An agreement on the donation of an item (apartment, house, car, etc.) is a gratuitous transaction in which the donor transfers the gift and the recipient accepts it (Article 572 of the Civil Code of the Russian Federation). The process of preparing documents, depending on whether it will be carried out independently or with the participation of a notary, will require certain financial investments . You will also have to pay for registering the transaction with government agencies.

The transaction process usually occurs in the following order:

- preparation of a package of necessary documents for registration of a donation (can be done either independently or with the involvement of a lawyer, if additional documents are required to complete the transaction);

- signing a gift agreement and notarizing it, or independently preparing the text of the gift agreement (it should be borne in mind that it is not always possible to formalize a gift in simple written form);

- registration of the transfer of ownership of the gift (if the agreement is not notarized, the gift agreement itself is also registered);

- obtaining documents confirming state registration and title documents for the gift.

Information

Notarization of a gift consists of preparing the text of the document and certifying the signatures of the parties. In this case, you will need to pay the notary a state fee for technical work and for the certification procedure itself. State registration also requires payment of a state fee.

Costs for certification of a gift agreement by a notary

In accordance with Art. 574 of the Civil Code of the Russian Federation, a gift transfer agreement can be concluded orally (if the amount of the gift does not exceed three thousand rubles and the transaction is concluded between citizens) or in writing (in simple written form or notarial form).

Certification of a donation transaction by a notary has its positive aspects:

- correct execution of the text of the agreement (which is drawn up by a notary, guided by legislation and regulations);

- trust in the transaction of the parties to the donation (since the notary signature and seal are perceived by citizens as a full-fledged document, rather than an agreement that is concluded independently);

- a notary checks the documents provided to formalize the transaction and identifies missing ones, as well as the ability to formalize some on the spot (for example, consent of spouses, parents, etc.);

- notarization of a document implies the least possibility of challenging the donation (since the notarial procedure involves verifying the legality and integrity of the transaction being concluded).

In addition to the positive aspects of notarization, there are also negative ones - significant financial costs for drawing up an agreement, which are as follows:

- drafting the text of the agreement - depends on the region or the notary himself (tariffs that are approved by special regulations limit the minimum and maximum amount);

- % of the cost of the donated item itself:

- drawing up and certification of other documents necessary for concluding a transaction (consents of spouses, parents and other persons).

Important

The amount of the notary registration fee is calculated as a percentage of the cost of the subject of the gift agreement. Depending on the item of the saddle itself, as well as on the degree of relationship between the parties, the tariff will vary.

Fines in case of artificial reduction of expenses

Taxpayers must calculate personal income tax payable on their own. They are required to report on personal income tax and

transfer it to the budget. There are penalties for failure to submit a declaration and late payment of taxes. They range from 1000 rub. for a missing declaration and up to 20% of the personal income tax not transferred.

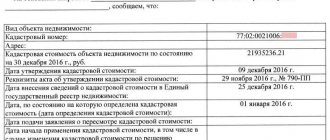

Currently, taxpayers must use the cadastral value of the site when determining personal income tax, which minimizes the possibility of underestimating the tax base and calculated personal income tax. There are no tax deductions when concluding a gift agreement.

Therefore, parties wishing to reduce the tax base enter into an imaginary purchase and sale agreement instead of a gift, under which there is no actual transfer of money. If the Federal Tax Service considers that this agreement is fictitious and concluded with the aim of avoiding tax consequences, then it will assess additional personal income tax, taking into account fines and penalties.

State duty when donating an apartment

Real estate that is intended to be donated must have an appraised value . When completing procedures, a notary must be guided by the legislation regulating this activity. When calculating the state duty, the tariff amount will differ depending on the situations:

- certification of transactions for the alienation of real estate to family members and close relatives - 3,000 rubles + 0.2% of the subject of the transaction (but not more than 50 thousand rubles);

- certification of transactions for the alienation of real estate to other persons depending on the value of the real estate:

- up to 1 million rubles - 3000 rubles + 0.4% of the contract value;

- more than 1 million rubles up to 10 million rubles - 7000 rubles + 0.2% of the contract value exceeding 1 million rubles;

- more than 10 million rubles - 25 thousand rubles + 0.1% of the contract value, which exceeds 10 million rubles (in case of alienation of residential premises (apartments, rooms, residential buildings) and land plots occupied by residential buildings - no more than 100 thousand rubles).

- certification of other transactions, the subject of which is subject to assessment:

- up to 1 million rubles — 2000 rubles + 0.3% of the contract value;

- more than 1 million rubles. up to 10 million rubles - 5000 rubles. + 0.2% of the contract value, which exceeds 1 million rubles;

- more than 10 million rubles - 23 thousand rubles + 0.1% of the contract value, which exceeds 10 million rubles. (no more than 500 thousand rubles).

Additionally

To determine the value of the donated item, you must contact licensed specialists who will carry out appraisal work and issue an opinion on the value. Such work is also paid according to the tariffs regulating this type of activity.

Amount of state duty on gift deed

There is also a separate state fee for registering an individual’s ownership of a land plot intended for personal farming, summer cottages, gardening, vegetable gardening, individual housing or individual garage construction. It is 350 rubles. The purpose of the land is indicated in the cadastral passport.

It is also necessary to keep in mind that the use of a land plot may be limited, depending on its purpose (agricultural land, park land, etc.). The 13% tax is calculated from the market value and depending on whether a house or other structure is located on the land, the amount may vary.

It should be noted that you can donate a house located on a plot of land only if you have the appropriate documents for it.

State duty when donating a car

Donating a car is a transaction for the alienation of movable property. Certain requirements and tariffs for payment of state duties apply to such a transaction.

When notarizing the donation of a car, you must pay a state fee at the following rates:

- certification of gift agreements in relation to children, including adopted children, spouses, parents, full brothers and sisters - 0.3% of the value of the agreement (not less than 200 rubles);

- certification of gift agreements in relation to other persons - 1% of the value of the agreement (not less than 300 rubles).

When all the documents for registering a donation of a car have been prepared, it is necessary to make entries in the vehicle passport about the new owner and the owner who has lost ownership of the car.

The transfer of the car to a new owner is registered by state traffic inspectorates . To do this you will need:

- identification document of the new owner of the car;

- vehicle passport;

- vehicle registration certificate;

- gift agreement;

- OSAGO insurance policy.

With a package of documents and a car, go to the traffic police for registration. Registration with the State Traffic Safety Inspectorate is as follows:

- state taxes are paid;

- an application for state registration of a car is written (at the traffic police department or through the government services portal) and a package of documents is submitted;

- the car is provided for inspection by traffic police (if there is no diagnostic card, it is necessary to undergo maintenance);

- documents confirming the completion of the vehicle registration procedure are presented.

The state fee for registering a car with the traffic police is paid at the following rates:

- making changes to the vehicle passport - 350 rubles;

- issuance of a certificate of state registration - 500 rubles;

- issuance of license plates - 2000 rubles (if the car does not have license plates).

Payment of gift tax

Attention

After completing all the necessary documents to transfer ownership of a gift from the donor to the recipient, you should not forget that the tax office must be notified about this. The notification is submitted within a certain period established by the Tax Code (clause 4 of Article 174 of the Tax Code of the Russian Federation) - until July 25 of the following year (after the year the gift was received).

Tax Inspectorate, in accordance with Art. 229 of the Tax Code of the Russian Federation, notify by filing a tax return, to which are also attached documents confirming the transfer of rights, as well as documents indicating exemption from tax. Such persons are (Article 217 of the Tax Code of the Russian Federation):

- family members of the donor;

- close relatives of the donor.

Persons who are not exempt from paying tax are required to pay (Article 228 of the Tax Code of the Russian Federation):

- 13% of the value of the donated property, if the donee is a citizen of the Russian Federation;

- 30% of the value of the donated property, for foreign citizens.

After submitting the documents and declaration to the tax office, the inspectorate sends the taxpayer a receipt (tax calculation), which must be paid .

Important

The fine for late payment of such tax is set at 20% of the tax amount, and if the tax inspectorate proves that the actions of non-payment of tax are intentional on the part of the taxpayer, the fine amount will be 40% of the tax amount.

Example

The cost of the property (let's say an apartment) is 4 million rubles. The tax amount for persons who are citizens of the Russian Federation will be 13%:

4 million rubles x 13% = 520 thousand rubles.

The amount of tax to be paid is 520 thousand rubles.

If the donee is not a citizen of the Russian Federation, the tax amount will be 30%:

4 million rubles x 30% = 1.2 million rubles.

In case of late payment of tax, the amount is 20% of the tax amount.

In the first case, with an amount of 520 thousand rubles x 20% = 104 thousand rubles. So, the fine will be 104 thousand rubles, and in total you will have to pay to the budget: 520 thousand rubles (tax) + 104 thousand rubles (fine) = 624 thousand rubles. A fine of 40% of the tax value is calculated using the same scheme.

If the gift is not the whole apartment, but only a share, the tax is calculated on the amount of this share. For example, an apartment costs 4 million rubles, and 1/2 of the apartment is donated. Consequently, the amount of the gift will be 1/2 of the cost of the apartment, i.e. 2 million rubles. We calculate the tax:

- for citizens of the Russian Federation - 13% (2 million rubles x 13% = 260 thousand rubles) - the tax amount will be 260 thousand rubles;

- for foreign citizens - 30% (2 million x 30% = 600 thousand rubles) - the tax amount will be 600 thousand rubles.

Amount of state duty on gift deed

NK, the tariff is set at 350 rubles. As already mentioned, if there are several entities as applicants or property alienators, the amount of the state duty is divided between them in equal parts.

If one of such applicant entities, in accordance with Chapter 25.3 of the Tax Code of the Russian Federation, is exempt from paying it or is provided with benefits, then the amount of the fee is reduced in proportion to the number of beneficiaries among the applicants and is payable by the remaining entities that are not exempt from paying it, in exactly the same amount

USEFUL INFORMATION: What rights and responsibilities does a trustee and guardian have?

Important The amount of state duty paid by applicants if it is necessary to make changes to the state register and re-issue a certificate confirming the registration of the right. Yes, for physical

for individuals it will be 350 rubles, for legal entities - 1 thousand rubles. It is noteworthy that payment of the state duty is possible both in cash and non-cash form.

The procedure for registering a deed of gift in 2020

Since 2013, the deed of gift itself does not require going through the state registration procedure. The signed document is the basis for contacting the registrar in order to make changes to the database about the change of owner.

To go through the procedure, you need to comply with a number of legal subtleties and go through a number of authorities. The algorithm does not depend on whether the parties are close relatives or strangers.

Preparation of contract

In order for a gift agreement to be recognized as concluded, it is necessary that the document drawn up has the following characteristics:

- the presence of two sides, both the recipient and the donor;

- the transaction must take place free of charge;

- the agreement should not contain conditions, without the fulfillment of which

- the beneficiary will not be able to receive the subject of the transaction.

The document is drawn up in simple written form in triplicate. With the help of a deed of gift, you can donate not only real estate, an item, but also money, intellectual property, services, shares.

The text must contain:

- details of the parties, according to passport data;

- a detailed description of the subject of the agreement, including the price of the gift necessary to accrue fiscal obligations;

- description of the features of the transfer: timing, who pays the cost of the deed of gift for the apartment, etc.;

- date of preparation, signature of the parties.

The absence of any of the points may be a reason for refusing to formalize a change of ownership.

Before drawing up an agreement, the parties must decide how to go through the procedure. This can be done in two ways: independently, by contacting a notary office.

State registration

The final price of the gift agreement will be significantly lower if you go through the procedure yourself.

To correctly draw up an agreement, you can contact a lawyer, or then make changes to it. This is important to know: Features of the agreement for donating a share in an apartment

In order for the new owner to assume his rights, it is necessary to register the transaction with Rosreestr.

You can submit documents yourself in several ways:

- directly to the registrar's office;

- by contacting the multifunctional center.

Registration through the MFC may take longer due to the fact that service employees transfer the submitted data to the registrar. All parties must be present at the time of application and provide the following package of information and evidence:

- national passports;

- agreement drawn up in triplicate;

- documents of title for the item being donated;

- certificate of family composition/extract from the house register.

If the alienation of real estate affects the interests of minors, incapacitated persons, or a legal spouse, it is necessary to provide permission from the guardianship authorities, from the husband or wife, giving the right to conclude the transaction.

In the event that one of the parties cannot appear before the registrar, it can send a representative acting on the basis of a power of attorney executed by a notary.

Notarization

A notarized deed of gift is not required. The parties can do this voluntarily. Contacting a notary has a number of advantages:

- a specialist will help you draw up a contract correctly, taking into account all the interests and wishes of the parties;

- an apostille increases the legal purity of a transaction, reducing the likelihood of its cancellation in court;

- The obligation to register a change of ownership falls on the notary, which speeds up the preparation of documents and allows all issues to be resolved in one visit.

Turning to the services of a notary negatively affects the amount of costs associated with registering an agreement.

Gifting to a close relative: how much does it cost?

If the donor and the donee are not closely related, several consecutive donation transactions can be concluded. Such actions will allow you to evade personal income tax (at least 13% of the value of real estate) and require repeated payment of the state duty for recording the transfer of assets to the new owner in the Unified State Register (2 thousand rubles for each re-registration).

- Personal income tax (personal income tax), paid as a percentage of the value of assets received as a gift;

- state fees for notarization of donations of real estate between relatives, paid as a percentage of their value;

- state duty for state registration, the amount of which depends on the type of property, but does not depend on its value.

What is considered a gift?

The transferred object can be cash, valuable documentation, any thing, property or right of claim.

In legal practice, the following items of donation are often encountered:

- real estate object: house, apartment;

- automobile;

- household and electronic goods;

- valuable assets.

If the transferred item is a thing that has restrictions , then the donee must have the appropriate documents (for example, for a weapon).

Claims for compensation for damage to health are not entitled to be alienated . In relation to third parties, the donation is carried out in accordance with the norms of Russian legislation in the form of assignment or assignment.

All individuals and legal entities can accept gifts. In this case, certain conditions must be met. A transaction is considered void if :

- transfer of rights occurs after the death of the donor. In this case, the law of inheritance comes into force;

- the acquirer is employed in a government agency or municipal organization;

- the parties to the issue are commercial companies;

- donors are minor children or incapacitated citizens. An exception is that the interests are represented by a capable person, and the price of the issue is not higher than five minimum wages;

- the documentation does not indicate the subject of the donation;

- the document is concluded by one spouse without notifying the other.

Important! The main requirement for all types of contracts is correct execution. If the registration authority has doubts about the correctness of the document, it will have to involve a lawyer. He will be able to completely replace a person in legal matters, which will minimize delays and receive ready-made documents.