Features of buying an apartment in a new building

- From the seller

The list of documents when purchasing an apartment in a new building and the specifics of the procedure depend on how it is purchased:

- Under the agreement of shared participation in construction (Article 4 of Federal Law No. 214 “Agreement of participation in shared construction”). The bank participates in the transaction, an escrow account is opened, to which the shareholder transfers the money.

- Under an agreement of assignment of rights of claim, when the shareholder himself sells an unfinished apartment to another person. Shareholders are being replaced.

- According to the agreement of share contributions to the housing cooperative.

- According to a housing certificate issued before 07/01/2018.

- In installments provided by the developer.

- Under the purchase and sale agreement, if the object has already been put into operation.

Important! Regardless of the method of acquiring real estate, ownership is registered in the name of the buyer in Rosreestr. For this they pay a state duty.

Take the survey and a lawyer will tell you for free how to avoid mistakes in an apartment purchase and sale transaction in your case

○ Advice from a lawyer:

✔ We bought an apartment on the secondary market, we receive receipts for a large debt for housing and communal services, how can we prove that this is not our debt?

There is no need to pay on old receipts. This is not your problem, but the management organization's. You are a payer of utility bills from the moment of registration of property rights (clause 5, part 2, article 155 of the Housing Code of the Russian Federation). Just sign up for a new personal account and pay your bills. The MA does not have the right to collect the debt from you. If the management organization does not want to open a personal account, go to court. In such cases, the court takes the side of the new owner (for example, the decision in case No. 2-1837/12 of the Zavolzhsky District Court).

List of documents when purchasing an apartment in a new building

The lists of documents for purchasing an apartment are different for the buyer and the seller. In the first case, the maximum number of certificates will be required. For the buyer, often only a passport is enough.

Let's figure out what exactly is required from both parties when purchasing real estate in different ways.

From the buyer

The buyer only needs to present a passport and notarized consent of the spouse if the apartment is purchased with a mortgage. In other cases, it is not necessary, but it is better to formalize it, especially since the sellers themselves often ask for consent.

When buying an apartment, you will have to use a bank for a mortgage. To review your application you will need:

- Passport;

- SNILS.

- Spouse's consent.

- Income certificates.

- Marriage certificate (for married couples).

- Child's birth certificate (if available).

- Certificates confirming the availability of additional income.

Note! Each bank establishes its own list of documents for purchasing real estate with a mortgage. It is better to check with the department for details.

From the seller

What documents must the seller of an apartment provide to the buyer when buying and selling in different ways:

| Sales method | Documentation |

| According to DDU |

After completion of construction, a transfer and acceptance certificate, a cadastral passport for the apartment, and a certificate of payment of amounts under the DDU are drawn up; you will need permission to put into operation |

| Under the agreement of assignment of the right of claim |

|

| According to the agreement of share contributions to the housing cooperative | For membership in the housing cooperative:

To register ownership upon completion of construction:

|

| In installments from the developer |

|

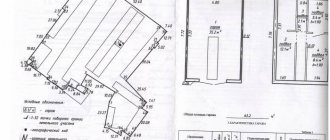

| According to the purchase and sale agreement | The same as for installments. Additionally, a commissioning certificate, floor plan and cadastral passport are provided |

Legal advice: to be on the safe side, it is recommended to study reviews about the developer and check the availability of permits. This is necessary regardless of the method of acquiring real estate.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Mortgage and documents

Purchasing an apartment with a mortgage differs from a standard transaction in that a note is entered into the register indicating that the real estate purchased for the lender's money is pledged in his favor. At the same time, the mortgage itself is registered under the mortgage, loan agreement and purchase and sale agreement, in which this item is noted.

After completing the registration procedure, the lender receives the mortgage, which means that the buyer will not be able to take it from Rosreestr.

Since the buyer submitted the original loan agreement along with a copy certified by an employee of the department accepting documents, the registering person will verify the information contained in this document, then leave the copy in the archives, and give the original back to the buyer.

As a result, the buyer receives the following documents:

- purchase and sale agreement with signature after registration;

- acceptance certificate (if it was provided during registration);

- an extract from the register of registration of ownership of housing.

Features of buying an apartment on the secondary market

The package of documents for purchasing an apartment on the secondary market is significantly different. Here, instead of a developer, the seller is usually an individual, or less often an organization.

It is important for the buyer to check the documents for the apartment when purchasing so as not to lose his money. For him, the deal has the most risks. The seller must prepare them in advance in order to reach a deal faster and eliminate the risk of challenge by a third party.

Are you planning a deal to buy or sell an apartment?

Lawyers will answer any question regarding the transaction free of charge and in detail. Ask a question so you don't waste time reading!

Documents for purchasing a resale apartment

The list of documents when purchasing an apartment on the secondary market depends on how it is purchased: for cash or with a mortgage. The maximum list of certificates will be required from the seller.

The purchase and sale agreement is drawn up before submitting documents for registration. If payment is made through a safe deposit box or letter of credit, the parties to the transaction need to come to the bank and conclude a tripartite agreement.

From the seller

What documents are needed for the seller to register the purchase of an apartment:

- Passport.

- Certificate of ownership.

- Transfer deed.

- Technical passport.

- Documents of title: contract of sale, gift, exchange, annuity, certificate of inheritance.

- An extract from the Unified State Register of Real Estate, ordered no more than one month ago.

Legal advice: the buyer is recommended to independently order an extract from the Unified State Register using the Rosreestr service. This will eliminate the risk of the seller falsifying the extract and the likelihood of purchasing real estate with an encumbrance that was not previously stated.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

When a buyer is found, the seller needs to obtain an extract from the house register to confirm the absence of registered persons in the apartment being sold. You will also need certificates confirming the absence of debts for housing and communal services.

These documents have a limited validity period (from 10 days to 1 month), so there is no point in ordering them in advance, only when entering into a transaction.

From the buyer

The buyer only needs to have a passport with him. If an apartment is purchased with a mortgage, the bank will need the following documents:

- Certificate of income.

- Spouse's consent.

- Real estate documents (requested from the seller).

- SNILS.

Additionally, the bank may request a military ID (for men under 27 years old), as well as copies of all pages of the work book.

Lawyer's answers to frequently asked questions

How to check the developer before buying an apartment?

Information about the developer must be in a single register. If the company is not there, this is a reason to be wary and refuse the deal. Also on the website of the Russian Ministry of Construction you can check new buildings for compliance with legal requirements in order to minimize risks. Before concluding a contract, it is recommended to request the documents presented above from the developer.

What documents are required when purchasing an apartment with an encumbrance?

The seller must present a mortgage agreement with the bank, as well as permission to sell or replace the borrower. If the lender requires the mortgage to be paid off before the sale, permission will not be required, but the buyer must provide an earnest money deposit equal to the amount owed.

I lost the sales contract under which I bought the apartment. Now I want to sell it. Is it possible to restore PrEP?

Yes, the contract is restored through Rosreestr. You need to apply for a duplicate. If the DCP was certified by a notary, a duplicate can be obtained from him.

What documents are needed when buying an apartment from a developer to check for bankruptcy?

The developer does not provide such documents, but you can independently check information about it through the Unified Federal Register of Bankruptcy Information. Citizens can also check for debts through the FSSP Enforcement Proceedings Data Bank.

Where can the seller obtain documents confirming that there are no debts under the DKU when selling an apartment?

Certificates are issued by the management company or HOA. For some services, they are provided by separate organizations (electricity company, water utility). Details need to be clarified in the Criminal Code; each region has different rules.

Do you need a purchase and sale agreement?

We’ll show you how to draw up a contract correctly and avoid mistakes.

Registration period

Russians are required to register at a new place of residence within 7 days after the old registration expires. This rule is contained in clause 16 of the “Rules for registration and deregistration of citizens of the Russian Federation at the place of stay and place of residence within the Russian Federation.” Violation of this norm may result in administrative liability in the form of a fine of 2-7 thousand rubles.

But many citizens incorrectly interpret this provision of the law: the specified seven-day period begins to be calculated from arrival at the address, and not from deregistration.

It is worth understanding that living in a region other than your place of registration for more than 90 days requires mandatory registration .

Registration is completed within 7-14 days. On the appointed day, the person receives a passport with a registration mark. If an extract from the old place of residence was issued in advance, then registration can be carried out on the same day.

Thus, if a person plans to only manage the apartment, then he does not need to register at all. If it plans to receive services (medical, educational, social), then it makes sense to register. To do this, you need to contact the regional unit of the Main Directorate of the Ministry of Internal Affairs, the MFC, or submit an application electronically. To register, you must first deregister at your previous place of residence, but you can go through the deregistration and registration procedures at the same time.

Or on the website. It's fast and free!

At the stage of registering the rights of the owner in Rosreestr, the paperwork associated with the purchase of housing does not end for the happy owner. This is only the beginning of a long journey through the authorities in order to re-register numerous contracts for the provision of utilities and other services. Therefore, I recommend postponing the housewarming celebration for a couple of weeks and moving on to more pressing matters. In this article I will talk about what you need to do first when buying an apartment, where to go and how the procedure for re-registering utilities and other services takes place.