How and why is a notarized waiver of the pre-emptive right to purchase issued?

A refusal is an official response to the seller's notification of an upcoming transaction. Regardless of how the notice of sale was sent, the waiver of the pre-emptive right to purchase must be made in writing.

The text clearly states that the citizen will not exercise his right and claim a share of the plot in the future. The document is certified by a notary. All these measures are aimed at protecting the seller - in case the co-owner changes his mind and files a lawsuit.

The preemptive right is transferred to the heirs. When one of the co-owners dies, notice of sale must be sent to his successors.

Refusal is not mandatory. Participants in shared ownership have the right to ignore the notice. However, obtaining waiver documents is the only way to quickly sell a share to a third party. Otherwise, the seller must wait 30 days.

If the seller breaks the law and sells the land share early, the person whose rights were violated will be able to file a lawsuit within three months from the moment he learned of the violation. The statement of claim will indicate the requirement to transfer the rights and obligations of the buyer to the participant in shared ownership.

Waiver papers are attached to the documents when registering the sale and purchase. They serve as proof of the absence of an obstacle.

There are two ways to submit a refusal:

- Independent registration and sending by registered mail with notification of delivery by mail.

- Contact a notary.

The second method is recommended. If you decide to file a waiver yourself, consult a lawyer. This can be done on our website.

How to give up your share in an apartment in 2020: instructions and cost

There are situations when a citizen, for a certain reason, does not plan to own part of the real estate. This may be due to both high taxes and the desire to save yourself from unnecessary worries. Below we will consider how to give up a share in an apartment in full compliance with the current law.

How to refuse in favor of another owner: existing methods

You need to choose the option of transferring it to another owner, who also owns part of the apartment, depending on the specific circumstances. Situations may be different:

- The share already exists and needs to be re-registered.

- The share will arise as a result of inheritance or privatization and must be abandoned.

Each has different features for registering a refusal. Let’s look at how to apply in more detail.

Note. Be sure to order a fresh extract from the Unified State Register of Real Estate - this way you will understand the current status of the housing.

If you already have a share

Most often, the need to re-register as a co-owner arises when one of the owners moves or wants to concentrate the right to the entire apartment. It does not matter on what basis the right arose - as a result of privatization, shared construction in Russia or the acquisition of secondary housing under any document.

The following options are available:

The share will go to the person indicated by the recipient or buyer. The purchase and sale procedure differs from donation in a significant way - this must be taken into account when making a decision.

We draw up a deed of gift

The simplest procedure for re-registration of an existing share in the ownership of an apartment. Today, a deed of gift is formalized through the signing of a gift agreement. The algorithm for the owner’s actions when donating is as follows:

- Obtain the spouse's consent to the gift if the share was acquired during marriage. Consent is certified by a notary.

- Three copies of the gift agreement and deed of transfer are drawn up and signed. The gift agreement must be certified by a notary.

- Next, you need to collect a small set of documents: a technical plan of the apartment, a current extract from the Unified State Register of Real Estate, a receipt for payment of the fee (2,000 rubles).

- The parties are sent to Rosreestr to register the donee's property rights. You can organize it through a notary office - faster, but a little more expensive.

- Upon expiration of the registration period, the donee takes ownership of the apartment, and the donor loses ownership of the share.

Important. When donating a share, you do not need to obtain the consent of the co-owners.

As for taxes, the donor does not pay anything to the budget (since he did not receive any income), and the donee is exempt from personal income tax if the share is received from a close relative (parents, children, grandparents, grandchildren, brothers and sisters) . In other cases, the new owner of the share must calculate and pay 13% of the price of the property to the treasury.

The donation agreement can be found here.

We arrange purchase and sale

The algorithm of actions for buying and selling is as follows:

- It is necessary to notify the co-owners in writing of the pre-emptive right to purchase the share.

- The seller must obtain the consent of the spouse for the sale in notarial form.

- The DCT and the transfer deed must be drawn up in triplicate. The contract is certified by a notary.

- The agreement, act, technical documents for the apartment and a receipt for payment of the fee (2,000 rubles) are submitted to Rosreestr for registration.

- After registration, the buyer assumes the rights of the owner.

Practitioner agreements can be found here.

If the share must be abandoned at the stage of its acquisition

It often happens that a person is destined for a part in an apartment, but for some reason he does not want to accept it. We are talking about inheriting housing for the deceased or about privatization. Let's consider these situations in more detail.

How to refuse inheritance

After the death of the testator, an inheritance case is opened. Within 6 months, the notary searches for all the property that was left after the person, as well as all heirs. Distribution occurs by law or by will. At the same time, the heirs have no obligation to accept the inheritance.

Refusal of a share of the inheritance is permitted only in writing. Ideally, visit a notary and draw up a waiver document with him.

If this is not possible, you can send a refusal to the authorized notary by letter, but in this case, the signature of the heir must, in turn, be certified by a notary.

Another way is to send your representative to the notary using a notarized power of attorney, which contains the right to refuse inheritance.

When refusing an inheritance, you need to remember the following:

- It will not be possible to take back the refusal - if the heires refused, the property cannot be returned.

- You cannot refuse your obligatory share in the inheritance.

- It is possible to refuse either in favor of a specific heir or without regard to certain persons.

- It is impossible to refuse in favor of a third party who is not an heir. To do this, you must first accept the inheritance and then sell or gift it to such a third party.

Attention. You can only accept or refuse an inheritance in full. It is impossible to partially receive one property and refuse another. The refusal form can be downloaded here. The form for renunciation of inheritance in favor of another heir can be downloaded here.

How to refuse to participate in privatization

It is quite simple to renounce a share in an apartment during privatization - you need to have the refusal certified by a notary, and then attach it to the privatization documents. The vacated part will either be equally redistributed between households, or, with the consent of the remaining owners, transferred to one of them.

Remember that a minor cannot refuse privatization on his own. This requires the consent of the guardianship and trusteeship authority.

Cancellation statements can be found here.

How much does a refusal cost?

Any of the above actions will require certain costs. Most of the paperwork is done by notaries. Let's look at how much a refusal costs.

| Method of refusal | A document base | Fee for registration in the Unified State Register of Real Estate | Other expenses |

| Gift deed | Donation agreementFrom 2,000 rubles | 2,000 rubles | Consent of the spouse from 1 to 2 thousand rubles. Electronic registration through a notary up to 3 thousand rubles. |

| Purchase and sale | DKPfrom 5,000 rubles | 2,000 rubles | Consent of the spouse from 1 to 2 thousand rubles. Electronic registration through a notary up to 3 thousand rubles. |

| Refusal of inheritance | Witnessing signature on waiver from 500 rubles | Not required | Power of attorney for a representative from 1,000 rubles Postage costs |

| Refusal from privatization | Witnessing signature on waiver from 500 rubles | Not required | No |

Note. The drafting of contracts by a notary depends on the transaction price. You can find out the exact amount in your case during a preliminary consultation.

What documents are needed

If a waiver of a share in an apartment or house is formalized through a deed of gift or sale, you will need:

- Passports of the parties to the transaction.

- Technical documents for the apartment (technical passport).

- Extract from the Unified State Register for the apartment.

- The gift agreement or DCT is drawn up by a notary.

- Transfer deed.

- Receipt for payment of state duty.

- Consent of the spouse to donation (sale).

- An application for transfer of rights is drawn up by an employee of Rosreestr, MFC or a notary for electronic registration.

For a purchase and sale transaction, you will also need evidence of compliance with the pre-emptive right of purchase of co-owners - notices, postal receipts or notarial waivers of the share.

If the refusal is carried out during inheritance or privatization, to register the refusal itself with a notary, you need a passport and payment for the services of a notary office.

Advantages and disadvantages

What to choose if you already have a share in the apartment and need to give it up?

| Advantages | Flaws | |

| Gift deed | Not subject to tax for the donor. Not subject to personal income tax for the donee if the share is received from a close relative. Co-owners do not have a preemptive right. Cheaper than DCT. | You cannot apply for a tax deduction when purchasing housing. If the gift was not received from a close relative, you need to pay 13% of the price of the property to the budget. |

| PrEP | A universal form of transfer of rights to housing. It is possible to obtain a tax deduction when purchasing housing. | It is necessary to observe the pre-emptive right to purchase from co-owners. The seller must pay personal income tax on the sale amount. |

The choice between these methods of transferring a share to another person is made depending on specific conditions.

Features of refusal in favor of parents (mother or father)

If the share in the apartment is already owned, it is better to use the design of the gift agreement. Parents will be able to avoid taxes on the purchase, and you will not have to pay personal income tax for the alienation.

When making a transaction with relatives, you should remember that they should not cover up other goals. The fact of tax evasion through a gift can be very easily revealed during a tax audit. If the transaction was sham, the department can challenge it in court.

Features of refusal in favor of the state

The share is transferred to the state as a result of deprivatization. This is a procedure for canceling a privatization agreement and returning property to the country. This procedure is carried out exclusively through the court. The initiator of the proceedings can be any owner of the apartment or the relevant control authorities if a violation of rights has been identified.

You can file a claim to invalidate the privatization agreement within three years from the date of transfer of the apartment for privatization. You can only return the apartment in its entirety.

Peculiarities of giving up a share in an apartment purchased with maternity capital

Shares in an apartment purchased with maternity capital are distributed among all family members. Most often, a situation arises when one of the spouses wants to give up his part.

This can be done by drawing up a refusal from the notary to exercise the right to participate in determining the shares. The spouse does not receive a share, but he retains the right to common property.

In case of divorce, the second spouse's share will be divided.

Features of refusal in favor of a child

When determining the method of relinquishing a share in favor of a child, one must proceed from specific conditions. An adult child can independently act in a transaction on his own behalf. When re-registering a share, the interests of children under 18 are represented by their parents. Most often, a gift agreement is used to renounce a share in favor of a child.

The form for waiver of pre-emptive right (refusal to purchase a share in an apartment sample) can be downloaded here.

How to waive the pre-emptive right

You can register a waiver of the pre-emptive right to purchase a share through a notary. Then the paper must be handed over to the seller of the share, who will submit it to Rosreestr employees when registering the transaction. If it is not possible to issue a notarized refusal, you can ignore the message about the pre-emptive right. The consequences will be the same as with a written refusal.

The law provides several ways to refuse a share in an apartment. Most often, citizens use a gift agreement, since it does not entail the payment of personal income tax. However, when accepting an inheritance and privatization, special documents are used - waivers, which are drawn up by a notary.

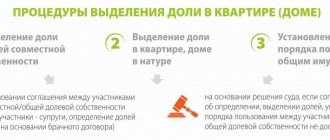

You will learn more about how the allocation of shares occurs below.

We remind you that if you need to give up your share in the apartment, and you do not know how to do everything correctly, then it is best to consult a lawyer about this. Sign up for a free consultation in a special form on our website in the corner of the screen.

We are waiting for your questions and will be grateful if you rate the post and like it.

Source: //ipotekaved.ru/oformlenie/kak-otkazatsya-ot-doli-v-kvartire.html

If one of the co-owners is a minor

The situation becomes more complicated when one of the participants in shared ownership is a minor or incapacitated citizen. The guardianship and trusteeship authorities carefully monitor compliance with the pre-emptive rights of these persons.

Depending on the category of the owner, the following persons will contact the guardianship authorities to formalize the refusal:

- parents, if the minor has not reached the age of 14;

- parents and child personally, if he has reached 14 years of age;

- guardian if the owner is incapacitated or partially incompetent.

The refusal is issued in the territorial department of the guardianship and trusteeship authorities at the place of residence. You will need to provide copies and originals of documents for the land plot and a notice of sale. You need to have your passport, birth certificate, and a document confirming your lack of legal capacity.

How is it processed?

The requirements for this agreement have a number of conditions, if not met, the document will be considered invalid:

- Details, passport details and other information about the participants in the transaction must be as detailed as possible ;

- Precisely defined subject of the agreement : exact address, technical data (total area, living area, etc.);

- Clearly defined shares for each owner : to whom and how much;

- Detailed information about title documents that can confirm ownership: contracts for the purchase of housing, or a certificate of inheritance of a house/apartment;

- Privatization certificate of ownership.

This is important to know: Maternity leave before sick leave: conditions for provision

Among other things, the agreement specifies additional conditions:

- procedure for operating property registered as shared ownership;

- unilateral ban on refusal to fulfill all obligations;

- absence of any encumbrances on real estate ;

- absence of any material claims against other owners;

- the procedure for making emerging additions and changes to the agreement;

- temporary deadlines for registration of additions and changes.

Document structure and procedure

In the waiver of the pre-emptive right to acquire a share of land, it is necessary to indicate specific information relevant to the case. So, the document states:

- full address of the land plot;

- cadastral data;

- square;

- characteristics of the share;

- timing of consideration of the proposal to buy out a share;

- Full name and passport details of the participant in shared ownership;

- date and signature.

The place of registration is indicated at the top of the document. There is no need to write the usual “hat”. This is followed by the main part, which describes the property and the waiver of the pre-emptive right to purchase a share. If difficulties arise, contact a lawyer.

When registering through a notary, you will need to provide the following documents:

- general civil passport of the Russian Federation;

- notice of sale of a share of land;

- title documents for land.

Notary services are paid. On average, pay about three thousand rubles. If the document is drawn up by a specialist at a notary office, the amount will increase by the cost of technical work.

Differences between joint and shared ownership

Joint ownership is the joint ownership of common property by citizens.

They own it on equal terms , having absolutely the same privileges and obligations. Maintenance costs, utilities and taxes are jointly paid.

A good example would be an apartment owned by both spouses .

If it was acquired after marriage , then ownership will not belong 50 to 50, as many owners are accustomed to believe, but 100% to both the first and second owners, that is, each will own the apartment completely .

All property acquired after marriage becomes joint property by default.

Unless other conditions are stipulated by an official marriage contract or a shared ownership agreement .

Shared ownership is individual ownership of part of the common property.

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

In this case , there can be many co-owners and they do not have to be relatives. The size of the shares can also be different for everyone.

The most common option is an ordinary family living in an apartment and dividing ownership between all its members - parents and children.

In such a situation, utility payments come entirely to the entire residential premises , but everyone will pay taxes for themselves .

The share in most such cases is not determined by a specific premises and cannot be sold to strangers . It can be bought by relatives living in the same apartment.

You can also receive a cash reward , equivalent to the cost of the share upon sale. If desired, this option can be converted into the second – allocated share.

An example of an allocated share with specific meters and binding to a specific room would be a multi-room apartment (communal apartments are still a very common phenomenon in Russia), in which each room has its own owner .

This is important to know: Child care benefit under 3 years old: who is entitled to it, amount in 2020

The size of the rooms is different, and, accordingly, the size of the share . Utilities and taxes, with this type of property, everyone pays for themselves and only for their own meters.

The allocated share can be given as a gift or sold without the consent of all other owners . However, when selling, other “owners” will have the privilege of having the right to buy out their shares as a matter of priority .

After refuse to purchase, you can offer the deal to third parties .

What is the concept of a share in an apartment, read in our article.

Features of refusal under the Civil Code of the Russian Federation

Failure to comply with the notification procedure and waiver of the pre-emptive right to purchase will result in the cancellation of subsequent transactions. First of all, it is extremely important to formalize the transaction under the same conditions as those indicated by the seller in the notice of the planned sale of the share.

For example, if a seller offers co-owners to buy a share of land for 500 thousand rubles, and then, after their refusal, enters into a deal for 250 thousand, then the participants in shared ownership have the right to file a lawsuit and challenge the deal. If the price decreases, the law requires sending a new notification to the co-owners.

After writing the waivers, the seller should draw up an official document from a notary. To this end, all written waivers are provided, as well as notices of sending and receiving alerts. The notary will examine the submitted papers and issue a certificate confirming that there are no obstacles to the sale of the land share to a third party.