Legal provisions

By virtue of paragraphs. “I.2” clause 8, part 1, art. 58 of Law N 212-FZ for organizations using the simplified tax system, the main type of economic activity (in accordance with OKVED (OK 029-2001)) of which is real estate management, during the transition period 2011-2027 there are reduced rates of insurance contributions from payments and other remuneration to individuals.

According to clause 3.4 of Art. 58 of Law N 212-FZ during 2012-2018, these insurance premium payers apply the following insurance premium rates: in the Pension Fund of the Russian Federation - 20%, in the Social Insurance Fund - 0%, in the Federal Compulsory Medical Insurance Fund - 0%.

Important addition. Several significant changes came into force on January 1, 2014:

— Federal Law No. 333-FZ of December 2, 2013 extended the period of application of the preferential tariff for insurance premiums until 2020 (updated version of Article 58 of Law No. 212-FZ);

— in accordance with Federal Law dated December 4, 2013 N 351-FZ, payment of insurance contributions for compulsory pension insurance (starting from the billing period of 2014) is carried out by a single settlement document sent to the Pension Fund of the Russian Federation to the corresponding accounts of the Federal Treasury, using the BCC (in 2013 and 2014, it is the same), intended to account for insurance contributions for the payment of the insurance part of the labor pension. The amount of insurance contributions for compulsory pension insurance to finance the insurance and funded parts of the labor pension in relation to insured persons is determined by the Pension Fund independently on the basis of individual (personalized) accounting data in accordance with the pension option chosen by the insured person.

In accordance with section. OKVED group 70.32 “Real estate management” includes two subgroups: 70.32.1 “Management of the operation of housing stock” and 70.32.2 “Management of the operation of non-residential stock”.

According to Part 1.4 of Art. 58 of Law N 212-FZ, the corresponding type of economic activity provided for in paragraph 8 of Part 1 of this article is recognized as the main type of economic activity, provided that the share of income from the sale of products and (or) services provided for this type of activity is at least 70% in total income. In this case, the amount of income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation.

Some experts believe that a “simplified” HOA has the right to apply reduced insurance premium rates only if it classifies as taxable income payments by apartment owners for maintenance and repairs, as well as for utility bills. In arbitration practice, it is quite rare, but such an interpretation of the law still occurs. For example, the Resolution of the FAS UO dated September 27, 2013 N F09-10040/13 supports the conclusion that the disposition of Art. 58 of Law No. 212-FZ corresponds with the disposition of Art. 346.15 of the Tax Code of the Russian Federation, from which it follows that the preferential tariff provided for in Art. 58 of Law N 212-FZ, can only be applied when calculating insurance contributions to the wage fund, the source of financing of which was the taxable income of a business entity. Similar conclusions were made in the Resolution of the Seventeenth Arbitration Court of Appeal dated May 20, 2013 N A50-18174/2012. These clarifications are all the more surprising considering that in other decisions the same courts make absolutely opposite conclusions.

In practice, many partnerships, in accordance with the accounting policies they apply, recognize mandatory payments by their members, which are associated with the payment of expenses for the maintenance, current and major repairs of common property in apartment buildings, as well as with the payment of utilities, target revenues that are not subject to a single tax when applying USNO. Do they thereby deny themselves the opportunity to apply lower tariffs? The author claims no. In a number of court decisions (decrees of the FAS UO dated July 23, 2013 N F09-5561/13, dated February 14, 2013 N F09-2/13, FAS MO dated September 25, 2013 N A41-50078/12, the Seventeenth Arbitration Court of Appeal dated August 20. 2013 N A50-23309/2012) when considering cases when all funds received from homeowners are taken into account by the HOA as taxable revenue and are not classified as targeted revenues excluded from income on the basis of Art. 251 of the Tax Code of the Russian Federation, the judges specifically drew attention to the fact that:

- if the HOA reflects all payments received to it from the owners of premises as targeted revenues, its right to the benefit is not lost, since these revenues (being received and reflected in tax reporting) will also be classified under OKVED code 70.32;

— the bodies of the Pension Fund are not controlling in the field of taxation and do not provide evidence of incorrect formation of the revenue part of the single tax base.

Let us highlight two positions on the issue of calculating the share of income from “preferential” types of activity.

Taxation of HOAs under the simplified tax system in 2020

→ → Current as of: April 30, 2020 For joint management of the common property of an apartment building, premises owners can unite into homeowners' associations - HOAs ().

We will tell you how to keep accounting and pay taxes for homeowners associations using the simplified tax system in our article. The HOA is a non-profit organization (). HOA facilities consist of the following ():

- mandatory payments, entrance and other fees of HOA members;

- other supply.

- payments from homeowners who are not members of the HOA;

- subsidies for the operation of common property, carrying out current and major repairs, providing certain types of utilities and other subsidies;

- income from the entrepreneurial activities of the HOA aimed at fulfilling the goals, objectives and responsibilities of the HOA ();

The HOA keeps records of targeted funds in account 86 “Targeted Financing”.

For account 86, it is necessary to open sub-accounts based on the sources of funds received. Let's consider the accounting of HOA fees, except for payments for housing and communal services, the accounting of which will be discussed below.

Operation Account debit Account credit Accrual of contributions due from HOA members, including contributions for major repairs 76 “Settlements with various debtors and creditors” 86 “Targeted financing” Receipt of contributions (except for contributions for major repairs, which are accumulated in a special account) 50 “Cash ", 51 "Current accounts" 76 "Settlements with various debtors and creditors" Receipt of contributions for major repairs 55 "Special accounts in banks" 76 "Settlements with various debtors and creditors" Reflection of current expenses for managing common property 20 "Main production", 26 “General business expenses”, etc. 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors” Write-off of costs for managing common property using targeted financing 86 “Targeted financing” 20 “Main production”, 26 “ General expenses”, etc.

The share is calculated only based on the taxable income of the HOA

In other words, income from real estate management should be considered income taken into account for tax purposes. If the HOA identifies owner payments for maintenance, repairs, and utilities as earmarked revenue, then such payments should not be included in the calculation of the revenue share for purposes of applying reduced insurance rates. The validity of this approach is reflected, for example, in the Decision of the Arbitration Court of the Perm Territory dated December 11, 2013 N A50-18921/2012.

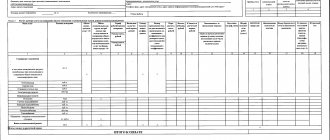

What amounts are included in the calculation? This is, for example, income from the rental of common property, interest on deposits, penalties for late payment by consumers of the appropriate fee, etc. Looking ahead, let’s imagine how section will be filled out. 3.6 (since 2014 - section 3.5) of the RSV-1 calculation of the Pension Fund of Russia:

1) in conditions where the HOA does not consider the receipts from apartment owners for maintenance and repairs, payment for utilities to be targeted:

Taxes for homeowners associations under a simplified system 2020

» » How can a homeowners association calculate their unit tax in 2020? Among the main advantages of the simplified system for HOAs are:

- Exemption from VAT. The ability to reduce the tax base when new residents of the house join the partnership. Possibility to exempt from taxes the profits of a housing association arising as a result of economic activities. The possibility of maximizing the amount of taxes paid by leveling the income-expense difference.

It is possible to reduce the difference between the income and expenditure side regardless of the size of the net income side, which is a significant advantage for large housing structures.

The disadvantages of the simplified system in relation to housing associations include: The need for additional accounting operations for correct accounting of accounts.

Membership fees Membership fees are mandatory payments that are paid by each member of the partnership at the frequency specified in the constituent documents. Membership fees are intended to cover the costs of:

- remuneration for the work of members of the audit commission.

- remuneration of the board of directors of the partnership;

- remuneration of workers who are members of the HOA;

- remuneration of temporarily hired personnel;

Targeted revenues from other enterprises or individuals aimed at maintaining non-profit organizations (which include HOAs) and for their statutory activities, used for their intended purpose, are not recognized as an object of taxation.

- Land tax. By analogy with the previous paragraph, it is paid only if the HOA owns a separate land plot. The tax base is the cadastral value.

General rules for using the simplified tax system Of course, this does not mean that everyone can switch to this special regime.

Chapter 26.2 of the Tax Code of the Russian Federation lists a number of restrictions and requirements for those who can apply for the use of “simplified taxation”.

Income from rental of common property

By virtue of paragraphs. 1 item 2 art. 137 of the Housing Code of the Russian Federation HOAs have the right to provide for use or limited use part of the common property in the apartment building. According to paragraph 2 of Art. 152 of the Housing Code of the Russian Federation, leasing, renting part of the common property in the house refers to the economic activity of the HOA. But should such income be classified as income from real estate management activities? There are no official clarifications, and there are different opinions locally.

Clarifications from various departments. The author has at his disposal the response of the Ministry of Health and Social Development in 2012 to a private request from an insurance premium payer. In it, the department explained that for the purpose of applying Part 1.4 of Art. 58 of Law N 212-FZ, income from the rental of common property in apartment buildings refers to income from the activities of the HOA in managing real estate. At the same time, in 2014, in response to a similar request from another payer of contributions, it was recommended to address the question of classifying activities for leasing common property in MKD to one or another OKVED code of the Ministry of Economic Development.

In turn, the author is familiar with the explanations of the statistical bodies, agreed with the Ministry of Economic Development, that the activities of horticultural, vegetable gardening and dacha non-profit associations, which consist in the management of real estate belonging to them (land, wells, water supply, fences, public houses, etc. .), supervision over its condition and operation, collection of rent, etc., which is carried out by boards elected by citizens, refers to code 70.32.2 “Management of the operation of non-residential assets” OKVED.

Obviously, the activities of HOAs should be qualified in the same way.

Arbitrage practice. In most cases, judges state that income from the provision of parts of common property for the use of third parties forms in the HOA income related to the management of real estate (code 70.32 OKVED).

In addition, in the Resolution of November 22, 2013 N F09-12625/13, the FAS UO refuted the arguments of the Pension Fund Administration (UPFR) that the income received by the HOA under lease agreements should be attributed to the provision of intermediary services in the purchase, sale and rental of real estate property (code 70.31 OKVED), and not for real estate management, and income from leasing advertising space on the facade of a building - for advertising activities (code 74.40 OKVED), which do not give the right to apply reduced rates of insurance premiums. The court reasoned as follows: in accordance with OKVED, the group “Real Estate Management” (code 70.32) also includes the type of activity “Management of the operation of housing stock” (code 70.32.1). In turn, this type of activity includes the subtype “Activities of institutions for collecting rent for the operation of housing stock.” Thus, since the HOA is taxable under Art. 346.15 of the Tax Code of the Russian Federation, income from managing the operation of the housing stock and the requirements of Art. 58 of Law N 212-FZ, it lawfully applied a reduced rate of insurance premiums. According to the charter of the partnership and an extract from the Unified State Register of Legal Entities in relation to the HOA, the information on the types of economic activities of the latter does not include intermediary and advertising activities. In this regard, the activities of HOAs in leasing the common property of homeowners are included in group 70.32 “Real Estate Management” and do not require independent classification into other OKVED groups.

Local attempts by the UPFR to classify the activity of leasing common property in MKD as OKVED code 70.20 “Rental of own real estate” should also be considered untenable. Thus, in the Decision of the Arbitration Court of the Khabarovsk Territory dated April 1, 2013 N A73-14622/2012, it is noted that the common property in the apartment building is in the common shared ownership of the owners of residential premises. And if the HOA receives income from the rental of this property, then it should be identified in accordance with code 70.32 “Real Estate Management”. In order to document the illegality of the application of “preferential” tariffs, the UPFR must provide evidence that the HOA as a legal entity has property that belongs to it by right of ownership, leases it out, and the share of income received on this basis exceeds 70% of the total income of the HOA.

Thus, income from the rental of common property participates in determining the share of income that ensures the application of preferential insurance rates, and is shown both in line 361 and in line 362 of section. 3.6 (since 2014 - section 3.5) of the RSV-1 Pension Fund form.

Interest and penalties

Such income of HOAs, such as interest on deposit agreements and penalties for late payment of housing and communal services, in the opinion of judges, do not relate to income from real estate management activities (Resolution of the Federal Antimonopoly Service UO of February 14, 2013 N F09-2/13, Seventeenth Arbitration Court of Appeal dated 08/09/2013 N A50-17099/2012, Decision of the Arbitration Court of the Perm Territory dated 12/11/2013 N A50-18921/2012).

Therefore, they are reflected in line 361 of section. 3.6 (since 2014 - section 3.5) of the calculation of the RSV-1 Pension Fund as part of total income and are not indicated on line 362 of this section of the form.