Until what date is the debt for housing and communal services subject to write-off?

From the date the court issues a ruling recognizing the application for declaring a citizen bankrupt as justified and introducing the restructuring of his debts (Article 213.11 of the Federal Law on Bankruptcy):

- a moratorium is introduced on satisfying monetary claims against the debtor;

- the deadline for fulfilling obligations that arose before the date of the court's decision is considered to have occurred.

Obligations to pay for housing and communal services that arose before the date of the court ruling are subject to inclusion in the register of creditors. Obligations to pay for housing and communal services that arose after the date of determination are considered current, and creditors for current payments are not recognized by persons participating in the bankruptcy case.

Thus, if a debtor for housing and communal services is declared bankrupt and the procedure for settlements with creditors is completed, then his obligations to pay the debt for housing and communal services as of the date of the court’s ruling declaring the citizen bankrupt are considered terminated.

Is the debt for housing and communal services subject to write-off after the date the debtor is declared bankrupt?

As stated earlier, the debt for housing and communal services that arose after the decision to declare a citizen bankrupt is current.

In turn, the claims of creditors for current payments remain valid and can be presented after the end of the bankruptcy proceedings of a citizen (Part 5 of Article 213.28 of the Federal Law on Bankruptcy).

Thus, after declaring a citizen bankrupt, the management authority has the right to collect debts for housing and communal services that arose after the date of the court’s ruling declaring the citizen bankrupt.

Is it easier to get your money back if you have a receipt?

Obtaining a loan by receipt is the most popular method of “certification” among Russian citizens, most of whom have little idea of how exactly to give a handwritten document legal force.

A properly executed receipt is drawn up in two copies and must contain information such as:

- Full name, passport details of the lender and borrower;

- Their actual place of residence and registration;

- The loan amount in words and in numbers;

- Date of receipt and return of money;

- The fee for use is at the discretion of the lender, the penalty for failure to repay within the prescribed time is mandatory;

- Full name, passport details of the witness (if any), his signature;

- Signatures of the parties.

Failure to repay a debt on a receipt implies both administrative liability provided for

, and criminal -

, if the borrower’s actions show signs of fraud.

Be sure to read it! Husband is the owner of the apartment - what rights does the wife have in 2020?

It is worth remembering that criminal liability in some cases is more effective for debt repayment than administrative liability. According to

The statute of limitations is 3 years, and a criminal case can be initiated after 6-10 years. For the debtor, such consequences are an excellent motivation to repay the money on time.

What should the management authority do if the debtor applies for debt write-off?

After the bankruptcy procedure was completed, the debtor applied to the management authority, homeowners association with an application to write off the debt, attaching to the application a court ruling declaring him bankrupt, terminating the procedure for settlements with creditors, etc.

The question immediately arises: what to do and is it obligatory to write off the debt?

It should be noted that in this case there is no single algorithm for the actions of the management authority to write off debt, just as I noted earlier, there are no requirements for maintaining personal accounts for housing and communal services. When receiving an application from a bankrupt, the management authority is obliged to take into account the provisions of the Federal Law on Bankruptcy regarding the termination of obligations.

The article will be useful: Walking dogs in the local area of the apartment building: what does the law say?

Many management companies continue to make accruals taking into account the debt that is subject to write-off, and payments received in the future from the owner are counted against this debt. There is no need to talk about the legality of accounting for payments against obligations that are considered by virtue of the Federal Law on Bankruptcy, and therefore there is no point in reflecting debts in payment documents as of the date of the court’s determination.

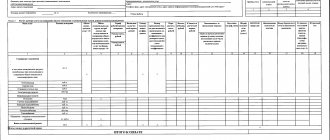

Traditionally, there are two options for reflecting debt write-off from the point of view of maintaining personal accounts:

- closing the current personal account on the date of debt recognition of the debtor as bankrupt and further opening of a new personal account;

- making changes (adjustments) to the current personal account in terms of “writing off” the debt on the date the debtor was declared bankrupt.

Recovery of damages from the management company

Co-owners of an apartment building can choose a management company (MC), which will be entrusted with performing administrative and business functions in order to ensure the normal operation of the building.

Mutual rights and obligations of the parties, fees for the provision of services and other terms of cooperation are stipulated in the contract. It also defines sanctions and fines for violation of obligations.

In such cases, funds are recovered from the management company in the amount of losses caused to residents.

Among the main responsibilities assigned to the management company:

- repairing the facade of the house, roof, entrances, basements and other objects that are in common use;

- maintaining the recommended temperature in the home during the cold season;

- sealing metering devices located in apartments;

- ensuring timely snow removal, cleaning the roof from snowdrifts and ice;

- care of green spaces and much more.

The full list of services is determined by agreement of the parties. It should be based on the requirements of Russian legislation on housing and communal services, including the Rules for the maintenance of common property in an apartment building.

If the management company does not fulfill its duties

In practice, there are widespread cases when a management organization performs poorly and does not fully perform the functions assigned to it. The most common cases of violations:

- failure to carry out repairs in the house;

- refusal to seal apartment meters;

- flooding of the home due to a roof leak;

- falling snow or icicles from the roof;

- damage to cars from falling trees;

- violation of housing heating standards, and so on.

Sometimes the management company may spend the funds allocated to it in an inappropriate manner, commit inflated expenses and other violations.

In such situations, residents of an apartment building have the right to demand compensation from the management company for material (and in some cases, moral) damage. Damage caused by violation of the contract or improper performance of one’s duties is subject to compensation voluntarily or compulsorily.

An approximate algorithm for the actions of residents who have suffered from unfair actions of the management company:

- send a claim to her to eliminate violations;

- in case of refusal - resolution of the dispute in court;

- repayment of debt established by a court decision.

The best option is if the issue can be resolved at the first stage by filing a claim. But in practice, management organizations often refuse to admit their guilt in improper performance of duties in the housing and communal services sector. Therefore, such companies do not want to voluntarily compensate for the harm caused.

In this case, affected citizens must file a claim in court.

Trial

Before filing a claim against the management organization, it is necessary to collect the most complete evidence base. Recommended use:

- witness's testimonies;

- materials of photo and video recording of violations;

- acts drawn up jointly with other residents;

- data on previous applications to the Criminal Code.

Before going to court, you also need to objectively assess the amount of harm caused. Sometimes this requires the involvement of experts or other specialists. The amount of debt to be collected must be described in detail and justified.

Certain categories of cases

One of the most common complaints that residents make to management companies is the flooding of their apartments. Most often it occurs due to a roof leak or a pipeline break. The management company is the defendant in such cases, since it is responsible for the proper maintenance of engineering systems, their timely repair and replacement of faulty elements.

In the event of an emergency, you must:

- immediately contact the management company (call a representative by phone and confirm in writing);

- record the damage caused in a photo;

- it is imperative to draw up an act on the bay, observing the rules and deadlines established by law;

- determine the amount of damage caused with the involvement of an independent appraiser.

Timely implementation of all of the above actions will greatly facilitate the process of subsequent compensation for all losses (including forced compensation).

Another common situation is damage to cars parked in the courtyard of an apartment building.

Most often this occurs due to the fall of dry branches, tree trunks or snow, ice, or icicles from the roof.

The management company is directly responsible for the maintenance of the house, the surrounding area, and green spaces in the yard, so it is the company that is the defendant in this claim.

It is important to remember that in accordance with the current legislation of the Russian Federation on the protection of consumer rights, citizens have the right to receive additional compensation.

If the organization providing the services (in this case, the management company) does not voluntarily compensate citizens for all losses caused, in the future, if a positive court decision is made, it is obliged to pay a fine.

It constitutes fifty percent of the total amount of damage.

In addition, you can recover money from the management company for services declared, but not actually provided. They are often indicated on bills without any real basis.

If the residents of the house paid for work that was not actually performed, or was not performed in full, they have the right to recalculate. After this, a refund of the overpaid amounts is required.

The same should be done in case of poor quality work - they are not subject to payment in full.

You can recover money from the management company even after refusing its services. If the owners of a residential building decide to change the management company, then the previous organization is obliged to return all funds for the maintenance of the property that remained in its accounts.

This money has a specific purpose, and therefore is not the property of the management company. However, in practice, companies often delay the return process, violating the law and creating additional difficulties for consumers.

How to collect debts?

One of the most pressing problems that a citizen faces after receiving a court decision is the difficulty in actually receiving the amount of debt due. Therefore, issues of enforcement of decisions and collection of awarded debts are of paramount importance.

Often, a management company that has debts to consumers is in no hurry to repay them voluntarily. As a result, the money never reaches citizens, who are effectively deprived of the opportunity to recoup their losses. Situations are considered especially difficult when we are talking not about one-time compensation, but about covering debts to all residents of an apartment building.

To effectively deal with emerging obligations and promptly receive funds, we recommend contacting professionals. Acting in the legal field, in strict compliance with the requirements of the current legislation of the Russian Federation, specialists will take all necessary measures to facilitate full settlement by the debtor. Among the most effective measures:

- debtor search (if required);

- identification of property owned by the management company;

- conducting telephone and written negotiations;

- searching for several alternative calculation methods;

- Constant control of the payment process until repayment.

During the collection process, measures to additionally motivate the debtor are applied. This allows you to speed up the procedure, avoid its deliberate delay, and the management company ignoring its obligations.

offers services to ensure real, quick repayment of debt by the management company. Our priorities are prompt repayment of debts in full in order to maximize the protection of the interests of the creditor. The company's clients pay remuneration only after the management company has fully reimbursed all losses and fines.

03.12.18

Are RSOs obligated to write off the owner’s debt to reduce the debt of the management company, HOA to RSO

In the presence of a classic scheme for the provision of public utilities - RSO - UO (HOA) - consumers, the legal relations of all parties are regulated by the relevant rules of law and contractual relations. RSO is not obliged to write off the debt of the management company or HOA in terms of utilities, since the party obligated to pay to RSO for utilities is not consumers, but

Note! This article does not touch upon the issue of reflecting debt write-off transactions in accounting, nor does it touch upon the issue of the technical feasibility of software for accounting for accruals and payments for housing and communal services. Also, the article was written without taking into account the extrajudicial bankruptcy procedure.

Print