The Tax Code states that tax deductions are not provided when purchasing an apartment from relatives. Every buyer who has purchased a primary or secondary home can receive it, but not a close relative of the seller.

When registering a deed of gift or inheritance for the real estate of close relatives, the owner receives the right to benefits in paying taxes and paying for notary services. In this case, the agreement records the existence of a direct relationship and attaches documents confirming family ties. Considering the results of donation and sale, we can conclude that they differ slightly; it is difficult to give preference to any of them without certain knowledge.

Registration of a deed of gift entails additional financial expenses, unlike a purchase and sale agreement, which can be drawn up, printed and signed without the help of lawyers. A deed of gift can also be issued without a notary, because in the case of a gift to a close relative, there is no point in paying for the security guarantee that a notary can provide. After persons enter into inheritance rights, litigation may arise that contradict the will of the deceased; therefore, many prefer to use other transactions for the registration of an apartment. The main difference between different types of transactions is the payment of taxes.

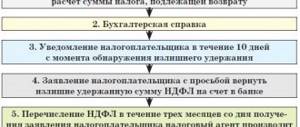

Rules for obtaining a tax deduction

Unlike a deed of gift, which gives the right to cancel the 13% tax for close relatives, there are no such advantages when selling a home. The tax is also levied on owners who sell residential premises that they have owned for less than 3 years. When completing such transactions, neither the seller nor the buyer are entitled to benefits, and they are also denied the right to a tax deduction.

Based on the tax code and other regulations, applicants for the deduction are buyers who are not related to the seller . Previously, all buyers who were related even by distant family ties could not receive a deduction. However, in 2012, the legislation was slightly modified, narrowing the list of those to whom payments are not intended. Citizens who have made a transaction with close relatives are not entitled to the deduction.

Transactions between close relatives

First, it is necessary to determine who is considered close relatives. So in accordance with Art. 14 of the Family Code of the Russian Federation (hereinafter referred to as the Family Code of the Russian Federation), close relatives are relatives in a direct ascending and descending line: spouses, children and parents, grandmothers, grandfathers and grandchildren, as well as full and half brothers and sisters (who have a common father or mother).

Close relatives can give, buy, sell, rent real estate, transfer it by inheritance, enter into rental agreements and other agreements. Transactions between close relatives can be carried out according to the general rules provided for by the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation) and must comply with the provisions of the Civil Code of the Russian Federation on the legality of the content of transactions. The legislation defines only the specifics of some transactions.

A purchase and sale transaction is the most common transaction in the real estate market. Today, the number of transactions between relatives in which they sell property to each other has increased. We pay special attention to the fact that if a purchase and sale transaction was completed fictitiously, without a real transfer of money (for example, only for the purpose of obtaining a tax deduction), then such a transaction may be recognized as imaginary. An imaginary transaction, that is, a transaction made only for show, without the intention of creating legal consequences corresponding to it, is void. Therefore, it is necessary to comply with all the conditions of the legality of the transaction, in particular, to provide evidence of settlement between the parties. Violation of these rules entails the invalidity of the transaction.

The sale by one of the spouses to the other of property that is jointly owned but registered in the name of one of the spouses does not comply with the law. In accordance with Art. 153 of the Civil Code of the Russian Federation, transactions recognize the actions of citizens and legal entities aimed at establishing, changing and terminating civil rights and obligations. In this case, there is no change, termination, or establishment of ownership rights, since the property from joint ownership “enters” into the joint ownership of the same persons. It should be noted that no legal consequences, namely alienation of property and transfer of ownership to another person, occur. Consequently, such a transaction for the “disposition” of jointly acquired property can be characterized as imaginary, carried out only for show, which means that such agreements are not subject to state registration on the grounds that their content does not comply with the requirements of the law. If the transfer of property into the ownership of one of the spouses is necessary, then a solution in this situation may be the conclusion of a marriage contract, which will determine the ownership of the property, or the conclusion of an agreement on the division of common property and the determination of the shares by which the property will be divided into shares (equal or unequal) belonging to each of the spouses separately. After which the spouse can independently dispose of his share in the right, for example, give it to the other spouse.

Another common transaction between relatives is donation. A gift agreement can be concluded with any relative – both close and distant. When making a gift, the donee receives the property as personal property. It is not subject to division as marital property, even if the donee is married. Income received as a gift is exempt from taxation if the donor and recipient are family members and (or) close relatives in accordance with the RF IC.

Now let's look at the features of transactions involving minors.

Russian legislation establishes prohibitions on certain transactions. So in accordance with Art. 37 of the Civil Code of the Russian Federation prohibits paid transactions (purchase and sale) between minors and their legal representatives - parents, adoptive parents, guardians, trustees, as well as their spouses and close relatives. According to this norm, for example, it is impossible to sell real estate belonging to a minor citizen, for whom his mother acts, to the mother’s parents or other close relatives. This prohibition applies to all transactions for compensation, regardless of whether children are the acquirers or alienators of property. Recently, cases have become more frequent (especially when purchasing housing using maternal (family) capital) when the sellers of the apartment are grandparents, and the buyers are their grandchildren. You should be aware that this prohibition applies to transactions aimed at purchasing residential premises using maternal (family) capital, the direct participants of which are minors and close relatives.

Thus, legal representatives, guardians and trustees and their close relatives can transfer property to the ward as a gift or for gratuitous use, that is, they can only enter into gratuitous agreements that entail an increase in the property of the minor. At the same time, donations on behalf of minors by their legal representatives are not allowed (Article 575 of the Civil Code of the Russian Federation), and the gratuitous assignment of a child’s property rights is also prohibited.

State registration of such transactions will be denied, since they do not comply with the law.

Another type of transaction is the act of issuing a power of attorney. Quite often, for transactions, powers of attorney are issued in the name of close relatives. It should be remembered that a representative cannot make transactions on behalf of the person represented in relation to himself personally (Article 182 of the Civil Code of the Russian Federation), that is, one cannot be a representative by power of attorney on both the side of the seller and the side of the buyer. So, for example, if a son has given a power of attorney to his father, then the father cannot sell the son’s property to his wife by concluding a purchase and sale agreement, since in this case the property becomes the common joint property of the spouses. This transaction also does not comply with the requirements of current legislation.

Thus, relatives can choose any type of transaction suitable for each specific situation; everything is decided individually. The main condition is legality, compliance with all necessary formalities and open expression of the will of the parties.

What kind of family ties are deprived of the right to deduction?

Citizens who are to the seller are deprived of the right to a tax refund:

- legally married spouse;

- parents or guardians;

- a natural or adopted child;

- sibling or half brother or sister.

When drawing up a contract for the purchase and sale of a house, apartment or other category of real estate with one of the listed relatives, you must be aware that a tax deduction will not be made.

Often relatives purchase housing from each other for economic purposes:

- replace the gift agreement with a purchase and sale transaction, without seeking to enrich themselves;

- they can carry out such transactions with the aim of illegally obtaining profits at the expense of the state.

The presence of family ties between citizens is not a reason to change the terms of registration of various transactions between them, however, they are deprived of the opportunity to return a tax deduction even if a real financial turnover has been made.

Regardless of the category of housing being purchased (individual ownership or shared ownership), tax deductions are not paid when purchasing an apartment from parents or other direct relatives. This is explained by the fact that the outcome of the economic transaction does not meet real conditions; the seller often sells the property much lower than the market value.

Is it possible to exchange housing between relatives through gift agreements?

Author Pavel Morozov

10.01.2019 14:32

Real estate

1 shared

Close relatives can exchange apartments by signing two gift agreements. Such a transaction is possible if ownership is established for both apartments.

The question of whether there are any privileges for relatives who wish to exchange living space is popular. Now a related exchange of housing requires the same documents and certificates as with a regular exchange.

Close relatives can exchange apartments. To do this, they must sign two gift agreements. Such a transaction is possible if ownership has been established for both apartments. In the case of municipal housing, such an exchange is impossible.

But in every big business, as they say, there are nuances.

The transaction may be declared void

Such a transaction may be considered void. This is despite the fact that donation is one of the most common methods of transferring real estate between relatives. Or fake. This is the case if it turns out that, under the guise of a gift, the participants in the transaction made an ordinary purchase and sale in order to evade taxes. And when donating shares in an apartment, they wanted to bypass the pre-emptive right to purchase a share by other co-owners of the property.

From a legal point of view, a gift agreement for the purpose of exchanging apartments is allowed when two separate transactions are executed. The basis for recognizing such a transaction as void may be the motive if two gift agreements cover another transaction. However, this is difficult to prove. In court, you can try to prove such intent. But if there is no objective data, then it is not possible to obtain it in court.

The will of the parties to enter into such transactions. There will be no words about exchange in the agreement itself. By law, one party has the right to donate housing to the other party. The other party also has the right to make a gift. In other words, one person gives one apartment to a relative for his birthday, and the second, in turn, gives his own gift. And this approach cannot be considered mine. This will be a gift.

When completing such a transaction, you should take into account that such an exchange does not involve any additional payments. They simply cannot be spelled out in such an agreement. By signing the gift agreement, the parties only exchange residential real estate.

According to the law, in the case of transfer of money or rights, the contract will not be recognized as a donation, it will be considered feigned. In this case, the rules of the contract that the parties actually had in mind will be applied to him, namely the rules for the purchase and sale of housing.

What prevents you from concluding an exchange agreement?

The terms of the contract, of course, will be different. In the case of an exchange agreement, a person receives another residential property. And when giving, it means that a person does not receive anything in return. The donor cannot take anything from the recipient. If the court determines that there was, for example, an additional payment, then both transactions will definitely be declared void.

Do I need to pay tax on a gift agreement?

When concluding a gift agreement, there is no need to pay tax if the donor and recipient are family members or close relatives. True, not all relatives are released, namely close ones. According to the Family Code, the circle of such relatives is relatively small. All other persons who receive an apartment or house as a gift are required to pay tax.

Family members and close relatives are spouses, parents, children, both natural and adopted. And also grandparents, grandchildren, brothers and sisters. Gift transactions between them are not subject to tax. But a gift between, for example, an aunt and nephew or cousins is not recognized as a tax-free transaction. Such relatives will have to pay personal income tax.

Photo: rating-remont-kvartir.ru

Subscribe to the channel “Truth of Real Estate”, we will be the first to know about many things)

Changes in legislation

Previously, even indirect relatives could not obtain the right to a property deduction, for example, if a transaction was concluded between an uncle and nephew, between cousins, etc. The turning point came in 2012, when the circle of persons eligible for deprivation of the property deduction was significantly narrowed to direct family ties. Today, persons who are indirectly related and have entered into a transaction with each other can receive a property tax deduction.

When concluding transactions between close relatives, it does not matter whether real money turnover occurs or not, the right to deduction is lost, but it can be achieved. To do this, you need to draw up a claim and send it to the court. A positive court decision will be an incentive to withhold taxes in full in accordance with the cost of the purchased home and the income declaration provided by the buyer.

Tax deductions are not available to persons who purchase an apartment that has been owned for less than 3 years.

To achieve the right to a tax refund, direct relatives should draw up a sales contract in a slightly different way. To do this, you can draw up an assignment agreement for the sale of any type of housing. In this case, the tax is returned to all buyers, regardless of their relationship with the sellers.

Property deduction when purchasing a home before 01/01/2012

If the apartment was purchased before 2012, then the tax office, when deciding on a tax deduction, applies the old provisions on related parties.

In the old version of the Tax Code of the Russian Federation, relatives for determining the right to a tax deduction included:

- spouses;

- relatives;

- brothers-in-law (husband's (wife's) relatives);

- adoptive parents and adopted children;

- guardian (trustee) and ward.

Persons related to close relatives are listed in the Family Code of the Russian Federation. These include parents and children, grandparents and grandchildren, brothers and sisters.

In-laws include mother-in-law (father-in-law) and son-in-law, mother-in-law (father-in-law) and daughter-in-law, and other relatives of the spouses on both sides.

From the above, we can conclude that the old version of the law does not contain a specific list of relatives to determine the right to a property deduction.

Therefore, the tax office may refuse a deduction, even if the transaction was not made with close relatives before 2012. For example, a deduction may be denied in a transaction between an uncle and a nephew, between cousins, or between a stepson and stepmother.

Therefore, for transactions before 2012, when purchasing an apartment from almost any relative or brother-in-law, a tax deduction is not provided.

Drawing up a purchase and sale agreement for a share in an apartment between relatives

The nuance of an apartment purchase and sale agreement between relatives is that they know the condition of the housing, will not require special checks, and will be able to buy it in installments. Today, shares, parts, and individual rooms are often sold. This is convenient if whole families are buying housing, but each family member wants to claim a part of it.

To sell a share of an apartment, a relative needs to collect a similar package of documents as for a regular purchase and sale agreement, draw up a document, register it and pay the state fee.

The sale of a share by a relative occurs for the following reasons:

- A family member sells a privatized room in a communal apartment;

- Relatives inherited an apartment; a person may want to sell his own share;

- During a divorce, spouses divide property, so they sell shares;

- Privatization by children and parents of parts of the apartment in which they live.

Close relatives to whom you can sell a share:

- Grandmother and grandfather;

- Spouse;

- Mom and Dad;

- Children (if relatives are selling to them, then a separate document is needed, for example, a power of attorney for the child to represent the interests of the grandmother).

Procedure:

- Collection of a simple package of documents;

- Draw up and execute an agreement;

- Pay state duty receipts;

- Officially register property rights;

- Receiving a certificate of a successfully completed transaction.

However, it should be remembered that other owners of shares in the apartment have the first right of purchase. Refusal or consent to purchase by other owners must be in writing.

Registration of the contract

A transaction between spouses can only occur if the apartment belongs to the husband or wife. For example, it was acquired before marriage, one of the spouses inherited it or received it as a gift. If the spouses received housing after they entered into a union, then one family member can only sell half of the living space.

Contents of the contract for the sale and purchase of a share of an apartment between relatives:

- At the beginning of the agreement, the place of its preparation and date are written, all other owners of shares of the real estate are listed, and most importantly - information about the seller and buyer, their passport and registration data;

- The document must contain all the information about the apartment, including its defects and damage. To do this, you can invite a specialist to conduct an examination, but relatives usually do not do this. Write the address, floor, area of the share that is for sale, etc.;

- The parties indicate the price and payment method in the act;

- The rights and obligations of the parties must be formalized at the time the contract is valid and, if necessary, for a certain period after the expiration of the contract;

- All other homeowners, the size of their shares and written waivers of the priority right to purchase are registered;

- The parties write the validity period of the document;

- At the end of the act, signatures with transcripts.

List of documents

In order to sell a share of an apartment to relatives, the same package of documents is required as for the usual preparation of a purchase and sale agreement.

List of documents:

- Passports of the parties to the transaction with their photocopy certified by a notary, or a power of attorney for a third party who will conduct the transaction instead of the seller;

- Certificates issued by tax authorities;

- All documents by which the seller has title to the property he wishes to sell. This could be a document about a gift, inheritance or purchase, etc.;

- All extracts about real estate from the Unified State Register and the house register;

- A certificate issued by the relevant authorities, which indicates that the seller has registered his rights to the property of the living space being sold;

- Cadastral passport and its copy.

The list of documents can be supplemented, it all depends on the transaction being made. To obtain information about a package of documents specifically for a transaction carried out by specific parties, you can call Rosreestr and get advice.

There are few differences between selling a share of an apartment to a relative and selling it to a stranger, since a standard document is drawn up. In accordance with the legislation of the Russian Federation, the main difference is the state duty paid.

In the case of close relatives, the state fee for notarization of a transaction varies, depending on who the parties are to each other. The closer the degree of relationship, the lower the amount calculated in accordance with the cost of the apartment.

If an outsider buys an apartment, he will require a home inspection, namely, hire specialists to inspect the property for defects or damage. Relatives may turn a blind eye to minor defects or know about the condition of the apartment.

Advantages and disadvantages

Selling an apartment to a close relative has a number of pros and cons.

Advantages and disadvantages of buying and selling a share of an apartment to a relative:

- If spouses bought an apartment from close relatives, it will be considered jointly acquired property. In case of divorce proceedings, it will be divided between husband and wife;

- If the seller of the apartment dies, third parties who bought its share may consider that from that moment it belongs to them. But, if a close relative of the seller bought a share from him, then by right the living space belongs to the relative;

- The downside is that the relative who sold the share of the apartment no longer has rights to it. For example, parents sold a share of an apartment to their children. They want to exchange it, but this is impossible, since the rights to this share now belong to the children;

- It is impossible to challenge the transaction or invalidate it.

After selling an apartment to a relative, it can no longer be returned, and the transaction cannot be declared invalid.

The so-called property deduction is carried out during a transaction if the owner has owned the property for less than three years. This happens because, according to the law, such a sale is a desire to make a profit. And there is a tax on net profit in the Russian Federation - 13%.

Cases when no tax deduction is charged:

- The owner has owned the property for more than three years;

- The amount of money when selling an apartment corresponds to the amount of money from the purchase;

- The property costs less than a million rubles.

The law prohibits the unofficial transfer of funds between relatives when buying or selling an apartment. If the amount is 20% or lower of the market value of the property, then the tax service charges a penalty.

Often transactions related to the sale and purchase of an apartment are carried out between relatives. Thus, many people are reluctant to enter into an agreement citing family ties.

This statement is incorrect, since there may be unnecessary problems in the future that it is advisable not to encounter. Therefore, as for the content of the contract, it must include all the most important points, while complying with the norms of civil law.

If you want to sell real estate, you can do it without much effort if you approach the issue wisely. Moreover, you can sell an entire apartment, and a share in it, although there are some peculiarities. In any case, the transaction should never violate the rights of other persons.

What this means is that before you wish to transfer your share to, for example, your great aunt who lives on the other side of the country, it is important to invite all family members to become buyers. If they refuse, then only in this case can we carry out our plans.

At the time of drawing up the contract, important points must be included in it. Such as:

- Date and place;

- Information about the parties to the transaction;

- Bank details, address details;

- The description of the item plays an important role, so you will need to indicate the necessary information about the property, namely, in what area it is located, you should indicate the apartment number, etc.

- Information about all existing deficiencies;

- Data about citizens who live in the apartment;

- The procedure for paying expenses that will be associated with the conclusion of the contract.

In any case, the participants in the transaction must draw up a transfer deed; this is a document indicating the transfer of a share in the apartment.

It is important to know that if the property was owned for less than three years, and the value under the contract is more than one million rubles, then the seller must pay a tax of 13%.

If you carefully consider this issue, you will personally see that there is nothing complicated here. For example, if you are the owner of an apartment, then you can exchange or bequeath your share only with the consent of other owners. Remember that this is one of the most important points; you should never forget about it if you do not want to face unnecessary problems.

It is also impossible not to add that the right to buy out a share by other owners is considered to be a priority; be sure to take this into account. What this all boils down to is that before selling, the seller must inform the co-shareholders about this; they may want to buy out the share.

In addition, you should always pay attention to the fact that there are no simplifications from the law in relation to relatives, so the transaction is formalized as usual, traditionally.

In order for the transaction to take place, you will need to prepare the necessary documents, without which this will not be possible.

The following will be required:

- technical certificate;

- papers evidencing ownership;

- real estate documents;

- identification of all participants in the transaction.

It is important to understand that completing such a transaction is always a responsible procedure. First of all, this is due to the fact that we are talking about serious money, so you should understand in advance whether you can cope without consulting experienced lawyers or not.

Of course, it is always advisable to seek help from specialists, at least to avoid various delays in the future. After all, as practice shows, more and more often problems arise precisely when a real estate purchase and sale agreement is drawn up between relatives. Therefore, you should not relax, citing the fact that these are close people.

A distinctive feature of a gift agreement is precisely the absence of any remuneration from the recipient to the donor. If such a condition is violated, the contract may be contested or cancelled.

Features of the agreement

The purchase and sale agreement between relatives does not have any features associated with close kinship:

- there is no need to indicate the degree of relationship in the contract;

- It is not necessary to notarize such an agreement (only if a part is being sold or the seller is a minor).

The contract must indicate the same points that are necessary in a transaction with an outsider:

- Full name, passport, address of the parties to the transaction;

- subject of the agreement: detailed description of the apartment;

- apartment price;

- procedure and deadline for transferring the apartment;

- payment procedure and terms;

- other conditions, including seller guarantees;

- an indication of whether a seller's lien arises.

At the same time, taking into account the confidential nature of the transaction, it is possible to do without an acceptance certificate for the agreement. To do this, you need to directly indicate in the text of the document that a transfer document is not required:

“The parties agreed that this agreement is at the same time an act of acceptance and transfer of the apartment. The signing of the contract indicates that the Buyer has inspected the apartment and his consent to accept the apartment in the technical condition in which it is on the date of signing the contract."

If you are entering into a deal just for show, it is better to sign the transfer deed. Otherwise, it will be easier for the creditors of the debtor who has “re-signed” the apartment to a relative to prove the sham of the transaction.

Basic requirements for the contract

The donation of real estate is confirmed by a special agreement (deed of gift), and is most often concluded between individuals. The main features of such a transaction:

- property must be donated without any material compensation;

- a mandatory condition is the voluntary actions of the donor and the consent of the recipient to accept the gift;

- the absence of any restrictive conditions for the use of the gift - a ban on use before reaching a certain age, a taboo on sale, etc.

You can donate not only an apartment, but also part of it in the form of a share . At the same time, there is no need to notify other owners (not spouses) about this, since they will not have a priority right to repurchase.

You can donate an apartment only with the permission of the second spouse if the property was acquired during a legal marriage and is considered joint property, even if the property is registered only in the name of the future donor. This document must be notarized. If the apartment is considered premarital property, you do not need to obtain permission.

Important! If a deed of gift for an apartment is issued in the name of a minor, only parents or official guardians can sign documents and give consent to accept the gift on his behalf.

The gift agreement can be drawn up in any form, but to eliminate discrepancies and errors in wording, it is easier to take a sample from official sources. At a minimum, you should ensure that the text of the document contains:

- place and date of the donation transaction;

- personal data of the donor and the one who accepts the gift;

- a complete list of applications confirming ownership of the donated real estate;

- conditions for payment of registration costs;

- personal signatures of participants.

Important! Donating real estate is impossible if it is under encumbrance. This fact is checked by specialists when registering a transaction and its conclusion may be refused.