Sale of a share of an apartment in shared ownership in 2020-2020

“Transactions involving the sale of shares in common property are an area where violations often occur. For example, an unscrupulous buyer acquires a small share in an apartment and receives the right to live in it, after which he creates unbearable living conditions for neighbors in order to force them to sell their shares at a price below the market price (or force them to buy their share at a high price). All these frauds will be revealed when the transaction is registered by a notary,” says managing partner of Metrium Group Maria Litinetskaya. If the introduced legislative norm concerned only these cases, it would only have advantages.

Property deductions

In Russia, it is possible to obtain a tax deduction from the personal income tax paid for citizens purchasing housing in the amount of 13% of the cost of the real estate. This rule also applies to apartments purchased as shared ownership.

From the beginning of 2014, the following deduction rules came into force for apartments owned by a group of persons, namely:

If housing was purchased before January 1, 2014, then the following tax deductions apply to it:

- The total tax deduction can be a maximum of 2,000,000 rubles, in other words, those citizens who purchased a share worth 2 million or more can get back 260,000 rubles;

- All share owners can count on receiving a deduction, but only in accordance with the size of their shares;

- It is prohibited to assign your share to another owner;

- If a share in an apartment was acquired by an individual owner after the housing had initially become shared ownership, then the tax deduction is not distributed to this owner.

- If an apartment was purchased after the introduction of amendments to the Tax Code of the Russian Federation, then the deduction limit equal to 2 million rubles begins to apply not to the property, but to its individual owner.

In this case, the maximum deduction from all property owners should be no more than 3,000,000 rubles. This makes personal income tax returns more profitable for shared owners.

Shared Property Law 2020

A share in the right of common ownership of a residential premises cannot be divided by the owner into parts if this would make it impossible for each owner to move into the residential premises, taking into account the requirements established by Article 50 of the Housing Code of the Russian Federation. At the same time, it is provided that these provisions do not apply when the right of common shared ownership of residential premises arises as a result of privatization or when inheriting residential premises, as well as in other cases when the right of common shared ownership arises by force of law.

We recommend reading: Payment by Sberbank card online

The procedure for registration in housing that is in shared ownership

Shared ownership provides for the presence of several owners of a certain property at the same time, and there is no difference in what share each owner has. In order for one of the owners to register another person in the specified apartment, he will need to first obtain written consent from the other owners, regardless of what share they have in the specified premises.

Freedom of movement and choice of place of residence is provided for by current legislation, and in particular, it is spelled out in the Constitution, which makes it absolutely guaranteed. At the same time, the procedure in accordance with which citizens are registered at their place of residence is established by Law No. 5242-1, issued on June 25, 1993.

We recommend reading: Providing subsidies for housing and utilities

Shared ownership 2020

• If you have done everything possible to notify the co-owners of the privatized apartment about your intentions to sell the share, but have not received a clear explanation of why they are against such a transaction, the court will decide the issue. As a rule, for owners who do not want or are not ready to buy such a share, the court does not find other compelling reasons that could prevent the allocation of part of the shared property and its subsequent sale. Remember that if you act within the law, you can always allocate and sell a share in a privatized apartment.

An important question: is it necessary to have a land purchase and sale agreement certified by a notary?

To certify the contract for the sale and purchase of a land plot, the parties must contact the nearest notary office (private or public). You must have all the documents confirming the transaction with you, since in the future copies of them will be sent to Rosreestr to register the transfer of ownership rights.

Is notarization required for the land with the house?

In fact, the article indicates all options for acquiring land, i.e. certification is no longer required for either a mortgage or shared purchase . However, citizens are recommended to contact a notary in case of purchasing a share of a land plot without a house on a mortgage, if the remaining owners do not alienate their parts during the transaction.

IN). Transactions related to the disposal of real estate under the terms of guardianship, as well as transactions for the alienation of real estate belonging to a minor citizen or a citizen recognized as having limited legal capacity, are subject to notarization (Clause 2 of Article 54 of the Federal Law of July 13, 2020 No. 218-FZ). The law begins on January 1, 2020. It is currently in force.

Many people ask: will Rosreestr register a purchase and sale agreement or a donation agreement for a share of real estate without a notarization if the transaction was concluded before the date when the notarization was introduced?

Transactions with land shares

The changes concern articles 24, 24.1 and 30 of the Federal Law of July 21, 1997 No. 122-FZ “On state registration of rights to real estate and transactions with it.” Also, from 01/01/2020, the Federal Law of 07/13/2020 No. 218-FZ “On State Registration of Real Estate” came into force, which is in force today.

We recommend reading: Moscow Government Resolution No. 29122020 Benefits for Veterans

The significance of innovation cannot be underestimated. Shared ownership is quite common in the Russian Federation; according to Rosreestr, more than 65 million rights of common shared ownership of individuals are registered in the Unified State Register of Real Estate.

Transactions with shares in 2020 will take place according to the new rules from July 31. According to the latest changes, if an object in respect of which the regime of common shared ownership is established is sold under one document at a time by all co-owners, notarization is not required.

Which transactions with shares in real estate require notarization?

According to the norms of Federal Law-76, it is now possible to additionally buy or sell a share without a notary if all co-owners simultaneously enter into one agreement on the alienation of their shares or a mortgage agreement. This is the essence of the latest change, which was announced with loud phrases “notarization of transactions with real estate shares is canceled in 2020.”

- A thorough check of all documents provided for concluding a transaction in order to establish the fact of its legality and the absence of violations of the interests of the participating parties (to achieve this goal, the notary is given a period of one month to check the documents, during which he must check all the documents provided, and, in if necessary, sending requests to establish the authenticity of the submitted documents).

- Assistance in developing (if necessary) a draft purchase and sale agreement or checking, at the request of one of the parties, the drafted text of the agreement in order to determine whether there are any violations of the law in the agreement, as well as whether the text of the document contains possible violations of the interests of the parties to the agreement .

- Providing guarantees for the payment of monetary compensation in the event that fraud is established with the documents provided and this fact is not clarified by the notary at the stage of preliminary verification of all provided information before the conclusion of the contract.

- When notarizing a transaction, the date and time of the procedure must be recorded. This fact, in the event of a dispute with a specific site, will make it possible to establish whether the dispute arose before or after the conclusion of the agreement.

In the event that Rosreestr employees consider it possible to classify any of the transactions as the listed types, the new owner will not be able to obtain a certificate of ownership until the contract is signed by a notary.

Buying and selling an apartment 2020

1. An individual who is the owner of the only residential premises suitable for permanent residence, who for reasons beyond his control does not have the right to reclaim it from a bona fide purchaser, as well as an individual who is a bona fide purchaser from whom the only residential premises suitable for permanent residence was demanded, has the right to payment from the treasury of the Russian Federation of a one-time compensation for the loss of ownership of such residential premises (hereinafter referred to as one-time compensation).

New rules for selling a share in an apartment

- written refusal of all shareholders to purchase;

- in the absence of the above refusal, evidence of the implementation of actions aimed at notifying the co-owners should be attached;

- a certificate-document on state registration of a share in the apartment, in its absence, an extract from the Unified State Register;

- technical passport from BTI;

- cadastral passport;

- written consent certified by a notary, spouse;

- identification documents of the parties;

- consent of the guardianship authorities if a minor is involved in the transaction;

- the actual purchase and sale agreement for a share in the apartment.

Paying taxes

Currently in Russia there is a gradual transition to collecting real estate taxes at the cadastral price of the property, which is closer to the market value of apartments and houses (read more). Undoubtedly, the total amount of the mandatory fee may be higher than previously, when it was levied at inventory value. However, share owners will not find the tax burden excessive because:

- The tax amount is paid by all owners in proportion to the size of their shares;

- The tax is levied even on those owners who own a share in the apartment, but do not live in it.

The same rules apply to tax on income received during the sale of real estate in shared ownership, namely:

- The payment is distributed among all owners in accordance with their shares;

- The tax deduction, which for residential property is 1,000,000 rubles, and for non-residential properties - 2,500,000 million, does not affect each owner individually, but all property owners as a whole, in proportion to their shares.

The amount of tax on the sale of a share in an apartment and options for reducing it

The law equalizes the right to property between a share in a standard apartment and a room in a communal dwelling. The owner of such housing has similar benefits and concessions when paying taxes on its sale. But before carrying out sales operations, he is obliged to notify his neighbors about this and, if possible, sell his square meters to them. The calculation scheme for tax collections in this case is standard, the tax rate will be 13%, and a tax deduction of up to 1 million rubles will also be available.

The main laws of 2020 in the real estate sector

On January 1, 2020, new rules in the field of shared-equity construction came into force. The requirements for developers' activities have become much stricter. Firstly, this concerns the financial activities of developers. Companies will be required to have one bank account for all transactions. Developers are prohibited from making transactions that are not directly related to raising funds from shareholders. In essence, we are talking about strengthening control on the part of credit institutions over the funds of construction companies. The amount of the developer's own funds must be at least 10% of the project cost of the property.

Is it necessary to make a transaction through a notary in case of joint ownership?

Not long ago, I already wrote about significant changes in the procedure for processing all real estate transactions in which there is shared ownership.

Our legislators decided to give a little help to the decaying notary business and forced people to pay pointlessly extra money into the notary's pocket. It is assumed that this will protect citizens from apartment raiding. But it is not clear what kind of raiding we are talking about if it is not a share in the apartment that is being sold, but the entire apartment, even if it is registered as the shared ownership of people?

Well, okay, we have a lot of meaningless laws, one more or one less.

But with these changes, some confusion arose with other documents for the apartment. Some realtors believe that common joint property also falls under the scope of this law. And it forces sellers to allocate shares (!) and be sure to make a deal through a notary. Don't settle for these pointless expenses.

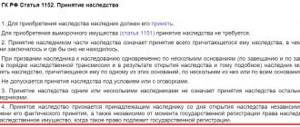

Let me remind you that the Civil Code in Article 244 describes two types of common property: common shared property and common joint property. Even by simple logic one can see that these two options are somehow different by the legislator.

- Community ownership means that the property is owned by several people and their shares are clearly defined. The owner of such a share can sell it relatively calmly, having fulfilled a number of restrictions and requirements of the laws (Article 250 of the Civil Code of the Russian Federation).

- Common joint property refers to the same several people, but no shares are implied. There is no way to sell a piece of an apartment without the other owners. This piece/share does not exist in principle. And if someone still wants to resolve the issue of real estate separately from the rest, they must first allocate a share from the total mass.

Let's see how the changes to the law are described, which have confused everyone so much and doomed many to increased spending:

“1) in Article 24:

a) paragraph 1 should be stated as follows:

"1. Transactions on the alienation of shares in the right of common ownership of real estate, including when all participants in shared ownership their shares in one transaction, are subject to notarization.”

We are talking only about common shared ownership. Therefore, those who have documents for real estate in the form of common joint property can rest easy - they will not have to spend extra money on a notary.

And in the end - who are we even talking about ? After all, many buyers, sellers and realtors, for the most part, see only “shared ownership” in documents and certificates of registration of rights.

Recently, in fact, they are most often trying (again, based on legal requirements) to register real estate as shared ownership. But, for example, spouses can also apply for a joint one. They also often drew up documents for joint ownership during privatization in the 90s. It was precisely such documents that became the impetus for writing such boring but important material.

UPD. Changes/additions from January 1, 2017 :

1. Since the beginning of 2020, a new law “On State Registration of Real Estate” (FZ-218) has been in force. Everything related to registration of real estate transactions is there.

2. The article that talks about registration of transactions with common joint property in this law is Article 42, paragraph 3.

Sergey Vishnyakov was with you.

If you have a question about your real estate transaction, its security, consult me by phone 8 (499) 403-1143 or 8 963 7507293