Free legal consultation by phone:

8

In cases where one party to an official marriage survives the other, the entire property estate that belonged to the deceased must go to his immediate relatives. Here it is appropriate to talk about the typical process of accepting an inheritance. And the fact that the inheritance mass consists of joint property will not play a significant role in this case.

The deceased's share must go to his relatives. How inheritance rights will be implemented in this case, and exactly how the division will take place, will be explained in detail below.

Division of property after the death of one of the spouses - prenuptial agreement

Judicial practice shows that the presence of a marriage contract can quickly resolve such an issue. As a rule, the prenuptial agreement deals with the division of the entire jointly acquired property. Therefore, if the deceased directly renounced his legal part while still married, then the dispute with relatives and all other heirs will be excluded by default.

Moreover, in such cases, the marriage contract will have legal force commensurate with the will. Therefore, any claims of all other heirs will be groundless. Division between relatives after the death of one of the spouses will be possible if he did not dispose of his share in any way after death. How to avoid division of property after the death of one of the spouses will be discussed below.

Division of property after the death of one of the spouses between the heirs

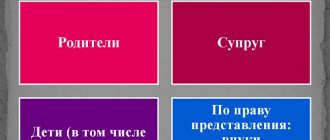

According to the dispositions of the relevant law, after the death of the owner, who did not leave any disposition regarding all of his property, it is the heirs of the first priority who will have the right to acquire a certain part of the inheritance mass.

But in this case, it is necessary to take into account that the second party, by default, is the owner of 1/2 of the object. Therefore, only 50% will be included in the hereditary mass. It is this part that will be distributed among relatives by all heirs of the first stage.

The division of property of former spouses after the death of one of them does not apply to donated property, and does not apply to citizens after the divorce procedure has been completed.

Division of donated property after the death of one of the spouses

If there is no agreement, then during life all property must be divided between the current spouses in equal shares.

Therefore, after the death of one, the second party automatically becomes the owner of 50%. But by way of inheritance, he can also claim a certain part from the other half. But this rule does not apply to donated property.

According to the law, donated objects should not be divided, because their sole owner is the donee. After death, the surviving spouse will have rights to a specific share on an equal basis with all other relatives and heirs. The division of property after the death of one of the spouses may provide children and all other heirs with a specific share of the property right.

How to receive an inheritance?

How is the spousal share in the inheritance formalized? To accept inherited property, you need to bring an application to the notary for acceptance of this inheritance. The heir chooses the type of such statement independently. Usually it sets out a request for the issuance of an inheritance document.

You need to find out the phone number and address of the notary office where the deceased spouse was registered, you can do this at the main notary office. The inheritance is accepted six months from the date of death of the testator. If the heir misses his deadline, then there are alternatives to receiving the inheritance:

- restore this period;

- recognize inheritance rights in court;

- recognition by submitting the required application to a notary.

You need to prepare all the required documents to obtain property and provide them to the notary. This must be done so that the notary can provide you with a document on the allocation of inheritance. He needs to give information and bring papers that confirm:

- death of the testator and the cause of his death;

- death certificate issued by the registry office (sample);

- the right to inheritance (this could be a will or, for example, a marriage certificate);

- this property belongs to the testator;

- the price of the property, confirmed by an independent assessment of specific institutions.

Let's give an example. The price for living space can be confirmed by documents provided by the BTI, which will indicate its descriptive price. You must pay the state fee, then show this receipt to the notary. The state duty for close relatives, children, parents, brothers and sisters is 0.3% of the price of the entire inherited property, which is no more than 100,000 rubles. And all other heirs receive 0.6% of the inheritance, and this amounts to no more than a million rubles. The notary may also require other documents, since there is no specific list of required papers.

Judicial practice on the division of property after the death of one of the spouses

In such cases, it should also be taken into account that in practice, usually the parents of the deceased and all other relatives either sign an inheritance waiver or simply do not take any action so that the inheritance mass passes to the children, one child, or the surviving spouse.

The problem is that most disagreements concern real estate that can be divided in kind.

For example, if the parties are already divorced at the time of death, then in the absence of a marriage contract and in the presence of children, the surviving party and children together will have approximately 70% in equity equivalent. As a general rule, there is no point in challenging the rights to the remaining 30% in relation to other heirs.

Their rights are expressly stated in the law, so they can exercise them at any time. It will not be possible to achieve the abolition of hereditary preferences even through the courts. Here it would be more appropriate to try to negotiate with the applicant citizens, or provide them with a proportionate payment. A claim for division of property of former spouses after the death of one of them is filed against relatives.

Transfer of property according to the Code and the will of the testator

The right to inheritance after the death of a husband or wife arises as a result of the transfer of jointly acquired things and objects from one property to another. Every citizen can count on it, regardless of their gender and age. The law provides for several types of inheritance:

- According to the Code - transfer of things, real estate according to priority;

- According to a will , the desire of the deceased person himself, expressed during his lifetime.

Legal right arises on the basis of the Civil Code of the Russian Federation, Art. 1112, regulating the order of the queue. The transfer by will is documented and certified by the citizen during his lifetime.

Important! The spouse is the main contender who has the right to part of the things and other benefits acquired during their life together. The desire of the testator and the presence of other applicants do not matter under the law. The same applies to the obligatory share.

The list and amount of the due portion are established by the notary. Within 6 months from the opening of the case, the wife of the deceased person must contact him with a corresponding petition.

If the last will of a deceased citizen is missing, financial and other benefits are divided among all applicants based on an established list - persons of the first group and subsequent ones. Material assets are transferred to them on a general basis.

Division of property after the death of one of the spouses - law 2020

The law has not undergone significant changes in 2020. Each family member, directly included in the first place, has the right to receive a certain share. Therefore, such issues can be resolved with the help of a marriage contract, even before marriage, or by dividing the object into shares.

It will not be possible to achieve anything contrary to the law in court. The courts will not infringe on the rights of some citizens in favor of others. The division of property under a will after the death of one of the spouses in the Russian Federation is carried out only in accordance with the will itself. Violating the will of the deceased is prohibited by law.

Obtaining a document on the right to inheritance

You can receive this document six months after the death of the testator. It is given by a notary if all the necessary documents are available. You can purchase it earlier if there are no other interested parties who can contact you about the inheritance. Thus, the marital share of the inheritance passes to the successor.

For any type of property, similar papers are drawn up for inheritance of joint property of spouses. A sample of the required document can be obtained from a notary.

Inheritance services

MOSCOW CITY COURT

APPEAL DECISION dated June 14, 2013 in case No. 11-18270

judge of the court of first instance: E.D. Simonenko

Judicial panel for civil cases of the Moscow City Court, composed of presiding A.N. Ponomarev, judges E.N. Neretina, I.P. Kozlova, with secretary B., considered in an open court hearing based on the report of judge A.N. Ponomarev case on appeal by Kh.N. on the decision of the Nagatinsky District Court of Moscow dated February 12, 2013 in the case brought by Kh.A. to H.N. on the allocation of the marital share, recognition of ownership of 1/2 share in the ownership of an apartment by inheritance by law, determination of the share in payment of utility bills, with which the claim is satisfied,

installed:

HA. filed the above claim against Kh.N., citing the fact that the disputed cooperative apartment was acquired by his *** *** and Kh.N. (defendant) during the marriage. After the divorce, the defendant registered the apartment as his own, however, *** continued to live in the said apartment and fulfill the obligations of paying for it. After the death of ***, the plaintiff accepted the inheritance and asks to recognize the right of ownership of the inherited property in the form of 1/2 share of the disputed apartment. H.N. The claim was not recognized, considering it to be unfounded; in addition, he asked to apply the consequences of missing the statute of limitations. The case was considered in the absence of third parties - Moscow notary S., the Office of the Federal Service for State Registration of Cadastre and Cartography for Moscow, who were notified of the time and place of the court hearing. By decision of the Nagatinsky District Court of Moscow dated February 12, 2013, it was decided: the claims of Kh.A. to H.N. on the allocation of the marital share, recognition of the ownership of 1/2 share in the ownership of the apartment in the order of inheritance according to the law, satisfy; determine the shares of M. and H.N. in the apartment at the address: *** equal – 1/2 share for each; recognize for H.A. ownership of a 1/2 share in the ownership of an apartment located at the address: *** in the order of inheritance by law after death ***; recognize for Kh.N. ownership of a 1/2 share in the ownership of an apartment located at the address: ***; determine the shares in payment for housing and communal services for 1/2 share of Kh.A., and 1/2 share of Kh.N. In the appeal, Kh.N. the question of canceling the decision is raised. At the meeting of the judicial panel Kh.N. supported the arguments of the appeal. HA. and his representative V., by power of attorney dated February 4, 2013, asked the court decision to remain unchanged. The panel of judges based on Art. 167 of the Code of Civil Procedure of the Russian Federation considered it possible to consider the case in the absence of other persons participating in the case, who were notified of the time and place of the court hearing, who did not report the reasons for their absence, and who did not provide evidence of the validity of these reasons. After checking the case materials, listening to Kh.N., Kh.A. and his representative, having discussed the arguments of the complaint, the judicial panel comes to the following conclusion. In accordance with Part 1 of Art. 330 of the Code of Civil Procedure of the Russian Federation, the grounds for canceling or changing a court decision on appeal are: 1) incorrect determination of circumstances relevant to the case; 2) failure to prove the circumstances relevant to the case established by the court of first instance; 3) discrepancy between the conclusions of the court of first instance, set out in the court decision, and the circumstances of the case; 4) violation or incorrect application of substantive law or procedural law. There are no such grounds for canceling or changing the appealed court decision on appeal based on the arguments of the appeal, studied based on the case materials. From the case materials it appears that *** and Kh.N. were in a registered marriage during the period from year *** to year ***. In April 1989, that is, during the marriage, they fully paid the share for apartment N * in the building * building. * to *** Moscow. After the divorce, *** years, Kh.N. registered ownership of the disputed apartment in his own name, however, *** continued to live in the said apartment and fulfill the obligations of paying utility bills until her death on the *** year. From the opened inheritance case it is clear that Kh.A. (son of the testator) is the only heir *** according to the law, he accepted the inheritance within the period established by law. Within three years after the opening of the inheritance, on October 25, 2012, H.A. filed a real civil case in court. In resolving the dispute on the merits and satisfying the claim, the court was guided by the fact that the statute of limitations for Kh.A. is not missed, he has the right to the marital share of his mother by way of inheritance by law and, accordingly, is subject to satisfaction of the requirement to divide the payment for the disputed apartment in equal shares. These conclusions of the court are motivated, confirmed by the evidence available in the case file, and there are no grounds for declaring them illegal according to the arguments of the appeal. Article 256 of the Civil Code of the Russian Federation establishes that property acquired by spouses during marriage is their joint property, unless an agreement between them establishes a different regime for this property. The rules for determining the shares of spouses in common property during its division and the procedure for such division are established by family law. According to Article 34 of the Family Code of the Russian Federation, property acquired by spouses during marriage includes the income of each spouse from work, entrepreneurial activity and the results of intellectual activity, pensions and benefits received by them, as well as other monetary payments that do not have a special purpose. The common property of the spouses also includes movable and immovable things acquired at the expense of the common income of the spouses, securities, shares, deposits, shares in capital contributed to credit institutions or other commercial organizations, and any other property acquired by the spouses during the marriage, regardless of whether the name of which of the spouses it was purchased or in the name of which or which of the spouses the funds were deposited. By virtue of Articles 34 and 39 of the Family Code of the Russian Federation, property acquired by spouses during marriage is their joint property. When dividing the common property of the spouses and determining the shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses. In accordance with Art. 1112 of the Civil Code of the Russian Federation, the inheritance includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations. Taking into account these legal provisions, the court, having established that Kh.A. in relation to the requirements of Articles 1111 - 1148 of the Civil Code of the Russian Federation, as an heir according to the law of the first priority, who accepted the inheritance, has the right to inherit the marital share of his mother, correctly determined the size of the inherited property in the form of 1/2 share in the ownership of the disputed apartment. The correctness of the establishment of the above circumstances and the application of the said rules of substantive law in the appeal is not disputed. The arguments of the complaint boil down to allegations of violation of the applicant's procedural rights, deprivation of his opportunity to present evidence and participate in their study, as well as the plaintiff's dishonest behavior towards his mother, expressed in the fact that the plaintiff did not visit his mother for two years of her illness, after After the death of his mother, the plaintiff threw out the urn with her ashes and did not allow the applicant to bury her in the grave. In addition, the applicant believes that the court did not take into account that only Kh.N. was a member of the housing cooperative “***” and did not take into account the fact that the plaintiff became aware of the registration of ownership of the disputed apartment in the name of the defendant back in April 2010. However, these arguments cannot be used to justify the reversal of the court decision. Thus, from the case materials it appears that defendant Kh.N. participated in the court hearing, had the opportunity to present and examine evidence, including asking for re-examination of those witnesses who were interrogated in his absence, as well as making counterclaims for the recognition of Kh.A. unworthy heir according to Art. 1117 of the Civil Code of the Russian Federation. The fact that the defendant did not take advantage of these rights did not deprive the court of the opportunity to consider the case based on the available evidence within the framework of the stated requirements. The fact that *** was not a member of the housing cooperative, in relation to Art. 34 of the Family Code of the Russian Federation does not change the regime of joint ownership of spouses in relation to residential premises over which a dispute has arisen. In the appeal, the date from which the plaintiff became aware of the registration of ownership of the disputed apartment does not indicate that the plaintiff missed the three-year limitation period. Thus, provided for in Art. 330 of the Code of Civil Procedure of the Russian Federation there are no grounds for canceling the court decision based on the arguments of the appeal. Guided by Art. 328, art. 329 Code of Civil Procedure of the Russian Federation, Judicial Collegium for Civil Cases of the Moscow City Court

determined:

the decision of the Nagatinsky District Court of Moscow dated February 12, 2013 was left unchanged and the appeal was not satisfied.

Which child has the right to inherit after the death of the father?

Video: HOW DO HEIRS LOSE AN INHERITANCE OUT OF IGNORANCE OF THE LAW?

Video: ACCEPTING AN INHERITANCE IN 2020 | New rules

After the death of a father, his children are considered the most likely heirs of the property , for which they do not need to present any evidence. They can exercise this right regardless of whether they lived as one family in the same living space or did not have the opportunity to get to know each other.

Even in the absence of a will, the law gives the right of inheritance to children. First of all, this applies to property, which any direct heirs can dispose of after the death of the father:

- Natural children, regardless of what marriage they were born from;

- Children who were born out of wedlock. Proof is the presence of the father's surname on the birth certificate or confirmation of paternity in a peaceful magistrate or civil court.

- Children who were adopted by this family. They can be considered relatives provided that the family did not have children of its own. Otherwise, natural children will have the right of priority inheritance;

- Children in respect of whom the deceased man was deprived of parental rights. Despite the fact that the court decided to take away a citizen’s parental rights, his child can lay claim to the property of an irresponsible father.

Thus, it becomes clear that only the absence of mention of children in the will can serve as a basis for the children to be left without an inheritance. However, in this case there are exceptions.

Inheritance of jointly acquired property of spouses according to the law

Please note that in this section of the article we are considering inheritance by law, i.e. cases of inheritance of property after the death of a spouse, when there is no will, marriage contract or agreement on the division of property.

As a general rule, the common property of spouses includes:

- the income of each spouse from any activity, as well as pensions, benefits and other monetary payments that are received by the spouses and do not have a special purpose;

- movable and immovable things, deposits, securities, shares in capital acquired from the common income of the spouses;

- any other property that the spouses acquired during the marriage. In this case, it does not matter which spouse acquired the property, for whom the deposit was opened, or which spouse contributed the funds.

However, property received by one of the spouses during the marriage by inheritance or as a gift, as well as personal items, do not belong to jointly acquired property. The surviving spouse retains the right to half of the common property acquired during the marriage.

For example, if spouses jointly own a land plot, then half of the share in the ownership of the land plot remains with the surviving spouse. And the remaining share, constituting half of the land plot of the deceased spouse, is included in the estate for inheritance.

Features of inheritance by children

After receiving the application with the attached package of documentation, the notary makes a separation of the legal half of the spouse from the common property.

For six months after the death of the parents, other necessary documents specified by the notary are collected and applications from possible heirs are accepted. It is the responsibility of potential heirs to ensure the safety of the property of the deceased. If certain funds are spent on this, they can be taken into account when dividing property. Why maybe? Because in addition to inheritance by law, where children are classified as first-priority heirs, there is inheritance by will, in which children, for various reasons, may not be included. However, there are certain nuances here: if the child is a minor or disabled, he, despite the text of the will, will be assigned a portion of the inheritance determined by law.

Full support: establishing the fact of entering into an inheritance, excluding property from the estate, recognition as an unworthy heir, representing interests before a notary.

The successors who have received property under the rights of common ownership can independently agree among themselves on its distribution in equal parts by drawing up an appropriate agreement on the division of the inheritance. When a more valuable type of property is transferred to one of the successors, the law obliges the other successors who received less valuable property to pay commensurate monetary compensation.

At first glance, everything is simple. The property that belonged to the deceased man is subject to inheritance. But if you look at it, the husband owns...

- A man's personal property. What was acquired by a man before marriage, received as a gift or inherited by him before or during marriage. This property is subject to inheritance on a general basis.

- Joint property of spouses. What was acquired during marriage belongs to the husband and wife as joint property. Even if it was purchased with the husband’s salary or pension, even if it was registered in the husband’s name. This property is subject to division into two equal parts. One half belongs to the wife, the second is subject to inheritance.

The division of property between the heirs is made equally, according to the order of inheritance. The value of property is determined using documents indicating the financial value of objects: checks, receipts, invoices, and other documentation confirming the material value of objects.

For minor children, disabled children and parents, disabled wife, whom the testator deprived of inheritance, certain guarantees are provided.

The division of property between the heirs is made equally, according to the order of inheritance. The value of property is determined using documents indicating the financial value of objects: checks, receipts, invoices, and other documentation confirming the material value of objects.

Inheritance within the framework of civil law is usually called property, including property rights, of a deceased person. This property passes to the heirs in order of priority.

It is worth noting that the inheritance after the death of the mother should be distributed between her husband and minor (or incompetent) children. The case is considered again if a will has not been drawn up.

It is important to understand the main point! The children of the heir, no matter from what marriage they were born, have equal rights to inheritance.

Part of the property of the deceased spouse passes to all heirs. When the hereditary part in the common property is formed, the shares of the heirs are equal. What are the rights of the surviving spouse in inheritance?

Life does not stop even after the death of a person. And the division of property after death has always worried humanity. That is why, in order to avoid numerous disputes, hostility, and revenge, clear rules of inheritance were defined at the legislative level, making it possible to fully regulate the encroachment on the property of a deceased person.

Illegal marriage and inheritance

The spouse is the heir of the 1st stage , but the unofficial wife does not belong to any of them, and according to the Civil Code she has no right to claim things, money and other objects. After the death of the common-law husband, the cohabitant will not be able to document her claims to the property they acquired.

The main evidence of the relationship is a certificate issued by the Civil Registry Office.

Even if the unofficial spouse is registered in the living space of a deceased man, she has no right to it after the opening of the inheritance.

But the law provides for some exceptions:

- If the unofficial spouse was disabled and was dependent on the man, living with him for at least 1 year before his death.

- If the testator had no relatives, the common-law wife acts as the heir of the 8th stage and can claim material benefits.

An unofficial wife is recognized as disabled only in a few situations. Namely:

- Disability groups 1 and 2;

- Retirement age is 55 years (the benefit may not yet be assigned, the main achievement of this indicator).

Important! A woman was considered a dependent if a deceased person provided her with financial assistance, which was the source of her permanent and main income.

Expert opinion

Novikov Konstantin Yakovlevich

Lawyer with 8 years of experience. Specialization: family law. Extensive experience in protecting legal interests. Evgeniy

A common-law husband can leave an inheritance to his companion under a will. Here she receives all or part of the property, in accordance with the wishes of the deceased man, which he expressed during his lifetime and notarized.

On a note! According to the Code, only the cohabitant with whom the union was registered in the Civil Registry Office has the right to inherit property. And at the request of a deceased citizen, a woman can receive an inheritance even from her ex-husband, with whom the marriage was officially dissolved.