Essential terms of the exchange agreement

Under an exchange agreement, each party undertakes to give ownership of one item to the other party in exchange for another.

An exchange agreement is a transaction the essence of which is the transfer of property. All items delivered under the contract become the property of the receiving party.

One of the subtypes of exchange is barter. This deal is only applicable in foreign trade. To conclude such an agreement, the goods must be of equal value, and one of the parties must have a license.

The main condition of the barter agreement is the availability of the item. Other conditions become significant if specified in the contract.

Any item free of encumbrances can be exchanged. However, a reservation should be made that a party cannot transfer what it does not have the right to dispose of. For example, shares cannot be the subject of an exchange agreement if the person who transfers them is not a member of the company. But products produced at the plant can be exchanged without the consent of the director of the enterprise.

If the exchange is for items of unequal value, then one of the parties (the one who received more) will have to make up the difference.

In its content, the exchange agreement is close to the purchase and sale, and therefore the provisions of Chapter 30 of the Civil Code of the Russian Federation can be extended to this transaction.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to fill it out correctly?

The same rules apply to the execution of an exchange agreement as to other transactions with property. The parties here are of equal importance and are referred to as Party 1 and Party 2. This paragraph indicates the full names of the participants in the transaction, their passport details in accordance with the documents.

A significant difference between an exchange agreement is the fact that the subject of the agreement is two objects. Therefore, in this paragraph the characteristics of both subjects of the transaction are prescribed, and a reference is made to the title document for each of them.

Equivalent contract

Since the contract is the result of agreement on all essential terms, it should be taken into account whether the exchange is equivalent. In case of an equivalent exchange, the conditions contain:

- the obligation of the first party to transfer property to the second party and at the same time accept another, which is transferred in exchange from the second party;

- the obligation of the second party to transfer and accept, respectively, its property in exchange for the property of the first party.

Contract with additional payment

In the event of an unequal exchange, it is necessary to clarify the value of each of the items of the contract, indicate their value and determine the amount of additional payment due to the party whose ownership is transferred to the object with a lower value. This norm is established by Art. 568 Civil Code.

The essential terms of the transaction also include the rights of persons who, in accordance with the law, retain the opportunity to use the premises. This point concerns residential areas, which are most often exchanged under the appropriate agreement. If there are such persons, the contract must indicate a list of their rights to use the housing after the change of owner of the premises. These include:

- tenants;

- citizens and persons living with them under a rental agreement;

- recipients of annuities under a lifelong maintenance agreement with dependents;

- former family members of the owner.

When exchanging residential premises, the procedure for their release should be determined and specified in the contract. The terms of discharge from housing and its complete vacancy should be specified here.

Other terms of the exchange agreement

The barter agreement is usually concluded in writing. You can make a transaction orally in the following cases:

- the amount of the contract between individuals does not exceed 10,000 rubles;

- the contract is executed upon conclusion.

As for the content of the barter agreement, the rights of one party correspond to the rights of the other. Moreover, if a citizen does not fulfill his obligations to transfer the goods, then the party that fulfilled its obligations has the right to demand termination of the contract and compensation for losses.

The legislator does not establish special requirements for the subjects of the barter agreement. However, if we assume that under the terms of the transaction an item must be transferred, then the parties must have a property right to this item (for example, ownership). That is, the subject composition of the transaction can consist of both individuals and legal entities, as well as constituent entities of the Russian Federation.

The Civil Code of the Russian Federation prescribes the condition that all costs under the barter agreement fall on the party performing this or that action. However, if we are talking, for example, about state registration in Rosreestr, then both parties pay the fee.

As for the term clause in the barter agreement, as a general rule things must be transferred at the same time. But if this is not the case, the document usually specifies the period within which the party must receive the item. It is from this time that the period will begin when the counterparty has not fulfilled its obligations, which means it must compensate the losses of the other party.

Making additional payments

Since the contract specifies the cost of the apartments, an additional payment is established in the form of the difference between the specified cost . Its amount and the fact of availability are included in the clause of the terms of the transaction.

Here you will need to provide information:

Having a lawyer when making an exchange with an additional payment is especially appropriate , since he will not only help draw up an agreement for the exchange of an apartment with an additional payment, but can also provide representative assistance when transferring money.

In some cases, it is convenient to use a safe deposit box, where one party deposits the agreed amount, and the other withdraws it after signing the agreement.

Land exchange agreement

The exchange agreement itself (Civil Code of the Russian Federation, Chapter 31) of a land plot is not subject to state registration in Rosreestr, however, the transfer of ownership of the plot is mandatory.

In addition, it is assumed that the exchanged items are equivalent in value. If this is not the case, then one of the parties pays a certain amount specified in the contract.

In addition to this condition, it is recommended to include several more important provisions in the land exchange agreement:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

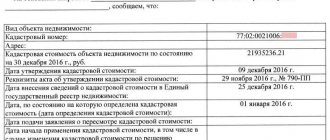

- identification data of the site (cadastral number, its area, location, etc.);

- intended purpose of the land;

- real estate objects located on the site.

In most cases, the parties attach graphic plans or drawings to the exchange agreement, which indicate where the site is located.

Please note that easements may be established on the transferred plot. Check with the owner about them, or even better, write this condition in the exchange agreement.

MINSK CITY AGENCY

List of documents for concluding an agreement

EXCHANGES, DONATIONS, PURCHASES AND SALES.

1) Document of title for the apartment (agreement on determining the size of the shares of privatization participants, marriage contract, agreement for the purchase and sale of an apartment, agreement of gift, exchange, privatization, certificate of inheritance, certificate of ownership of a share in the common property of the spouses, court order etc.), certificate (certificate) of state registration or

registration certificate or notification of amendments to USRNI documents, technical passport (

originals

).

2) Certificate from the local executive and administrative body (district administration, ZhREO, ZhES, RSC) on the accrual of the housing quota to persons who participated in the privatization of the apartment.

If, in addition to the owner, anyone participated in privatization, then the written consent of the persons who took part in the privatization with their housing quota and (or) funds, including minors aged 14 to 18 years is required (personal appearance

when submitting an application for certification of the contract or the written consent of the privatization participant certified by a notary).

In case of personal appearance, have a valid civil passport (residence permit) with you.

3) A copy (extract) of the personal account (issued by the organization operating the housing stock: RSC, ZhES, Owners' Association, housing cooperative, etc.) with information about the residents (registered) in the apartment ( current

).

If adult members, former family members of the owner of the residential premises, as well as citizens living in residential premises provided on the basis of a lifelong maintenance agreement with dependents, testamentary refusal, etc. live in the apartment (registered, have the right to use), then their written consent ( personal appearance

when submitting an application for certification of the contract

or

the consent of such persons, certified by a notary).

In case of personal appearance, have a valid civil passport (residence permit) with you.

4) Permission from the guardianship and trusteeship authority (district administration at the place of residence of the ward or minor, or at the location of the residential premises) for the alienation of residential premises belonging to minors, incompetent, partially incompetent citizens, or in which citizens recognized as incompetent, partially incompetent by the court live , minor members, former members of the owner’s family, recognized as being in a socially dangerous situation or in need of state protection, or living quarters assigned to orphans or children without parental care (Extract from the protocol, certified in the prescribed manner).

5) Consent of the spouse or former spouse of the owner, if the alienated property was acquired during the marriage and is joint property ( personal appearance

when submitting an application for certification of the contract

or

written consent of the spouse certified by a notary).

In case of personal appearance, have with you a valid civil passport (residence permit), marriage certificate or divorce certificate and (or) a court decision on divorce.

In the absence of a spouse or former spouse who can claim the alienated property, the alienator additionally certifies this fact by signing the appropriate application.

6) If one of the spouses has died, and the property is jointly owned by the spouses and registered in the name of the surviving spouse, as well as in other cases provided for by the current legislation of the Republic of Belarus (a privatization participant has died, and his share in the property right has not been allocated, etc. .), then the following documents are required: information about the heirs who accepted the inheritance (death certificate, information from the notary office or notary office at the place of opening of the inheritance about the opening of the inheritance case and about the heirs who accepted the inheritance, or, if the inheritance case was not opened, information from the last place of residence of the testator and (or)

from the location of the alienated real estate object about persons living with the testator or in the alienated residential building, apartment, isolated premises on the day of opening of the inheritance or during the period established by the Civil Code of the Republic of Belarus for accepting the inheritance

(personal appearance

when submitting an application for certification of the agreement or written consent of the heir, certified by a notary).

In case of personal appearance, have a valid civil passport (residence permit) with you.

Note: in this case, alienation of real estate is possible only after the expiration of the period established by the Civil Code of the Republic of Belarus for accepting an inheritance!

7) Certificate from the tax authority at the location of the alienated property about payment by citizens of the Republic of Belarus who do not permanently reside in the Republic of Belarus, foreign citizens, stateless persons or foreign or international legal entities (organizations that are not legal entities) not located in the Republic of Belarus personal income tax, land tax and real estate tax in relation to the alienated real estate.

When selling (exchanging) a share in ownership to an outsider (not a co-owner), a refusal of all other participants in shared ownership is required ( personal appearance

When selling (exchanging) a share in ownership to an outsider (not a co-owner), a refusal of all other participants in shared ownership is required ( personal appearance

when submitting an application for certification of the contract,

either

a waiver of the right of first refusal, certified by a notary),

or

a certificate of transfer of a statement of intention to carry out a paid alienation of a share in the right, issued by a notary.

In case of personal appearance, have a valid civil passport (residence permit) with you.

9) When selling an apartment using a bank loan - an agreement on a current (settlement) bank account opened in the name of the Seller

.

10) Documents confirming the powers of representatives (power of attorney or other document).

11) Documents confirming family relations (birth certificate, marriage certificate or archival certificate, etc.).

12) Documents confirming the right to benefits when paying state duty in cases established by law (pension certificate, disabled person certificate, guardian certificate, decision to recognize a person as incompetent).

13) Personal appearance of the parties (participants) to the transaction and a valid civil passport (residence permit) of the parties (participants) to the transaction.

Date Time:_____________.

Registrar:__________________________________________

Address:_______________________________________________

Estimated cost of drawing up, certifying the contract and its state registration (excluding the cost of technical documentation): for close relatives - 140 rubles; for others – 210 rubles.

Preliminary consultation and registration on issues of certification of transactions is carried out at the address: Minsk, st. Maxim Bogdanovich 153, Reception Hall.

Certification of transactions by appointment - Minsk, st. Maxim Bogdanovich, 153, rooms 101-116.

NOTE:

If it is necessary to carry out a large amount of work on an application for certification or if there are other valid reasons (certification of an agreement with several real estate objects, lack of certainty among the parties to the transaction regarding the essential terms of the agreement or the need for their additional approval, lateness of the parties to the transaction, etc.) , the drawing up and certification of the contract can be carried out within 3 working days from the date of filing the application for certification.

In this case, the registrar will assign additional time within the specified period for the parties to sign the agreement.

Vehicle exchange agreement

A car exchange agreement is used when:

- the car owner cannot sell the vehicle for a long time;

- the trade-in scheme is used - exchanging an old car for a new one;

- It is necessary to exchange vehicles (one year old) without time difference.

A trade-in agreement is one of the easiest ways to get a new car. Its preparation and subsequent registration of the right will not take much time, and the owner will receive a new vehicle, as they say, without leaving the cash register.

The algorithm of actions is as follows:

- a car exchange agreement is drawn up and signed;

- The ownership of the vehicle is registered with the State Traffic Safety Inspectorate.

The legislator does not require notarization of the transaction, only at the request of the parties.

If an additional payment is made under the exchange agreement, this must be indicated in the document.

Renovation in Moscow: which apartments will residents from demolished five-story buildings be moved to (video)

– The area of the rooms in these series of houses is slightly different. In LSR - a little smaller, for example, the kitchen is about 9 square meters. m. In “Cube 2.5” the footage is larger, the same kitchen is already about 12 sq. m.

meters.

The total area of the one-room apartment is from 34 to 40 square meters. meters, kopeck piece - from 53 to 59 meters (see layout diagram).

In the kitchen there is a stainless steel sink with a mixer, as well as an electric stove from the Moscow Electromechanical Plant named after Vladimir Ilyich (model ZVI 417, price - about 9 - 10 thousand rubles). Simultaneous power consumption is 5.5 kW. The set includes 4 cast iron burners, upper and lower heating elements, oven temperature adjustment within the range of 50 – 280 °C, oven light, baking sheet, and grate. Photo: Evgenia GUSEVAtrue_kpru

Taxes

An exchange agreement is equivalent to a purchase and sale agreement with the ensuing legal consequences. This point primarily concerns the payment of taxes.

The tax is provided for apartments that have been owned by a person for less than 3 years and the cost of which is set at more than 1 million rubles.

In case of exchange or sale, such objects are subject to a tax of 13% of the total cost , from which 1 million rubles are deducted.

In some cases, participants in a property transaction apply to the Federal Tax Service with an application to deduct taxes by mutual settlement if they are entitled to a property tax deduction.

What plays a role here is the fact that barter is a simultaneous process of buying and selling, which is carried out by one person.

The exchange agreement provides for all procedures that must be followed when preparing this type of document. In addition, important points inherent to the specifics of this type of property transactions are taken into account.