About the earth

Definition of grading and quality To fully understand the topic, it is necessary to determine the value of grading within the framework

When carrying out various works related to land plots or carrying out transactions, it is necessary to have a list

Disputes over land plots are often the subject of litigation. Citizens who own land

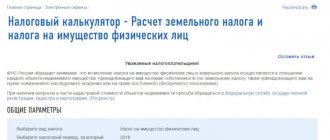

Pravozhil.com > Real estate registration > Property tax > How is land tax calculated –

How to legalize a land plot? There is one caveat: if registration occurs en masse, i.e. that's what they want

Construction standards on LPH land plot 2020 For this privilege, the plot should not be

Characteristic[ | ] The very concept of this complex word is the totality of all cases when possession

Home / Land, dacha, construction / Documents and legislation / Land plot / Cadastral

Title document for a land plot - what is it? Any right relating to a plot of land must

What is the amount of the state duty based on the estimated value of the inheritance? In what cases is the state duty not paid? How