Is it possible to donate a garage using a deed of gift?

- Notary

- Step 1: collecting and preparing documents

- Arbitrage practice

Donation of a garage by deed of gift is permitted. A parking space, a separate standing building or a room located under or in a residential building are also donated, if there are title documents.

The transaction must meet the following requirements:

- The donor has the right to own the garage.

- Together with the garage, the land plot where it is located also becomes the property of the donee. Donating two objects separately is unacceptable.

- Absence of a counter condition for the transfer of money.

- You cannot give real estate with the condition that the right passes after death - inheritance rules apply.

- Donation is not allowed under the condition of the donor's lifelong maintenance by the donee - in this situation, annuity standards are relevant.

You can draw up a gift agreement for a garage in the future, where the property will become the property on a specific date or after the occurrence of a certain event: the recipient’s wedding, graduation from university, etc.

According to Art. 130 of the Civil Code of the Russian Federation, a garage is recognized as real estate, and on the basis of Art. 574 of the Civil Code of the Russian Federation, the deed of gift is drawn up in writing, and the transfer of rights is subject to state registration. The recipient has the right to refuse the gift.

Briefly: you can donate a garage, but you need to draw up a written agreement and re-register ownership in Rosreestr. A conditional transaction is not allowed; it is completely free of charge.

Complete the survey and a lawyer will share a plan of action for a gift agreement in your case for free.

Rules for registering a deed of gift

Since the legislation in the Civil Code of the Russian Federation establishes the rules for drawing up agreements, when drawing up a deed of gift for a garage, it is important to consider the following points:

- the subject of the transaction is indicated accurately and unambiguously. If the item is missing, the transaction is considered invalid;

- additional conditions are included in the gift agreement if they do not contradict the law;

- It is unacceptable to include in the deed of gift conditions on the reciprocal transfer of a gift from the donee to the donor, the payment of money or the provision of a service;

- Since the garage is considered a piece of real estate, after drawing up the agreement, it is necessary to register the resulting ownership. Without registration, the object is not considered the property of the recipient of the gift;

- donation from a minor or incapacitated person is unacceptable;

- the donation must be voluntary, the donor must be aware that the transaction will deprive him of ownership of the object;

- a deed of gift cannot be canceled due to a change of mind of the donor, so it is worth thinking carefully about this step.

Thus, there are rules that cannot be violated in the process of formalizing a transaction for the gratuitous donation of a real estate object.

Who can I give a garage to?

You can give a garage to anyone - the donor chooses the recipient, because... this is a voluntary transaction. But everywhere has its own characteristics.

Son or daughter

If the donor has children and the garage was purchased during an official marriage, the consent of the spouse must be taken and certified by a notary. Property purchased during marriage is recognized as common property, and alienation is possible only with his permission (Article 35 of the RF IC).

If the garage was purchased before marriage or received by inheritance or gift, consent is not required - the property is recognized as the sole property of the spouse (Article 36 of the RF IC).

Note! Permission will not be needed if a marriage contract is drawn up between the spouses, where the property acquired during the marriage belongs to the donor spouse.

For a minor child

To transfer a gift to a minor child, the consent of parents or legal representatives will be required. Children over 14 years old sign the documents themselves and go together with the donors to register the transaction. The participation of children under 14 years of age is not necessary - instead, all signatures are signed by one of the parents.

Unlike the alienation of a minor’s property, donating a garage to him does not require the participation of the guardianship authorities, so there is no need to obtain permission from them.

Grandson or granddaughter

Grandparents can give real estate to their grandchildren. If they are under 18 years of age, the rules described above for minor children apply. If the garage was purchased during marriage, you need to take the notarized consent of the spouse.

Grandchildren who have reached the age of 18 participate in the transaction independently.

Giving to spouses

If one spouse gives property to another, notarized consent to the transaction is not required - it is confirmed by the parties at the time of signing the gift agreement (hereinafter referred to as the DD).

Legal advice: think carefully before registering a DD. Property acquired during marriage under a deed of gift is not subject to division during divorce, because is the sole property of the spouse. We will have to cancel the DD (which is problematic), and then divide it through the court or by agreement.

Elena Plokhuta

Lawyer, website author (Civil law, 6 years of experience)

Close relatives

In this case, relatives should be understood as other people: aunts, uncles, brothers, sisters.

They can also be given garages and other real estate, observing the rules established for transactions with minors and cases of alienation of jointly acquired property by spouses.

To a friend or acquaintance

General rules apply for gifts to friends. If a friend is over 18 years old, it is enough to draw up a DD and register the change of owner in Rosreestr.

Briefly: you can give a garage to anyone. If the donee has not reached the age of majority, the consent of his parents will be required. Permission from the guardianship authorities is not required.

Other important nuances

In addition, in the process of registering a gift transaction, you also need to take into account a lot of other subtleties, ignorance of which can create certain difficulties.

Features of the procedure

Like any real estate, a garage must be properly registered as private property. The rules in accordance with which this procedure is carried out are prescribed in the articles of the Civil Code, and according to the paragraphs of the relevant articles, the preparation of documents for property is even simpler than for residential premises.

In particular, the current legislation provides for the possibility of using a simplified procedure for registering private property, and therefore the papers required for registration can be collected much faster.

The key difficulty here is that the garage is not only a specific building, but also the real estate that is located under it, and therefore many often forget about the land on which this object stands.

It is also worth noting that many also “forget” to purchase the appropriate share or invest in a garage cooperative, and therefore later experience certain problems in the process of conducting various transactions with this real estate.

Cadastral passport for the garage

Required documents

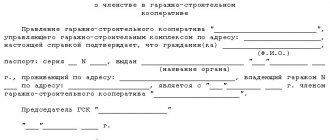

The list of documents will depend on which garage is being transferred as the object of donation. If the property is part of a garage cooperative, then during the process of drawing up the contract the donor will have to provide the notary with a document that confirms his ownership of the garage box.

Article 574. Form of gift agreement

Such a document can be an agreement confirming a citizen’s membership in a garage cooperative, which must contain information about how much this citizen contributed to purchase property in common use. The contributed funds give the citizen the right of ownership to certain real estate.

If the garage is officially the property of the donor, then in this case the notary will have to receive the following papers:

- a certificate received from the Technical Inventory Bureau no later than ten days before the transaction;

- a document that confirms the absence of any claims to the transferred property on the part of third parties;

- passports for the land plot and garage;

- notarized consent of each person who is the owner of this property.

In addition, the notary will be required to obtain documents confirming the identity of each party.

Sample of notarized consent

Conditions of the gift and cases of challenge

If the donee does not belong to the category of close relatives of the donor, then in this case, in accordance with current legislation, he will have to pay personal income tax, the amount of which is 13% of the value of the transferred property, stated in the cadastral passport.

In this case, the following persons can be considered as first-degree relatives:

- grandparents;

- spouses;

- dads and moms;

- children (including adopted children);

- sisters and brothers (including step-brothers).

All these citizens, by law, cannot be subject to any taxes in the process of conducting a real estate donation transaction, but if the relative does not belong to this category, and at the same time is not a resident of Russia, then in this case he will need to pay tax in the amount of 30% of the property donated to him.

Contesting a deed of gift can be carried out exclusively in court, and only the donor is allowed to do this.

In the vast majority of cases, this procedure is carried out based on the following factors:

- due to the execution of this transaction, the donor’s financial or physical condition has significantly deteriorated;

- any unlawful actions have been registered on the part of the donee towards the donor or his close relatives;

- the donee dies before the donor (if this condition was initially provided for in the process of drawing up the gift agreement);

- the recipient did not fulfill the condition that was set during the process of drawing up the deed of gift (for example, to quit smoking or something else).

Who has the right to act as a donor?

Donation of real estate is possible only by an adult and legally capable citizen. If the garage belongs to a child under 184 years of age, any transactions are prohibited.

If the owner has limited legal capacity, a guardian acts on his behalf, but with the permission of the guardianship authorities. The likelihood of it being processed is low.

Briefly: the donor has the right to be a citizen over 18 years of age, to whom the garage belongs as property. Donation on behalf of children by parents is possible with the consent of the guardianship authorities, and it is difficult to obtain.

Need help with a gift agreement?

Lawyers will answer your question regarding the deed of gift free of charge and in detail. Ask a question so you don't waste time reading!

Restrictions and prohibitions

Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

Registration of a deed of gift for a garage is not available to incapacitated and minor persons, as well as organizations. It is prohibited for the recipient of the gift to be employees of state or municipal institutions if their activities are related to the provision of services (goods) of any type. A minor may be the recipient of a gift. In this case, the mandatory participation of his guardian or representative is necessary.

To make a donation, you must be the owner of the object of the gift - a garage and land. In Russia, the alienation of a garage, which is what a donation is, cannot be carried out without transferring ownership rights to the land under the garage. A transaction executed without compliance with this rule will be considered void. Therefore, the donor first needs to register ownership of the garage and land.

Where to draw up a gift deed?

To get an idea of the cost of the deed of gift, check out the prices depending on the method of issuing it.

If you draw up a gift agreement yourself, for obvious reasons you do not need to pay - just pay the state fee when registering with Rosreestr.

Notary

A notary is needed only in two situations:

- a share of a garage with several owners is given;

- the owner of the property is a minor.

In the above cases, notarization of the gift agreement is required. It is not necessary to obtain the consent of the other owners for the donation.

If the garage was purchased during marriage and is alienated in favor of a third party (child, relative, friend), you will need a notarized permission from the spouse.

For notarization of the DD you will have to pay 0.5% of the cadastral value of the garage, but not less than 300 and not more than 20,000 rubles. (Article 333.24 of the Tax Code of the Russian Federation).

The cost of certification of the spouse’s consent is 500 rubles.

Let's look at the example of calculating all amounts:

The garage costs 1,000,000 rubles and is donated under the DD. Bought by the donor during marriage, i.e. your wife's consent will be required.

1,000,000 x 0.5% = 5,000 rubles. – fee for DD certificate.

5,000 + 500 = 5,500 rub. – general expenses, provided that the deed of gift is drawn up independently. If the parties turn to a notary for registration services, expenses will increase to 10,000-15,000 rubles.

Important! Prices for drawing up contracts by notaries are determined by regional notary chambers. They are usually significantly higher than those of lawyers. But if you contact a notary, he can transfer documents for registration himself - the service is provided free of charge from 2020.

MFC

The MFC employs lawyers who draw up contracts. You have the right to contact them and immediately register the gift deed. Their services cost 2,000-5,000 rubles.

Lawyers

Contacting lawyers from other organizations is the best option: they are interested in high-quality and competent drafting of contracts for clients.

Lawyers' services are cheaper: on average, deeds of gift cost 2,000-3,000 rubles. If you wish, you can order the registration of the transfer of rights from a human rights activist, and he will do everything himself, using a power of attorney.

Taxes and other expenses for the service

The cost of registering a deed of gift may include the following cost items:

- issuing paid certificates in an accelerated manner;

- payment for notary services;

- income tax, which is 13% or 30% of the value of the transferred property, depending on the status of the donee;

- payment of tax to the Federal Migration Service.

In accordance with the norms specified in the Civil Code, all relevant costs are borne by the donee or his guardian if he has not yet reached the age of majority. In this case, the donor is given the full right to, at his own request, take on all possible costs.

How to issue a deed of gift for a garage: step-by-step instructions

The transaction process consists of four steps. Let's look at everything in detail.

Step 1: collecting and preparing documents

The donor prepares the documents, because they are with him.

To register a DD for a garage you will need:

| Document | Where to get |

| Certificate of ownership of the land plot where the garage is located | MFC, Rosreestr |

| Cadastral passport | MFC |

| Documents on ownership of the garage | Rosreestr, MFC |

| Passports of the donor and recipient | Department of Internal Affairs of the Ministry of Internal Affairs, MFC |

| Notarized permission of the spouse (if required) | Notary |

| Parental consent to donate to a minor | |

| Registration certificate | MFC, BTI |

| Certificate of payment of the last share contribution | Chairman of the GSK |

Step 2: registration and certification of DD

The deed of gift is drawn up independently, by a notary or by lawyers.

Notarization will be required when alienating a share in property, or when making a transaction on behalf of a minor.

Sample contract

The deed of gift for the garage must contain information about:

- Full name, registration addresses, passport details, dates of birth of the parties to the transaction - the donor and the donee;

- address, area, cadastral number of the land plot where the garage is built;

- area and location of the facility;

- intentions to donate a garage to the recipient free of charge;

- date of entry into force of the DD.

Signatures of the parties are required. The DD is drawn up in triplicate.

Sample garage donation agreement:

Step 3: submitting documents to Rosreestr

Documents can be submitted to Rosreestr through the MFC - it’s easier. Both parties must appear to serve. It is recommended to make an appointment in advance.

The list of documents is listed above, but you will also need the contract itself.

State duty

Registration of rights to a garage costs 2,000 rubles. Additionally you need to pay 350 rubles. for re-registration of rights to the land plot where it is located.

Step 4: obtaining an extract from the Unified State Register of Real Estate

10 days after the application, the MFC specialist will issue an extract from the Unified State Register, where the donee will be indicated as the owner. The deed of gift is returned with a note about registration.

Are you planning to draw up a gift deed?

We’ll show you how to properly formalize and draw up an agreement so that it won’t be challenged in the future.

We arrange the donation of a garage yourself

When donating a garage recognized as real estate, a written agreement must be concluded.

To prevent Rosreestr and the tax office from having unnecessary questions, the donation must be unconditional. That is, the deed of gift cannot indicate the obligation of the donee to do anything for the donor. Otherwise, the agreement may be considered a sham transaction.

To ensure that the signed agreement contains all the necessary information, we recommend using a sample deed of gift for a garage. The document must include the following information:

- date and place of signing of the deed of gift;

- passport details of the donor and recipient indicating registration;

- detailed description of the garage: basis for acquisition (agreement, payment of a share in a cooperative, inheritance), address, technical characteristics (indicated in accordance with the property document or cadastral passport);

- a clearly expressed condition regarding the transfer of the garage as a gift;

- information about the presence or absence of an encumbrance on the rights of third parties (pledge, lease);

- information about who bears the costs of drawing up the contract and its registration (costs of a lawyer, notary, payment of state fees);

- the date it comes into force - from the moment of signing or after a certain time.

It is also useful to indicate in the text of the contract that the garage is being donated to a close relative. According to the Civil Code, donations between close relatives are exempt from personal income tax in the amount of 13%. Such a clause will protect you in advance from claims from the tax authorities - they will immediately see that under the agreement there is no possibility of additional taxes.

How can a notary help?

If desired, the agreement can be concluded in notarial form . The notary will draw up a deed of gift for the garage on a special form intended for notarial documents and check the legal capacity of the parties to the transaction before signing the document. This, in turn, will reduce the risk of the contract being declared invalid.

Otherwise, the procedure for concluding an agreement is no different from signing a document yourself.

Currently, the law does not contain requirements for mandatory certification of real estate contracts by notaries. A notarial agreement has the same legal force and is also subject to registration with Rosreestr.

Note! At the request of the parties, after drawing up the agreement, the notary can independently submit the agreement for registration to Rosreestr. This opportunity became available on 02/01/2019. Check with your notary about the technical possibility of performing such an action.

Why is notarization of contracts valued now? It minimizes the risk that the other party will try to “back out” by claiming that they did not sign the agreement. Agree, it is difficult to make such statements if an independent notary was present when signing the transaction.

The checks that a notary carries out when signing an agreement include checking consents to enter into an agreement. If the donor is married, the notary will either ask for notarized consent from the spouse to donate jointly acquired property, or will issue the consent himself if the donor’s spouse is present at the transaction.

Documents required for donation between close relatives

Now let’s look at what documents are needed to formalize a deed of gift for a garage between close relatives.

You will need to collect the following set of documents:

- passports of the donor and recipient;

- technical and cadastral passport for the garage;

- certificate of ownership of the garage;

- the same certificate for the land plot underneath it or a lease agreement for it;

- the document under which the donor's ownership rights arose (sale or gift agreement, will, construction permit, act of putting an object into operation, court decision, etc.);

- notification of the absence of arrears in payment of shares and membership fees to the garage cooperative;

- certificate of no encumbrance on the garage.

It is recommended that all collected documents be listed in the contract as appendices and handed over to the recipient.

If the contract is planned to be drawn up by a notary, you will also need to provide the written consent of the spouse, certified by a notary.

Taxation

Receiving ownership of any object is recognized as profit, for which you need to pay personal income tax - 13% of the cadastral value. The payment deadline is July 15. The declaration must be submitted by April 30.

Close relatives of donors are exempt from paying tax: brothers, sisters, parents, children, grandparents. But you will still have to bring a declaration and a document confirming the relationship.

This can be done in person at the Federal Tax Service at the location of the property, or through the taxpayer’s personal account on the official website of the department.

FAQ

| Do I need to draw up separate agreements for the garage and the land? | In accordance with the current legislation, capital buildings are a single whole with the land plot on which they are located, and therefore it is enough to draw up a donation agreement in a single copy. |

| Do I have to pay tax if I sell a donated garage? | If, within three years from the date of registration of his ownership rights to a certain property, a citizen decides to sell it, then in this case he will need to pay personal income tax, the rate of which is currently 13% of the price of the property. |

| Do I need to pay a state fee if the gift is made between close relatives? | The state fee is paid by everyone, including persons who are close relatives. Close relatives are only exempt from paying taxes. |

Cancellation of deed of gift

Cancellation of a gift agreement is permitted on the grounds specified in Art. 578 Civil Code of the Russian Federation:

- commission by the donee of a deliberate crime against the life and health of the donor;

- careless handling of property, entailing the threat of irretrievable loss;

- death of the donee, if the possibility of cancellation by the donor is indicated in the DD.

The donor's heirs have the right to cancel the transaction in the event of intentional murder by the donee. Also, the right of cancellation belongs to creditors: property transactions completed six months before a citizen applies to an arbitration court with a bankruptcy petition are canceled at their request.

Arbitrage practice

The practice of canceling a donation is varied, and usually the courts satisfy the claims of plaintiffs who have presented comprehensive evidence of the circumstances specified in Art. 578 Civil Code of the Russian Federation.

Case study:

A woman gave a garage gift to her son. After registering the transaction, he inflicted moderate bodily harm on her. The beatings were removed and a police report was filed. The donor decided to challenge the deed of gift and went to court, presenting a medical report and certificates from the police department.

The claim was satisfied and the transaction was cancelled. After entry into force, a copy of the decision is sent to Rosreestr to re-register ownership of the donor.

Are you planning to challenge the gift agreement?

We'll tell you how to prepare a claim, what documents will be required, and explain the action plan.

Garage as a gift

Before we begin to consider the garage as a gift, it should be noted that it can be either a real estate object or a movable property.

In the first case, in order for ownership of a garage to be registered and the owner to be issued a certificate of ownership of it, the structure must be permanent and attached to the land plot. Without this, the alienation of this real estate is not possible.

In the second case, when the garage is a lightweight prefabricated metal structure that can be easily moved without causing damage to it, and does not have a strong connection with the ground, ownership of it is not subject to state registration. Typically, such buildings are located on rented land.

The execution of transactions with it, including donations, will depend on the individual characteristics of the garage, its belonging to movable or immovable property. Therefore, before accepting a garage as a gift, the recipient must familiarize himself with all the documents confirming and establishing ownership rights to it and the land on which it is located.

A garage can be an individual building, or it can be part of a GSK (garage and construction cooperative). If the donor has all the documents on the right of ownership and is legally executed, then there should be no problems with the donation. It will be different if the donor, being a member of the State Joint Stock Company, has not paid the share in full. Then he will not be able to donate the garage due to the fact that he is not its owner.

Example

Citizen Samoilov I., being a member of the GSK, gave the garage to his grandson. After the donation agreement was executed, changes were made to the membership book, and the recipient thought that he had become the owner of the property donated to him. After a certain time, a certain person interested in the land plot under the GSK bought it and registered it as his own property. The new owner of the land decided to demolish all the garage boxes and buildings that were not registered as the property of their owners at that time, paying meager compensation for them.

Thus, those members of the garage cooperative who did not pay their share contributions in full and thus did not have time to register their garages as their property, practically lost them. Among them was the grandson of citizen Samoilov I.

From the example it follows that simply rewriting the name in the membership book does not transfer ownership to the new member of the garage cooperative. Only after making full payment for the share, the owner of the garage can register ownership of it, and in the future have full rights to dispose of his property.

Features and limitations in drawing up a gift agreement

The legislation of the Russian Federation prohibits the following citizens from acting as a donor during the registration of a deed of gift:

- disabled people;

- guardians or representatives of minors;

- employees of municipal authorities;

- employees of government agencies;

- employees of institutions where persons involved in the transaction are trained or treated.

Citizens who have not reached the age of majority can participate in the transaction, but the presence of their legal guardian is required.

find_in_page

Articles on the topic

(click to open)

- Garage purchase and sale agreement

- How to privatize land under a private house or garage, privatization of a country house in 2020

According to Russian law, transferring a garage into the possession of another person is impossible without transferring ownership of the land located under it.

How to give a garage to your son or daughter - gift agreement

Construction norms and rules (SNiP) in force in Russia define a garage as a structure for parking, storage, repair and maintenance of vehicles.

The donation agreement for this type of premises is drawn up taking into account some of the nuances that will be discussed in this article.

Features of donating a garage

Drawing up an agreement to transfer a garage as a gift implies the transfer of this structure by the donor as a gift to the recipient. In this case, it is possible to conclude a consensual transaction - a promise to donate a garage on a certain date agreed upon when concluding the transaction.

A garage can be both real and movable property. If it is movable (for example, it is a collapsible structure), then there is no need to register ownership of it; as a result, there is also no need to conclude an agreement on the donation of such a garage.

If the garage is immovable, in order to formalize an agreement on the donation of such property, it must be capital . In practice, this means tying the garage to the plot of land where it is located.

Without fulfilling this condition, registration of ownership and, as a result, donation of the garage is impossible.

Often garages are part of GSK - a garage-building cooperative. In this case, for the transaction to be completed correctly, the donor must not have any arrears in paying for the share, being a member of the GSK, since, according to the Civil Code of the Russian Federation, the owner receives the right of ownership of the garage within the GSK, according to the Civil Code of the Russian Federation, only after he has paid the share contribution.

If the share has not been paid, the donor must first pay off the outstanding contribution before executing the contract.

If the garage is an individual building, then the donation agreement can be drawn up without any hindrance using the same algorithm that is used to donate a plot or house. It is impossible to donate any real estate, including a garage, without donating the land on which the garage is located.

Gifting to a family member

An agreement to transfer a gift to family members differs from a regular gift in that it is not subject to income tax of 13% of the value of the object.

Also, when donating a garage to close relatives, it is not necessary to have it certified by a notary. However, the signatures of the parties to this agreement are still required. According to the laws of the Russian Federation, close relatives are considered:

- Parents.

- Spouses. In this case, the second spouse must provide certified consent to the execution of the deed of gift.

- Brothers and sisters.

- Grandmothers and grandfathers.

- Children and grandchildren.

In all other cases, the donee pays income tax.

When donating a garage to a minor under 14 years of age, the presence of his legal representative: a parent or guardian is required.

When registering a deed of gift for children, spouses, parents or grandchildren, you need to pay 3,000 rubles plus 0.2% of the price of the garage as part of the notary fee.

Form and terms of the contract

The garage donation agreement is drawn up in the same way as any other deed of gift. The following documents are required to complete it :

- The actual contract for the transfer of a gift.

- Identity cards of the parties to the transaction.

- If necessary, the consent of one of the spouses or co-owners of the property.

- Documents confirming the right to own the garage.

- Cadastral passport with all the characteristics of both the garage and the plot to which it belongs.

- Receipt for payment of state duty in the amount of 2000 rubles.

Download: sample garage donation agreement.

It is prohibited to give property to minors, incapacitated citizens, pupils of special educational institutions, some government employees, as well as legal representatives of all these categories of citizens.

It is possible to register a deed of gift by an outsider acting under a power of attorney on behalf of the donor.

The donation agreement is drawn up at the territorial branch of the State Registration Department (Rosreestr). The above package of documents is provided to Rosreestr along with the already drawn up gift agreement.

The period for consideration of the application by the relevant government agency is ten working days , and if the documents are certified by a notary - three days.

After the application has been approved by Rosreestr, the parties to the transaction must appear at the local office of this authority and sign an agreement there in the presence of the registrar of rights. Three copies of the agreement are drawn up: for the donor, for the donee and for the State Registration Office.

Cancellation of the donation procedure

Either party can appeal or cancel the gift agreement by first going to court . The grounds for cancellation of the contract at the initiative of the donor are:

- An attempt by the recipient to harm the health of the donor.

- Attempt on the life of the donor.

- The death of the donee before the donor.

- Deterioration of the financial situation of the donor.

A citizen who accepts property as a gift can refuse it at any time , citing his refusal to accept this object as a gift.

The decision to cancel the deed of gift is made by the court.

Drawing up a gift agreement is a widespread practice in Russia. With its help, you can transfer property to any person: both a close relative and a stranger. When completing such a transaction, you need to be extremely careful and careful to avoid possible negative consequences.

Find out from a lawyer what is better - a deed of gift or a will for a garage:

Who can receive a garage as a gift?

You can give a garage to almost anyone. The right of ownership allows the owner to dispose of the property at his own discretion. But for some categories of citizens who act as the donee, there are some nuances regarding the procedure for completing the transaction. The most common questions relate to the following categories:

- Son or daughter. The owner can draw up a gift agreement for both natural and adopted children. If the building and the land under it are the joint property of the spouses, then written permission from one of them is required to carry out the transaction.

- Minor child. Children over 14 years of age and younger can accept a garage donation. The only difference is that the senior category signs the contract and is present at the conclusion of the transaction, while parents have the right to do this for the younger ones.

- Grandson or granddaughter. In this case, the age of the gift recipient plays a major role. For minors, the above rules apply, and adults can enter into a transaction on their own.

- Spouses. This option is the simplest. Apart from the mandatory list of documents, nothing is required to be submitted.

- Close relatives. In addition to those listed, the category of close relatives includes brothers, sisters, aunts and uncles. The registration procedure may have special features if the garage is the property of both spouses or the relative is a minor.

- Friend or acquaintance. This situation implies a standard donation procedure. In addition, if the donee is a minor, only permission from his parents is required. There is no need to involve the guardianship authorities.

From the above we can conclude that you can give a garage to anyone. Certain nuances apply only to minor children and spouses if they jointly own a garage.