Home / Real estate / Purchasing real estate / Mortgage

Back

Published: 08/31/2016

Reading time: 10 min

0

2203

The possibility of using maternal (otherwise known as family, MSK) capital when purchasing or constructing residential real estate is enshrined at the legislative level.

Also, financial assistance from the state can be used to pay off obligations as part of the purchase of housing with a mortgage.

- What is maternity capital?

- Who can pay a mortgage with family capital?

- Documents to receive Registration of a personal certificate Submit a package of documents

- Receive the document from the territorial office of the Pension Fund of Russia

- Obtaining a certificate from the bank about the balance of the loan debt and interest

What is maternity capital?

The state has been providing material support to families called maternity capital since 2007.

We are talking about those families in which two or more born or adopted children are raised.

For several years, the state has been indexing the subsidy.

From 2020, the amount of maternity capital is 453,026 rubles, personal income tax is not withheld from it.

Previously, it was expected that the family support program would “work” until December 31, 2016

inclusive. However, last year a decision was made to abandon alternatives and extend the program until December 31, 2018. This is stated in Part 1 of Art. 13 of Federal Law No. 256-FZ of December 29, 2006 “On additional measures of state support for families with children.”

You can receive maternity capital once in your life. The family has the opportunity to contact the Pension Fund division to issue a certificate of the same name immediately upon the birth of their second child. Cashing out the entire amount of money is not allowed: within the framework of the law, you can only receive 25,000 rubles.

In addition to solving the housing problem, the subsidy has other purposes.

In what cases can they require it?

They may require this document from you immediately after you decide to contact a pension fund or multifunctional center in order to obtain a certificate for the use of maternal capital. As a rule, after you have received a certificate, you can apply for a measure of government support in cash at any time.

However, before transferring funds to the account, the state wants to make sure that they will be sent and transferred in accordance with the law.

Therefore, all documents submitted by you, as well as a certificate containing details and information about the status of the account, are carefully checked.

You can read information about this in the rules for submitting an application for one-time payments, as well as in the rules for submitting and providing a certificate for the use of maternal capital under number 251 dated April 27, 2015.

Who can pay a mortgage with family capital?

The owner of the certificate can pay off the mortgage using capital funds. This right has been secured since 2009.

The following can count on receiving support from the state:

- A woman citizen of the Russian Federation who adopted or gave birth to a second child after 01/01/2007;

- A male citizen of the Russian Federation who is the sole adoptive parent of a second child by a court decision that entered into force no earlier than 01/01/2007;

- Regardless of citizenship, the father or adoptive parent of the child, if the woman loses (due to death, deprivation of parental rights) the opportunity to receive payment.

There are two main options for attracting capital when buying a home with a mortgage:

- Payment of the down payment. Not all banks take the certificate into account as a down payment. Often, the borrower still has to attract additional personal savings. In fact, it turns out that the amount of the down payment can only be reduced at the expense of maternity capital;

- Partial payment of the principal amount. This option is quite beneficial for the borrower, since it can significantly reduce the total amount of overpayment. It occurs much more often.

The owner of a certificate for receiving maternity capital can apply it according to any of the specified schemes, including transferring funds to repay a mortgage loan:

- Registered in the name of one of the spouses;

- Registered in the name of both spouses.

It’s not for nothing that maternity capital is called “family capital”.

If funds are used to improve the family’s living conditions, the purchased housing must be registered as the property of both parents and children.

There is the following nuance: clauses in the lending agreements of some banks clearly prohibit the allocation of shares to minors. In this case, in order to exercise the right to receive maternal capital, it is necessary to provide a notarial undertaking to register the property as the property of all family members after the closure of the loan agreement.

Certificate of maternity capital balance through State Services

Next, using an account in the Unified Identification and Authentication System (USIA) - also known as an account on the State Services portal, go to the account of the insured person and submit an application in electronic form.

The certificate will be sent in PDF document format by email.

If there is no account on the Unified Portal of Public Services, then you need to create one. This can be done by following the instructions:

- Go to the State website

- Enter your last name, first name, phone number and email.

- Enter the code that will be sent to the specified phone number.

- Create a password.

- Provide personal information, including the pension insurance certificate number (SNILS), series and passport number.

After this, a standard account will be created. To use all services on the site, you must verify your identity by creating a verified account. This can be done in one of the following ways:

- visit a special service center, for example, a branch of the Russian Post, MFC, Rostelecom branch and others;

- online through Internet banks: in Sberbank, Tinkoff Bank or Post Bank (if the account is confirmed by a client of one of these banks;

- enter the personal code sent in a registered letter on the State Services website.

On the Pension Fund website you can find out the balance of the family capital online without ordering a certificate, but you cannot use this information when contacting a bank or other institution.

Documents to be received

Registration of a personalized certificate

After the birth or adoption of a second child, the right to receive maternity capital arises. First of all, you need to issue a personal certificate . You can do this as follows:

Submit a package of documents

They are submitted to the territorial branch of the Pension Fund or to the MFC division for the production of a certificate confirming the right to capital:

- Statement. The application form is available on the website or at the Pension Fund branch;

- Passport and SNILS of the applicant;

- Birth certificates for both children.

Receive the document from the territorial office of the Pension Fund of Russia

After 1 month - this is the period regulated at the legislative level and is necessary to obtain a certificate, obtain the document from the territorial office of the Pension Fund of Russia.

Every year the amount of maternity capital is indexed, but there is no need to make changes to an already issued certificate.

Repaying an existing mortgage

If a family decides to use funds to pay off an existing mortgage loan, the action plan is as follows:

Obtaining a certificate from the bank about the balance of the loan debt and interest

Tips for obtaining:

- In some credit institutions, this document can be ordered online in Internet banking, and then go to a bank branch to receive a prepared copy;

- Sometimes special divisions of credit institutions are involved in issuing such papers, and the process can take from 3 to 10 days. Therefore, it is better to take care of obtaining a certificate in advance.

In the credit department of the bank, you must write an application for early repayment of the loan, in which you indicate the method for recalculating the balance of the debt through:

- Loan term;

- Amount of monthly payment.

Draw up an obligation to grant ownership rights to all family members

The owner of a residential property purchased with a mortgage must visit a notary and draw up an obligation to vest ownership rights in all family members.

Contact the territorial branch of the Pension Fund or MFC

Here you must provide the following package of documents (original and copy):

- Passport and SNISL;

- Certificate for MSK;

- Loan agreement;

- A certificate from the bank about the outstanding balance of principal and interest. The validity period of the certificate issued on the date specified by the borrower in the application is unlimited;

- Certificate of state registration of real estate rights;

- Notarial obligation to allocate shares in the apartment to all family members.

If the borrower is the sole spouse, the following is additionally provided:

- Spouse's passport;

- Marriage certificate.

Simultaneously with the package, it is necessary to submit an application for the use of maternity capital funds to improve housing conditions (mortgage repayment) and an application for the transfer of funds indicating payment details.

In the application, the owner of the certificate can indicate both the full amount of capital and its part.

We use it as a down payment and the best offers from banks

At the moment, quite a lot of banks accept maternity capital as payment for a down payment. The most favorable conditions are now in Sberbank and Uralsib Bank.

So in Sberbank you can now take out a mortgage at a rate of 12% per annum, in Uralsib from 10.8%. At the same time, an additional down payment in cash is not required, as in VTB 24, Bank of Moscow, Raiffeisenbank. Mat.drop. counts as a down payment, but there is a special nuance.

The loan funds are issued in full and for the first 2 months (until the money from the Pension Fund comes in) you pay the mortgage from the entire cost of the property. Next comes maternity capital and the payment schedule is recalculated. Those. after the mortgage is issued, you must quickly visit the pension fund with all the above documents and write an application for the use of maternity capital.

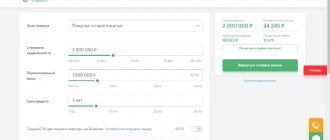

Example. Mortgage (maternity capital as PV) for an apartment worth 2 million for 10 years in Sberbank at 12% per annum. For the first 2 months you will have a payment of 28,694.19 of the entire cost of the apartment (2 million), after transferring 453,026 rubles from the Pension Fund, the payment will be reduced to 22,137.29. Use our mortgage calculator to estimate your payment specifically.

What happens after a decision is made?

The law allows PFR employees a month to check the package provided. After this period, the authorized person:

- Makes a positive decision. In this case, within 30 calendar days from the moment the application is satisfied, funds in the amount specified by the applicant will be transferred to pay off mortgage obligations;

- Refusal. In this case, the certificate holder can try to challenge the decision of the authorized person of the Pension Fund in court, having first analyzed the reason for refusal indicated in the response to the application.

There are two features of transferring maternity capital:

- It can be used to repay a mortgage only when the loan is issued non-cash to an account opened in the name of the owner/official spouse of the certificate holder;

- The law does not prohibit using funds simultaneously to repay several loans for the purchase of housing.

Real estate transactions involving minors - how legal is it? You will learn how to allocate a share in special cases in our feature article. How to take the extract you need from the house register, you will read in our material at the link.

Reasons for refusal

After a long time of collecting documents, writing applications and other legwork, you anxiously expect a positive result, and in response you receive a decision with a refusal. The question arises: What could be the matter?

The reasons are as follows:

- errors were made when filling out the application;

- not a complete package of documents was provided;

- the applicant has committed a crime against a child;

- deprivation of parental rights to a child for whom maternity capital was received;

- restriction by guardianship and trusteeship authorities of the rights of the guardian.

Having familiarized ourselves with the reasons for the refusal, we draw conclusions for ourselves. When collecting a package of documents and filling out applications, be careful; it is better to double-check and ask several times than to waste time and nerves when re-submitting.

If you want to know more about mortgages, then be sure to subscribe to our website. We are waiting for questions in the comments. To receive free legal assistance, fill out the form in the lower right corner.

To repay the loan with family capital, you need to collect a package of documents and contact the Pension Fund. In most cases, a positive decision is made, but a refusal is also possible due to the credit institution’s non-compliance with the requirements of the law. If the Pension Fund allows the funds to be spent, the money is transferred to a bank account, which makes full or partial repayment of the debt. Ownership of housing, paid for with maternity capital, is divided among all family members.

Maternity capital is funds allocated to a family upon the birth of a second or adoption of a second or subsequent child. possible in different ways. One of the most common and popular is repaying the mortgage with maternity capital.

It has been established that money received from the state can be used as a down payment when purchasing real estate with a mortgage, and can also be used to pay for housing loans, including principal and interest for use. It does not matter when the family took out the loan, since the law allows for the possibility of repaying the debt for obligations that arose before the birth of the child. Restrictions are established only regarding the repayment of certain debts incurred on the loan: penalties, fines and other sanctions related to failure to fulfill obligations to make payments.

Instructions for filling out point by point

The sample certificate from the bank for maternity capital does not contain much information, but you need to familiarize yourself with what this documentation looks like.

- In the upper left corner of the certificate, which is made on an A4 sheet, a stamp is placed, which is inherent in the bank that is the account holder. On the right side of the A-four sheet of paper, the period within which this document will be sent to the pension fund or multifunctional center is indicated.

The word “help” is placed in the middle, then the presentation of necessary and important information begins.

The certificate has its own number, which should be indicated on the left side of the header.

A date is also entered that corresponds to the date of issue of the document. It is necessary to indicate to whom this document was issued; in this case, your passport data must be present, namely last name, first name and patronymic.

Help about mat. capital informs that an account has been opened in your name with a certain credit institution, and its name is specified. Next, it is clarified what details are provided for your review. For example, these may be details for transferring maternity capital funds in a set amount to receive a lump sum payment, or for using maternity capital funds in a certain amount.

Further, in the form of a table, the main details that are necessary in order to transfer funds to your account are listed. An obligatory point in the certificate of maternity capital status and at the same time the final point is the purpose of payment. The name of this item may vary; the most common option refers to the transfer of a lump sum payment from available maternity capital funds, or the use of maternity capital funds for certain purposes.

The certificate is signed by the official, and your signature is also affixed.