Today no one is safe from encountering scammers. Moreover, dishonest citizens ply their trade in a variety of areas, from banal shortchanging in the market to forging signatures in financial contracts. The real estate sector is especially attractive to scammers, because here, if they are lucky, they can quickly get a very substantial sum.

There are hundreds of fraudulent apartment schemes. Below we will discuss the five most common of them, and give advice on how to avoid becoming a victim of scammers, and what to pay special attention to when concluding such transactions.

Fraud with deposit

One of the most popular types of real estate fraud is deposit-based fraud. The property is offered for sale at a very competitive price. At the first meeting, the buyer is presented with documents confirming that the property really belongs to the seller.

The buyer is satisfied with everything, and he declares his readiness to complete the transaction. The seller puts forward the condition that he needs a deposit. The relevant agreement states that if the buyer refuses the transaction, the deposit will not be returned to him. After transferring the deposit to the seller, the buyer suddenly becomes aware of facts that were hidden from him by the other party at previous meetings, but at the same time they are very significant. The buyer refuses the transaction and loses the deposit. The amount of the deposit is not critical for the buyer, but nevertheless, the deception is obvious. Although, the parties entered into an agreement, therefore, in a formal sense, the seller’s actions can be considered legal, and there is no corpus delicti in them. In transactions with a deposit, you need to pay attention to the little things and try to understand the seller’s logic.

The emergence of unexpected heirs

The next fraudulent scheme has to do with inheritance. In general, the topic of inheritance in real estate is very attractive to scammers. The reason for this is the imperfection of the law and, so to speak, the “nothingness” of the property belonging to the deceased.

For example, an apartment is offered whose price is 20% lower than the market price. Explaining the reason for such generosity, the seller usually says that the property was inherited and is being sold cheaply solely because of an urgent need for money. A purchase and sale transaction is drawn up. And after a little time, another heir of the former owner of the apartment suddenly appears, who declares that he just learned about the death of a relative, and immediately, as provided by law, came to the notary in order to submit an application for acceptance of the inheritance. And already there, at the notary’s, he “suddenly” found out that the apartment had been sold to a new owner.

After this, the buyer spends a long time proving in court that his actions when purchasing real estate were absolutely legal, and that there are no grounds for invalidating the purchase and sale agreement. And the new heir, seemingly also on completely legal grounds, claims that he did not know and was not aware of the death of his relative, and now he has all the rights to inherit property.

Unfortunately, the court usually takes the side of the heir. After all, according to the law, if he presents to the court evidence that he really did not know about the death of a relative, then the period for accepting the inheritance can be restored. In this case, the purchase and sale transaction for the inherited apartment is considered invalid. As for the apartment seller, look for the wind in the field! He has already spent money on the apartment, but he has no property.

Fraud when buying an apartment, living and related to its cost

New types of real estate fraud in the secondary housing market, as a rule, are based on the history of the property being sold (in the future, as an example, we will talk about a transaction with an apartment in a multi-story building).

Option 1: creating unbearable conditions in the neighborhood.

This is the newest type of fraud in the secondary housing market. The method is quite simple: scammers are looking for an apartment with two owners (registered in shares, for example, by ex-spouses, brothers and sisters), between whom there is no particular harmony. One of the shares is officially purchased. The other owner is offered to sell his share for half of its actual market value. Naturally, he refuses. After this, the newly created owner of the share moves into the apartment legally and begins to actively create unbearable conditions for the remaining residents. Any available methods are used: loud music all day long (without violating the norms of “silence”), constant and large numbers of guests who come at any time of the day or night (“What? I’m the owner, I have the right to receive guests whenever I want!” "). Own initiative does not help - the apartment is rented to tenants as cheaply as possible and to as large a family as possible. The optimal solution is to create unsanitary conditions and disorder, that is, to create the most uncomfortable living conditions for people. There is only one goal - to force the owner of the second share to sell it immediately, for any price. The “ugly” new co-owner finally buys the second share on his own terms. As a rule, this is not even half the price, but even less. Result: the fraudster becomes the full owner of the entire apartment for a relatively low price and can already sell it at the market price.

A variation of the considered option is to force the co-owner to buy a share from the fraudster at the highest possible price. The method is the same. In this case, the emphasis is on the desire of a conscientious tenant to live in peace. However, this is not always possible, since if the tenant had enough money, he would have long ago bought the share from the former co-owner (former spouse, etc.).

The result: having bought cheaply, sell at a high price part of the apartment, which, in principle, is not needed by anyone except the co-owner already living there.

Option 2: exchange for an inexpensive apartment with an additional payment.

Despite numerous multi-volume criminal cases and high-profile trials of gangs of fraudsters throughout the country, this type of fraud used by them is still alive and thriving. Its main focus is on lonely elderly citizens of an asocial type: alcoholics, not completely mentally healthy people and others. The main criteria: the apartment is owned, the owner is a single person whom no one will look for. Using a person’s passion for addictions and their own eloquence, a person is persuaded to sell his apartment in the center, exchanging it for housing in the periphery with an additional payment, so that he has something to comfortably live out his life on and indulge his habits. At the same time, the housing to be purchased is not even shown. Housing, as a rule, is of the lowest quality: much smaller in area, located in the most uncomfortable areas (near railway stations, train stations), remote from all infrastructure. As a rule, such housing is on the outskirts of the city or in the countryside. It’s good if the deceived citizen is still allowed to purchase this premises, that is, the purchase and sale transaction actually takes place. Most often, the housing provided is not even purchased by the defrauded citizen. It can be rented in advance by paying six months in advance. Or move into a house prepared for demolition, from which half of the residents have already moved out. They simply move him there... and forget about his existence. What then happens to the citizen, where he is evicted by the owners of the premises, is no longer of interest to the scammers. From the proceeds from the sale of a citizen’s own comfortable apartment, they give him a little money - only so that he does not immediately come to his senses and does not understand that he has become a victim of deception.

Result: the fraudster gets almost the full cost of the single citizen’s apartment, minus a small part of it spent on renting housing for relocation (or purchasing the citizen’s property), as well as on giving the citizen a certain amount for personal needs (the so-called surcharge).

Option 3: planned challenge of the transaction in court.

This option actually includes several varieties that are equally actively used depending on the specific situation.

Situation 1: understatement of the cost of the apartment in the purchase and sale agreement.

The apartment has a good history, previous transactions (if any) are beyond doubt, there is a “clean sale”. The method of fraud is typical for new buildings that have recently been registered as property. The buyer is asked to indicate in the purchase and sale agreement the price of the apartment, which is reduced to 1 million rubles, in order for the seller to avoid paying personal income tax. Or (counting on the greed of the buyer) it is proposed to buy an apartment at the offered price plus the amount of tax that the seller will have to pay when selling the apartment at its real cost. The basis for the offer is clear and transparent to the buyer: after all, three years have not yet passed from the date of registration of ownership of the apartment (or from the date of the last purchase and sale transaction). The risk of challenging the transaction is somehow little predicted: the seller looks decent, the history of the apartment is clean. This is where the trick lies. Loss of vigilance can cost the buyer the price of the apartment. After the transaction has taken place, the legal process of challenging it begins on various grounds permitted by law. The court makes a decision on bilateral restitution, orders the former seller to return the apartment, and the buyer - the money. The apartment has to be returned to the defrauded buyer. But, as a rule, it is not possible to get the money back in full. In 100 cases out of 100, they have already been spent and begin to be collected from the seller through the bailiff service - for a long time and little by little, until, finally, the collector (deceived citizen) finally loses hope of receiving the entire amount or the debtor discharges himself and moves to place of residence unknown to bailiffs. At this point the performance usually subsides.

The result: instead of a major purchase and a happy and comfortable life in the purchased home, the buyer is left with nothing - without an apartment and without money. The seller and the realtor (without them, as a rule, such scams cannot be carried out) are left with a double benefit - both the apartment and an amount of money equal to the cost of this apartment.

Situation 2: challenging one of the previous purchase and sale transactions with an apartment.

Studying the history of transactions with an apartment, it is discovered that earlier, during the commission of one of them, violations of the law were committed (especially dangerous if the rights of minors were violated). The apartment is put up for sale, and after registering the buyer’s ownership of it, the process of challenging not the last, but one of the previous transactions with the apartment begins. Further, the process and outcome are similar to those described in situation 1.

Situation 3: challenging the long-standing privatization of an apartment.

After the sale of the apartment, transactions on the privatization of this premises are disputed. As is known, the statute of limitations for these transactions can be quite long and amount to 10 years (Part 1 of Article 181 of the Civil Code of the Russian Federation). Moreover, the requirements of the owner or another possessor to eliminate any violations of his rights, even if these violations were not combined with deprivation of possession (Article 304 of the Civil Code of the Russian Federation), are not subject to limitation at all (Article 208 of the Civil Code of the Russian Federation). Basically, this type of fraud (as in all three development situations) is entirely the initiative of “black realtors” who are looking for apartments that at the same time have “blank spots” in their history, allowing them to challenge the privatization transaction and expect the consequences of invalidating this transaction to be applied. The process and outcome are similar to those described above. The buyer is deceived. In this case, the person who brought the claim (whose rights were violated during privatization) may not even know anything about his rights or about the process that took place. Persuading a person to issue a power of attorney for the right to conduct court cases and participate in enforcement proceedings is a fairly simple task for a fraudster with the proper amount of charisma and eloquence. Subsequently, at the stage of enforcement proceedings, within the framework of the law, it is possible to conclude a rather complex settlement agreement, as a result of which the buyer of the apartment remains to live in the purchased apartment, the ownership rights remain with him, and the citizen whose rights were violated (the plaintiff in a legal dispute, whose interests are allegedly represented by scammer) receives a certain amount of money from the last buyer.

Option 4: sale of an apartment with encumbrances.

The most common type of encumbrance now encountered is the mortgage of an apartment from a bank. Less often - arrest. Considering the specific consequences of this type of encumbrances, a buyer who does not check before the transaction (and even before giving a deposit) the fact of the existence of encumbrances risks being left with nothing. The bank, as a mortgagor, in the event of non-repayment of the loan, will foreclose on the collateral. And the presence at this moment of another owner of the property is not an obstacle to this. Arrest in practice means the presence of controversial claims to the apartment, which, quite possibly, will not be resolved in favor of the seller.

It should be noted that when concluding a preliminary purchase and sale agreement, when transferring the deposit, the seller can present a certificate without a note about the presence of an encumbrance. The procedure for registering transactions, as well as the ability to obtain a duplicate certificate of ownership, allow you to do this without much effort. Fortunately, this type of deal is becoming rare. The caution of modern real estate buyers prevents not only the completion of this scheme, but also the implementation of even its beginning.

Not from a legal point of view, the presence of relatives of the seller registered in the living space, including those removed from registration long ago and without their desire (for example, those sentenced to long terms), can also be considered a “burden” from a legal point of view. However, in this case we are talking only about the availability (or restoration) of the right of residence of these persons. This is a nuisance, of course, threatening, most likely, monetary “payoffs” from such proximity in the same apartment. But in this case there is no talk of losing the apartment or its full value.

Result: loss of a certain amount of money while maintaining housing.

In all of these cases, a citizen deceived by scammers, as a rule, risks either the entire apartment (or a share in it), or the full cost of the apartment (share). These are the largest and most popular real estate fraud schemes in the secondary housing market.

Use of an illegal court decision on inheritance of property

Some scammers operate using an illegal court decision that allows them to inherit property. Usually, for this purpose, they prove their relationship in the district court of a small city. According to the law, the fact of relationship is established at the applicant’s place of residence. There is hardly any need to voice the factors that contribute to fraudsters in obtaining such a court decision. Anyone who wants to get it knows how to do it.

Having obtained a decision from such a court, the fraudster goes to a notary to declare his rights to the inheritance of the deceased. It is clear that most often the objects of attention of swindlers are the apartments of people who have no immediate relatives. Or there are such relatives, but due to some circumstances they cannot formalize the inheritance within the six-month period established by law (for example, they are serving a sentence in prison).

Frequently used fraud schemes: how to avoid falling for them?

If you decide to buy a home, you should weigh the pros and cons. Buying an apartment is an expensive purchase . If you are ignorant of the choice and all the intricacies of completing a transaction, then it is best to turn to specialists with this question.

Today's real estate market is replete with apartment scammers. To understand how not to run into scammers when buying an apartment, it is worth familiarizing yourself with the possible frauds that they most often operate.

What scams do resale home sellers resort to?

- One of the most common and expensive frauds is sale of an apartment using a forged document. In this case, the homeowner’s details are entered into false documents. Then the scammers use forged documents to obtain title documents and sell the home.

According to experts, when buying a home, it is very difficult for an incompetent person to detect fraud. This can only be determined by a specialist. As a result, the buyer loses his money, since the transaction is declared invalid and the apartment is returned to the owner.ATTENTION! You can prevent the occurrence of such a situation by obtaining a certificate of state registration of housing for the person with whom you are directly making a transaction.

There is a widespread scheme of fraudulent activities carried out against elderly and incapacitated people. Scammers use illegal methods to obtain an apartment and register it in the name of a more “sane” person.

The only thing that might be alarming about this transaction is the series of purchase and sale procedures, which are carried out in the shortest possible time. In this case, you will also lose your savings, and the apartment will again go to its real owner.

In this case, you can protect yourself with a certificate from the PND (psychoneurological clinic) at your place of residence. If the seller of the apartment is not listed in this institution, then this is a guarantee that you have an adequate person responsible for his actions.

- Another factor to be wary of when buying a home is concealment of heirs. Often, scammers hide existing heirs. However, there were cases when the owner himself did not know about their existence (illegitimate children). Sometimes relatives agree among themselves that they will not claim a share of the inheritance.

Such agreements are most often concluded only in words, and after the sale, the refusing party asserts its rights to a share of the inheritance. In this case, it is safest to carry out a transaction with the heirs of the first priority. Although here there is no 100% guarantee that illegitimate children will not appear. One of the options for solving this problem may be a clause specified in the contract.According to it, the heirs who appear after the conclusion of the transaction will have claims exclusively against the former owner of the apartment. If the seller refuses to sign an agreement of this kind, then it is best to refuse to purchase the apartment.

- Purchase and sale transactions involving minor children. If an apartment in which minor children are registered is put up for sale, then in return they must receive housing of equal size. As a rule, this is not always taken into account by sellers.

In this case, if the child has not reached the age of 21, he has the right to apply to the court for restoration of the living space. His request may be granted, and the new residents will lose their purchased apartment. It is in the interests of the buyer himself to take into account all the nuances of this purchase.To do this, you should contact the guardianship authorities at your place of residence and determine the presence of minor residents. Next you need to act in accordance with the law.

- Sale of an apartment purchased with maternity capital .

When purchasing such an apartment, all minor children must be allocated certain shares in the apartment. If this was not done, then the guardianship authorities have the right to declare the transaction invalid. As in the previous paragraph, all owners of the apartment should be identified. An extract from the house register or an appeal to the guardianship authorities will come to the rescue. After this, it is necessary to ensure that minor children are provided with equivalent housing or that amounts of money for the purchase of new housing are frozen in their accounts. - Deception by proxy. The sale of housing can be carried out on the basis of a power of attorney. In this case, scammers use a “fake” or revoked power of attorney.

In any case, during registration or signing of the contract, require the presence of the owner. Otherwise, refuse the purchase, do not risk your money! This is the case when you have the right to demand the owner!Only through personal acquaintance can you be convinced of a person’s sanity and avoid financial losses.

Fraudulent schemes used in new buildings

Even if you are making a purchase through a development company that has been working in the real estate market for several years, be on the alert and familiarize yourself with the main frauds during the sale.

- One of the most common fraud schemes is the sale of a property by a company supposedly part of the developer’s holding company .

The development company from which you plan to purchase housing offers to enter into a documented agreement with another company. After receiving the money, the latter disappears from the real estate market, and you are left without funds and an apartment. To avoid possible risks, make a purchase only through the official developer company and only after checking the project declaration and building permit. - Proposal to join the housing cooperative (housing and construction cooperative).

In this case, during the construction of housing, you can bear the costs incurred in the accounts of the cooperative. The disadvantage of such a purchase is that you will not be able to regulate the ever-increasing costs. As a result, the price of a new building will increase significantly. This type of sales is completely legal and has been implemented in practice for several years. The only disadvantage of this type of purchase is the constant financial investments that buyers are required to make to the cooperative. - Two owners of one apartment .

This scheme works well when the developer enters into an agreement with real estate agencies for the sale of apartments. Both organizations begin selling housing, and as a result, the developer receives money for one apartment twice. Problems arise during the commissioning of housing. Then everyone begins to shift their blame and this can drag on for many years. In order not to fall for the bait of such scammers, you should ask the seller, registered with the federal service, for a shared construction agreement! - After purchasing an apartment, the development company can offer housing registration services (property rights, risk insurance).

Such services can cost about half the cost of the entire apartment. In addition, without competent specialists, the paperwork can be drawn up with a lot of errors and inaccuracies. After drawing up such an agreement, the owner spends a long time running around various authorities in order to correctly prepare the documents. As a result, the buyer ends up with a fake contract in hand and missing funds. - When signing a contract, always ask for approved documentation !

The provided approximate calculations always differ from the true indicators not in favor of the buyer. Approximate calculations may indicate one area of the apartment, but on the approved plan the square footage will be significantly less.

REFERENCE! The contract must be strictly regulated by 214-FZ! In addition, the package of documents must contain a plan of the apartment, a check confirming the deposit of funds into the seller’s account, and a letter from the developer stating that there are no claims for payment.

Conspiracy of scammers with an unscrupulous notary

For a will to have legal force, it must be approved by a notary. It must be said that the Federal Chamber of Notaries regularly carries out purges, depriving the powers of notaries who are accused or suspected of illegal activities. And yet, scammers find unscrupulous notaries who are ready to certify a will illegally, “retroactively,” in the absence of the testator himself. At the same time, his signature is forged.

For example, a person died without leaving a will. In this case, his apartment must pass to the heir by law. However, having entered into an agreement with a notary, the scammers create a “will” according to which the apartment should go to one of them. You need to understand that challenging a will certified by a notary is a very difficult task. First of all, because since 2020, the notary’s certificate has been given the force of a certified fact, that is, it is practically undeniable. Further, among notaries there is also such a thing as corporate solidarity. That is, the notary community does not enthusiastically accept the fact of a notary’s dishonesty, so an ordinary citizen has very little chance of proving his illegal actions.

Fraudsters use fake documents

Most people don't even realize how realistic fake documents can be. There are “craftsmen” who can concoct a court decision with seals and signatures; a will, as if certified by a notary; certificate of inheritance, etc.

For example, a Sochi resident’s aunt, who lived in the Moscow region, died. The man was her only relative, and within the period established by law, he accepted the inheritance according to the law. But when there were only two weeks left before the expiration of the six-month period, the notary who was in charge of the inheritance case was provided with a will in favor of another heir, allegedly certified by a notary from Kursk. When they began to look into it, it turned out that the signature and seal on the will did not match the signature and seal of this notary. In addition, there was simply no such will in his registry.

How to recognize fraud

First of all, the low price of real estate (especially if it was inherited) should cause caution. All buyers should remember: having illegally inherited property, scammers try to sell it as quickly as possible. After all, there is always the possibility that a criminal plan will be discovered, or that a real heir will emerge. Therefore, in order to speed up the sale, they offer real estate at prices below market prices (usually no less than 20%).

Another sign of fraud may be the frequent change of homeowners. Often, in order to create the appearance of legal ownership of a property, scammers conduct several transactions. According to experts, if the apartment has changed owners more than twice over the last three years, it is better to refuse the purchase. Moreover, even if one transaction was carried out within three years after the acquisition (a gift transaction between relatives does not count), this should raise red flags, because a personal income tax of 13% is a serious argument. And more than two transactions in three years, as practice shows, almost always indicate that the property is very problematic.

Hidden dangers and ways to successfully avoid them

Regardless of the primary or secondary housing market, each segment has its own risks. In our material we will cover in detail the “dark” sides when buying a home and how to solve them.

Secondary housing

In most cases, the purchase of secondary housing is carried out through individuals . In this regard, this operation will not be as burdensome as purchasing a new building through a developer. But even here there are nuances and pitfalls that an ignorant buyer may fall into.

The most common “profit” that buyers fall for is voicing the undervalued cost of the apartment. Moreover, the seller may offer to reduce the cost of housing “on paper” in order to avoid a large tax deduction. You might think that it acts for the benefit of new residents.

However, situations may be different and in the event of termination of the contract, you will receive only the money indicated in the contract, and not the actual amount paid to the seller.

- Before buying a secondary home, you should check the apartment for the presence of tenants and their frequency of residence . If the documents indicate frequent transfers of property from hand to hand, this may indicate the illegality of the first alienation.

- When completing the transaction, you should check all the residents registered in the apartment . If there are minors among them, then the alienation occurs in a special regime with the presence of guardianship and trusteeship authorities. The legislation talks about providing this category of citizens with equivalent housing. This should be followed strictly!

- It is necessary to check the owner's legal capacity . It is the practice of realtors to provide a certificate of competence from their psychoneurological dispensary. This significantly reduces the risk of the transaction.

- Be sure to pay attention to whether the apartment is encumbered (with arrest, mortgage, rent). You can exclude the encumbrance through an extract from the Unified State Register. This document will tell you what rights the apartment owner has taken possession of the property.

- When purchasing a privatized apartment, carefully read the privatization procedure . Often, owners exclude minor children (registered in the apartment) from privatization.

You can find tips on what questions to ask when buying an apartment here.

Primary housing

Housing in a new building also has its advantages and disadvantages. The “advantages” of such a purchase include the relatively low price of apartments, the absence of possible owners and a “clean” history.

From a legal point of view, registration of housing in a new building is more labor-intensive. Along with this, it is necessary to take into account all the nuances that exist when purchasing housing in a new building.

- Firstly, Before buying a home, you should carefully “probe” the developer. This can be done based on reviews on the Internet, or by asking those who have already made a purchase about the company. In resolving this issue, it is important to find out whether the building is frozen or not.

You should also take into account the fact that reviews on forums and developer websites are not always objective. Often, staff members will send positive notes to the developer on behalf of buyers. What to do in this case? Comments from real people and the help of word of mouth will help here.Please note that many buyers are very picky. Base your guesses on objective observations!

- Secondly, the documentary side of the transaction is the most important aspect when registering housing.

We are talking about signing an agreement (DDU). According to official requirements (Federal Law 214), the development company can register the contract with Rosreestr after the latter has all the permitting documentation in hand. Very often, the developer does not always have all the necessary permits.In this case, he proposes to conclude a preliminary agreement for the DDU, thus booking an apartment. By signing the contract, the developer assures you that the signing of the main contract will be completed as soon as possible, although this can often drag on for years.

REFERENCE! By law, signing a preliminary agreement does not provide for payment. It is possible only after registration of the main agreement in Rosreestr.

However, this does not bother construction companies, which charge buyers a fee when signing a preliminary contract.

It is worth mentioning right away that such registration of housing will not always be deceptive. But, if there is a rush when concluding a preliminary agreement, then you should be on your guard!

Read the contract carefully, check the deadlines for putting the house into operation. They must match both in the contract and on the developer’s website. The developer fulfills only those obligations that are indicated in the contract! In case of litigation, the information on the site has no legal force!

- Thirdly, personally review all permitting documentation .

Information of this kind may not always be posted on the website. You can go to the main office of the company and ask for all the documentation for building a house. If information of this kind is not provided, then this is a reason to think about the legality of the development. In this case, it’s better not to take risks! The Gosstroynadzor website has started working on the Internet, which allows you to make sure that the company you have chosen is not on the developer’s “black list”. In addition, the Land Resources Committee will come to the rescue, which on its website reflects all planned residential complexes with permits for construction.

You can read about what you need to know before buying an apartment, as well as what and how to check, here, and what you should pay close attention to and what the collection of information involves is in this article.

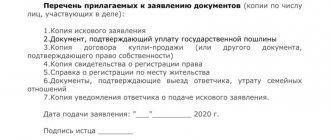

What documents should be required from the seller?

No one can give an absolute guarantee of the purity of the transaction. However, you can secure the transaction to a certain extent by requesting some documents from the seller or obtaining them yourself. If there is any doubt, you need to ask the seller for additional documents. After all, he wants to sell the apartment, which means it is in his interests to convince the buyer that the transaction is safe.

The standard set of documents is presented:

- certificate of ownership/extract from the Unified State Register;

- certificates from PND and ND;

- document of title (agreement, certificate of inheritance);

- spouse's consent to the transaction.

An additional set of documents may include:

1. Certificate of transfer of rights to the purchased housing. It can be issued by the territorial body of Rosreestr only to the owner of the property. Using this document, you can trace the chain of transactions along with the grounds for the transfer of rights.

2. Extended extract from the house register. By studying it, you can find out who was registered in the apartment, where they checked out and for what reason. Here you need to pay attention to whether young children were registered at this address, where they were discharged, and how old they were at the time of the transaction. If a person was discharged from the apartment due to a conviction, then problems with the apartment may also arise.

3. Technical passport of BTI. From it you can find out whether work has been carried out in the apartment that needs to be coordinated with the relevant authorities. An important point: all statements and certificates must be received in the presence of the buyer or his authorized representative.

4. If we are talking about inherited property, then you should look at how long the heir owned the property. If it is less than three years, it makes sense to study the materials of the inheritance case, which the heir can take from the notary.

- Related Posts

- Last will: how to bequeath an apartment correctly

- What you need to know about inheritance: 10 important facts

- How to get a deposit by inheritance, or “easy” money is not easy

Fraud with a deposit when buying an apartment

Not a smaller part of the total number of frauds in this area is occupied by schemes of smaller deceptions, when fraudsters “stop” at the amount of deposits, without claiming either the apartment or its full cost. Among the most popular methods of deposit fraud are the following:

2.1. Fraud using a general power of attorney. A person who has a general power of attorney not only shows the apartment for sale, but also takes a deposit. After this, the trusted person disappears and does not answer calls. When trying to find it, it turns out that the apartment was not planned for sale, the general power of attorney was issued a long time ago and only for the sale of a country house or a car and a garage, or was generally canceled a long time ago. It’s even worse if the power of attorney is fake, that is, it was never issued and was never certified by any notary. Yes, there are still cases when a buyer with low vision cannot distinguish the original from a skillfully made color copy.

2.2. Tenant fraud. The tenant, having rented an apartment and received a copy of the certificate of ownership (or even without it), presenting a copy of the power of attorney (which is not difficult to produce with the help of modern office equipment), deceitfully and cunningly assures potential buyers that the apartment is for sale, he is engaged in its sale and is authorized accept the deposit. The goal is to pay for your stay in the apartment plus earn a little more from deception. The scammer has no real goal of selling the apartment.

2.3. Dumping price and speedy deal. A situation of haste with the upcoming transaction is artificially created: the buyer is assured that because of the good price for the apartment there are several applicants and whoever gives the deposit first will ensure that the transaction takes place. At the same time, the deadlines for preparing a transaction are set to be unrealistically short, within which a buyer who does not have the entire amount for the purchase at once will not be able to “meet it.” Fraudsters find out in advance about the composition of the amount of money for which the apartment is planned to be purchased (cash, credit funds, maternity capital funds, etc.). Naturally, the deal falls through due to the fault of the buyer and the deposit remains with the seller. At the same time, it is very difficult to prove that this was originally intended and not to conclude a real deal.

As a result of the above methods of deception, the fraudster is left with the amount of the deposit, and no transaction with the apartment is made at all.