Free land plots for labor veterans

This regional law establishes cases of provision of land plots in state or municipal ownership, the disposal of which in accordance with the Federal Law “On the Enforcement of the Land Code of the Russian Federation” is carried out by local government bodies, into the ownership of citizens free of charge.

Article 1. The provision of land plots in state or municipal ownership into the ownership of citizens free of charge can be carried out in the following cases:

3) provision of land plots for private farming and livestock farming to parents with many children who have three or more dependent children, disabled people, parents with a disabled child;

4) provision of land plots for individual housing construction to parents with many children who have three or more dependent children, disabled people, parents with a disabled child, labor veterans, citizens exposed to radiation due to Chernobyl and other radiation accidents and disasters, citizens who lost their housing as a result of natural disasters, citizens who have a living space per family member of no more than 6.5 sq.m.;

5) provision of land plots for running a peasant (farm) economy for the first time to citizens from among adoptive parents, parents with many children, having three or more dependent children.

Article 2.

We recommend reading: return of household appliances under warranty

Benefits for Labor Veterans in Gardening Partnerships

Considering that for a number of categories of citizens, social support measures are established by laws and other regulations of the constituent entities of the Russian Federation , we were recommended to contact the Ministry of Social Protection of the Population of the Moscow Region, which told us the following: “The issue of providing social protection measures for paying for housing and utilities at the place of temporary residence of citizens is not regulated by law. Federal Law No. 66-FZ dated April 15, 1998... provides for the following concepts: entrance fees, membership fees, targeted contributions... which are not provided for preferential payment in accordance with the law." Thus, you can raise the issue of the availability of funds for the maintenance of your site only before the state, and not before a group of gardeners . In addition, the presence of ballast in a gardening partnership that is unable to pay targeted fees leads to the disruption of measures to resolve general social and economic issues of gardening, i.e. to the disruption of the achievement of the statutory goals of the non-profit organization for the sake of which it was created. As we see, any benefits must be established by the state in the form of a Law, which, among other things, must provide for a mechanism for reimbursing the costs of providing such benefits. And in conclusion, I would like to remind the “beneficiaries” of the words of the Holy Scripture: “ Do not covet... anything that is your neighbor’s.”

.My personal opinion is that the obligation to provide benefits is the duty of any state to its people. In damned America they say World War II veterans receive 5 thousand dollars in addition to their old age pension. I consider it an immoral attempt by some individuals to shift state obligations for benefits additionally (except for tax payments) onto the shoulders of other citizens. The Russian people are warm-hearted and sympathetic by nature; certainly, such calls on SNT are from good intentions. But today’s situation is when there is rampant capitalism and money is not so easily earned and does not fall from the sky , and the worst thing is that a person is not sure of the future . The day has passed and thank God. Therefore, taking additional expenses from the family budget for the maintenance of certain categories of gardeners is also immoral . I personally want to offer a general benefit for all gardeners and their minor children for travel during the summer season. Because the plot does not feed the gardener, I would not say so, since almost all of Russia lives off the harvest from the plot. In the Moscow region, this is less pronounced, a large percentage of vagrants. Therefore, I am against benefits at the expense of my neighbor in the area.

We recommend reading: Benefits for Young Families in 2020 in Tatarstan

Question answer

For land tax, the tax base is reduced by a tax-free amount of 10 thousand rubles. per taxpayer in the territory of one municipality in relation to a land plot owned, permanent (perpetual) use or lifetime inheritable possession of disabled people with disability group I, as well as persons with disability group II established before January 1, 2004, disabled people from childhood, veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations (clause

What land tax benefits are available to labor veterans?

- Moscow .

- Saint Petersburg .

- those who have a working experience of more than 40 and 35 years for men and women;

- those citizens who began their working careers under the age of 18 during the Second World War;

- persons who have various awards and honorary titles in the USSR, RSFSR and Russia;

- if the citizen has documented gratitude and certificates from the government of the USSR, RSFSR and Russia.

The citizens in question have the opportunity to count on a land tax benefit only if such an item is included in the corresponding regional budget for the current year (that is, for 2016-2017).

I got on the waiting list, but they didn’t give me a plot of land.

I have a question of this nature. In Voronezh, there is a rule on providing free land to military veterans on the basis of the following laws.

I think it would be logical to start solving this issue at the federal level, that is, with the Federal Law “on veterans.” This law does not establish the right of combat veterans to receive land.

This circumstance does not deprive veterans of the right to acquire free ownership of a plot of land, due to the fact that Art.

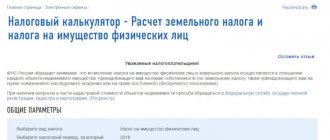

Legislative framework regulating the payment of taxes on land and real estate

The fundamental document regulating the procedure for calculating and paying taxes in Russia is the Tax Code. Until recently, the Law “On Personal Property Tax” was in force (repealed in 2020). All additions, changes and amendments to the Tax Code are made within the framework of the adoption of relevant laws at the federal level. In addition, the procedure for paying land tax is regulated by the provisions of the Land Code.

Land tax and property tax, including real estate, according to the Tax Code, are local taxes, that is, they go to local budgets. Accordingly, the procedure for their payment is influenced by local laws operating within the region.

Payment is made at the end of the tax period, which corresponds to the calendar year. That is, payment of land and real estate taxes for labor veterans for 2020 is made starting from January 1, 2020. The size of local taxes, similarly, is determined by the region.

Allocation of land plots to labor veterans

I heard that now labor veterans are given plots of land within the city. I don't know all the details. Maybe someone has already encountered this? Mom will go to the administration on Monday, we will ask.

According to clause 2 of Article 28 of the Land Code of the Russian Federation (hereinafter referred to as the Land Code of the Russian Federation), the provision of land plots into the ownership of citizens and legal entities can be carried out in cases provided for by the Land Code of the Russian Federation, federal laws and laws of the constituent entities of the Russian Federation.

We recommend reading: Eviction of a tenant

Benefits for paying for electricity in 2020

Payment for housing and communal services falls heavily on the shoulders and wallets of the majority of the country's citizens. The amounts on receipts are growing, but income is not keeping up with them. Therefore, benefits for electricity and other types of housing and communal services are now in demand, as are subsidies.

We recommend reading: Can Bailiffs of One District Seize Property of Another District

It is necessary to understand that part of the payments falls on the budget. For example, if a citizen is given a preference of 50%, then the state is obliged to reimburse the service provider. Moreover, the payer is the region, not the federal budget.

Application for provision of land sample

The applicant is a labor veteran. The applicant learned that he, as a labor veteran, has the right to receive a free plot of land. When the applicant tried to get information on this issue at the council, he was not even allowed there. They simply said that there was no land and there was simply no need to contact us about this issue. The applicant wants to exercise his right to receive a land plot. The applicant requests to be provided with a land plot in accordance with current legislation.

I, ______________________, am a labor veteran, in accordance with certificate No. ________.

Do labor veterans pay land taxes?

Veterans of labor, like other owners, pay land tax, but local legislation often establishes benefits, that is, a reduction in the tax base.

Regional tax services regularly carry out educational work among citizens to explain how to produce and pay taxes, what concessions are allowed, and how to prevent debt.

At the federal level, it has been established that labor veterans who are:

Land plot

Since 2005, the right to free privatization has been legislatively abolished. or free use. Since January 1, 2005, all land has been owned by someone. not registered physical persons - owned by the municipality (village council administration). The administration also paid money for the documentation of these (in fact ownerless) lands (otherwise it would be impossible to sell the plots).

There is simply no law on free allotment of plots of land! There is a program to allocate construction sites for large families.

Heating benefits

The area of housing is of no small importance . For persons with disabilities, the heated area will be taken into account in its entirety; for other citizens, it is possible to return funds only for heating 33 square meters of the apartment.

We recommend reading: Percentage of Dilapidated Housing in Russia 2019

By November, the pensioner paid off the debt and reapplied for benefits, which were accepted. In December, the woman received her first compensation payment. Of the 2,200 rubles actually paid for utilities , including 1,100 for central heating , Inna Makarovna returned 1,100 rubles.

What documents will be required?

From the documents you need to prepare:

- application according to the established form;

- passport;

- a document indicating the right to receive compensation (the presence of an appropriate preferential status);

- extract from the house register;

- a certificate confirming the absence of utility debts;

- certificate of income received;

- documentary evidence of income of other family members;

- confirmation of the location in a private house of a heating device that runs on solid fuel.

In some cases, the applicant may be required to provide a certificate indicating that it is impossible to install central heating in a residential building.

Is land tax paid on a garden plot in 2020 and how?

Due to the large difference between cadastral and inventory values, the legislation provides for a transition period lasting 5 years. During this period, reducing factors will be used when calculating the amount of the contribution to the state. During this period, you can challenge the assessed value, since it is not always adequate.

In order not to contact the tax office every year, it makes sense to contact its specialists so that you can be included in the mailing list. At the same time, you will be able to find out about the benefits you are entitled to. To apply you will need to have the following documents with you:

Labor veteran of federal significance: benefits, payments, rights

- An application is submitted and then registered. The review is carried out by a special commission that will check the indicated information. This takes no more than 30 days from the date of registration.

- The decision can be positive or negative, of which the person is notified within 5 days.

- If the decision is positive, an administrative act is created, after which the person can receive a labor veteran’s certificate.

We recommend reading: Honorary Donor in the Republic of Bashkortostan Benefits 2020

Amounts of land tax for pensioners and existing benefits

In each specific case, you need to take a number of measures in order to find out whether benefits are available and what criteria should be met. Only in this case will it be possible to reduce the tax burden on land property.

- you need to obtain a demarcation plan and a cadastral passport, if it has not already been done;

- after registering the plot of land, it is assigned an identification number, which allows you to find out the value of the plot today;

- you should register on the official website of the Rosreestr to go to the portal and find the benefits column (after selecting the territory and indicating the type of tax, you can familiarize yourself with the local rates for pensioners);

- the cadastral value of the plot is multiplied by the specified rate (it cannot exceed 0.3 percent and is applied when a person does not qualify for exemption).

Tax on the sale of land: what has changed since 2020

By April 30 of the year following the year of sale of the land plot, the owner must submit a declaration to the tax authorities. Moreover, the payer will have to calculate the personal income tax independently.

- The only living space was sold specifically to purchase another.

- If the object has been owned for more than three years and its value does not exceed 5 million rubles.

- If the price at which the living space is sold is less than or equal to the one at which it was purchased. To do this, you must provide the relevant documents.

We recommend reading: Amount of subsidy for the purchase of housing for those on the waiting list 2020 in Moscow