Elena Mishchenko, head of the city real estate department of the northeastern branch, answers:

Spouses, regardless of what type of ownership - shared or common joint - buy property, can both count on a tax deduction, the maximum amount of which is 13% with 2 million rubles for each.

Let’s say the spouses purchased an apartment for 5 million rubles, and the amount from which the deduction will be returned will be 2 million rubles for each spouse. Thus, each spouse can count on a tax refund in the amount of 260 thousand rubles, provided that this amount was previously paid to the budget in the form of personal income tax.

How to get a tax deduction by buying an apartment?

Is it possible to get a tax deduction again?

How to get a tax deduction for a co-borrower on a mortgage?

A co-borrower under a mortgage agreement has the same rights and obligations as the main borrower.

. He also has the right, in certain cases, to a tax deduction on the purchase of an apartment and on mortgage interest. How to get money, what documents you need to collect. Step-by-step instructions for filing a tax deduction for a co-borrower.

In what cases can a co-borrower receive a deduction?

It is legally determined that a co-borrower will have the right to a tax deduction if the following conditions are met:

- Availability of documents confirming the purchase of housing by the co-borrower. The acquired property or its share must be registered as the property of a co-borrower (the rule does not apply to spouses; the acquired property becomes common to them in any case);

- If the co-borrower has not previously used the right to apply for a tax deduction. By law, you can only use it once;

- The co-borrower must be a personal income tax payer;

- Availability of documents confirming the fact that the co-borrower has incurred expenses for servicing the mortgage loan.

It is mandatory to fulfill all requirements together

If the co-borrower under the agreement is a spouse, then he can receive a tax deduction in any ratio with the main debtor. Usually the shares are distributed 50/50, but by agreement of the parties any other ratio can be agreed upon. Since the deduction is calculated annually, the proportions can be changed at the request of the spouses.

When drawing up a mortgage agreement, it is necessary to think in advance which of the spouses is more profitable to issue a tax deduction, since there are situations when the main borrower, not having a permanent job, cannot count on payment, while the co-borrower under the agreement can return part of the funds spent on buying a home.

One party to the transaction may completely refuse to receive payments.

How to apply for a deduction?

The deduction is processed similarly to the procedure for receiving a refund by the main borrower.

From buying an apartment

When buying an apartment, borrowers under the agreement can return 13%

from 2 million rubles If the purchase price is less than this amount, then borrowers can use the unused deduction when purchasing another property.

From mortgage interest

A refund of 13% of a maximum of 3 million rubles is possible from mortgage interest. in this case, the payment is made one-time, i.e.

If the borrower has not received the maximum amount, the underused benefit will not be carried forward to the next transaction.

if spouses plan to purchase another property in the future, then it is more profitable for them to issue a deduction for one of the spouses, then the other will be able to take advantage of the benefit under the next agreement.

what will be required?

To receive a deduction, the mortgage payer must contact his Federal Tax Service office

with a package of documents.

Required documents

List of required documents:

- Applicant's passport;

- Help on f. 2 personal income tax, confirming the actual payment of tax for the reporting period;

- An extract from the Unified State Register of Real Estate, which confirms the applicant’s acquisition of real estate or its share, with supporting documents;

- Mortgage loan agreement;

- An extract from the creditor about the actually paid debt service fees and the absence of overdue payments;

- Documents confirming the fact of payment of the loan by the applicant: an extract from the borrower’s card account, checks for cash deposits, receipts for interbank transfers, etc.

- Marriage certificate.

- Declaration according to f. 3 personal income tax.

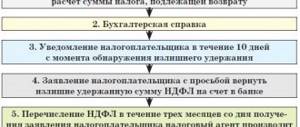

After collecting documents, the algorithm of actions is as follows:

- Fill out a tax refund application. There is no regulated application form. The following information is required: Full name. applicant, address of actual residence, TIN, for which year the deduction is issued, address of the mortgaged apartment, amount of the deduction, details for transferring funds, list of attached documents. Sample application:

- Fill out personal income tax declaration 3. On the website www.nalog.ru you can automatically generate a document. During the data entry process, the information is checked and adjusted if necessary by the system.

- The declaration can be submitted at any time without any time limit.

- Methods for filing a declaration: personal visit to the Federal Tax Service, send by mail with copies of documents attached, or by registered mail with notification. Users registered on the Tax Service website can submit a declaration online.

- The application review period is 3 months from the date of receipt of documents.

The applicant can receive a tax deduction through the employer, which must be indicated in the application for its receipt.

In this case, no income tax will be withheld from him until the full amount due for refund has been paid. The maximum payment period is 3 years.

Source: https://www.Sravni.ru/ipoteka/info/nalogovyj-vychet-sozaemshhiku-po-ipoteke/

Managing partner of Metrium Group Maria Litinetskaya answers:

Today, a married couple purchasing an apartment is in a much better position from the point of view of tax legislation than before 2014. According to the latest amendments, both spouses immediately received the right to a tax deduction (TD) when purchasing real estate. And if a house or apartment was bought with a mortgage, then both will be able to return part of the interest paid on the loan.

Since the Family Code recognizes any property acquired during a legal marriage as joint property, it does not matter which spouse (or both of them) is listed as the owner. And it doesn’t matter on whose behalf the payment for the purchased housing was made. Even if all the papers are issued in the name of the husband, the wife does not lose the right to NV. The situation is the same with the mortgage deduction: usually in the loan agreement, one of the spouses acts as a borrower, and the second is indicated as a co-borrower. As a result, the couple can receive a refund on the interest paid “for two.”

As for the size of the deduction, if the value of the property is more than 4 million rubles, the husband and wife have the right to return personal income tax in the amount of 13% of 2 million rubles each, that is, a total of 520 thousand rubles. If less than 4 million rubles were spent on the purchase, then the amount of NV for each spouse will be calculated as 13% of half the price of the property. A husband and wife can apply to redistribute the deduction in favor of one of them if the second has already used his right or has no income. However, receiving money for a partner (that is, 13% of 4 million rubles by one person) is impossible.

An important innovation of the tax authorities was the permission to apply for tax return multiple times before the limit of 2 million rubles is exhausted. The maximum deduction for a mortgage is limited to 3 million rubles for each spouse. If the amount of interest paid by the couple on the loan is less than 3 million (for example, a mortgage of 4 million rubles for a period of 10 years at an 11% rate implies an overpayment of 2.6 million rubles), then it is logical to apply for a deduction to only one spouse. Then the second one will be able to “save” this right for future loan agreements.

Taxes when buying and selling housing: 23 useful articles

Is it possible to get a tax deduction for the second time for the purchase of an apartment and a mortgage?

Who is a “co-borrower” and is he entitled to a deduction?

Co-borrowers are so-called “joint and several” borrowers under the loan agreement. The bank has the right to demand from the co-borrower not only part of the loan debt, but also its full amount. So, if there is a delay, the bank turns to each co-borrower individually for the required amount. But the bank also has the right to contact only one of them. Therefore, until the mortgage is fully repaid, all co-borrowers are responsible for repaying the full amount of the loan. There is also a rule regarding the borrowers themselves: when one co-borrower pays off the mortgage, he has the right to turn to another in order to claim part of the funds from him as part of the so-called “recourse claim” (that is, repayment of his losses).

A husband and wife, parents and children, brothers and sisters, etc. can act as co-borrowers. However, in order to become one, it is absolutely not necessary to be married or otherwise related; you can also involve a friend as a co-borrower. However, it is spouses who most often become co-borrowers.

In the case of purchasing real estate, co-borrowers can simultaneously become the owners of this property, but it is also possible to register only one of them.

The state provides two types of deductions when purchasing residential real estate. Co-borrowers can apply for both of them :

- The main property deduction from the amount is limited to 2 million rubles (given once in a lifetime, the balance can be transferred to other objects).

- The so-called “mortgage” deduction for interest on an amount with a limit of 3 million rubles (given once in a lifetime and only for one apartment, that is, it is prohibited to transfer the balance).

The main differences in the distribution of the deduction depend on whether the co-borrowers are legally married or not.

Is a co-borrower on a mortgage entitled to an income tax refund?

Both co-borrowers have the right to deduct the mortgage loan. But it can only be realized if a number of conditions are met. The main thing that the tax authorities will take into account is whether the applicants are married and the type of property.

Who is a mortgage co-borrower?

When purchasing an apartment with a mortgage, one person or several may act as a borrower. If a loan is issued for two people, they acquire the status of co-borrowers. Such citizens have equal rights and equal responsibilities regarding the loan. This means that the debt to the creditor must be repaid by both co-borrowers jointly or each individually.

The terms of the loan agreement may provide for a situation where real estate is purchased for only one of the co-borrowers. He will subsequently be registered as the owner of the property. In this case, both co-borrowers are equally liable for the loan debt. Even the one who does not become the owner of the object.

Lender, i.e. the bank has the right to make demands for debt repayment to each co-borrower separately or to both of them simultaneously.

Co-borrowers can be close relatives or legal strangers. It is common for most mortgage transactions to involve spouses. Less often these are parents and children, etc.

If the mortgage co-borrower decides to repay the entire loan debt on his own and the terms of the agreement do not prevent this, he can pay off the creditor and then demand recovery of part of the paid amount from the second co-borrower.

Can a co-borrower get a tax deduction on mortgage interest?

When purchasing residential real estate, some new owners have the right to receive a tax deduction. Its value is fixed in Art. 220 Tax Code of the Russian Federation. The maximum amount will be 13% of 2 million rubles. The process of providing a deduction when purchasing an apartment is a refund of part of the previously paid income tax. Accordingly, only a person who regularly pays personal income tax has the right to deduction.

If real estate is purchased under a mortgage loan agreement, in addition to the main deduction upon purchase, you can return part of the funds in the form of a deduction for the payment of interest on the mortgage. The maximum possible amount is 13% of 3 million rubles.

The amount of tax deduction depends on:

- amount paid to the bank;

- the amount of income tax paid.

When drawing up a mortgage loan agreement, it may indicate several co-borrowers. As a rule, these are spouses, but not necessarily. In this case, co-borrowers can also receive a deduction for both the main loan and interest payments. Its size and the procedure for registration will depend on the related relationships of the co-borrowers.

For spouses

The Family Code establishes that property acquired by spouses during the period of marriage is recognized as their joint property. Unless they independently determine otherwise by the terms of the written agreement. This means that when spouses purchase an apartment, it is assumed that they spent the funds for the purchase from the general family budget.

Therefore, spouses can receive a joint tax deduction if real estate is acquired as joint property. And it doesn’t matter in this case whether the husband and wife are listed as co-borrowers or not.

But both spouses can receive a deduction for interest only if, according to the agreement, they are co-borrowers. Otherwise, a tax refund is possible only for those who are official borrowers.

When spouses purchase an apartment in joint ownership, if they act as co-borrowers, they are entitled to one deduction for both. But they can distribute them in any proportions at their own discretion or completely arrange them for only one person.

If the co-borrowers are not spouses

The spouse does not necessarily act as a co-borrower on the mortgage. A woman and a man can live together, but not register their relationship. Moreover, the law does not prevent complete strangers from registering as co-borrowers. For example, an employee and his employer.

In this case, each of them can receive a deduction. Moreover, these will be separate tax deductions. Their size will depend on the amount contributed by each co-borrower. But the maximum possible for everyone individually is 2 million and 3 million rubles.

When purchasing an apartment with a mortgage, unmarried co-borrowers can apply for separate tax deductions subject to the following conditions:

- Each of the co-borrowers in the purchased property received their share in the property. And this fact is confirmed by an extract from Rosreestr.

- Each co-borrower pays his or her share of the debt to the bank from a separate account. Even if shares in real estate are allocated to two owners, but only one of the co-borrowers repaid the debt to the bank, only he alone will have the right to receive a deduction on interest and on the principal debt.

Conditions for registration

The answer to the question whether a co-borrower can receive a tax deduction under a mortgage loan agreement will depend on several factors. If co-borrowers are married and bought housing as joint property, they are entitled to one deduction for both, in any case. They can divide the allocated amount in any proportion.

And if the co-borrowers are not married, the following options are possible for them:

- Everyone receives separate deductions corresponding to the value of their share in the real estate, provided that according to the documents, everyone paid their own part of the debt and received a share in the property.

- If only one co-borrower is registered as the owner, and he also paid the loan, the deduction is due to him alone.

- One co-borrower was registered as the owner, but the second one paid the debt. In this case, no one is entitled to a deduction.

- Each of the co-borrowers has their own share in the purchased apartment, but only one of them paid the debt to the bank. In this case, the deduction is due only to the one who paid.

That is, in order to qualify for a deduction, a citizen must receive property in joint or shared ownership and independently repay the debt to the bank.

Compensation amount

The Tax Code of the Russian Federation determines only the maximum deduction when purchasing real estate. The final result will depend on a number of factors. If an apartment was purchased as joint property by spouses, they have the right to a deduction for interest and a deduction for the main agreement.

The maximum amount will be provided only if they paid it as a debt to the bank. Provided that the amount paid was less, the deduction will be calculated from it.

For example, an apartment was bought with a mortgage for 2 million 150 thousand rubles. At the same time, the initial payment amounted to 400 thousand rubles. This means that the main debt to the creditor is 1 million 750 thousand rubles. In this case, the spouses will be returned 13% of this amount - 227 thousand 500 rubles.

The overpayment of interest for the married couple amounted to 1 million 800 thousand rubles, so the deduction for payment of interest on the loan for them is equal to 234 thousand rubles.

In this case, it is more profitable for the spouses to distribute the deduction on the main loan among themselves in any convenient shares. And deduct interest for only one person, if they plan to ever take out a mortgage again in the future.

The fact is that the balance of the deduction on the main loan can be transferred to the next transaction. For example, if the spouses decide to divide 227 thousand 500 rubles. in equal proportions (113 thousand 125 rubles), then each of them will be able to return another 146 thousand 875 rubles upon the next purchase of real estate. every.

And the deduction for mortgage interest does not carry over to other transactions. Therefore, if you register it only in the name of the husband, the wife will be able to receive a deduction for the interest on the next mortgage. And if a deduction for interest is issued for two, under the next mortgage lending agreement, neither spouse can claim a tax refund for interest.

If the acquired real estate is registered in the shared ownership of co-borrowers, regardless of whether they are spouses or not, the amount of the deduction will depend on the amount paid by a particular co-borrower. Naturally with a maximum limit.

For example, a man and woman living together bought an apartment worth 6 million rubles. We registered the property as shared ownership of 50% each. The total overpayment on the loan amounted to 5 million rubles.

Men and women have the right to receive a tax deduction. Under the main agreement, each person is entitled to 13% of 2 million rubles. Plus the amount of interest deduction for each will be 325 thousand rubles. (13% of 2.5 million rubles).

In total, out of 12 million rubles. co-borrowers will return 1 million 117 thousand rubles.

Distribution of mortgage interest between spouses and co-borrowers

It follows that a tax deduction is possible even for a co-borrower who is not the owner. In this case we are talking specifically about spouses. A husband or wife can exercise the right to a return of 13 percent on the mortgage, even if the apartment purchased during marriage is registered in the name of only one of them.

We recommend reading: Is it considered a large family if three children and one of the parents is permanently registered in the Moscow region and the other in Moscow

Almost the same provisions follow in the presence of shared ownership. Previously, until 2014, when determining the property deduction, they relied on data on the size of shared ownership: what share was registered in the Property Registration Certificate was declared in the return declaration.

Amount of tax deduction for a mortgage

The amount of the deduction may vary depending on how long ago a person received the right to use deductions. In particular, in 2014, amendments appeared in Article 220 of the NKRF that regulated the method of providing tax benefits for mortgage lending.

The maximum amount of property deduction, as before, does not exceed RUB 2,000,000. (Returning 13% of the amount, respectively, you can get back 260 thousand rubles). But not for those who received the right to deduction after 2014. In this case, the amount of interest deduction is limited to RUB 3,000,000.

Tax deduction after refinancing a mortgage

If another bank is refinancing your mortgage, you may be able to get a deduction on both the existing debt and the new debt. This is regulated by clause 4.clause 1.st 200 of the NKRF.

Important:

In the agreement concluded with the bank, it must be indicated that the agreement is drawn up for the purpose of refinancing the principal debt

Is a tax deduction entitled to a co-borrower on a mortgage?

According to the law, spouses are co-borrowers on a mortgage. Accordingly, it does not take into account who pays the mortgage fees, because the property is initially already joint property.

Therefore, it does not matter how much of the joint income is offset as a deduction. Co-borrowers have equal rights, including in terms of taxes, and accordingly, can claim deductions.

The rights to deductions are also distributed to people who have a loan for property in shared ownership.

Register now and get a free consultation from Specialists

Is it possible to get a tax deduction if an apartment is purchased with a mortgage? Return conditions and procedure

There are two mortgage deductions: interest and principal . According to paragraph 1, paragraph 3 of Article 220 of the Tax Code of the Russian Federation, you have the opportunity to receive a tax deduction in the amount of expenses incurred upon purchase, not exceeding 2,000,000 rubles. This refers to cases of transactions for the acquisition of housing or shares in it, as well as construction. Refunds in such situations are considered a major tax deduction.

We recommend reading: Sample order for a business trip on a day off

Nuances if the mortgage loan has not yet been repaid

- the direct owner of the apartment or house;

- upon the fact of shared ownership to everyone who has entered into a share;

- legal representatives of children under the age of majority, if the latter have a share in the property;

- both spouses, if the mortgage was taken out during the marriage (find out how to return the tax deduction when purchasing an apartment with a mortgage for two spouses in joint and shared ownership here).

Now a very important question is whether the payment received by the second participant in the relationship limits the right to deduction of the borrower himself? No, the exercise of the right by one party does not affect the possibility of providing preferences to the second spouse (parent, adult child).

Who can apply for a tax deduction on a mortgage if there are three co-borrowers and one owner?

What is this note under my question? I am still waiting for a qualified answer from your specialist to my question, and not a formal reply. Repeat your question. It feels like we are talking to you, not texting. Or do your experts read questions blindfolded? Very, very disappointed

Opportunities for obtaining a deduction Citizens of the Russian Federation and foreign citizens who legally carry out labor activities in our country and pay tax on personal income have the right to apply for a tax deduction. persons This type of deduction is provided only once in a lifetime, in the amount of 13% of the costs incurred by the applicant in connection with the acquisition of residential real estate, with the proviso that its value does not exceed 2 million rubles. This means that if the price of the purchased residential property exceeds 2 million rubles, 13% in any case will be accrued only on these 2 million rubles, which means that the maximum amount of property deduction will not exceed 260 thousand rubles. It is also important to note that 13% of the present value of housing is returned only if the housing was purchased after 2009; a transaction completed earlier involves calculating a deduction only for real estate, the cost of which is 2 times less than that mentioned earlier. It should also be said that the parent of a child who has not reached the age of majority has the right to claim this deduction. The point is that if the purchased housing was subsequently registered as the property of the children, then the parent also has the right to receive a deduction. The great news for those who purchased their home using a mortgage is that these people are entitled to receive a tax deduction. Moreover, this may apply not only to the cost of the real estate itself, but also to the interest that you undertake to pay to the bank in accordance with the agreement. The optimal amount of interest, which gives the right to provide a deduction, should not exceed 3 million rubles. It must be said that you can apply to the tax office for the due deduction at any time, regardless of when you purchased a home or concluded a mortgage loan agreement. How is the deduction provided? The property deduction for a mortgage can be allocated as a total amount and paid in a lump sum, or it can be paid in fractions. The fact is that the total annual deduction cannot exceed the amount of income tax paid by a certain citizen during the reporting year when the purchase of residential real estate was made. For example, this is housing purchased in 2010 for 2 million rubles, then you should expect to receive a deduction in the amount of 260 thousand rubles. However, if the amount of income tax you paid for this period is no more than 50 thousand rubles, this means that you can only hope for this amount. The remaining money of the accrued deduction will be paid in subsequent years until its entire amount is repaid. If we are talking directly about receiving a property deduction for the interest paid to the bank accrued on a mortgage loan, then they can be paid at a time, but only if the mortgage is fully repaid. If payments on a housing loan have not yet been stopped, then an annual deduction is provided at a rate of 13%, calculated on the amount of bank interest actually paid for the year. The duration of such payments is limited only by the duration of the mortgage loan, as well as by the optimal limit of the amount used to calculate the deduction, which is equal to 3 million rubles, the amount of the deduction itself will be 390.0 thousand rubles. Deduction from interest on a mortgage Those who know first-hand what a mortgage is also know that with a long term of such a loan, you have to pay interest on it, the amount of which is a very “tidy” amount, it can reach up to 3 -x million rubles. If these are the terms of your loan, then know that you have the right to contact the tax authorities located at your place of residence to receive partial compensation for the costs incurred associated with the payment of interest. To receive a deduction, you will first need to contact the bank and get a certificate stating how much interest will be charged to you for the entire period allotted for repaying the mortgage loan, as well as the interest to be paid annually. Based on the received bank document, the total amount of property deduction due is calculated, as well as the amount of compensation broken down by year. It must be emphasized that regardless of whether the interest limit of 3 million rubles has been exhausted, the borrower has the right to provide a mortgage interest deduction only once in his life, and only in relation to a single residential property. But the fact is that since 2014, the legislator has given citizens the right to apply for additional deductions when purchasing a second (subsequent) residential premises, if the first one was purchased after 2009 and its cost was less than 2 million rubles. In this case, the additional charge will be calculated from the residual value of the maximum calculation amount. That is, if the first residential property was purchased for a million rubles, and the amount of the deduction was 130 thousand rubles, then as a result of the acquisition of subsequent residential real estate of a greater value (for example, for 3 million rubles), you can count on the remainder of the maximum deduction amount from the remaining amount, that is, another 130 thousand rubles. Documents provided for calculating the property deduction First of all, of course, you will need an identification document of the applicant. For Russian citizens, this is a passport of a citizen of the Russian Federation, and for foreigners, a passport of a foreign citizen or any document equivalent to such. Declaration (form 3-NDFL) (See How to fill out a declaration (NDFL3) when buying an apartment?). To confirm the withheld amounts of income tax, a certificate of form 2-NDFL is provided; it must be taken from the accounting department of your enterprise (organization, company). It should be said that income tax is paid only from the “white” salary, so if your salary is minimal, get ready to receive a tax deduction in doses over several years. You will also need documents that can confirm the expenses incurred in connection with the purchase of housing: this is a purchase and sale agreement, a certificate of ownership, an act of acceptance and transfer, a copy of the mortgage loan agreement and a bank statement about the interest accrued by the lender. If the property was purchased for children, then official papers will be required that can confirm the borrower’s relationship with them. Deduction through the employer The deduction provides for payment in two options: directly through the tax organization - by allocating the total annual amount, or through the employer through monthly additional payments. How this happens If you plan to use the calculated deduction for a specific purchase, then, of course, a more profitable option is to receive the entire amount at once. In such a situation, it is better for you to prepare the entire set of documents to submit to the tax authority and prepare to wait, approximately 2 to 4 months, for the decision that the tax office must make regarding the provision of deductions and transfer of money. In order to speed up this process, and if you do not have any special plans for these financial resources, you can obtain them at your enterprise. To do this, you will also have to contact the tax office at your place of residence with the mentioned set of documents and receive an order, which must subsequently be provided at the applicant’s place of work. Based on such an order, the employer has the right to exempt you from paying income tax on the income received; the amount will be paid to you monthly as an addition to the basic salary. Its size is calculated very easily - just calculate 13% of your “white” salary. It should be specifically emphasized that this method of paying a tax deduction is possible only before the expiration of a 3-year period from the date of purchase of residential premises. If during this period the accrued deduction amount is not paid to you in full, then in any case you will have to contact the tax authority for its “remainders”, then you can only wait for the receipts. An example of calculating the amount of the required deduction For example, an apartment worth 3 million rubles was purchased under a mortgage program. The mortgage was issued for 15 years, during this period the interest accrued on the loan is 2 million rubles. In such a situation, you have the right to count on a property deduction calculated at a rate of 13% of the cost of residential premises, but not more than 2 million rubles - which is 260.0 thousand, and in addition to this amount another 13% of 2 million ( what was the interest on the mortgage loan) - this is another 260.0 thousand rubles. As a result, the total amount of payment due to you will be 520.0 thousand. The only limitation is that 260.0 thousand rubles for the immediate cost of housing can be paid to you in a lump sum (provided that such an action allows you to withhold and pay income tax). But 260.0 thousand for “mortgage” bank interest will be paid to you throughout the entire lending period (if it is not yet completed). It is important to emphasize that both spouses have the right to return 13% of the amounts paid for the purchase of residential premises, provided that they work and conscientiously pay tax on the income they receive. Persons who do not have the right to receive a property deduction There are categories of citizens who do not have the right to receive such a deduction. These categories include persons: Those who work “unofficially”, therefore, who do not pay income tax; Those engaged in individual entrepreneurial activities and using a simplified or patent tax system; Citizens who have become owners of housing paid for by other persons, as confirmed by documents submitted for consideration (payment orders, checks, etc.); Persons who previously applied for a tax deduction for another or the same residential real estate, the value of which is from 2 million rubles or more, as well as deduction for accrued bank interest. The deduction may also be refused if the applicant provides false information or an incomplete set of documents required to apply for a property tax deduction. In this case, you have the right to deduct from the moment you submit the missing documents or submit correct data. The refusal of the tax authority on other grounds is considered unlawful and can be appealed to higher structural units of the tax inspectorate or to court.

We recommend reading: Up to what age do Sberbank offer a mortgage?