Housing problem

Agree, not everyone can boast of their own home. Since there are no wealthy parents or the inheritance of a rich grandmother, there is little choice. Either rent a house or start saving money. A small but personal apartment, a plot of land with a cute house - tempting offers are flying from everywhere. And it doesn’t matter how old you are, at any age your wishes should come true. Couldn't save up funds? This is also not a problem. The housing issue can be solved in an elementary way; you just need to understand the intricacies of lending and understand how to make your dream come true.

Redevelopment of a Sberbank mortgage apartment 2020: approval

Nikita, the appraisal company wrote what they saw. Now how will the bank understand this scripture? Comprehensibility directly depends on the manager’s awareness and his reaction to the phrase “illegal redevelopment.” There are significant and non-essential redevelopments. If, for example, the apartment has a gas stove, then one thing. If you just removed the door between the corridor and the room, it’s different.

It is in the interests of the bank that the collateral property does not lose value. Therefore, the loan agreement indicates that the borrower, before carrying out redevelopment work, must coordinate construction work with the credit institution and provide the necessary papers.

Typically, mortgaged apartments remain in their original condition until the mortgage is removed. If it is planned to redevelop a mortgaged apartment, Sberbank may well refuse to approve it. Let's look at the nuances below.

It is in the interests of the bank that the collateral property does not lose value. Therefore, the loan agreement indicates that the borrower, before carrying out redevelopment work, must coordinate construction work with the credit institution and provide the necessary papers.

The majority of Russian citizens trust their funds to Sberbank; many prefer it when receiving housing loans. Typically, mortgaged apartments remain in their original condition until the mortgage is removed. If it is planned to redevelop a mortgaged apartment, Sberbank may well refuse to approve it. Let's look at the nuances below.

If something is impossible, we adapt it. For example, I don’t have a door between the kitchen and the hallway, but according to the regulations there should be one. Thus, in the sketch I draw door partitions that will definitely exist in the future.

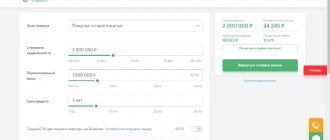

Mortgage concept

One of the most affordable ways to buy a home is a mortgage. For many families, this is the only option for purchasing real estate and improving their living conditions. Mortgage loans are becoming more and more attractive due to low interest rates and ease of registration. In addition, there is no need to search for the subject of collateral - the apartment itself becomes collateral. A competent choice of a banking institution and a thorough analysis of your financial capabilities guarantee an excellent result.

Additional details

How to obtain consent

Obviously, to obtain consent, the first step is to collect all the necessary documentation. Moreover, you can do this not only yourself, but also with the help of intermediaries who have special knowledge and skills, which will significantly speed up the collection process. To use the services of an intermediary, the borrower will need to draw up a power of attorney and pay the costs of paperwork.

The process of collecting documentation requires significant resources: time, nerves and effort.

So, before remodeling your apartment you need to:

- An application with a permit attached to it from the Bureau of Technical Inventory. It is recommended to make a copy and also make a request to the bank so that the answer is in writing.

- Insurer's consent.

- Floor plan.

- Redevelopment project.

- Title documents for real estate. They are usually found in a jar. Therefore, it is necessary to draw up an appropriate act on the transfer of documents from the credit institution to the borrower.

- Application for permission for reconstruction from the owners of the premises.

- A copy of the personal account.

- Technical passport and plan before reconstruction. Taken to BTI.

- Conclusion on the possibility of reconstruction.

After the work on renovating the premises has been completed, it is necessary to register the changes in the apartment in the BTI, and also submit them to the bank.

In most cases, if there is a positive technical conclusion, the bank gives its consent to the redevelopment of the collateral property

Before receiving property

Step-by-step instructions for registering the reconstruction of an apartment before receiving ownership look like this:

| Plan all activities | You need to clearly understand the need for redevelopment and its consequences, so there must be a plan to avoid various minor inconsistencies. |

| Coordinate actions with other residents and persons | In particular, this is necessary if the reconstruction will affect the supporting structures - then the services of an architect are required. He will conduct research on changing the configuration of the structure. In some cases, you need to contact the services for the protection of the cultural heritage of the locality - this is mandatory if the building has appropriate value for the region or country. |

| Create a project or sketch | In such a situation, you need to visit BTI or a construction company that has the right to provide services of this kind. It is worth understanding that the decision of the Housing Inspectorate to permit redevelopment largely depends on this moment. |

| The element of reconstruction of plumbing equipment deserves special consideration | To carry out actions, you must obtain permission from the SES. If activities are carried out that could lead to a fire hazard, then an inspection by the Ministry of Emergency Situations should be obtained. |

| Collecting the necessary documentation and sending them to the Housing Inspection authorities | In the case of a simple project, it is reviewed within 14 days . It is worth understanding that in the case of more complex work, the inspection period increases, and additional inspections by specialists are possible. |

If all relevant permits are obtained, the owner can proceed directly to redevelopment work. Upon completion, an additional check is carried out, during which compliance of the change with legislative norms is established.

The results of the inspection are submitted to the bank, where employees additionally review and approve the assessment report.

How to legitimize

The main point of the procedure for redevelopment of a mortgaged apartment is knowing how to legalize the changes.

In particular, the repair process must comply as much as possible with the approved reconstruction plan, since any deviations may require additional permission, and their implementation without approval will have the same consequences as an unapproved reconstruction.

After completing the repair activities, you will need to register changes with the Technical Inventory Bureau. It is important to understand that all certificates, technical and other documents will be included in a personal file at the bank - this will eliminate claims from inspectors regarding changes in the configuration of the premises.

Thoughts on remodeling an apartment

When you become the owner of a new apartment, it seems that joy has no limits. However, over time, any person may have a need to change their favorite home to a more comfortable, comfortable one. The apartment needs redevelopment. Redevelopment consists of such changes that should be made to the technical passport of the residential premises. How the question falls from the sky: “Is it possible to carry out major repairs and remodel the apartment if the loan has not yet been repaid?” We will soon find out about this.

The procedure for remodeling an apartment with a mortgage according to the rules

The standard redevelopment procedure is as follows:

- A BTI employee is called to draw up reports on all changes.

- A conclusion is sent to the SES that the housing complies with established standards.

- An order is placed for the development of a technical project.

- A referral to court is issued through the district administration.

If the judicial authorities make a positive decision, the owner will need to transfer all the necessary papers to the BTI and the Cadastral Chamber.

Subtleties of mortgage

When issuing a loan, the bank formalizes the purchased apartment as collateral. The owner of the apartment is legally limited in his rights and for the duration of the loan agreement does not have the opportunity to dispose of the collateral. Housing must remain in the same condition in which it was at the time of assessment by the expert. Any transformation of the apartment should not reduce its value. Therefore, first of all, it is enough to open a mortgage agreement - the main document that defines the key points relating to the subject of collateral (housing).

The section “Rights and Obligations of the Borrower” should indicate what procedures are allowed to be performed with the pledged property.

Some banks prohibit any kind of repair and construction work in the apartment until the debt is repaid. Still, most credit institutions provide assistance to their clients. If you are an executive borrower, you have a favorable credit history and have not had any late payments, you will probably get permission from the bank.

Recommended article: How to rent a place with pets: expert advice

Price

An important issue when redeveloping a mortgage is the cost of services in 2020.

The cost of home renovation will depend on:

- difficulties of redevelopment;

- cost of materials;

- the volume of work carried out and other factors.

Also, a lot depends on whether you draw up a design project yourself or turn to professionals.

It is also necessary to take into account the cost of coordinating redevelopment according to a sketch or project.

Table of the average cost of remodeling an apartment

|

|

| consultation | 1000 – 2000 rubles |

| obtaining a registration certificate from the BTI | 2000 – 7000 rubles |

| drawing up a redevelopment project | 3000 – 15000 rubles |

| obtaining permission from the Housing Inspectorate | up to 30,000 rubles |

| obtaining permission by contacting intermediaries | over 30,000 rubles |

| approval of project documents | about 5000 rubles |

| designing an opening for one wall panel | 20,000 – 30,000 rubles |

| legalization of planning in court | from 30,000 rubles |

If you have firmly decided that there is an urgent need for redevelopment in your mortgaged apartment, do not be afraid to take on this procedure.

If you do everything legally, then no problems will affect you, and the apartment will delight you with increased practicality and comfort.

Unauthorized and illegal redevelopment

Occasionally, there are citizens who allow willful redevelopment without coordination with the responsible authorities, including without the permission of the bank. If in the future you try to legalize the alteration administratively or judicially, you will not be able to do without a trial with representatives of the bank.

However, if you decide to do repairs without notifying the bank, you risk earning a negative reputation. The collateral specialist has the authority to make a surprise visit to you and check the safety of the collateral. If during the inspection it is discovered that reconstruction has been carried out illegally, the bank will require a written undertaking from you to restore the condition of the apartment to its original condition, in accordance with the technical passport, or to pay a fine.

A tougher option is that the bank has the right to offer to repay the loan early due to the borrower’s violation of the terms of the agreement.

If the loan is not repaid at the appointed time, the financial institution may file a lawsuit to collect the debt and seize the mortgaged property. So you can lose your apartment completely, and your plans will remain in your dreams.

Basic provisions

Not every renovation is a redevelopment. Art. 25 of the Housing Code determines that redevelopment is a change in the technical parameters of an apartment. Such changes are reflected in the technical passport of the housing.

You can’t just combine a bathroom or install a shower. Such actions must be coordinated with authorized bodies.

5 actions that cannot be done without permission:

- demolish and eliminate partitions;

- combine and separate rooms;

- arrange additional bathrooms;

- move doorways;

- rebuild vestibules.

Obtaining permits takes time. Therefore, some citizens decide to remodel their housing without permission. If illegal changes are discovered, violators will have to pay fines. Housing inspectors can issue fines, according to Art. 7.21 Code of Administrative Offenses.

We are starting redevelopment

According to the law, only its owner can initiate redevelopment of a home. In our case, when the owner of an apartment loses the authority to own property during the term of the loan agreement, only the bank can provide permission. In addition, the insurance company must provide consent. After all, the contract was initially concluded for an apartment, the price of which may become different after renovation. Accordingly, the cost of insurance will change. Based on this, a real estate appraiser must conclude that the value of the apartment will not subsequently be lost.

Application for approval of redevelopment (redevelopment has not yet been carried out or ownership of the object has not been registered)

Application for redevelopment that has already been carried out

Recommended article: Presidential mortgage

The bank’s decision depends on what the upcoming redevelopment will be:

- The simplest option is to work from a sketch. As a rule, the bank does not have any questions here. Such changes include glazing balconies, combining or dividing bathrooms, and dealing with built-in furniture. On a copy of the floor plan it is enough to indicate the places of future changes.

- Project reorganization is much more complicated; additional documents may be required. These are changes such as connecting a balcony to a room, moving a sanitary unit, or destroying load-bearing floors between rooms. Taking into account the competent preparation of the project in a specialized organization and its approval by the insurance company, it is quite possible to count on a positive decision from the bank.

- If your plans include a complex overhaul of housing with damage to critical structures, with transformations prohibited by sanitary and construction restrictions, you do not have to wait for the bank’s consent.

What is redevelopment?

Redevelopment is a modification of the configuration of the premises, which is necessarily displayed in the technical passport of the building. The following options are available for changing the geometry of the room:

- According to the sketch drawing. This type of construction work does not require the development of a construction project. It involves moving built-in furniture and non-permanent partitions. To coordinate this type of construction work, the documents provided by the BTI are sufficient. The procedure for approving draft documentation takes place within 2 months;

- Drawing up a project. This option for remodeling the living space requires the development of a detailed project. Project redevelopment may mean changing the floor structure, demolishing non-permanent walls and other layout changes;

- A radical change in the parameters of a capital construction project. The most complex type of construction and installation work, which involves changing the load-bearing structures of the building.

All changes in the construction of real estate must be registered with the BTI. After completion of construction work, the owner of the premises must take an extract from the Unified State Register of Real Estate (it must contain a note about the legalized redevelopment). Reporting documentation must be provided to a bank employee. You need to be prepared for the fact that a bank employee may come to the secured apartment and check for major repairs. If the changes made to the housing layout do not correspond to the design documentation, then the premises will have to be restored to their previous condition.

Credit department specialists closely monitor the redevelopment of collateral property. Any violations may result in the property losing its collateral value. If the borrower stops making payments on the loan, then a questionable change in the layout will become an insurmountable obstacle to the sale of the collateral property. The bank charges a commission for reviewing an application for redevelopment.

What kind of redevelopment cannot be legalized?

It is important to remember that legislative documents prohibit:

- re-equipment that may lead to disruption of the stability and strength of supporting structures;

- distribution of massive equipment in apartments, which will lead to an increase in load on supporting structures;

- construction of the attic, technical floor;

- work in emergency buildings;

- installation of terraces;

- removal of heating appliances to the balcony;

- heated floor connected to the central heating system;

- transfer of wet spots to living quarters (for example, the kitchen and the room were swapped);

- carrying out actions that worsen the operating conditions of the house and the living conditions of the residents.

These types of redevelopments will be impossible to legitimize either administratively or judicially. And the consequence can be troubles, ranging from a fine to loss of property rights to housing.

Reasons for refusal and consequences

Reconstruction may be refused if:

- upcoming work affects interfloor ceilings, load-bearing walls or stiffening diaphragms;

- ventilation equipment is blocked;

- as a result of renovation work, apartments that belong to different owners will be combined;

- the authorities concerned did not issue permission;

- the soundproofing of the floor will be compromised;

- other reasons.

The refusal is regulated by Art. 27 Housing Code of the Russian Federation. If you do not consider the refusal to be justified, you will have to obtain permission in court.

Unauthorized redevelopment of a mortgaged apartment is not allowed. In this case, administrative sanctions will be applied to the violator:

- imposition of a fine;

- requirement to return the apartment to its original form;

- obligation to legalize the redevelopment as soon as possible;

- termination of the contract with the requirement to pay the balance of the mortgage loan in a lump sum.

Don't expect that unauthorized changes to your mortgage will go unnoticed. As mentioned above, the bank annually checks the condition of the collateral. Voluntary confession will help avoid extreme measures. Most likely, in this case, the citizen will limit himself only to a fine. When an apartment is purchased with a mortgage, redevelopment can be done, but taking into account the opinions of interested parties and the bank.

Necessary documents for approval of redevelopment

Finally, the consent of the credit institution has been received, all that remains is to visit the institution where redevelopment approvals are carried out in your city. An example set of documents is:

- application - Application for approval of redevelopment (redevelopment has not yet been carried out or ownership of the object has not been registered), Application for redevelopment that has already been carried out;

- ownership documents;

- your dream layout project;

- technical certificate and floor plan;

- consent of regulatory organizations (fire department, gas industry);

- written approval of the bank;

- agreement with the insurance company;

- engineering report.

In addition to the listed documents, you may be required to provide additional materials clarifying plans for future work.

Having received a positive answer, you can begin the long-awaited redevelopment of the apartment. The deadlines and order of work must be strictly observed. It is possible that the bank, along with the permit, sets a specific time frame for carrying out repair work, which must be met. The final type of work performed must fully comply with the project.

Is it possible to make redevelopment in a mortgaged apartment according to the law?

According to the law, the algorithm for carrying out redevelopment is as follows:

- Drawing up a project or sketch reflecting future changes in the design of the room.

- Approval of the project (obtaining a technical report) from the BTI or a construction organization licensed to provide such a service (specialists check whether it is technically possible to implement the project without disturbing the structure of the entire house and the interests of other residents).

- Obtaining consent to carry out work from all owners of the premises and from neighbors if it is planned to affect load-bearing structures and the common living area.

- Submitting an application and a package of documents (it includes the papers listed in paragraphs 1-3, an apartment passport and a floor plan and total living area) to the local housing supervision authority. He will issue a permit to carry out the work.

- Signing the completion certificate.

- Replacement of technical passport. When the redevelopment has already been carried out, you need to call specialists from the BTI to assess the compliance of the modified premises with the project. If there are no deviations, a new technical passport for the apartment will be issued.

- Changing the data on the premises in the Rosreestr authorities and obtaining a new certificate of ownership.

In addition, before applying for permission for reconstruction, you must obtain approval from the fire safety authorities, Vodokanal, and Energonadzor, if the redevelopment involves changes that affect the relevant types of safety.

In practice, many Russians choose a faster route - legalizing a new project after construction work has been completed. A project is developed, implemented, and then approved by the housing inspection and BTI.

Unauthorized redevelopment is the reason for applying administrative measures to the owner of the apartment, and in some cases, criminal sanctions. The administrative fine is about 2,500 rubles.

As a general rule, Sberbank does not prohibit redevelopment of a mortgaged apartment. Cases when the bank includes in the contract a condition that it is impossible to make changes to the design of the premises are rare. If the mortgage agreement does not say anything about redevelopment, it can only be carried out after receiving the consent of the lender in writing.

Thus, the algorithm for owners of mortgaged apartments includes all of the above procedures, as well as additional ones at the request of the bank. As a general rule, this is permission from the insurance company and a certificate from the appraiser.

As for illegal construction work, when you have a mortgage in Sberbank, as in any other bank, it is extremely undesirable to carry them out. The reason is that the legislation does not protect the interests of citizens in this situation. Sanctions remain at the discretion of the bank.

If for illegal construction work on your own premises you can pay a fine, be prosecuted or receive a court order demanding that the apartment be returned to its original appearance, then if there is a mortgage, the bank, in addition, has the right to oblige the borrower to repay the entire loan amount within a short period of time.

According to the law, housing supervision or the court (if the apartment owner files a lawsuit to challenge the decision of the local supervisory authority) may not approve the redevelopment and demand that the premises be brought into compliance with the technical passport only if the changes made are dangerous for the residents of the house.

Types of redevelopment

Redevelopment of any residential premises is a detailed change in the overall configuration of the apartment. Moreover, this procedure necessarily requires making appropriate adjustments to the general technical documentation of the property. The situation is regulated by the housing law; an entire article is devoted to the redevelopment procedure - Art. 25 Housing Code of the Russian Federation.

Depending on the need for legal approval for repair work, several types of redevelopment are distinguished:

- Redevelopment requiring mandatory approval. Relocation, as well as complete elimination of doorways, creation of new structures in other areas of the apartment.

- Dismantling common interior partitions, as well as creating new ones. Complete combination of individual premises, as well as their separation in order to qualitatively change their purpose.

- General expansion of your own living space due to additional premises.

- Construction and general refurbishment of standard vestibules.

These types of redevelopment require the mandatory preparation of project documentation and further confirmation by authorized authorities.

In addition, for mortgaged real estate there is a mandatory rule of preliminary approval of all actions taken with the financial institution, which pledges the apartment.

Procedure for registration of redevelopment

If the owner properly plans and executes the redevelopment of the apartment, a Sberbank mortgage most likely will not interfere with its implementation.

There are two exceptions:

- a condition prohibiting redevelopment is provided for in the contract (the standard form of the contract does not contain such a prohibition; this clause can be included for payers with an insufficiently good credit history or in case of late payments);

- the value of the collateral is less than 1.5 million rubles.

What information must be included in the application for redevelopment?

The application for redevelopment must indicate the following information:

- FULL NAME;

- Passport details;

- Loan agreement number;

- Address of the collateral apartment;

- Brief description of the redevelopment project;

- Borrower's signature;

- Date of application.

The application will be reviewed within 6-7 days. In case of refusal, Sberbank will provide a written explanation of its decision. The most common reasons for refusal are late payment of a mortgage payment or insurance premium, as well as occupancy of tenants not agreed with Sberbank.

How to make redevelopment legal?

Redevelopment of a mortgaged apartment from Sberbank must be agreed upon with local governments (district administration). Only its owner can change the configuration of the apartment.

To carry out the redevelopment, you must collect the following papers:

- Statement;

- Written consent signed by the owners of the living space;

- Papers confirming the ownership of housing;

- A project that takes into account state standards;

- Technical passport of a mortgage apartment;

- A report from an insurance company whose specialists do not object to the redevelopment of the apartment;

- If the building in which the apartment is located is a cultural monument, then a certificate from the relevant government agency will be required.

The completion of the redevelopment must be confirmed by an act signed by the members of the acceptance committee. The composition of the commission is determined by employees of the district administration (according to Art.

28 of the Housing Code of Russia).

If the redevelopment is done illegally (with a deviation from GOST or with violations of the building plan), then the owner of the apartment faces a large fine and administrative liability.

If “construction innovations” are not eliminated within the period determined by the court, then the living space will be sold through special auctions. The court may approve the redevelopment if it does not violate the interests of the residents of the apartment building and does not pose a danger to people's lives. In this case, the apartment owner will only get away with a fine. He will also have to pay legal costs.