The concept of jointly acquired property

While married, spouses acquire property.

It doesn’t matter who pays for it and in whose name the purchases are made. It is still considered joint property. In Art. 34 of the Family Code of Russia clearly defines its list:

- income of both spouses;

- movable property;

- deposits;

- shares;

- real estate;

- securities of value;

- shares in capital.

One of the spouses in a marriage may well not have any income for a long period. This happens for valid or other reasons:

- disease;

- care for children.

In this case, the person’s right to jointly acquired property in the event of divorce is preserved.

It does not matter exactly how the spouses’ money was received. This could be entrepreneurial activity, intellectual or labor activity, government assistance or a pension. Income is taken into account from any activity.

If real estate was purchased with money received during marriage, then it is considered family property and jointly acquired property. Such property includes:

- Earth;

- apartment;

- house;

- garage;

- another building.

The concept of personal property

It is necessary to distinguish between personal and own property. The second term refers to all the property that the spouses acquired during the marriage. This could be expensive household appliances, a vehicle or a piece of real estate. And personal property includes everything that a person acquired before marriage.

This category also includes property received by a citizen through official legal transactions free of charge. For example, a man inherited an expensive car while married. In this case, only he is the owner of the vehicle, and the car does not belong to the category of joint ownership.

A more specific list of property that is considered personal is presented in Article 36 of the IC of the Russian Federation:

- All objects that a person acquired before entering into a marriage relationship;

- All objects that were received by a citizen through official legal transactions free of charge (under an agreement of gift, inheritance, or privatization);

- Personal belongings and items. We are talking about any clothing or shoes, as well as hygiene products;

- Intellectual property rights (copyrights). Let's say a married spouse wrote a book. After the divorce, he alone is the owner of the copyright.

But there are exceptional cases. When dividing property through the court, an object may be recognized as joint property, despite the fact that it was acquired before marriage by one of the spouses. There must be a good reason for this: the second spouse must invest a lot of money in the object, namely an amount exceeding its original cost.

In court, it is necessary to present documents that confirm the right to ownership of property acquired before the marriage. This can be various receipts, as well as official testimony of witnesses. In the vast majority of cases there are no problems with this. During the divorce process, spouses can easily prove their right to own property.

How is property acquired before marriage inherited?

The division of property in such a situation will also cause difficulties, especially considering that the property that is given to a person in this order cannot, by law, belong to anyone other than the heir. This is how the rule sounds in general, but exceptions are allowed when even the second spouse has the right to present his demands. Inheritance is almost always associated with the personal rights of a person.

Accordingly, it is necessary to confirm your involvement in the property received. This is not easy to do, especially when making a will. Thus, the law directly provides that this property cannot in any way become the object of family relations during its division, since it fully belongs only to one of the spouses by right of inheritance. The situation with inheritance is similar to a gift agreement.

Inheritance received during marriage is divided or not in divorce

Separately, I would like to touch upon the issue of inherited cash savings. After the divorce, the spouses will be able to divide them only by voluntary agreement. Otherwise, the spouse of the heir will not be able to claim them. Even if they were on a savings deposit, in the form of shares or bonds, and good interest was added to the amount of money over a long time, they will belong only to the actual heir.

Here we must immediately talk about the “pitfalls”. If the heir-spouse decides to challenge and change the previously drawn up agreement, then the law will most likely be on his side. In most cases, the court rules in favor of the plaintiff who wants to regain his inheritance.

We recommend reading: How long can you make repairs in an apartment in Novosibirsk

Is an apartment purchased before marriage divided?

If real estate was acquired by one of the spouses before the wedding and he solely took ownership, then it will remain his personal property both during the marriage and after the divorce. There are only a number of exceptions to this rule.

Improving living conditions using shared money

If the housing, which belongs to one spouse as personal property, has undergone significant repairs or reconstruction using funds taken from the general family budget or money that belonged to the second spouse, then you can expect that the court will allocate a share in this property to this spouse. Or oblige the owner to pay compensation to the husband or wife.

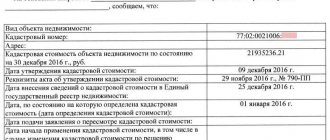

The amount of compensation payments is calculated as follows. If the money taken for repairs was related to joint property, then the parties will be required to conduct an independent examination in order to determine the market value of the apartment at the time of the divorce. The original cost will be deducted from it (indicated in the contract of sale, gift, etc.). The amount received will be divided in half - this will be the amount of compensation due.

If the ex-spouse is registered

Let's consider whether an apartment purchased before the wedding is divided if during the marriage its owner registered the spouse in it. Such an apartment cannot be divided during a divorce in 2020. It will remain the property of the person who purchased it. After the divorce, the second spouse will be required to leave the occupied living space. If he does not agree to do this voluntarily, he will have to be deregistered by a court decision.

In a number of cases, the court agrees and allows the ex-spouse, who is not its owner, to live in the apartment if he does not have his own home. But the period of such residence cannot exceed 6 months, i.e. until a new place of residence is found.

If there are children

The RF IC determines that neither parents have rights to their children’s property, nor, accordingly, children have rights to their parents’ property. This means that the apartment purchased before marriage by the father or mother remains their personal property. The presence of children will not affect this fact in any way.

If a child has official registration in this apartment, then it does not give him the right to claim ownership of part of it. However, in this case, the child can continue to live in this apartment even after the parents divorce. If the housing belongs to the husband, and the court left the child with the mother, then his mother can live in this apartment until the child comes of age.

Provided that the child does not have permanent registration in the apartment, the decision on his further residence will depend on the availability of his own housing with the parent with whom the child remains in court. If there is no such provision or it is recognized as unequal, after the parents’ divorce and until the child reaches adulthood, the court may allow the child to live in the apartment with the parent who is recognized as the main guardian. If housing is available, the child and this guardian must move to live with him.

Mortgage property

If a spouse purchased an apartment before marriage, then it is his personal property. However, there are some nuances here.

For example, an apartment was bought on credit. Here you need to understand how the loan was repaid.

Mortgages typically take several years or decades to pay off. Therefore, the following options are possible:

- If the loan was repaid during the marriage using joint funds, then the second spouse may raise the issue of changing the property regime. The court may satisfy a claim for recognition of ownership of half of the apartment.

- If the spouses entered into a marriage contract and the mortgage was paid from personal funds, then the second spouse has no rights to the marital share.

Apartment in a new building

If the apartment was purchased before marriage in a house under construction, then the further development of the situation will occur in the same ways as with mortgage housing.

So, if the buying spouse is able to prove that joint funds were not spent on such an apartment, then it will be recognized as purely personal property. If the construction was completed during the period of marriage, then for such property during a divorce, either the division of shares or the payment of a compensation sum of money to someone who will not get this apartment is provided.

If an apartment in a new building purchased before marriage was put into operation only after the husband and wife divorced, then one of the spouses has the right to file a claim in court to recognize such an apartment as joint property. But only after the final delivery of the house. While it is under construction, it is not possible to divide the apartment, because... Legally, it doesn’t even exist yet.

A marriage contract has been concluded

Art. 40 of the RF IC allows spouses to resolve a number of property issues without involving a court. For this purpose, you can conclude either an amicable separation agreement or a marriage contract. If spouses want to regulate the division of property purchased before marriage or not yet acquired at all, then the second option will be more correct for them, because The agreement allows for the division of only property recognized as jointly acquired property.

A husband and wife have the right to draw up a contract both before the wedding and during the marriage. If it states that an apartment purchased before marriage will go to only one of the spouses during a divorce in 2020, then this is precisely the condition of the document that will be accepted. There is only one exception to this condition. So, if maternity capital was invested in the reconstruction of such an apartment or in repaying the loan for it, then the conditions of division will be completely different.

Federal Law No. 256 determines that if maternity capital was used to improve housing conditions, then the real estate in which it was invested should be divided in equal shares among all family members. This also applies to an apartment purchased before marriage. No agreements, contracts or other documents can cancel this rule. In such housing, each family member receives his or her equal share.

The marriage contract is drawn up in any form. It is important to record as carefully as possible all the details regarding the divisible property. Those. if we are talking about an apartment purchased before marriage, then it is necessary to enter basic information about the purchase and sale agreement.

How is property divided after the death of one of the spouses?

The surviving spouse has the right to a part of this half, which will be divided among the heirs within the same line in equal parts . For example, if the deceased had an apartment shared with his wife, then his wife will be left ½ for her use and ownership, and the second ½ will be divided in half if there is one adult child. Thus, the spouse will become the owner of 75% of the apartment, and the adult child will inherit 25%.

We recommend reading: How to Obtain Low-Income Family Status in Perm in 2020

This share is calculated from the intestate wealth of the deceased, and if this is not enough, or if there is no intestate wealth, then they will take part of the property that is mentioned in the will. In this case, the part due to the heirs under the will will decrease accordingly, but this is the law (Articles 1148, 1149 of the Civil Code of the Russian Federation).

Grounds for acquiring an inheritance

One of the spouses who survives the other may become the successor of the testator by law or by will.

Inheritance by law

The Civil Code (Articles 1142-1148 of the Civil Code of the Russian Federation) establishes 8 lines of inheritance. The husband or wife, children, parents and grandchildren, by right of representation, are members of the first priority, that is, they have a priority right over other relatives.

According to the law, the inheritance mass is divided between applicants of the same line in equal shares. Successors of other orders can claim the inheritance only in the absence of representatives of the previous order.

Spouses can inherit property in order of priority only if they have a marriage certificate registered in the registry office. In the event of a divorce, the former spouse is deprived of the right to acquire inheritance by law.

Inheritance by will

During his lifetime, the testator has the right to draw up a will, according to which all property acquired will be transferred to the persons indicated in it.

If the property was acquired after marriage, then the testator has the right to bequeath only half, that is, the part that belongs exclusively to him, and if everything was acquired before marriage, then all the valuables can be disposed of in their entirety.

Example. As a result of the divorce, the spouses divided their jointly acquired property, and each became the owner of ½ half of the house. After the death of the testator, the second wife became his direct heir, receiving only part of the real estate belonging to her husband.

When drawing up a document, it is important to take into account that a certain group of persons has the right to an obligatory share in the inheritance (Article 1149 of the Civil Code of the Russian Federation):

- minors, disabled heirs by law;

- disabled parents and spouses, dependents.

They are entitled to at least ½ of the share due by law in the absence of a will. Inheritance of goods under a will, if they were acquired before marriage, does not raise doubts regarding the shares of the heirs, since the document clearly defines the rights and obligations of the applicants.

How is the inheritance divided after the death of a husband?

- Wife. A wife can inherit after the death of her husband only if the marriage was concluded (even if it happened an hour before the husband’s death) and was not dissolved (if the death occurred an hour after the divorce, the ex-wife does not participate in the inheritance, even if she lived with the deceased many years). The so-called “common-law” wife (mistress or cohabitant) does not have inheritance rights by law (except if she was dependent on a man).

- The husband's parents (in relation to the wife - father-in-law and mother-in-law);

- Children. And not only children born in marriage between spouses, but also children from other marriages, illegitimate children, adopted children.

The law provides for the right to a portion of the inheritance for some heirs, even if the testator has deprived them of this right. We are talking about minor children, disabled children, parents, spouses. They are entitled to half the share they would have received in the absence of a will.

Spousal share in inheritance

Inheritance issues are spelled out in the list of norms of family legislation (Articles 33-38 of the IC of Russia). It is necessary to pay attention to civil laws (we are talking about Articles 1119, 1150, 1118, 1141, 256, 1142, 1149 of the Civil Code of Russia). The matter of inheritance can hardly be called easy. To correctly draw up and receive it, you need to understand notarial legislation. There are regulations of the Supreme Court on these issues (Resolution dated May 29, 2012 No. 9).

If one of the spouses has died, then the heirs of the first group have the right to the property first, if they are alive. The property is divided equally between them.

It happens that several heirs of the first group are absent, then the property is divided among the rest of the remaining ones.

The spouse is also included in the list of heirs; he will have to prove his right to the property. Submit a marriage registration certificate to prove that the deceased person was a life partner and this is officially recorded.

Inheritance of a premarital apartment

It is impossible to avoid opening an inheritance case in the event of the death of a husband or wife who is officially married. The entire amount of property belonging to the deceased is subject to division. A person could have made a will before his death, and events will unfold in accordance with it, or relatives will consider it necessary to challenge it.

The will is drawn up by a notary and the latter must certify it in accordance with the law. In this document, the spouse has the right to establish a list of heirs or one of them. The share of each is also determined.

The inheritance process will develop in full accordance with the rules of the law if there is no will. Parents, children, and the remaining spouse have the first right to inheritance.

After the death of a spouse, the joint share of the life partners is determined from the common property and transferred to the surviving one.

The amount of property remaining after determining what is common with the spouse is distributed between people. But at the same time, an additional share is allocated to the spouse so that it is not less than that of the others. It is possible that the spouse will receive a whole half of the real estate purchased during marriage, and another part of the remaining half of the inheritance.

There is no need to waste time to enter into the right of inheritance. You should write a statement and give it to a notary within six months from the date of death of your life partner. The property of one spouse after the death of the second is considered real estate. It doesn’t matter which of them paid for its acquisition, or for whom the documents were subsequently issued.

If the housing was not privatized or the surviving spouse refused this process during the life of his/her spouse, then a certificate of ownership will not be issued. Housing is not considered common if the partners lived in a civil marriage, but they did not consider it necessary to formalize it. But there are exceptions. When cohabiting persons have registered a share of ownership for everyone who lived in the house.

If life partners left for another world on the same day, then their right to inherit joint housing ends. The opening of each inheritance is carried out separately.

List of heirs

Children can claim inheritance from their parents. They are among the first priority. Their right is paramount. This is in the absence of a will. It is important: the offspring appeared in an official marriage or not. If one has not been concluded, then the child will definitely inherit the housing from the mother when she dies. But as for a man, the fact of paternity must be established in advance, during the lifetime of the parent.

If children were adopted by strangers, then the offspring lose the right to inheritance from their biological parents.

The following can count on a compulsory inheritance share:

- adopted or natural offspring;

- minor children;

- disabled offspring;

- parents who have lost their ability to work or their spouses (disabled people of groups 1-3, women over 55 years old, and men over 60);

- dependents.

Procedure for registration and deadline for accepting inheritance

If we are talking about a privatized apartment, then its inheritance is implemented in order:

- The inheritance case is opened (the day of the spouse’s death). The deadlines provided for the execution are counted from the date of death of the testator.

- The heirs write a statement of their consent to receive the property left by the deceased. The paper, prepared according to the law, is given to a notary whose office is located at the place of residence. This must be done within 6 months from the date of death of the relative.

- Obtaining a certificate of inheritance of housing. The executed document is given by the notary after 6 months from the date of death of the spouse.

The spouse, children, parents, and dependents can carry out a number of actions to prove the fact of acceptance of the inheritance. For example, they live in an apartment, have a residence permit there, where the deceased also stayed, and pay for housing. That is, actions should be aimed at confirming the desire to maintain the property.

If the testator has written a will, then the notary must submit the following documents:

- death certificate;

- a set of certificates from the BTI (the list includes a document that records the cost of housing, a registration certificate for the property);

- a copy of the will signed by a notary, you can also provide the original;

- extract from Rosreestr.

It is necessary to prove the testator's right to the transferred housing using a will. It is necessary to provide documents and paper confirming the absence of debt.

During the process of inheritance, disputes may arise and in order to resolve them, it will be necessary to submit additional documents. The notary will warn you about them. The specialist himself can make a request to provide certificates to the relevant services. The heir will not only receive rights to the property, but he will be charged with the responsibility of maintaining it.

If there are debts to pay for housing, then the heir will have to resolve this monetary issue. All obligations to repay the debt will fall on his shoulders.

After solving material issues, a person can dispose of property at his own discretion. The owner has the right to write a refusal of the inheritance due to him. This option may be appropriate if the number of debts exceeds the property benefits. In some cases, you have to pay a state fee, which does not exceed 1% of the value of the property.

Art. 333.35 of the Tax Code of the Russian Federation defines a list of persons exempt from paying state duty. These include those who lived in the same area as the deceased.

If a person lives in the apartment of the deceased, he is the first priority, then he actually accepted the inheritance. You can start registering your property rights at any time. But it is better to apply within 6 months after death.

In the case where there are several heirs, within six months from the date of opening the case, each of them can refuse the inheritance in favor of the others. After 6 months, this will no longer be possible.

Inheritance after the death of a husband without a will: shares of children and wife

According to Article 256 of the Civil Code of the Russian Federation, the living spouse has 50% of the property that is subject to inheritance . Thus, the spouse leaves 50% for herself, and the rest of the property passes as an inheritance, again to her and the children in equal shares . If there are no children, then to other relatives in order.

- 1st priority: biological children, spouse, and parents of the deceased person;

- 2nd stage - brothers and sister, and full-blooded and half-blooded (related to mom and dad, or one of the parents), as well as nephews and nieces are taken into account;

- 3rd queue: this queue includes uncles and aunts of the deceased person, as well as cousins;

- 4th stage: this includes great-grandfathers and great-grandmothers.

25 Jan 2020 etolaw 685

Share this post

- Related Posts

- The difference between registration by place of residence and place of stay

- Repair in an apartment building law time in Volgograd

- Check Payment By Whip

- The size of a labor veteran's pension in Sochi for the payment of a travel card