following information:

- Date and place of registration.

- Participants in the transaction, personal information about each of them.

- List of objects that are subject to inheritance and documents for them.

- Type of ownership.

- The value of the inheritance according to the appraisal report.

- The amount of the inheritance share of each successor.

- The procedure for distribution of property.

- The procedure for repaying debt left by the testator after death.

- Additional provisions are at the discretion of the parties, but do not contradict the law.

- Details of the participants in the transaction.

- Signatures of the parties. All heirs must sign.

The agreement is permitted to be concluded only after all heirs have received certificates confirming their inheritance rights, and before state registration of property rights has been carried out.

Form of property division agreement

The general rules on the form of transactions and agreements apply to the division agreement, that is, a simple written form is sufficient and there is no need for notarization (Article 161, Art.

434 Civil Code of the Russian Federation). The agreement is a civil contract; accordingly, it is necessary to determine its essential condition, namely, the subject (movable and immovable property) and its value. It may also provide for the division of the testator's debts in proportion to the inherited shares.