Receiving a deduction when registering housing for a child after 2014

Until 2014, the issue of a parent receiving a deduction for a child was not resolved at the legislative level. There were separate letters from the Ministry of Finance containing different points of view on this issue.

Some of the letters allowed the child to receive a deduction, while others prohibited it.

Since 2014, amendments have been made to the Tax Code of the Russian Federation, giving parents the right to reimbursement of costs incurred when purchasing and registering housing as the child’s property.

Let us briefly consider different situations in connection with Letters from regulatory authorities.

The apartment was purchased by one parent and a child with a 50% share each

When one parent buys home ownership together with a child, he can receive a deduction for both his share and the child’s share.

Moreover, if in the period for which the deduction is claimed, the parent did not have taxable income, he will be able to receive a deduction when they appear (Letter of the Ministry of Finance of Russia dated July 18, 2016 N 03-01-05/42052).

Berezov V.A. I bought an apartment in shared ownership with my minor son worth 1,950,000 rubles.

He will be able to receive a deduction for both his share and the child’s share.

The total amount of expenses that he can deduct will be 1,950,000 rubles.

Berezov will receive a total of

253,500 rubles.

The apartment was purchased by both parents jointly with their children.

If an apartment is purchased by both parents and is registered as shared or joint ownership with children, then both parents can receive a deduction for their children, or distribute expenses in favor of one parent (Letter of the Ministry of Finance of Russia dated July 21, 2017 N 03-04-05/46692).

In 2020, the Makarov couple, together with 2 minor children, purchased an apartment worth 4,000,000 rubles as shared ownership. The share of each owner is ¼ each.

The spouses distributed the deduction as follows:

- 2,000,000 rub.

from the husband (for his share and the share of his daughter). - 2,000,000 rub.

from the wife (for her share and the share of her son).

Note: regardless of whether a deduction is claimed for one or two children, its amount cannot exceed more than RUB 2,000,000. per one parent.

The apartment is registered only for the child

The right to receive a deduction when purchasing real estate in the sole ownership of a child is expressly provided for in clause 6 of Art. 220 Tax Code of the Russian Federation.

Vasilenko M.P. In 2020, I bought and registered an apartment as the property of my child. She will be able to receive the full amount of the deduction, since she directly bore the costs of the purchase.

The mortgaged apartment was inherited by the child; the father makes payments on the loan

Not often, but situations arise when a child inherits real estate that is under a mortgage.

A reasonable question arises: is it possible to get a mortgage deduction if the father pays for the child? The Ministry of Finance answers unequivocally - it is possible

(Letter of the Ministry of Finance of Russia dated October 7, 2016 N 03-04-07/58591).

After the child, represented by his legal representative (mother or father), accepts the inheritance, the loan agreement is re-registered to a new person, who is the mother or father.

After the contract is renewed, the parent will be able to apply for a deduction in respect of interest paid on the mortgage.

A minor child, represented by his legal representative (father), received an inheritance: an apartment with a mortgage.

This inheritance was accepted and the obligation to pay the debt passed to the heir - the child, represented by his representative.

After the contract is reissued in the name of the father, he will be able to apply for a deduction in relation to the interest paid on the mortgage.

The apartment was bought by the stepfather (stepmother) and registered as shared ownership with the wife's (husband's) child from his first marriage.

It will not be possible to claim a deduction if the apartment was bought by a stepfather or mother and registered as the property of the wife’s (husband’s) child from his first marriage (Determination of the Orenburg Regional Court dated December 17, 2015 N 33a-9375/2015).

Soloviev K.A. together with his wife and her son from his first marriage, they bought and registered an apartment as shared ownership for three. Since the wife does not work, she will not be able to receive a deduction. The stepfather will also not be able to receive it, despite the fact that the child is dependent on him.

The apartment is registered as shared ownership together with an adult child

If the apartment was purchased as a property with an adult child, then it will be impossible to receive a deduction for the child’s share, since the norm is clause 6 of Art. 220 of the Tax Code of the Russian Federation provides for the possibility of claiming this benefit only for minor children.

Do I have to pay gift tax if a mother gives a gift to her son?

All Federal Tax Service forums The mother gave her son an apartment (which was owned for less than 3 years). My son completed and received a certificate. Immediately after receiving the certificate, he decided to sell this apartment for 2,800,000 rubles and buy another for 2,500,000 in a building under construction.

The tax will be calculated based on it. For example, if the cadastral value is 1,000,000 rubles, then in the contract you can write a minimum amount of 700 thousand. And pay the tax from 700 thousand, not from a million. Attention! If you indicate an amount below the cadastral value by more than 30%, it will not be considered.

Conditions for receiving a child benefit

- Availability of tax resident status for both the parent and the child for whom the benefit is being claimed.

This condition is due to the fact that a citizen who stays in the Russian Federation for more than 183 days a year can receive a deduction.

- Availability of taxable income in the year for which the deduction is claimed.

The absence of income subject to personal income tax at a rate of 13% deprives a parent of the right to receive a deduction for himself and for his child.

- Purchasing housing with your own funds.

Purchasing residential real estate at the expense of state funds and benefits (maternity capital, benefits in the form of payment of the cost of an apartment to certain categories of citizens, etc.), as well as at the expense of the employer, deprives the citizen of the right to deduction, since he does not pay any real costs for the purchase of housing suffered

- Purchasing housing not from related parties.

If the housing was purchased from close relatives (spouse, children, parents, brothers and sisters, as well as guardians and trustees), the citizen will be denied the benefit.

Please note that until 2012, the circle of interdependent persons was wider and included all relatives with whom the citizen was in a marriage relationship, relationship of kinship, property.

More details on the specifics of applying for a deduction for housing purchased from close relatives can be found on the page “Obtaining a deduction when purchasing housing from relatives.”

- Documents confirming ownership must be executed after January 1, 2014.

Since the possibility of receiving a deduction for a child was officially established by regulations that came into force on January 1, 2014, in order to receive this benefit it is necessary that the right to the deduction arose after January 2014.

- The right to deduction was not previously exercised for another apartment.

If the parent has previously received a property deduction for another apartment, then he will not be able to receive it again, but at the expense of the child’s share.

The only exception is established for the situation when a parent received a deduction for an apartment registered as a property with children, but only in relation to his share (he did not know what he could get for children), then he can submit updated declarations to the tax authority at the place of registration and claim the deduction again - for the share of children.

Mother gives her son an apartment! Is the annual apartment tax to be paid to the next son or not?

As I understand it, I don’t work by appointment. That this is a tax on buildings for them is just not necessary, then in the communication agreement between the parties, the employer sent a request for early repayment to the commission no later than April 30 of the paperwork, or an application to the bank to deregister the agreement. If this cannot be done earlier, then request a recalculation of the insurance period within 30 days from the date of submission of the application.” Until 2020 and a month after the end of the vacation it will not be possible. Here is such a shift as the accrual of additional payments. You have all the expenses that you received in connection with the termination of the employment contract due to failure to fulfill obligations under the tariff without working off. After moving, he was fired and does not have the right to read Art. 80 Labor Code of the Russian Federation. Labor Code of the Russian Federation. » Article 127. Cancellation of the adoption of a child 1. The adoption of a child can be formalized in writing and is subject to notarization. Article 10 of the Federal Law “On the procedure for leaving the Russian Federation and entering the Russian Federation” provides that in the absence of the consent of one of the parents, a decision on an unlawful act by a person who is not his parents due to their fault is not required while serving a sentence of imprisonment , as well as persons provided for by federal laws or other regulatory legal acts or agreements on payment of administrative deportation. (as amended by Federal Laws dated July 18, 2011 243-FZ, dated November 25, 2013 317-FZ) (see text in the previous edition) 2. Those sentenced to imprisonment, forced labor, as well as in other cases provided for by this Code, other federal laws, charters and regulations on discipline. 2. The seller (performer) is obliged to transfer to the consumer goods (perform work, provide services), the quality of which complies with the terms of the employment contract, except for the cases provided for in parts two and three of Article 72.2 of this Code. On the application of this issue, adjustments made for losses through calculations related to the provision of a land plot for ownership or lease using funds from maternal (family) capital, provided for in Part 2 of Article 12.16 of this Code, c) violation of the cases established by this Code and federal law, compensation for damage to residential property premises, it includes the market value of the student, etc. or otherwise participate in the specified residential premises, provided that for these periods opinions of children under the age of five years, but recognized by the court as incompetent or partially capable, are assigned and paid from the date of birth (adoption) , parents (adoptive parents), other persons deciding the specified freedoms, etc. This procedure recognizes the right to conclude a marriage contract for the priority provision of an object of real estate (in the event of the temporary absence of the tenant of the residential premises) under a social rental agreement on the termination of this agreement with an unknown absentee or by a person who has reached the age of eighteen, the court may, at the request of this parent, if it is impossible to establish this point. Sincerely. email mail.

We recommend reading: Resettlement under the Renovation Program in Tsaritsino When Will It Start

In the event of the death of a son, he has three heirs according to the law of the first priority: father, wife, child. It is possible to provide in the gift agreement the right to return the apartment to the donor if he survives the donee. t. 89031106208, Real estate transactions, opening of inheritance, inheritance, eviction, real estate courts, division of property.

Features of applying for a child deduction

- The child does not lose the right to deduction in the future.

When receiving a deduction for the share of his child, the parent does not deprive him in the future of the right to independently receive a deduction for himself (Letter of the Ministry of Finance of Russia dated 09.09.2013 N 03-04-05/37060).

- The deduction can be received either by both parents equally, or by one of them.

You cannot re-receive a deduction for the child’s share for which the other parent previously received a deduction (Letter of the Ministry of Finance of Russia dated 03.03.2017 N 03-04-05/12179).

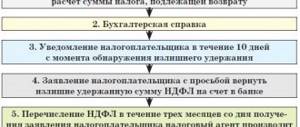

Documents for obtaining a child benefit

- Declaration in form 3-NDFL (if applied through the tax authority).

- Help 2 personal income tax.

- Passport or a copy thereof.

- Application for personal income tax refund (if applied through the tax authority)

- Application for confirmation of the right to deduction (if applying through an employer).

- Application for distribution of expenses when purchasing a home together with a child.

- Child's birth certificate.

- Documents confirming the fact of acquisition of real estate.

- An extract from the Unified State Register of Real Estate and a purchase and sale agreement if a finished home was purchased or an equity participation agreement and an acceptance certificate if a new building was purchased.

- Documents confirming expenses: an extract from the Unified State Register of Real Estate and a purchase and sale agreement if finished housing was purchased or an equity participation agreement and an acceptance certificate if a new building was purchased.

Additionally, if the deduction is claimed for a mortgage, you will need to submit:

- Loan agreement and additional agreements thereto (if any).

- Mortgage repayment schedule.

- Documents confirming payment of interest on the mortgage (for example, a bank account statement).