17.05.2016

The possibility of renting out real estate purchased under a “Military Mortgage” is a pressing issue for military personnel.

Quite often, NIS participants purchase an apartment with a military mortgage in the locality where they plan to live after retirement, and perform military service in another region. At the same time, no one has canceled the payment for utilities, and in order to ensure that the apartment does not stand idle, military personnel often think about the legality of renting out such real estate.

The question of the possibility of renting housing to military personnel arises for a reason. The whole catch is that 76-FZ “On the Status of Military Personnel”, Article 10 “Right to Work” provides for types of activities that a military personnel does not have the right to engage in. One of the points of this article is the prohibition on engaging in entrepreneurial activities, personally or through proxies, which raises the question of the legality of renting out their own residential premises to military personnel. We will try to understand this issue so that the conscience of military personnel who want to rent out apartments is clear. Let's start with the fact that renting out to military personnel their own residential premises purchased under a “Military Mortgage” should not be considered as entrepreneurial activity.

In accordance with paragraph 1 of Article 2 of the Civil Code of the Russian Federation, entrepreneurial activity is an independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, the sale of goods, the performance of work or the provision of services to persons registered in this capacity, in the manner prescribed by law. .

In addition, it is worth noting an important point: in accordance with Article 608 of the Civil Code of the Russian Federation, the right to rent out property belongs to its owner. In this case, property also means residential premises owned by right of ownership, and in order to be a lessor, an individual does not have to be registered as an individual entrepreneur.

Also, in accordance with the letter of the Ministry of the Russian Federation for Taxes and Duties No. 04-3-01/398 dated 07/06/2004 “On the leasing of premises (hiring)”, the activity of leasing residential premises owned by an individual is not should be regarded as entrepreneurial activity.

At its core, the rental of residential real estate owned by right of ownership is considered as a legal act certifying the fact that an individual is using his legal right to dispose of his property, and does not contain signs of economic activity.

In this letter, the Ministry of Taxes and Duties explains that the lessor (in our case, a military serviceman) receives income in the form of rent stipulated by the lease agreement, which is subject to income tax taxation (at a rate of 13%), and does not pay on his own the risk of any economic activity, since it is the lessee who carries out the activity using the leased property.

Summarizing the above, we come to the following conclusion: a serviceman can rent out an apartment, house, or townhouse purchased with a “Military Mortgage”! The main thing is to comply with the legal norms for renting out your own real estate. So, if a decision is made to rent out residential premises, the serviceman must take the following actions.

Coordination with mortgage holders

Due to the fact that the bulk of apartments and private houses are purchased by NIS participants using a mortgage loan under the Military Mortgage program, the first person with whom it is necessary to agree on the possibility of renting out mortgaged housing is the creditor bank, which is also the first mortgagee. Renting out residential premises without the consent of the bank is a direct violation of the terms of the loan agreement with the ensuing consequences, since basically all banks have these conditions spelled out in the agreement itself.

Any residential premises purchased by an NIS participant using funds from a targeted housing loan is pledged in favor of the Russian Federation represented by the Federal State Institution Rosvoenipoteka. This should also be taken into account when making a decision to rent out such housing, and agree on this option for disposing of your own property with the Federal State Institution “Rosvoenipoteka”.

How to get it - step by step instructions

The registration procedure is as follows:

- Registration in NIS. It is necessary to draw up a report addressed to the commander of your unit about your desire to join the register of the Ministry of Defense of the Russian Federation. In case of positive consideration, a savings account is opened in the name of the participant and a special indication number is assigned. Participation is confirmed by a NIS participant certificate.

Officers do not have to do this, since information about them is already in the register.

- Studying mortgage programs and choosing a bank. The conditions in all banks are almost the same, but you need to choose one lender that offers specific loan conditions. Only a limited number of banks are engaged in issuing mortgages for military personnel - about 13 institutions. The most popular credit institutions participate in the system: VTB-24, Sberbank of Russia, Svyaz Bank and others. We provided a list of the most reliable banks participating in the military mortgage program in this material.

- Selecting a specific property. The participant must choose accommodation in advance so that there are no problems with this in the future. The property must comply with the current norms and standards of the Housing Code of the Russian Federation (read about the requirements for real estate purchased with a military mortgage here).

- Application form for obtaining a loan. The information of the serviceman is recorded in it. Mainly contains the following items: name, age, place of registration, marital status, presence of children, length of service, place of service.

- Passport of a citizen of the Russian Federation. If guarantors are involved, their passports are also required.

- Certificate of participant of the NIS of housing provision for military personnel. It confirms the existence of the right to mortgage benefits.

- A document for the property for which a mortgage is being purchased. The exact set of documents will depend on what kind of housing is chosen.

Let us consider in detail the documents required to submit an application to the bank:

Coordination with the insurance company

In addition, the possibility of renting out residential premises should be discussed with the insurance company. Real estate purchased under the “Military Mortgage” program is collateral in accordance with the Federal Law “On Mortgage (Pledge of Real Estate)”, the mortgagor (in our case, a military serviceman) is obliged to insure the pledged property, and in the case of renting out the risks of loss and damage to the collateral assets increase. Obviously, in this case, the insurance company can quite naturally calculate the insurance premium at an increased rate, but if any insured event occurs during the period of renting out the premises, the insurance company will compensate for the damage. Otherwise, if the hiring agreement was not carried out, the insurance company will legally refuse to compensate for the damage, and the burden of restoring the collateral or repaying the loan debt will fall entirely on the shoulders of the borrower.

Any agreement with both the mortgagee and the insurance company must be made in writing and have written approval from all interested parties. In cases with a creditor bank and an insurance company, a written request should be prepared; it can be sent either by mail or submitted directly to the organization’s office.

When making a request to the Federal State Institution “Rosvoenipoteka”, it is recommended to prepare a written application (it is advisable to have the bank’s consent in hand at the time of sending this application and attach a copy of this consent to the application). It should be taken into account that in accordance with 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation,” a written appeal from citizens is considered within 30 days from the date of registration of such an appeal.

Once all approvals have been received from both the mortgagee and the insurance company, the service member should enter into a rental agreement. Banks that approve the rental of premises are asked to use their standard rental agreement form. If the bank does not insist on using a specific form of agreement, the serviceman should carefully consider its drafting, and it would not be a bad idea to seek the help of a qualified lawyer.

Residential rental agreement

When drawing up a rental agreement, you should take into account the basic provisions in order to protect yourself in the future from possible risks.

In accordance with Article 671 of the Civil Code of the Russian Federation, under a rental agreement for residential premises, one party - the owner (lessor) - undertakes to provide the other party (tenant) with residential premises for a fee for possession and use for living in it. The agreement is drawn up in simple written form. The contract should specify the subject of the contract, full information about the residential premises, including the exact address, area, total number of rooms.

It is advisable to include in the text of the contract: the rights, obligations and responsibilities of the lessor; rights, duties and responsibilities of the employer; a list of citizens living with the employer on a permanent basis and temporarily residing; conditions for current and major repairs of residential premises; size, terms and procedure for payments for residential premises; term of the rental agreement; other conditions (for example, conditions of operation of movable property, conditions of keeping animals, etc.); conditions and consequences of termination of the contract; procedure for resolving disputes; full details of all parties to the contract (full passport details, contact details).

Also an integral part of the contract is the act of acceptance and transfer of residential premises. The transfer and acceptance certificate must reflect the actual state of the property being transferred for use, the state of communications of the transferred movable property, and, if any, the condition of furniture, equipment, and the very fact of transfer in due time. If there is an agreement to transfer the payment by cash payment, a free-form schedule table should be drawn up, where the employer and the lessor will record the fact of transfer of funds, indicating the date, amount and purpose of payment, and it is possible to issue a receipt. If the rent is transferred by bank transfer to the landlord's bank account, payment is confirmed by a bank payment order or receipt.

At the end of the contract, care should be taken to draw up an act documenting the transfer of property intact and the absence of claims from both parties.

It should be noted that a rental agreement concluded between individuals is not subject to registration, regardless of its validity period. A rental agreement, in accordance with Article 35 of the Civil Code of the Russian Federation, is an independent agreement and is not a type of lease agreement (Article 34 of the Civil Code of the Russian Federation), and, therefore, the rules on state registration of a rental agreement do not apply to the rental agreement.

One of the elements of the legality of disposing of residential real estate in the form of rental is the declaration of income in accordance with the Tax Code of the Russian Federation. In accordance with paragraphs. 4 paragraphs 1 art. 208 of the Tax Code of the Russian Federation, income received from renting out premises is subject to personal income tax. Military personnel receiving payment from the rental of their living quarters are required to independently, before April 30 of the year following the period of receipt of income, submit a declaration in form 3-NDFL to the tax office (at their place of residence). Payment of the tax itself is carried out after verification of the submitted declaration, until July 15.

Hiring “on the sly,” at your own peril and risk, may be of interest to both the prosecutor’s office and commanders. Having all approvals, contracts and confirmations of tax payment in hand allows you to avoid situations involving loss of trust and live with a clear conscience, according to the law.

The funds received from the rental of residential premises can be used by the military personnel at their own discretion. However, Military Relocation believes that it would be more appropriate to use these funds for partial early repayment of the mortgage loan received under the Military Mortgage program. Directing funds for partial early repayment helps reduce the loan term and interest payments for using the loan, and, consequently, reduces the cost of the loan itself.

As a result of early repayment of the debt from the bank under the “Military Mortgage”, funds allocated from the budget of the Russian Federation and previously allocated to repay the loan will be formed in the personal savings account of the NIS participant, and after the right to use the savings becomes available, they will be paid to his personal bank account.

As a rule, apartments are purchased with a mortgage loan by those people who want to get their own home to live in. It's simple. But some borrowers are trying to make money in this way, so to speak. For example, a person has a certain amount of funds that he can use as a down payment. After purchasing an apartment on credit, the borrower does not move into it, but begins renting it out to tenants. The borrower transfers the amount received from renting out the apartment to the bank account, that is, repays the debt. Thus, the apartment, as they say, processes itself.

Recently, the so-called military mortgage, that is, a mortgage loan for military personnel, has gained wide popularity. This raises the question of whether it is possible to rent out an apartment with a military mortgage.

As you know, many landlords prefer to rent out an apartment without declaring income, although in reality this turns out to be a commercial activity. But a military serviceman does not have the right to engage in commercial activities in accordance with paragraph 7 of Article 10 of the Law “On the Status of Military Personnel.” Military personnel have no right:

Engage in other paid activities, with the exception of teaching, scientific and other creative activities, if they do not interfere with the performance of military service duties. At the same time, pedagogical, scientific and other creative activities cannot be financed exclusively at the expense of foreign states, international and foreign organizations, foreign citizens and stateless persons, unless otherwise provided by an international treaty of the Russian Federation or the legislation of the Russian Federation;

Engage in entrepreneurial activities personally or through proxies, including participation in the management of commercial organizations, with the exception of cases where direct participation in the management of these organizations is included in the official responsibilities of a military personnel, as well as assist individuals and legal entities in carrying out business activities, using their official position.

Based on what was written above, it is easy to conclude that in this case the borrower cannot rent out the apartment. True, someone may say that a military man can place tenants in an apartment and pass them off as his friends or relatives - and he will be right, since it is difficult to prove entrepreneurial activity in this case.

If we were talking about a regular mortgage, which is issued to ordinary citizens, then we could say that they cannot rent out mortgaged housing - the corresponding clause is usually stated in the loan agreement. But since the mortgagee of the apartment is the Ministry of Defense of the Russian Federation, which pays the loan debt for the borrower, you can turn to Article 40 of the federal law “On Mortgage”. Here's what it says:

Unless otherwise provided by federal law or the mortgage agreement, the mortgagor has the right, without the consent of the mortgagee, to lease out the pledged property, transfer it for temporary free use and, by agreement with another person, grant the latter the right to limited use of this property.

This means that if there is no clause on the rental of housing in the contract, then, theoretically, the apartment can be rented out. Just don’t forget that this is still a commercial activity, which military personnel cannot engage in. This is a twofold situation.

The life of military personnel is unstable, and this also applies to living conditions.

It may happen that you have received housing, but you need to go to live in another region due to work.

But what to do with the apartment so that it does not stand idle?

In this article we will look at how you can rent out an apartment to a military personnel if it is owned.

Features of a military mortgage

How to get a military mortgage? Almost any military personnel, but due to the difference in entering the service, has the opportunity to become a participant in the savings-mortgage system. But in order to be eligible to receive a military mortgage, the terms of service in the ranks of the Russian army are stipulated for at least three years. It is important to note that there is no housing queue for military mortgages. An NIS participant can independently choose a living space that suits the terms of the mortgage.

Under this program, the Ministry of Defense military mortgages in the form of savings contributions are transferred from the budget to a special account of the military personnel. State funds are credited monthly, which can be used to purchase housing after 3 years of service. How to use a military mortgage, i.e. funds from a personal account, described here.

The so-called mechanism for cashing out a military mortgage comes down to the need to have at least 20 calendar years of service. After this, the NIS participant has the opportunity to use the accumulated funds at his own discretion.

Military mortgage for housing for military personnel - budgetary housing programs are provided by the Government of the Russian Federation together with the Ministry of Defense. Funds from a personal account can be used not only to pay for the purchase of a home, but also to repay an existing mortgage loan, or to pay a contribution when participating in shared construction. The size of the military mortgage for each will be individual due to the different period of service.

The military mortgage program for housing under a shared-equity agreement is regulated by Federal Law No. 214-FZ of December 30, 2004 “On participation in shared-equity construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation.”

At the same time, military personnel are not limited by any conditions in choosing the location and area of future real estate. In addition, the military mortgage program and the official housing in which the NIS participant lives do not contradict each other.

The amount of the annual subsidy received by the specified account of the participant in the military mortgage program is determined by the relevant budget law and is indexed each year for inflation.

How to use personal account funds

In order to use the accumulated funds for their intended purpose, those military personnel who are entitled to housing under a military mortgage independently select suitable real estate and a bank that has the right to provide a loan for military personnel under a military mortgage.

After completing the necessary documents and concluding an agreement between the seller and the creditor bank, the entire package of documents is transferred to the Ministry of Defense - Rosvoenipotek. It, in turn, is engaged in transferring the necessary funds to the credit institution.

It is also necessary to take into account that the rules for obtaining a military mortgage establish the amount of the central mortgage loan, which in practice does not exceed 2.3 million rubles.

Based on the fact that, in fact, in terms of the quantity and pace of housing construction, the center of military mortgages is Moscow, but real estate prices here significantly exceed the size of the housing estate. Therefore, an NIS participant wishing to purchase living space in the capital itself or the Moscow region will need to use additional funds - their own or borrowed funds.

In addition, the military profession is often associated with dangerous activities and risks. Therefore, an important condition and the main difference between a military mortgage and a regular civil one is the mandatory conclusion of a comprehensive life insurance agreement for the borrower.

What categories are housing eligible for?

- Mandatory - warrant officers and officers who entered into their first contract for service in the Armed Forces after January 1, 2005;

- Possible ones include:

- - officers in the reserve who served voluntarily or by conscription with the conclusion of the first contract after January 1, 2005;

- — Midshipmen and warrant officers whose contract service period as of January 1, 2005 is already three years or more;

- — Soldiers, sailors, foremen and sergeants who have a second contract in their hands after January 1, 2005;

- - graduates of universities with military specialties who, after training, signed a contract for service until January 1, 2005.

Is it possible for a military man to rent out an apartment?

It is impossible to give an exact formulated answer as to whether military personnel can rent out their housing.

Each case has its own characteristics that must be followed in order not to break the law.

To figure out whether it is possible to rent out housing, you need to understand how a military member owns real estate.

If it is owned

Important: Renting out your own home is not considered a business activity and is not punishable by law.

There is an opinion that if an officer rents out his home, this is called the activity of an entrepreneur. The Law (On Military Duty, Articles 10 and 27) strictly prohibits military personnel from conducting business activities, otherwise the consequences will be dire.

But this opinion is incorrect, because the owner has the right to dispose of his housing as he wants, that is, the law does not prohibit renting out living space.

That is, a serviceman can rent out an apartment; for this he does not even need to register an individual entrepreneur . To legally rent, you must enter into an agreement with the tenant and pay a tax of 13% of the money received.

Under a social tenancy agreement

If this is a social tenancy agreement (STN), then the situation is different from that of owning housing. Article 67 of the Housing Code of the Russian Federation states that the tenant can sublet living space.

But Article 92 of the Housing Code of the Russian Federation states that residential premises that are included in the housing stock intended for specialized purposes (in this situation, this is service housing) cannot be rented out in this way. That is, you can rent out an apartment only if it is your own. Another person cannot rent this property under a power of attorney or rental agreement.

Purchased with a military mortgage

So, is it possible to rent out an apartment purchased with a military mortgage? Recently, housing purchased under a special housing loan program has become popular. In this case, apartments in the capital and St. Petersburg are not popular, as they are very expensive.

As a result, the serviceman purchases housing in another region, and when he leaves for service in the above-mentioned cities, the apartment remains empty. A good solution here could be renting out as additional income.

Most of the problems are associated with the fact that housing with a mortgage is pledged by both the bank and the state. Also, the serviceman may have had to insure the collateral property. What to do with this problem, is it possible to rent out an apartment in which no one lives?

You need to take care of this even before you get a mortgage. It is necessary to ask the bank issuing a loan for the future purchase of real estate whether it is possible to rent out the apartment. If the bank is not against such a solution to matters, you can rent out the apartment without any problems. If the bank does not provide rental rights, it is worth looking for another bank.

In the case of an already concluded mortgage agreement, you need to carefully study the agreement - it should indicate whether the property can be rented out. If possible, again, you can take it without any problems. Most banks are not too concerned about whether the apartment is for rent or not , therefore, most likely, you can find a note in the contract that the living space can be rented out.

As for property insurance, it is also advisable to agree with the insurance company about the rental in advance.

If you already have an insurance contract and the nuances of the lease are not specified, there may be problems in the event of an insured event - it will not be possible to obtain it even through legal proceedings.

Since the property is pledged not only to the bank, but also to the state, you must also obtain its permission. To do this, you need to contact the officials. If you rent out an apartment without permission from the state or the bank, the bank may check the property as collateral and you will have to repay the loan ahead of schedule because the loan terms have been violated.

Important: If the apartment will be rented out, the amount of insurance may be larger than usual, since in a rented property the possibility of an event against which it is worth insuring is much more likely. .

Requirements for the contract

Persons liable for military service have the right to compensation for renting premises if the commander of a unit (unit) is unable to provide his subordinate with official housing (what is the procedure for drawing up, concluding and terminating a rental agreement for official residential premises?). Officers are forced to enter into lease agreements with apartment owners who rent them out.

If a serviceman, in the case of renting residential premises, intends to reimburse part of the money spent at the expense of the state, he needs to enter into an official agreement. Executed between the owner and the tenant. Legal entities, individuals and municipal authorities can act as the owner.

The definition of lease or lease is located in the Civil Code (Chapters 34 and 35, respectively): under a lease (property lease) agreement, the lessor (lessor) undertakes to provide the lessee (tenant) with property for a fee for temporary possession and use.

When the residential premises belong to the city, the tenant of the housing, based on

social rental agreements

and, with the written consent of the landlord (relevant government bodies), enters into a sublease agreement with the tenant.

Read about who the lodger, tenant and tenant are, what rights and responsibilities they have, here.

For an individual, a rental agreement (Article 671 of the Civil Code of the Russian Federation) for a certain period is usually used.

Article 671 of the Civil Code of the Russian Federation. Residential rental agreement

- Under a residential lease agreement, one party - the owner of the residential premises or a person authorized by him (lessor) - undertakes to provide the other party (tenant) with residential premises for a fee for possession and use for living in it.

- Legal entities may be provided with possession and (or) use of residential premises on the basis of a lease or other agreement. A legal entity may use residential premises only for the residence of citizens.

More on the topic Permission to build a house on your own site in 2020

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

The grounds for payment of compensation are:

- copies of identification documents of all family members;

- rental agreement;

- statement of enrollment in the military unit;

- report addressed to the commander;

- certificate of family composition.

Payment may not be made if the person liable for military service is not in line for service housing or refuses it for unknown reasons.

The lease agreement is concluded in writing. It should reflect the following basic data:

- date of conclusion of the contract;

- passport details of the owner and tenant;

- document confirming ownership with a copy attached;

- address;

- total and living area of the premises;

- term of the contract;

- monthly payment amount;

- calculated number.

Terms of imprisonment

The term of the lease agreement can be any, from one month to infinity. And hiring is for a maximum of 5 years. If the contract does not specify a term, it is considered to be concluded for 5 years. Read about how to properly rent and rent out an apartment for a long period of time here.

Payment order

The serviceman pays for the rent of the premises independently from his own funds, then monetary compensation is received along with his allowance every month to the serviceman’s personal account. If for some reason compensation has not been received, you must contact the financial authorities assigned in accordance with the established procedure to the military unit in writing or by telephone.

At this point in time, registration of lease agreements by military personnel and members of their families is not provided, provided that it is concluded for a period of less than 12 months. If necessary, you can apply for registration to specialized organizations (Rosreestr, MFC), the preparation of the necessary documents requires a certain period of time from 7 to 14 working days.

Upon formalization of the contract, the owner will be required to pay income tax at the end of the year.

Under what conditions is it feasible?

As mentioned above, under certain conditions, officers’ apartments can be rented out. Otherwise it may be punishable.

- So, first you need to determine on what basis the serviceman owns housing. Based on this, it becomes clear whether the apartment can be rented out.

- Owned housing is possible.

- According to the DSN - it is impossible.

- Housing with a mortgage is possible if you have permission from the bank and the state.

- If this property has a mortgage and there is no permission from the bank or state yet, you need to get them.

- Once all permits have been received, you can rent out the living space. Everything is done as usual: the tenant must sign a lease agreement and pay 13% tax annually.

We understand the details of renting out an apartment purchased with a military mortgage

The first thing a service member needs to understand is that you are not breaking the law by renting out your mortgaged apartment. There is a law that military personnel are prohibited from engaging in business. So, renting out an apartment is not a type of entrepreneurial activity. Read about this at the link. In addition, you, of course, can rent out an apartment to friends not officially, but this activity is considered illegal.

How much taxes will you have to pay?

When renting out an apartment as an individual, you can pay not 13% tax on this type of activity, but 6% as an individual entrepreneur.

For example, if you officially receive 12,000 per month, 144,000 per year, 13% of them is 18,200 rubles.

How to provide housing for rent?

Military tenants are different from ordinary tenants, because their housing is paid for by the military unit. It is quite difficult to rent a one-room apartment to military personnel; high-ranking officers usually live in such apartments.

The most popular are 2- and 3-room apartments, in which 2-3 military personnel will live.

The big feature here lies in the execution of the contract. They come in two types:

- the contract is drawn up for one person, the one who is considered the eldest among the rest. The names of other residents are simply written down in the contract, but payment is taken from everyone in an equal share, added together.

Several contracts - according to the number of rooms in the housing, as if everyone rents housing separately, but from the same owner. The cost of housing is also divided equally among everyone and paid in total to the landlord.

To rent out an apartment to military personnel, you need:

- make copies of documents confirming that the housing being rented is owned.

- Sign the agreement that is issued to the military in the unit.

It contains a minimum of information: you need to fill in the price, names and passport details. No other information can be entered into it. It must be filled out without errors, since tenants have only one document and do not have a spare one. For this reason, you can invite them to sign another regular agreement, which spells out all the nuances of renting housing, so that an adequate relationship can be built between the tenants and the landlord. - Copies of the property documents and part of the contract in both copies are sent to the military unit for verification; after receiving the seal, one copy is returned to the lessor.

Just in case, you can take a deposit - this way you can be sure that the military will return. Now you can move in the military.

Important: Money is transferred to military personnel after the fact, that is, when they have already lived in the apartment for a month. For this reason, the military formalizes the agreement retroactively.

apartment rental agreements for military personnel

It is profitable and honorable to be a military personnel, but at the same time, many prohibitions and obligations are imposed on this person. It is important to take them into account when renting and renting out housing in order to avoid problems with the government. You need to carefully read all the documents and think about renting in advance, then solving problems will be much easier.

Many military personnel, knowing 76-FZ “On the status of military personnel”, Article 10 “Right to work”, are afraid to rent out their apartments purchased under the loyalty program. After all, it states that a serviceman does not have the right to engage in entrepreneurial activity not only personally, but also through trusted persons. To avoid unpleasant situations, you should take into account the peculiarities of renting housing purchased on preferential terms. So is it possible to rent out an apartment with a military mortgage?

Based on Article 608 of the Civil Code of the Russian Federation, only the owner can rent out a house. In order to be a renter, the homeowner does not have to register as an individual entrepreneur.

In addition, based on the letter of the Ministry of Taxes dated July 6, 2004 “On the rental of premises,” the rental of living space is not considered entrepreneurial if the owner is an individual. face.

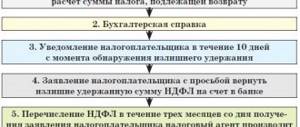

Thus, answering the question “Is it possible to rent out an apartment purchased with a military mortgage” and taking into account all the legislative aspects, we can answer in the affirmative. The only thing that is important is to follow this order:

- Bank permission is required.

- Take permission from Rosvoenipoteke.

- Make a contract.

- Pay taxes.

Grounds for purchasing housing with a military mortgage and at the expense of MSK funds

For citizens serving under a contract in the ranks of the RF Armed Forces, the opportunity to receive preferential loans for the purchase of residential real estate is provided.

The features of this type of loan are as follows:

- Only citizens who have a valid contract with the Ministry of Defense of the Russian Federation have the right to receive funds on preferential terms;

- for the entire period of validity of the loan obligation on the residential premises, a pledge is established in favor of the banking institution;

- upon dismissal from military service for guilty reasons, citizens lose the right to a preferential loan.

Note! The purchase of housing using such a loan is carried out by citizens applying to banks that provide this opportunity.

This is important to know: Agreement on the distribution of shares of maternity capital: sample 2020.

Not every credit institution provides lending on preferential terms to this category of persons.

Applying for a loan under this program allows you to immediately purchase housing owned by a serviceman’s family, without waiting for an apartment to be provided to him on the occasion of his transfer to the reserve.

The exercise of the right to receive maternity capital is not related to military service.

Conditions for issuing an MK certificate

To issue an MSK certificate and further manage funds, the following conditions must be met:

Thus, at the stage of completing documents to obtain mortgage funds or maternity capital, citizens will have to contact completely different government agencies and credit institutions.

Is it possible to use maternity capital with a military mortgage? This depends, first of all, on the possible ways of managing MSC funds.

Bank requirements

When deciding to rent out an apartment with a military mortgage, it is correct to initially contact the bank that issued the amount for the purchase of living space. There you must be given permission to rent out your home. At the moment, such permission is given by only one bank - VTB. To do this, the borrower needs to personally visit a bank branch, but first fill out the appropriate application on the bank’s website. In addition, after this you need to pay a commission in the amount of 1500 to 3000 rubles. Next, you need to send scanned copies of documents to the bank, which must include a lease agreement.

Other banks, including Sberbank, refuse, or ask you to contact your local branch for advice.

Conditions for the provision of state aid funds

An applicant to receive government funds under the program must meet the following criteria:

- become a member of the NIS and receive the appropriate certificate;

- To participate in the program, a soldier must be 43 years old ;

- the loan is issued only if the military man, his health, life, and property are insured;

- the bank provides an amount for the purchase of housing ranging from 300 thousand rubles to 2.4 million rubles ;

- The mortgage is provided for a minimum of three years .

It is important to choose the right banking institution.

Rosvoenipoteka cooperates exclusively with banks that have entered into an agreement to service military personnel in issuing loans. By the way, there are now the majority of such banks in the Russian Federation.

If a military man has served for three years, he can exercise the right to receive funds in advance by taking out a mortgage. The funds in this case can serve as a down payment or monthly payments.

Funds are transferred to a personal account for 20 years .

The choice of housing rests entirely with the military man and his family members. The state does not set the maximum cost of housing, its area and location. If you plan to purchase expensive real estate, the NIS participant pays the difference with his own funds.

Within the framework of the program, it is possible to purchase finished housing or participate in shared construction.

An innovation for 2020 in the context of a “military mortgage” is a one-time cash payment (LCP). It provides the right to quickly receive a subsidy if the following conditions are met:

- the total service life must be at least 20 years;

- Discharged military personnel must serve in the Armed Forces for at least 10 years.

Resolving the issue with the mortgagee

After purchasing a living space for a military personnel under the loyalty program, the first thought is whether it is possible to rent out an apartment with a military mortgage; one of the main “permitting” institutions is the bank. If you do not do this, then you will violate one of the clauses of the agreement with the bank, which will entail unpleasant consequences.

In addition, housing purchased under the loyalty program is pledged to Rosvoenipoteka, so it is important to resolve this issue with representatives of this body.

Coordination with the insurance company

The second authority you will need to visit is the insurance company. Contacting this authority is mandatory because you are dealing with collateral.

A military man can rent out an apartment purchased with a military mortgage only after notifying the insurance company. In this case, the cost of the policy may be slightly higher due to increased insurance risks. But if something happens to it during the delivery of the property, the company will compensate for damages under insured events.

If the insurance company is not notified of the decision to rent out the living space, then the damage will be compensated from the owner’s funds, which will entail additional costs.

What taxes do you need to pay?

Those who decide that they can rent out an apartment that they took out with a military mortgage should not forget about paying taxes. In accordance with the Tax Code of the Russian Federation, Article 208, Article 1, this process is carried out by declaring income. Military personnel who decide that it is possible to rent out an apartment purchased with a military mortgage must, by April 30 of the year following the one during which the income was received, be required to submit a declaration at the place of residence to the inspectorate in the form 3-NDFL. The tax itself is paid after checking the declaration by July 15 in the amount of 13% of the amount of income.