Is inherited property divided between former spouses during a divorce?

Marriage occurs under different circumstances. The main expectation of almost any citizen who agrees to officially join a family is a long life together with the accumulation of valuable property, housing and other property. But disagreements or simple fatigue from relationships are quite capable of provoking not only a difference of opinion, but also the official termination of family relationships - divorce.

Everything obtained through a long, painstaking process - earned, acquired - is divided, according to the articles of the Family Code, into equal parts between the spouses. When those getting married prefer a relationship with a stable, documented trust, they can enter into a marriage contract that transfers the marriage under the jurisdiction of the Civil Code.

In addition to what was acquired and bought during the process of building a family, spouses can receive something by inheritance from relatives or third parties. We are talking about different things:

- real estate (residential, non-residential);

- transport;

- valuables, jewelry;

- household items;

- antiques.

All this may have one or another value, which will later become quite important if you need to divide something between separating people. To clarify the state of affairs, the Civil Code is used, which clearly draws the line between different types of property:

- received by right of inheritance by one of the two spouses during their marriage is not subject to division upon divorce;

- if changes have occurred to the inherited property, such property changes its status from “inviolable” to being considered for division.

What kind of changes do you mean? This is a repair or restoration with the investment of your own funds. Moreover, if the funds were spent by a spouse who has nothing to do with the inheritance, then he has the right to claim ownership of this property, including during division regarding divorce. It is worth paying enough attention to this topic so that no misconceptions are created. What can be divided during a divorce, what remains inviolable?

Division of property during divorce

When a couple separates, each may be left with enough property to be in no way subject to claims from the other side of the divorce proceeding. These things include:

- everything that the spouse owned before marriage;

- personal property (clothing, jewelry, perfume);

- property necessary for professional activities;

- income received from investing personal funds in various events and campaigns;

- patent payments, awards received;

- everything protected by copyright law and income from them;

- received under a gift agreement or given as a gift without an agreement.

Most material income (pension, payment earned for work, student scholarship, proceeds from business activities) is considered jointly acquired. Money placed in banking or other structures as deposits is also taken into account.

Incredible difficulties can be encountered if an official marriage is not concluded and the couple lives without registration, acquiring property for common needs. The proceedings can last quite a long time - there is no documentary evidence of common interests in this case, but the situation can be revised due to the presence of a common child, officially registered with the common-law husband and wife as parents.

Many people are cunning and prefer to appoint relatives who have no relation to the other spouse as the owners of the acquired property. In this case, it is quite difficult to prove rights to property. The main topic of our proceedings is property inherited by one of the spouses during their life together. Can a husband or wife claim part of such property?

Division of property if both spouses are heirs

The law provides for 2 possible ways for both spouses to jointly own inherited property during a marriage:

- When the deceased person mentioned both in his will. In this case, both the husband and wife acquire the rights of full owners of real estate or other property in those shares that are specified in the posthumous document.

- In an extremely unfortunate set of circumstances, when all the children and immediate relatives of the spouses die, by law they both become equal heirs of the property.

How is credit divided during divorce?

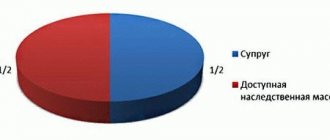

Does the ex-wife have the right to inherit after the death of her husband? When tragedy occurs and the actual direct heir, who is the husband or wife, dies without making a will, then by right of succession it is the second family member who lays claim to the entire property, thereby becoming the sole heir for the rest of his life.

Important! Does a husband have a right to his wife's inheritance received during marriage? If the donor did not have time to make a will, and only one of the participants in the marriage has the right to inherit, the second does not have the right to even look at the percentage of the farm under any circumstances, unless he invests his own money in this property.

Division of inherited property during divorce

The civil legislation of the Russian Federation is quite transparent regarding property received by a person by right of inheritance. In this case, a gratuitous transaction takes place, and the presence of a will or legislative decision does not matter. In any case, a person becomes the owner of property, which may not legally be shared with the former spouse as a result of divorce.

In this situation, several fundamental points can be identified that relate to the situation and can explain it:

- a person becomes an owner after entering into inheritance rights;

- the spouse cannot claim such property;

- all this is regulated by articles of the Family Code.

There are particulars that can allow the opposite party to express claims regarding inherited property. First, the owner himself can transfer property to his husband or wife on a voluntary basis. Secondly, as mentioned above, the property can be repaired, repaired or restored, and the money invested in the process could belong to the other spouse. In this case, the property loses its status and the sole owner.

We cannot exclude a situation where, by mutual agreement, property received by inheritance was sold for the purpose of acquiring benefits or improvement. Let's explain with a specific example:

- a husband or wife inherits a plot of land;

- at the family council, a decision is made to sell it in order to buy a larger land holding (the location or area is not suitable);

- the purchase of a new plot was accompanied by an additional injection of funds not only from the owner of the inheritance.

In fact, the newly acquired plot is jointly acquired property, which both spouses can claim equally in the event of a divorce. In any case, the court's initial opinion will help draw up a documented agreement, if present.

Peaceful resolution of the issue of division of property

Spouses can document the division of property by mutual agreement, then they will not have to start proceedings and involve the courts. The situation also applies to inherited property. If the owner of the inheritance voluntarily transferred his property to the other spouse, and a documentary transaction was drawn up, then the right of ownership passes to the other spouse legally.

This action does not require notarization, and therefore can be drawn up in free form with bilateral consent. The presence of a notary will only confirm the legality of the agreement.

In this case, it is worth paying attention to the following nuances:

- a spouse who inherited property and transferred it to another may then change his mind and demand the property back for division or full ownership;

- property received by inheritance can be gifted to the second spouse, and in the event of a divorce, both claim parts of the gift;

- For reinsurance, it is necessary to document all actions performed with the property.

The importance of the decisions made influences the fact that the court will always require confirmation of actions, and verbal agreements have no force. To more clearly understand the possibilities of various situations, it is worth looking at several examples of the distribution of property during a divorce.

Statistics of divisions of inherited property

Courts quite often face a variety of situations where legal intervention is required. People are not always willing to make concessions, especially in divorce cases. Let's look at a few specific examples where litigation was required regarding property received by inheritance and included in the divorce. Situation one:

- husband and wife lived together for a long time;

- the husband inherited a house, but it needed repairs;

- At the joint council, it was decided to invest common money in reconstruction.

After the manipulations, the value of the house increased; in the event of a divorce, both spouses can claim equal shares in the division of this property. At the same time, the value of the investment of each spouse does not matter, because the money invested in repairs is common, family property. Situation two:

- the wife inherited an apartment;

- it was decided to sell the resulting premises;

- the proceeds from the sale were partially spent on family needs, and the rest went to purchase another apartment.

In the event of a divorce, both spouses can claim equal shares of the housing, because it has acquired the status of joint property. Do not forget that it will not be possible to divide the apartment as such between two spouses, but as an option, you can sell it too, and the money received as a result of the transaction can be divided into equal shares between husband and wife.

These situations quite clearly define the financial investment of the non-heir spouse as sufficient grounds for his claim in the division of the property in question. At the same time, there are often cases when inherited property cannot be divided not only because of property rights.

When inheritance received during marriage is divided upon divorce

An inheritance received by a husband or wife during the period when they are legally married is subject to division only in certain cases:

- If jointly acquired funds were spent on the development and improvement of inherited property. For example, inherited living space will be the personal property of the heir, but if repairs are made using jointly acquired funds, the living space will have to be divided in the event of a divorce;

- In the case of selling an inherited property and then adding the amount taken from the joint budget to purchase a new one. An example would be an apartment sold by a spouse, which he received by inheritance, and a new home purchased, for the purchase of which funds were added from the general family budget. These actions transform the inheritance into the status of jointly acquired property.

Consequently, in this case the inheritance became subject to division. Of course, there will not be an even division. Who will get it and how much will have to be decided by the court, which, having assessed the amount of funds invested in the purchase of new real estate, will divide this property in proportion to everyone’s participation.

Of course, in order to conduct an objective hearing, it will be necessary to provide relevant evidence:

- Documents showing the value of inherited property;

- Documents confirming the fact of property improvement (photos, eyewitness accounts, accounting documentation, various contracts);

- Documents showing the value of the improved property;

- A motivated detailed calculation of the invested funds, as a result of which a difference arose between the price of the inheritance and the value of the property after its improvement (in addition to monetary costs, this issue takes into account time costs, efforts made and the market situation).

How to divide property during a divorce without court?

How to divide a business during a divorce, read here.

How loans are divided during a divorce, read the link:

Indivisible property received by inheritance

A person who has entered into inheritance rights does not share property with his spouse if the following is observed:

- Copyrights are inherited;

- the property is encumbered with debt obligations;

- inheritance is an investment of a monetary nature.

As for finances received by inheritance, there are a number of generally accepted norms that should guide the courts, which is something that “applicants” to property should pay attention to. Firstly, shares, bonds, and other securities remain in any case with the spouse who inherited them, and the other spouse does not have the right to claim them in the event of a divorce.

Secondly, money realized from the sale of property received by inheritance and placed in a bank is not the subject of disputes in the event of a divorce. They remain with the heir. As noted earlier, if a spouse in the future wants to claim ownership of property received by inheritance, he needs to financially invest in its reconstruction or improvement, if necessary.

There is one more point that is worth mentioning. Both spouses can receive the inheritance. What to do in this case?

What is not shared during a divorce?

After a divorce, the sole owner remains the spouse, who inherits the following:

- Debts of a deceased relative.

- Copyright.

- Property, for the improvement and increase in value of which, the second spouse did not participate either financially or using his labor, effort and time.

It is logical that no one will even try to fight in court for the division of their spouse’s inheritance debts. As for copyrights, it is almost impossible to sue them.

If money savings are inherited, then the spouses will be able to divide them during a divorce only voluntarily. Otherwise, the spouse of the heir has no right to claim them.

Even when the money has been in a savings deposit for a long time and good interest has increased, it will belong only to the heir.

Video: What property is not divided when spouses divorce?

Division of property inherited by both spouses

Spouses can not only jointly acquire a common fortune during their family life, but also jointly enter into inheritance rights. This can happen if they are mentioned in the will by relatives, no matter from which side, as well as their own children or grandchildren.

What to do if you receive property by inheritance? The manipulations are as follows:

- the owner's share is documented in the will;

- each spouse must enter into rights;

- after appropriate registration, the property remains with the heir.

At the same time, it is not possible to make claims on the share of the husband or wife. It is illegal. An exception is property issued by right of inheritance from one’s own children. Property acquired in this way becomes joint property and, in the event of a divorce, is divided into equal parts.

Is inheritance subject to division between spouses upon divorce?

The information that can be gleaned from the material described above will allow you to give an almost unambiguous answer. Property inherited by one of the spouses is the undisputed property of the heir, with the exception of special cases. First, the property could be sold and the proceeds spent on something else, which would then act as marital property. Secondly, repairs, improvements and other manipulations in relation to the inheritance, be it a vehicle or a country house, using family, common money, automatically transfers the received property to the jointly acquired section.

As it becomes clear from all these cases, it is always worthwhile to determine your wishes as precisely as possible. Additional activities will also be useful:

- If you have any questions, you should contact a lawyer for advice;

- all transactions should be documented, preferably in the presence of a notary, so that in future conflict situations it will be easier to make the right decision in favor of one of the applicants;

- an agreement or contract of a prenuptial nature will save not only time, but also the nerves of each spouse, and this event should not be explained by mistrust or a negative attitude;

- Before going to court on a particular issue, you should try to resolve the conflict situation peacefully, and also, with mutual agreement, have everything documented.

Inherited property may be subject to dispute in some situations, but in most cases the court will side with the original owner of the property. The inheritance is distributed legally according to a will or by decision of the relevant commission. The decision made in this case will have priority in the event of claims from a spouse who wants to divide something during a finalized divorce.

In any case, if any troubles arise, or there is a misunderstanding of the situation of one of the parties, it is worth consulting with a lawyer, and only then taking any action. Often, ignorance of the situation or its incorrect vision can lead to negative consequences. In the case of division of property during divorce, spouses in some cases may claim property received by inheritance, but the final decision will be made by the court.

What property is not divided when spouses divorce?

Share:

How is inheritance received during marriage divided during divorce?

Despite the fact that the law scrupulously spells out the procedure for dividing inheritance during a divorce, it makes it possible to amicably agree and decide whether they need to divide the inherited property. To consolidate the decision made, written documents that have legal force are drawn up - a marriage contract or an agreement on the division of property and property, which are worth dwelling on in more detail.

Marriage contract

This document can be drawn up both on the eve of marriage and during the period of living together. It defines the right of each spouse to receive certain property in the event of a divorce, and all property is distributed into joint and personal.

In an agreement, for example, you can indicate the possibility of dividing an inheritance received both currently and during your life together, stipulating that it will have the status not of personal, but of general.

marriage contract can be found here.

Property division agreement

It is formalized by spouses during marriage or after a divorce. It is believed that in a falling apart family, spouses are full of enmity and hatred for each other, although there are many decent, fairly intelligent couples who have retained self-respect, who calmly, without arranging analyzes and scandals, draw up an agreement on the division of property, taking into account the inheritance of one of them. sides

agreements between spouses on the division of property can be found here.

The main difference between a prenuptial agreement and an agreement is that the agreement can only divide property that is already available. Making bets on the future is the prerogative of the prenuptial agreement.