The purpose of the TIN, how to obtain it, whether it can be replaced when changing place of residence.

In connection with a change of place of residence, citizens of the Russian Federation are faced with the problem of replacing some documents and making changes to others; the issue of changing the taxpayer identification number (in common parlance, TIN) is no exception.

The article will help you understand what it is, what it is intended for, and whether the TIN changes when you change your place of residence. Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question free of charge To solve your problem, call: You can also get a free consultation online.

How is an identification number assigned?

All taxpayers, citizens and legal entities, are required to obtain a taxpayer identification number, or as we used to call it for short - TIN.

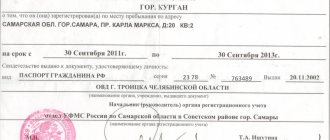

The document contains an individual set of numbers - a number that is assigned to all taxpayers in our country. It is a certificate of registration with the tax authorities, which indicates the person’s last name, first name, patronymic and a digital code that will not change throughout the citizen’s life. The TIN is mandatory and is assigned from the moment of registration with the regulatory authority at the place of residence or temporary stay in accordance with the application submitted by the taxpayer. To receive it, you need to contact the territorial tax office at your place of registration, provide your passport, a copy of it and an application on a special form. You can also fill out and submit the document electronically through the “government services” portal, then visit the government agency within the prescribed period and receive a taxpayer certificate. You can do the same if you need to change the document. The tax office has the right to carry out actions to assign an identification number independently, without the participation of an interested party.

It won’t be difficult to find out your TIN (if necessary, even someone else’s). You can request information via the Internet using a special service of the Federal Tax Service of the Russian Federation. This is often done by employers or counterparties of a legal entity.

Is it possible to change the TIN not according to registration, but according to place of residence?

You can change your TIN not by registration.

The code of our country states that citizens can apply for a code for the first time at the tax organization at their place of actual residence. That is, if ident. the code has not been assigned before, then you can contact the tax authorities of the district or city where you actually live. In this case, you will have to pay state tax.

If you previously received such a document and then changed your last name, then you can also change the TIN not by registration, but by place of residence. To do this, go to the Federal Tax Service of the region where you live and present your passport. You will also need a temporary registration document.

Tags: residence, place, change, change

« Previous entry

What is the purpose of the TIN

The existing number allows government bodies to exercise control over the payment of taxes, monitor tax and pension contributions, etc. Upon registration, the authorized body is obliged to issue a taxpayer registration certificate, change it (if necessary) and issue a new one. If a person, for some reason, did not do this himself, the tax service has the right to perform these actions for him.

You will not need to change your TIN when changing your place of residence. However, it is important to know that when you change your registration, the territorial tax authority where you will be registered also changes. Therefore, it is necessary to bring the documents into compliance.

Attention! Do not confuse replacing your TIN with replacing your taxpayer certificate. The identification number will never change; only a paper document - a certificate - can be replaced, since it indicates a specific territorial tax authority and the personal data of the taxpayer.

Changing your TIN when changing your place of residence is not required, regardless of whether you change the area within the same city or when moving to another region of the country. But changes that relate to registration should be made to the document, so that later discrepancies in the papers do not lead to confusion; the information specified must correspond to what is in the passport, because an identification number is necessary:

- to apply for a job in the public service;

- when filing an income tax return;

- when preparing and filling out all kinds of documents;

- to obtain information from tax authorities;

- to register a citizen as an individual entrepreneur if he intends to engage in business;

- to receive a loan (not required, but may be required).

And this is not the entire list of actions where such an important document is needed.

Documents to be replaced

When planning a change of residence, it is recommended to find out in advance what needs to be updated when moving. According to the current legislation, it is not necessary to change the TIN, but this rule is not general. So, what documents need to be replaced when moving or changing residence? The main ones are the following:

- Passport. There is no need to completely replace the document. It is enough to make changes to the page displaying the place of permanent registration. To carry out the procedure, you need to contact the MFC at the place of your current registration with an application for its cancellation. Next, you need to contact the MFC located at the new place of residence, provide documents confirming the possibility of registration, for example, ownership of the purchased apartment, and also fill out an application for registration according to the new place of residence.

- Citizens classified as liable for military service must also make changes to their military ID to change the place of permanent registration. To carry out this procedure, you need to contact the territorial military commissariat.

- If a citizen has a vehicle, it is necessary to make appropriate changes to the vehicle registration certificate.

- Citizens who are pensioners are required to visit the PF located at their new place of residence to complete the registration procedure.

It is necessary to highlight a number of documents that do not need to be changed when changing place of residence or registration. These include:

- TIN. As mentioned above, a unique number is assigned to a citizen once and is valid throughout his life.

- Driver's license. When changing the place of permanent registration, there is no need to change rights.

- SNILS. There are no requirements to change the insurance certificate, since the territorial divisions of the pension fund can exchange information, including a unique citizen code, independently.

- Compulsory medical insurance policy. This document is valid throughout the entire state and cannot be replaced when personal data changes. An exception is a change in last name, first name or patronymic.

When planning a move, it is important to inquire in advance about the documents that require replacement. In some cases, the possibility of changing is limited by short deadlines, violation of which entails administrative liability and penalties.

The law does not provide for the obligation of citizens to change their TIN when changing their registration, place of residence or other personal data. Moreover, such a replacement may be regarded as fraud. The identification number is assigned once and remains valid throughout life.

What documents do I need to change when changing my registration? Moving is a serious matter, requiring time and nervous tension.

In addition, the changes will also affect the personal documents of the person who has changed his place of residence. Some of these papers remain unchanged, others require adjustments.

The first action that needs to be taken in a new place is to settle the issue of registration.

All institutions and services are tied to the territory assigned to them for service, so any application makes sense only with a passport with a stamp of registration in the given area.

The wisest thing to do is not to waste time on deregistration from the previous place of permanent location, but to immediately issue a simultaneous registration and deregistration by contacting authorized persons at the new location.

We invite you to familiarize yourself with the process of dismissing the director of an LLC at your own request, execution of all documents, sample order

By the way, this is not only more convenient and saves time (one less visit to the relevant authorities), but also protects against delays: in this case, deregistration and registration at the new address will be dated on the same date.

You should not even try to visit any of the institutions without a re-registered passport; in any authority, first of all, they will check whether you are registered here.

When changing your address you will need to change:

- certificate of ownership;

- papers for the car - vehicle registration certificate.

You will need to change the license plates on your car and enter information about the driver who has just arrived in the region with his car into the traffic police database.

By registering again as a newly arrived car owner, a citizen will be able to move without problems in his new locality in his own vehicle.

It is important to keep in mind that the registration rules (Order of the Ministry of Internal Affairs No. 1001) oblige the re-registration of a car even within the same region, since the address has changed. They will correct the car’s passport, as well as the MTPL policy. There are opinions that this is not necessary, but it is advisable to bring all your papers into compliance.

There are two more documents that you cannot do without at your current place of residence:

- military ID;

- pensioner's certificate.

These papers do not change, they are valid.

And although the migration service must notify the military registration and enlistment office and the regional pension fund about the replenishment, it is worth coming to both of these departments without wasting time.

Without military registration, a citizen liable for military service will not be hired, and the question is not only this, but the notification nature of the registration: the military department must know that there is one more defender on their territory. The result of registration will be a mark on the military ID - a stamp of the corresponding content.

It is important for the pensioner to get to know his inspector and make sure that he is already registered here at the request of the registration authorities. If such a pensioner is not yet on the list, then you need to make sure that all the information is now entered into the card index, and at the same time clarify when to expect the money and choose the method of receiving it. But the funds will not be paid immediately; you will have to wait until the pension fund receives the senior citizen’s case upon request from its previous location.

If you have bank cards, you can use them throughout the territory, but you still cannot do without being linked to local branches of the relevant banking institutions. Employees will enter information about the client into local databases, correcting the address. Now, if you change your card after its expiration date, or if you lose it, you will not need to return to your previous city or village.

Replacing the TIN when changing temporary place of stay or permanent residence

If the question is about a temporary change of residence in connection with leaving the place of study or you intend to engage in work activities in another city, the identification number will also not change, it will remain the same, since it is uniform and will be valid throughout the entire territory of the Russian Federation, even if the registration of stay issued temporarily.

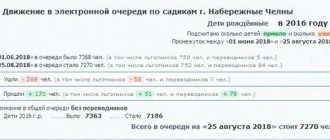

Many people who change their place of permanent residence have a question: when changing their place of residence, it is necessary to change the TIN or not. It is not necessary. Since the tax office will change when you change your place of residence, the service will carry out data exchange activities and the information will be provided to the authorized regulatory body at the citizen’s former registration address. As a result, the person is deregistered from the tax office at the previous place of residence and registered at a new address.

Changing the TIN when changing place of residence is not provided for by any legislative acts, since the number is assigned to a citizen once and for life. Changes can be made at the request of the taxpayer to the document - a certificate of registration with the tax authority.

TIN certificate, compulsory medical insurance policy and change of registration

The TIN certificate is issued to a person once; using this number, tax authorities can track income and control timely tax withholdings.

This figure accompanies a citizen throughout his life, regardless of a change of address, region, or even last name.

Legislative acts, namely Art. 84 of the Tax Code of the Russian Federation and clause 16 of the Federal Tax Service of Russia dated June 29, 2012 N MMV-7-6/435, Order of the Ministry of Finance of the Russian Federation dated November 5, 2009 N 114n clarified that the taxpayer certificate is valid throughout the country and does not require replacement, unless the citizen changed gender.

Even if the last name is changed, the paper is replaced, personal data is corrected, and the number itself is left the same, since it was and remains the same person, of the same gender, with his own history of income and taxes.

The tax office will be notified of the arrival of a new citizen by the registration authorities when the relocated person registers at a new address.

The compulsory medical insurance policy, in accordance with the requirements of the law “On Compulsory Medical Insurance,” is not changed, since this document is valid and recognized in any region of the Russian Federation.

In order for a new resident to be able to receive medical care and any medical services, you need to take your compulsory medical insurance policy, as well as a passport already registered in the new place of residence, a medical card, and at the clinic registry, territorially assigned to the residence address, they will create a new card or update the cover on the old one.

Free legal consultation

Attention! Due to continuous changes in legislation, the legal information on this page may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Previous

Change of place of residence Address sheet for departure from previous place of residence

Next

Change of place of residenceProcedure for registering a car with the traffic police when changing place of residence, list and document forms

What is a TIN and why is it needed?

For what purposes, where and when can a TIN certificate be useful? Since this number is individual, no person can be obliged to provide it. There are exceptions, but they are few. For example, a certificate may be required if you are seeking employment in government agencies, but if we are talking about employment in another organization, there is no need to provide it.

Bank employees also do not have the right to force a citizen to provide his personal TIN when applying for a loan, or tax inspectors in the process of accepting a declaration.

The declaration, submitted in the form of Form 3 Personal Income Tax, must contain your full name and, at your choice, either passport data or TIN.

Where and how do you get a TIN? This issue is solely within the competence of the tax authorities, since they are the ones who assign TINs, register individual entrepreneurs, and also perform many other tasks.

The certificate itself confirming the registration of an individual, where the assigned TIN is indicated, can be obtained from the tax authority at the place of residence when submitting a separate application.

The certificate can be issued within five days (working days), but often it is issued immediately upon the applicant’s request.

Tax deduction for purchasing an apartment 2020: changes.

How to calculate land tax based on cadastral value, read here.

Read about land tax benefits for pensioners at the following link:

It can be issued again when making a corresponding request (a free form is used). Additionally, a payment document is submitted with it to confirm that the fee has been paid. Its size is 200 rubles, but if it is necessary to speed up the issuance process, the amount doubles. The certificate itself is received on the next business day.

Since 1999, the tax service receives all data on newborns from the registry office, for this reason children are assigned their TIN immediately. To obtain a certificate, the parents or legal representatives of the child need to write an application to the tax service (based on registration).

However, there is a difference between the certificate and the TIN number itself:

- The first is issued only with a corresponding application submitted by citizens;

- Sometimes there is a need to change it.

The number, of course, does not change because of this - only the information contained in the certificate can be updated. This can happen, for example, when incorrect information about a citizen is identified in the certificate or when a name or surname is changed. Under these circumstances, the citizen will need an updated certificate, which he can obtain by contacting the Federal Tax Service at his place of registration.

Since the TIN will not change, there is no point in rushing the process of obtaining an updated certificate. Urgent replacement may only be necessary under the following circumstances:

- A citizen applies for a public position, where a complete match of the information displayed in the passport and certificate is necessary;

- If it is necessary to obtain a tax deduction for personal income tax;

- If the taxpayer loses his certificate.

How to become a TIN holder

The law states that citizens can obtain a taxpayer identification number from the tax office at their place of residence. The document production period is 5 working days. It is calculated from the moment of submission of all necessary documents:

- Passport of a citizen of the Russian Federation.

- A copy of your passport.

- Statement.

This process is not complicated and should not delay you much.

You can get a certificate even faster, check out some recommendations:

- Find out in advance via the Internet or a reference office the address of the tax office at your place of residence and opening hours.

- You must have your passport and copies of all completed pages with you.

- The application form can be filled out in advance (by downloading a sample from the official website) or on the spot.

- In 5 days you will be able to appear to receive it. The paper will contain your personal data and a 12-digit number.

- At your request, the TIN can be added to your passport here at the tax office.

TIN - where is it changed?

To change, you can contact the tax office directly (at your place of registration), or the department of the multifunctional center ( MFC ) (this is just the answer to a frequent question from our readers: is it possible to change the tax identification number in the MFC?), which performs the functions of the tax service.

Cost and state duties

Re-obtaining a certificate is subject to a fee only if it is lost or damaged. The state duty in this case is 300 rubles.

When changing your last name, first name or patronymic, obtaining a duplicate is not subject to state duty.

Replacement timing

The legislation does not regulate the period during which it is necessary to change the TIN. The TIN certificate itself is almost never required to be presented.

In this case, the new certificate must be in hand and the information in it must match the passport data, which should be taken into account when replacing. A new form with the TIN is made within 5 calendar days , that is, during this period after submitting the application, the citizen is obliged to appear at the tax authority to receive a new TIN certificate.

When you change your legal address, does the tax identification number also change?

Attention

As practice shows, only if you have lost a document will you need to restore it. Or, more precisely, get a duplicate. And nothing more. Therefore, if you are wondering whether you need to change your TIN when changing your registration, the answer will be negative.

You shouldn’t even rack your brains over this topic. Actions upon change In general, do you need to do anything when you change your place of registration? In principle, no. After all, such a document is required exclusively for tax services. And in Russia they are all interconnected. And when a person moves to another place of residence, all information about him is transferred automatically. Including TIN. The tax service of your previous district will notify you of your move to the branch associated with your place of registration. Your personal information will be automatically replaced. It turns out that the TIN is not tied to the place of registration.

This number is issued to a citizen once. And for life.

Change of TIN by mail

Before changing your TIN by mail, you must visit a notary’s office and have a photocopy of your passport certified by a notary. After paying the state fee, make a copy of the payment receipt. Then go to the portal of the Federal Tax Service and fill out the “2-2-Accounting” form. Print out the completed application, attach all the necessary photocopies to it and send it by registered mail to the address of the tax office at your place of residence via mail.

Other services are available on the website of the Federal Tax Service: obtaining a TIN via the Internet not at the place of registration, the ability to change the TIN, issuing a TIN for a child, the ability to find out your own and someone else’s TIN.

Thus, you can easily and quickly change your TIN in case of any changes in your data - change of first name, patronymic, last name or loss of TIN.

Tip 1: How to change the TIN when changing your name in 2020

Urgent replacement is necessary only in cases where:

- the citizen will have to work in the public service or in organizations where an exact match of the data in the TIN certificate and the information in the passport is required;

- he wishes to apply for a tax deduction for personal income tax;

- the taxpayer has lost the certificate - in this case it is necessary to obtain a new one for a fee.

Taxpayer Identification Number or, as it is popularly called, TIN is a document that is necessary for every taxpayer. Since 2000, every citizen must obtain a TIN as a mandatory requirement. This document is often required when applying for a job. In addition, a TIN is often required to fill out tax and other documents.

The TIN does not change throughout life. It is issued to a citizen once and for all, but the document itself on which this number is written must be changed in the event of a change of surname due to marriage. So, how to change your TIN?

What documents need to be changed when moving?

Changing our place of residence does not impose any special obligations on us to the state. All that is required from a citizen is registration of permanent or temporary residence. When purchasing an apartment, the owner has every right to change his registration and register for a new living space. If he is staying in another place temporarily, he must register with the local authority of the migration department of the Ministry of Internal Affairs (formerly FMS) within 7 days after arrival.

There is no need to change any documents. When receiving a new registration, you need to put the appropriate stamp in your passport; to do this, you need to appear in person at the territorial office of the Ministry of Internal Affairs for migration issues or the passport office, presenting documents on ownership of the apartment.

In addition to the new registration in your passport, when changing your place of residence, you must update:

- vehicle registration certificate;

- pension certificate (if available);

- military ID (if available).

If there are other documents that indicate the address of the former registration, then they will also have to be changed. When applying for medical help, you will have to get a new card at the district clinic.

When changing your place of registration, you do NOT need to change your SNILS (pension insurance certificate), health insurance policy, bank documents and cards, driver's license and other papers issued at the national level.

Getting a TIN has become easier: Video

Do I need to change my tax identification number when changing my registration?

Important

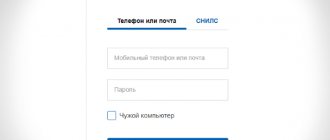

In addition to personally contacting the tax authorities, you can use the Internet to obtain a TIN certificate. You have every right to submit an application through the State Services portal, having an account there.

Usually there are no problems with this. Or the official website of the Federal Tax Service will help. The second option is more suitable, because for the first you may need a TIN. And if you don’t know him, you’ll have to abandon the State Services portal. First, create an account on the Federal Tax Service website and log in there. Next, fill out the electronic application form of the established form for issuing a TIN certificate, if necessary, provide copies of your documents with an electronic digital signature. And then just wait a while.